A local Redfin agent said at least half of her prospective clients ask about iBuyers, which are increasingly common in Phoenix and may be contributing to ongoing price growth.

Institutional buyers, known as iBuyers, are taking up a growing share of Phoenix home sales. iBuyers are companies—like RedfinNow, Zillow and Opendoor—that make instant cash offers to home sellers and close within days without any listings or showings, with the intent to re-sell for a profit.

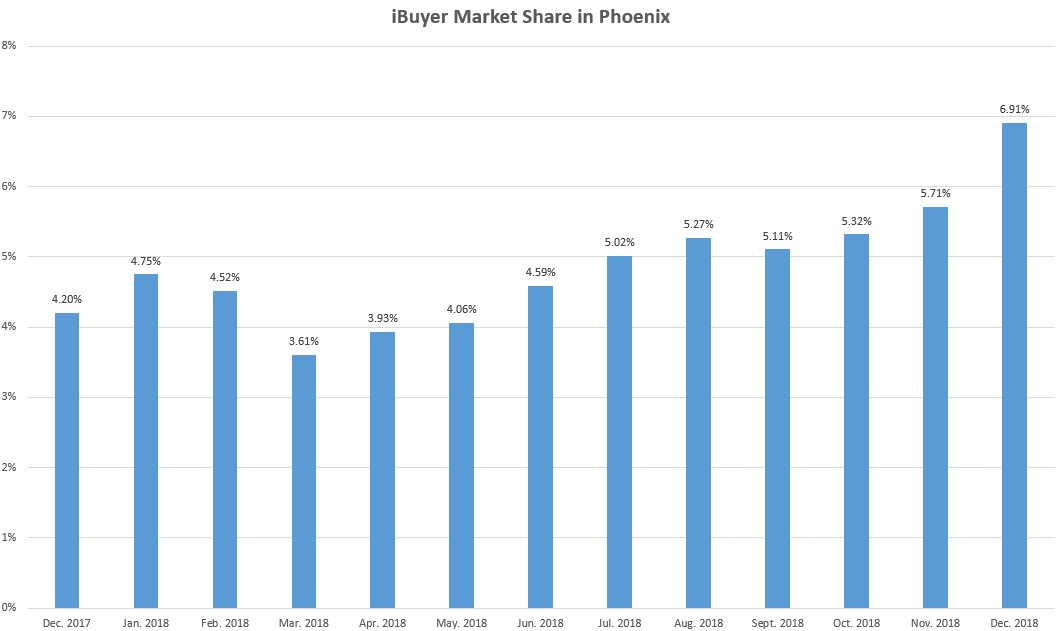

In Phoenix, iBuyers purchased an estimated 6.9 percent of homes that sold in December 2018, according to a Redfin analysis of public records. That’s up from 4.2 percent in December 2017 and it makes Phoenix home to the largest iBuyer market share of any metro area in the U.S.

Overall, iBuyers had an estimated 4.8 percent market share in Phoenix last year, versus 2.7 percent in Dallas and 2.2 percent in Atlanta, two other markets that have been popular with iBuyers.

Local Redfin agent Katie Shook said Phoenix’s popularity with transplants and snowbirds is one reason the area is so popular with iBuyers. One-third of searches for homes in Phoenix on Redfin.com were from users outside the metro in the last quarter of 2018, up from 16.4 percent a year earlier. Phoenix was the second-most popular migration destination in the U.S. late last year, having been at or near the top of the list in the first, second and third quarters of the year.

“Because iBuyers provide a convenient service, they’re able to capture a lot of business from people moving in and out of Phoenix who want to sell their homes quickly, particularly if they’re vacation homes and the seller’s primary residence is in a different state,” Shook said.

There are several other reasons why iBuyers target Phoenix. Not only is the housing market strong, but taxes are low and homes are relatively inexpensive, so buying a home in the area requires less upfront cash. Phoenix is also home to a lot of new housing developments, a plus for iBuyers because it’s easier to value homes that are similar to one another and new homes require less repairs and maintenance.

iBuyers typically buy homes, make repairs and improvements, then put them back on the market for a small premium. In Phoenix, that premium tends to equal about $5,000 to $10,000, according to Shook. That premium, paired with the additional demand for homes iBuyers bring to the market, could help explain why the Phoenix area is retaining relatively strong price growth compared to nationwide growth. In February, Phoenix-area home sale prices were up 4.1 annually to a median of $267,000. Although that’s the smallest year-over-year gain Phoenix has seen since December 2011, it far outpaces the meager 0.6 percent nationwide price increase posted last month.

“The market is looking different this year, partly because iBuyers are starting to have a real impact in Phoenix,” Shook said. “I’m asked about iBuyers by at least half of the prospective sellers I talk to about listing their home. I explain that iBuyers pay close to market value for homes, maybe a little less, but you pay a fee for the price of convenience. If you want to pick your close date and eliminate the hassle of showings and repair work, it’s a great option.”

Shook also mentioned a less direct role iBuyers play in the market. Buyers sometimes prefer to accept offers from iBuyers over traditional homebuyers because they tend to be all cash and reliable.

Even though iBuyers may be helping Phoenix continue to see price growth, it’s still the slowest rate posted in eight years—and there are other signs the Phoenix market may be shifting toward buyers’ favor.

2019 has brought double-digit declines in the number of Phoenix-area homes sold, down 10.2 percent year over year in February after falling nearly 16 percent in January. Meanwhile, the supply of homes in Phoenix was up 2.7 percent year over year, the third consecutive month of inventory increases following two straight years of declines.

Homes listed in the Phoenix area are taking longer to sell than they were last year. The typical home that sold in Phoenix in February spent 53 days on the market, six days more than the same month last year.

And Phoenix home sellers this year have been more likely to drop their prices than they were last year. In February, 28.6 percent of listings saw price drops, up from 23.8 percent a year earlier.

“There are fewer buyers out there searching,” Shook said. “Homebuyers are able to be more discerning. Last spring, buyers would jump on a home even if it had flaws and needed improvements, but this year, they’re able to bargain prices down or keep waiting.”

The softening market in Phoenix is likely to have similar repercussions on institutional buyers as it does on traditional homebuyers and home sellers. Like traditional homebuyers, iBuyers are able to take advantage of relatively low price growth in Phoenix—but when they are going through the selling process, it may be more difficult to find a buyer or get top dollar for a property than it was last year.

United States

United States Canada

Canada