The National Association of Realtors today entered into a $418-million settlement agreement for a wide range of class-action lawsuits brought by home-sellers. Unlike the earlier settlements with large brokerages, NAR also agreed to what could be a major structural change: eliminating the field in listing databases for the agent listing a home to offer a commission to the agent representing the buyer. The proposed rules changes would go into effect this July. The settlement doesn’t address the lawsuits against Redfin.

Redfin Has Long Advocated for Buyers to Pay Their Own Agent

The 108-page settlement was released just this morning, and different parties are already claiming it can be interpreted in different ways, so our reaction in this post is only preliminary. But if it becomes easier for buyers to understand how their agent is paid and easier for them to choose their agent based on the agent’s fee, that’s almost certainly good news for real estate consumers. Such a change would also be good for Redfin. For our entire history, Redfin has advocated for lower fees, transparency and more choices for real estate consumers. We’ve saved our clients over $1.6 billion in fees.

Reports of Cooperation’s Death Have Been Somewhat Exaggerated

But it’s still unclear if the settlement will end cooperation entirely. The proposed settlement could still let the seller offer money for a buyer to allocate to the buyer’s agent, and it doesn’t prevent that offer from being included in general-purpose listing-database fields. In the same way a seller might acknowledge a defect in the roof that will have to be repaired, a seller can anticipate that a buyer will have to pay her agent 2.5% of the sales price, and promise to support that fee in agent-only remarks.

But Perception is Reality, Weakening Cooperation

Even if the letter of the settlement allows for cooperation, how the settlement is perceived may still re-shape agent attitudes about cooperation, and consumer attitudes about fees. The result could be that agent-to-agent cooperation on fees is weakened but not killed. Changes already afoot will accelerate:

- The fees paid to buyers’ agents will keep falling: we know from our experience raising and lowering fees on buyers and sellers that when the consumer who hires an agent pays that agent, that consumer is much more careful about fees. Redfin believes that competition over the years has lowered the fees a seller’s agent can charge. If buyers choose an agent based in part on fees, we expect that the price pressure on buyers’ agents will be even more intense than that on listing agents.

- More listing agents will sell homes directly to buyers: in markets from Maryland to California, Redfin’s agents are already seeing more listings offering no commission to the buyer’s agent. By paying one agent instead of two, the seller can spend less overall in commissions, even if the listing agent earns more than before. A form of this is already common with newly built homes, with about 30% of unrepresented buyers working directly with a salesperson employed by the builder. Given the long-term shortage of homes for sale in the U.S., this trend seems likely to continue even in the absence of a settlement.

- All buyers’ agents will require their customers to sign a contract hiring that agent, which is already imposed by law in Washington state, and has been under consideration in California. These agreements, known as buyer’s agency agreements, can establish up-front how much the buyer’s agent will ask to be paid if in fact a listing doesn’t include an offer of payment. But the settlement appears to go beyond current practice and law on buyer’s agency agreements, requiring a consumer to sign the agreement before going on a tour with that agent. A homebuyer should be able to see one or more agents in action before deciding which one to hire. No one asks a homeowner to sign a listing agreement before inviting agents into her home for advice on pricing, staging and marketing.

- The number of homes marketed outside of the MLS will increase, making it harder for buyers to get a complete view of the housing market. Especially for brokers without a major online presence, there may be more backroom deals, benefiting well-connected buyers and sellers at the expense of people of color and immigrants who lose out on a listing without ever realizing it was for sale. A major reason agents post their listings to the MLS has been to tell the buyer’s agent how much the buyer’s agent could earn from the sale of the home. Consumer advocates who fight cooperation have never fully appreciated how important the MLS is to an open, fair housing market.

