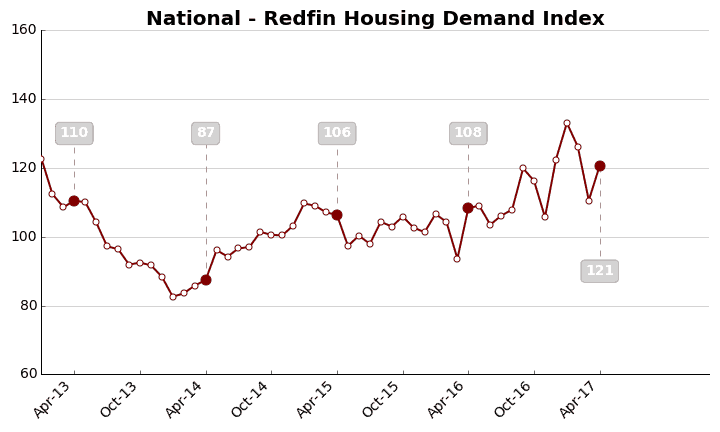

The Redfin Housing Demand Index increased 9.2 percent from March to a seasonally adjusted level of 121 in April.

The Demand Index is based on thousands of Redfin customers requesting home tours and writing offers. A level of 100 represents the historical average for the three-year period from January 2013 to December 2015.

Although it has remained above its historical average all year, the Demand Index has shown strong variability, steadily decreasing from January to March before picking back up in April.

Compared to March, the seasonally adjusted number of buyers requesting tours was up 12.1 percent in April, and the seasonally adjusted number of buyers writing offers was up 6.9 percent. The growth in demand is in stark contrast with the ongoing shortage of home supply. Across the 15 metros covered by the Demand Index, there were 13.1 percent fewer homes for sale than the previous March, marking the 23rd consecutive month of year-over-year inventory declines.

Demand has been moving in fits and starts over the last six months, but is still generally above the 2013-2015 average activity level. With prices exceeding their 2006 peak and inventory at the lowest point in recent years, the question becomes whether this adverse environment will start to cool the market.

“We know two things heading into the summer selling season. One, home prices continue to leap forward. Two, homebuyers continue to jump into the market,” said Redfin chief economist Nela Richardson. “A pop of new listings only encourages more homebuyers to barge their way into this crowded and competitive, low-inventory market in order to take advantage of still-low mortgage rates. For these reasons, we expect prices to continue to grow above their three-year average for the remainder of the year.”

Metro-Level Demand Highlights

Below, we provide a slideshow of local charts for each of the metros tracked by the Redfin Housing Demand Index and highlight noteworthy trends and agent insights from select markets. If you’d like to learn more about a particular market, please email press@redfin.com.

Seattle on Track to Become the Metro with the Least Inventory

Inventory in Seattle is trending even lower as prime selling season approaches. Currently, Seattle is the most inventory-constrained metro, as measured by months of supply, but it also has the third smallest amount of inventory, following Oakland and San Francisco. Seattle posted the largest year-over-year decrease in inventory, down 35 percent from last April. In the same period, the number of Redfin customers making offers climbed by 36.9 percent, an indication that the market is more competitive for buyers this year than it was last year.

“There’s no indication that this market is going to see a drastic increase in supply or a drop in demand, so waiting isn’t an option for a serious buyer,” said Redfin Seattle agent Kyle Moss. “People intent on purchasing this season should be discerning and focus on the one or two criteria that are most important to them, like commute time and/or schools. From there, carve out a list of homes that meet your qualifications and work alongside an agent who has experience winning offers in competitive situations to build and execute a competitive strategy that fits your budget.”

Touring Activity in Washington, D.C. High as the Market Continues to Become More Competitive

Demand continued to climb in Washington, D.C., up 26.4 percent from March to April. The number of Redfin customers requesting tours surged 50.2 percent from last year, but the number writing offers increased by only 3.6 percent.

“I think some buyers are hesitant to commit to an offer given the low inventory, rising prices and overall competition in the market,” said Steve Centrella, Redfin agent in Washington, D.C. “I have conversations with buyers all the time who sincerely want to buy, but worry if they are buying at the top of the market. I remind them that given the price growth throughout the city, many who are buying at the top price point in the current market, quickly settle into the median in the neighborhood within 12 to 18 months.”

United States

United States Canada

Canada