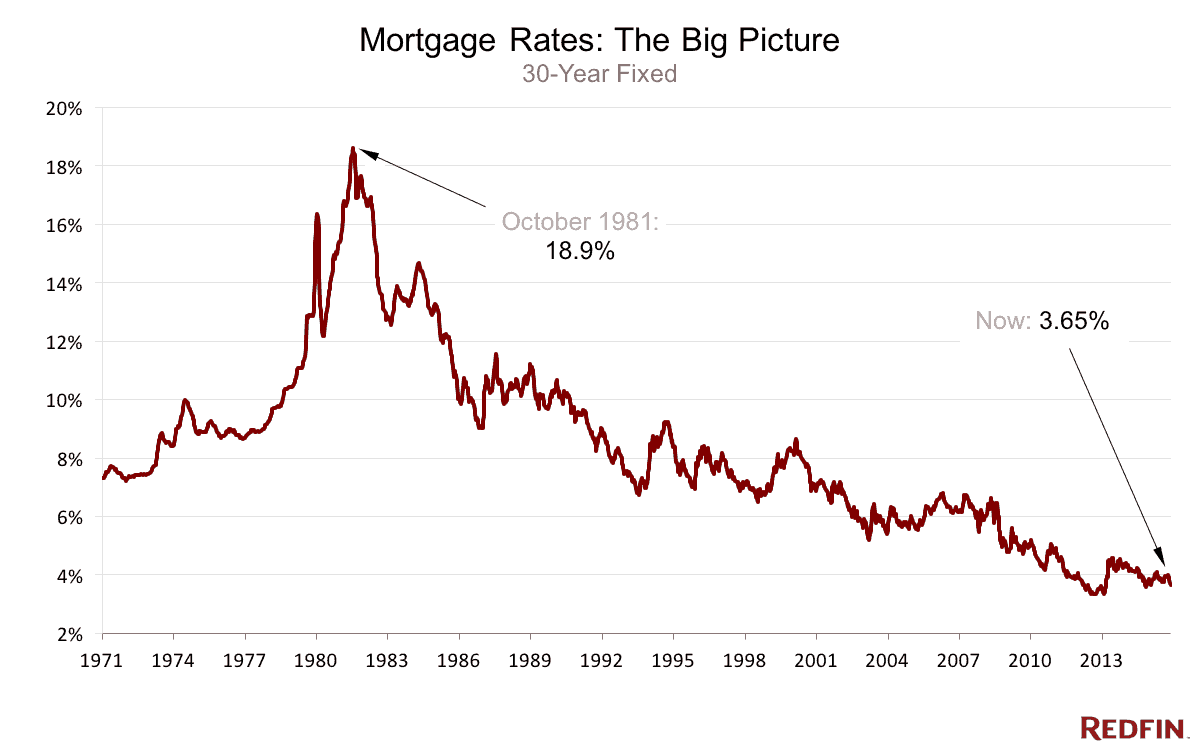

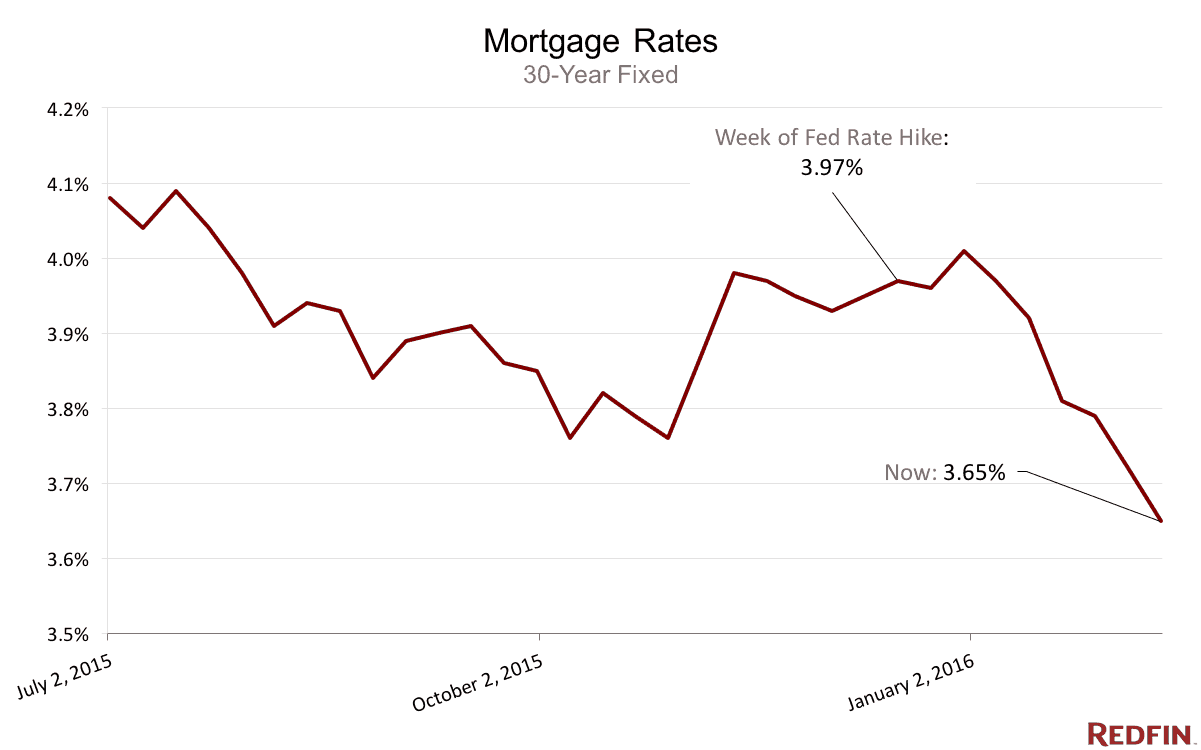

The swooning stock market helped push mortgage rates down again this week, with the cost of a 30-year, fixed-rate home loan falling to 3.65 percent from 3.72 percent.

Rates on home loans are at their lowest since last April, according to Freddie Mac, and chances are good they’ll fall again before we get out of this mess.

What’s the bad news?

Rates are falling because investors are looking for safe havens as global stock markets and oil prices nosedive. Money is pouring into Treasury bonds and other safe investments, which helps drive down mortgage rates.

While cheap borrowing is great for homeowners, it’s crushing banks, which have to work a lot harder to turn a profit. In addition to low rates, lenders are coping with an avalanche of costly new regulation imposed after the financial collapse. Most banks reported unimpressive earnings for the end of 2015 and their stocks are some of the biggest losers this week.

In the big picture, that stress on financial companies makes mortgages harder to get, even for people with decent credit, because banks have become overly cautious. And it could pose risks to the broader U.S. economy, Federal Reserve Chair Janet Yellen told Congress this week.

Should I be worried?

Not yet. A lot of pundits are throwing around the R word (as in recession). But the U.S. economy, while slow, is still growing and showing signs of strength. People are getting raises and buying cars and houses. Employers have been growing payrolls for 70 months, a record run of gains, and more workers are quitting their jobs to trade up.

“We’re not forecasting a recession,” JPMorgan Chase & Co. CEO Jamie Dimon told investors last month. “We think that the U.S. economy looks pretty good at this point.”

The odds of a Fed rate hike next month are slim and mortgage rates will stay low for a while. Speaking to the Senate Banking Committee today, Yellen was asked about the housing market and gave it good marks.

“We’re seeing a recovery in housing,” she said. “It’s very, very gradual. House prices are recovering. They’ve increased quite a bit and I think that’s helping the financial situation of many households.”

That growth should continue, she said.

“It seems to me there’s quite a significant way for housing to go before we say it’s at levels consistent with demographic trends,” Yellen said. “I think it will continue to improve.”

Translation: Our population is growing and millennials are moving out of basements. We all need a place to live. Homebuilders eventually will step up to meet that demand.

United States

United States Canada

Canada