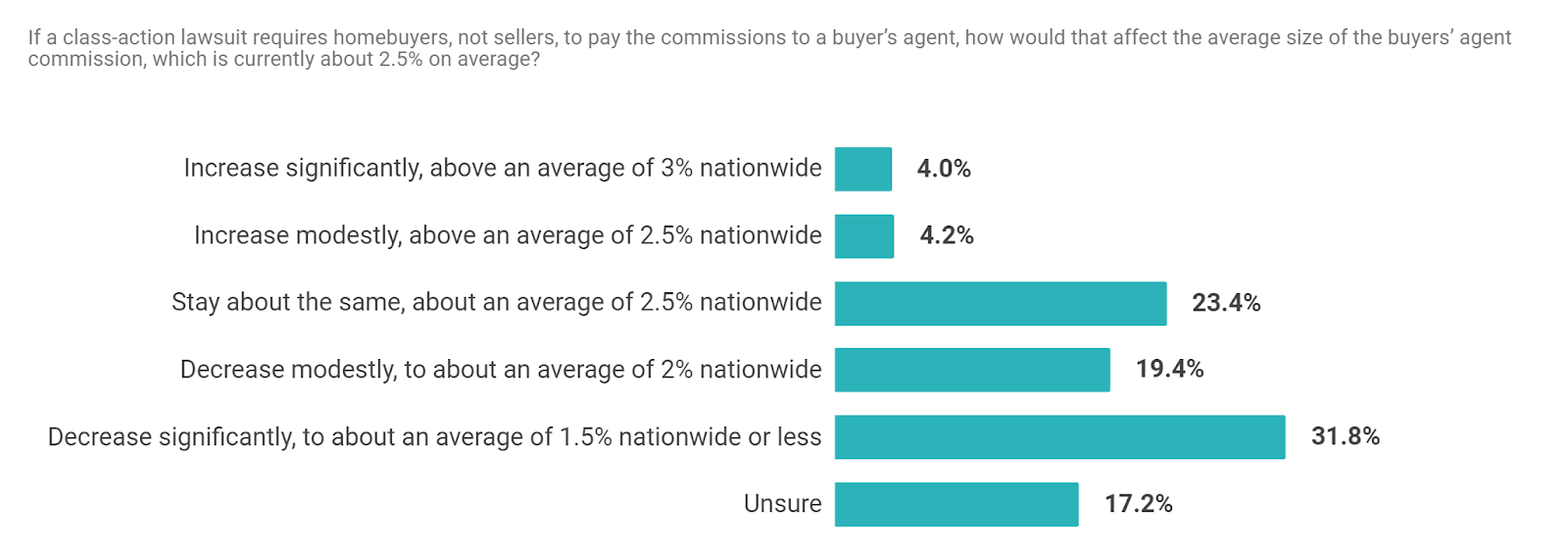

51% of Agents Believed That Settlements Like This Would Lead to Lower Fees

A December 2023 survey of 500 real estate agents from a broad range of brokerages, commissioned by Redfin but conducted by a research firm, anticipated a settlement similar to what was struck today. The settlement these agents had in mind may differ materially from today’s, but how agents are conditioned to think about the settlement of these lawsuits is almost as important as the settlement itself. The survey did not include any agents working for Redfin. Fifty-one percent of respondents said an end to cooperation would lead to modestly or significantly lower fees paid to buyers’ agents:

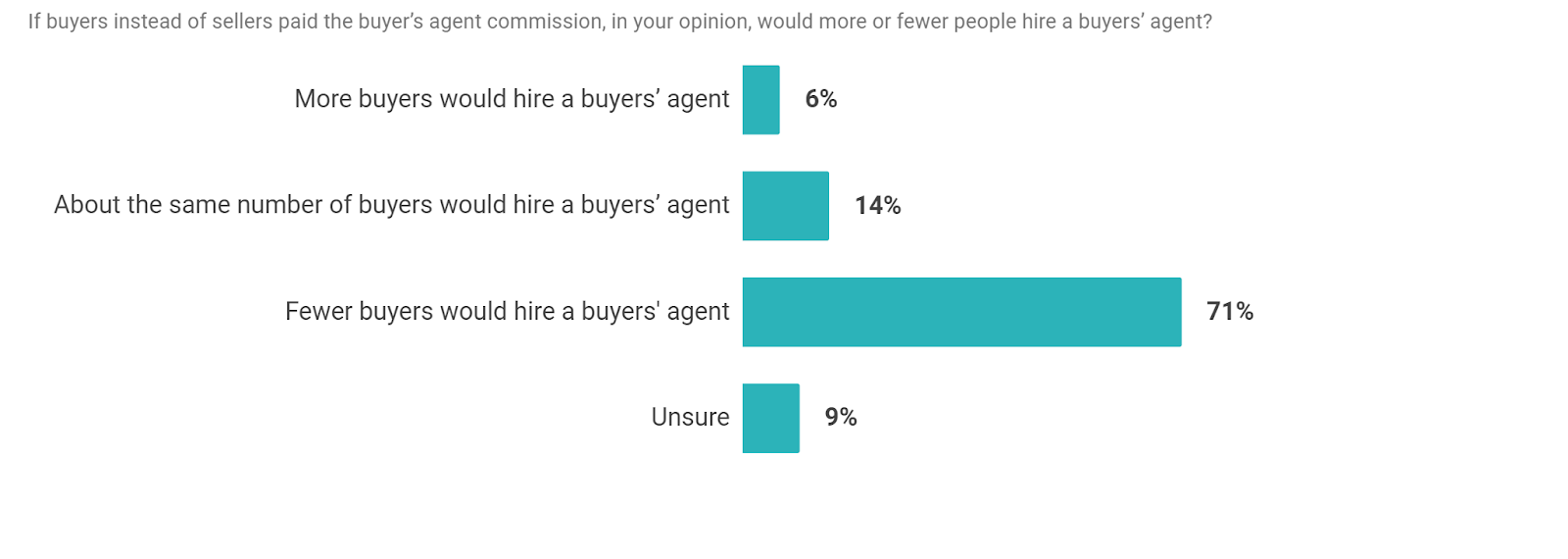

71% Believed Fewer Buyers Would Hire Their Own Agent

Seventy-one percent said that, if in fact cooperation were to end entirely, fewer buyers would hire a buyer’s agent:

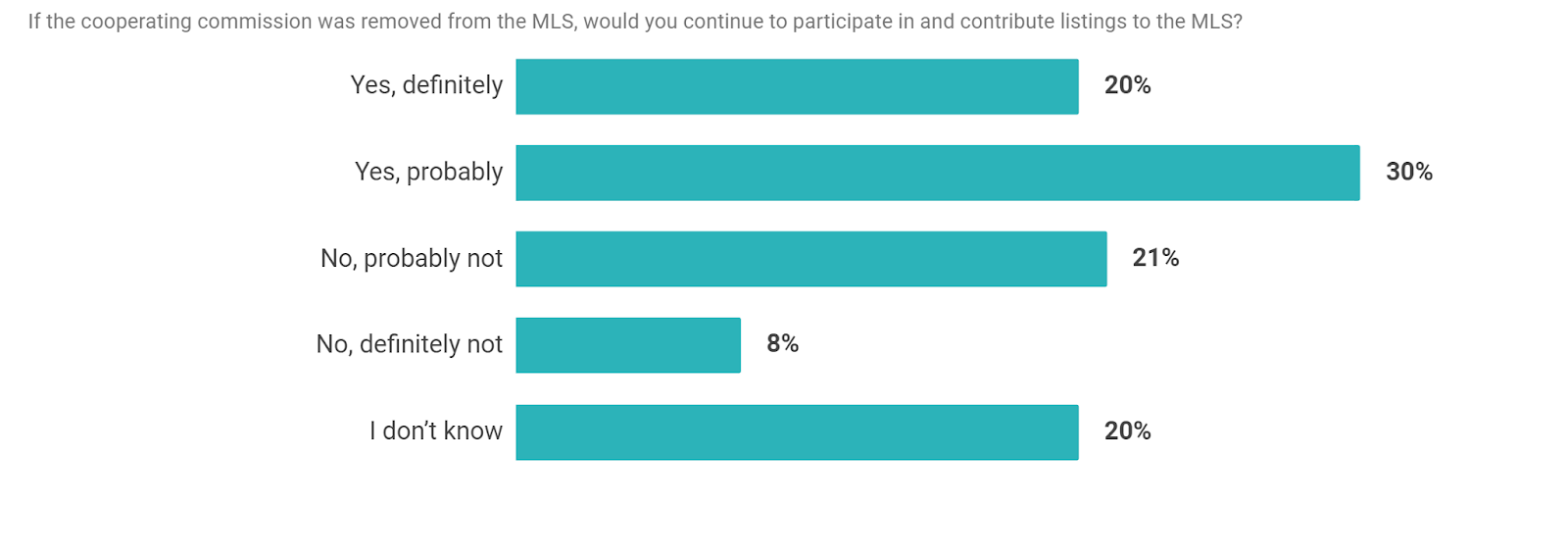

Nearly a Third May Choose Not to Publish Listings to the MLS

Thirty percent would reconsider listing homes via the MLS:

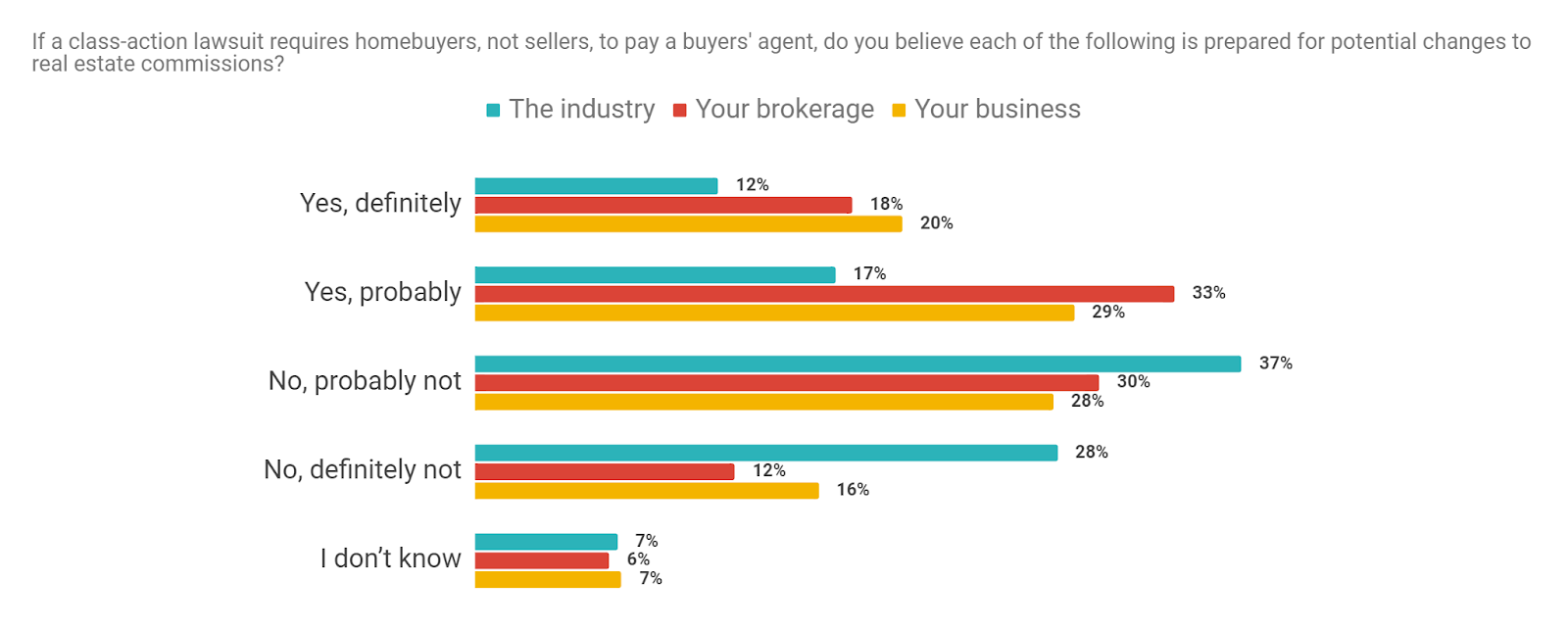

Nearly Two Thirds Say the Industry Isn’t Prepared for Change

And 64% said the industry isn’t prepared for an end to cooperation:

What’s Good for Consumers is Good for Redfin

As a brokerage that was founded to offer consumers a better deal, Redfin believes any change that gives customers more clarity and lower fees will benefit not only those customers but also our business:

- Alone among brokerages, we’ve built our business to be able to thrive on low fees. Redfin charges customers a listing fee as low as 1%. For years, when we couldn’t directly set the fee we earned as a buyer’s agent, we still refunded part of that commission to our home-buying clients. Today, Redfin’s commission refund is now paired with a buyer’s agency agreement, and offered everywhere that commission refunds are legal. And we’re confident in the value our buyers’ agents offer: we have the highest proportion of top producers of any major brokerage. Settlement or no, other brokers are just beginning to compete on a front where Redfin has spent its whole life fighting. The most efficient competitor always wants a price war.

- No one is better prepared to market our customers’ listings directly to buyers. We run America’s largest brokerage site, with nearly 50 million monthly visitors. We’ve developed Redfin Direct, technology for capturing offers from unrepresented buyers. Now more than ever, every listing agent should want to work for us.

- Other brokers will have to adapt to a change that Redfin has fought to bring about: Rather than preparing for a decline in cooperation, traditional brokers have tried to say it will never come. In times of great change, the most agile, forward-thinking competitor wins.

A long, long time ago, on a call when I despaired that Redfin could ever win against big traditional competitors, my twin brother sang out, “MAMMALS IN THE LATE CRETACEOUS.” Evolution is a slow process, but every once in a while, a giant asteroid helps it along.

United States

United States Canada

Canada