Sky-high mortgage rates and still-rising home prices have made it harder than ever to afford a home, especially for first-time buyers. The typical buyer needs to earn 15% more than they did a year ago–and wages are only up 5%.

It’s harder than ever for Americans to afford a home.

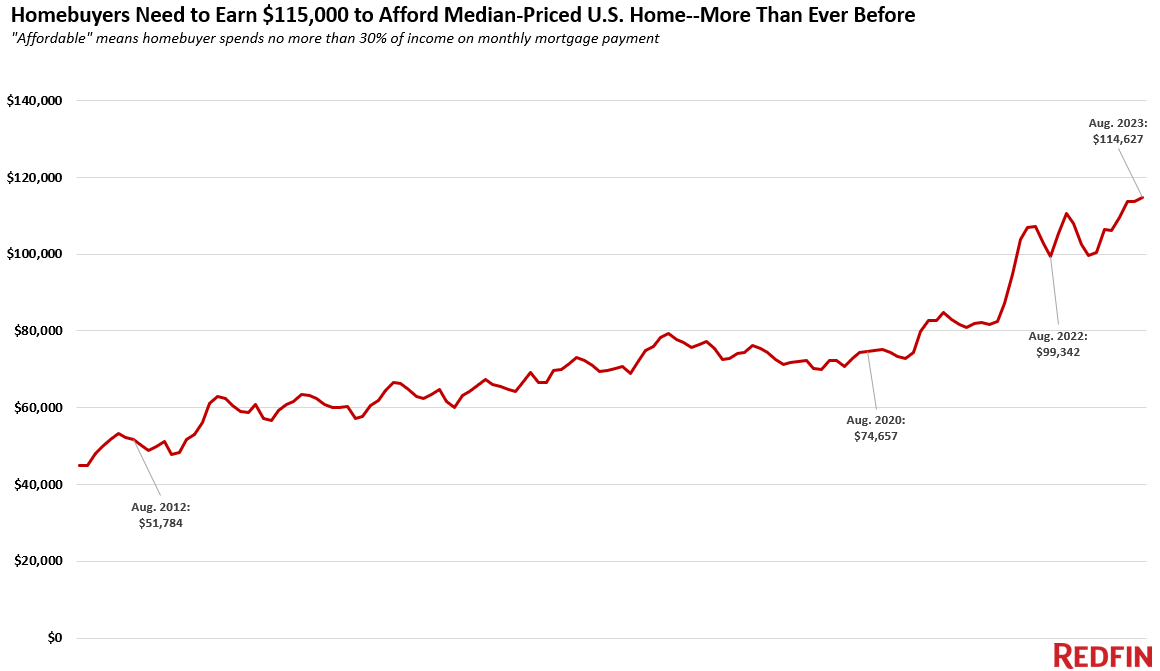

A homebuyer must earn $114,627 to afford the median-priced U.S. home, up 15% ($15,285) from a year ago and up more than 50% since the start of the pandemic. That’s the highest annual income necessary to afford a home on record.

This is based on a Redfin analysis that compares median monthly mortgage payments for homebuyers in August 2023 and August 2022. The national income data in this analysis is adjusted for inflation. See the bottom of this report for more on methodology.

Housing costs are higher than ever because of the one-two punch of sky-high mortgage rates and rising home prices. The average rate on a 30-year fixed mortgage was 7.07% in August. Mortgage rates have climbed even higher since then, hitting 7.57% during the week ending October 12–their highest level in over two decades. But even though soaring mortgage rates have dampened demand, low inventory is causing home prices to increase. The typical U.S. home sold for about $420,000 in August, up 3% year over year and just about $12,000 shy of the all-time high hit in mid-2022.

The typical U.S. homebuyer’s monthly mortgage payment is $2,866, an all-time high. That’s up 20% from $2,395 a year earlier, and by that time payments had already increased substantially from the beginning of the pandemic, a time of ultra-low mortgage rates and yet-to-skyrocket home prices. In August 2020, for instance, the typical monthly payment was $1,581, based on that month’s average mortgage rate of 2.94% and median home price of $329,000. At that time, a homebuyer would have needed to earn $75,000 per year to afford the typical home.

The typical American household earns about $40,000 less than the income needed to buy a median-priced home. The median household income was roughly $75,000 in 2022, the most recent year for which annual income data is available. Hourly wages have risen in 2023, but not nearly as fast as the income necessary to afford a home is rising: The average U.S. hourly wage has increased by about 5% over the last year.

“In a homebuyer’s ideal world, rising mortgage rates would push demand and home prices down enough to make up for high interest payments. But that’s not what’s happening now: Although new listings are ticking up slightly, inventory is still near record lows as homeowners hang onto their low mortgage rates–and that’s propping up prices,” said Redfin Economics Research Lead Chen Zhao. “Buyers–particularly first-timers–who are committed to getting into a home now should think outside the box. Consider a condo or townhouse, which are less expensive than a single-family home, and/or consider moving to a more affordable part of the country, or a more affordable suburb.”

Affordability is less of a problem for all-cash and move-up buyers. The major increase in income necessary to afford a home hits first-time homebuyers hardest. Buyers who can afford to pay cash aren’t impacted by high mortgage rates, and they likely earn more than the income necessary to purchase a home, anyway. Buyers who are selling a home to buy another one are in a better boat than first-timers because they have likely built up equity in their current home, which takes a bit of the sting out of soaring monthly payments. The caveat to the caveat is those who bought at the height of the pandemic-era market with an ultra-low mortgage rate and need to sell now: Not only are they giving up a low rate, they also may have lost money on their home.

Metro-level highlights: Income needed to buy a home has risen in all major metros, with biggest uptick in Miami and smallest in Austin

August 2023, analysis includes 100 most populous U.S. metros for which data is available. Note that year-over-year increases in income needed to afford a home in the metro section is not adjusted for inflation.

-

- Metros where necessary income has increased most: In both Miami and Newark, NJ, homebuyers must earn 33% more than a year ago to afford the typical home–the biggest percent increase of the major U.S. metros. Homebuyers in Miami need to earn $143,000 annually to afford the area’s typical monthly mortgage payment of $3,580, and Newark buyers need to earn roughly $160,000 to afford that area’s $3,989 payment.

- Other metros where necessary income has increased by over 30%: The income necessary to afford a median-priced home has increased by over 30% in four other metros, all in the eastern half of the country: Bridgeport, CT ($183,000); Dayton, OH ($60,000); Rochester, NY ($66,000); and Hartford, CT ($95,000).

- Buyers need to earn more in every major metro: Skyrocketing mortgage rates have caused the income necessary to buy a home to increase in every major metro, even the places where prices have declined over the last year.

- Necessary income has increased least in pandemic homebuying hotspots: Austin, TX homebuyers must earn $126,000 to afford the median-priced home, 8% more than a year ago–the smallest increase of all the major U.S. metros. That’s despite Austin home prices falling 7% year over year in August after they skyrocketed during the pandemic, with remote workers flocking in. Boise, ID, another pandemic homebuying hotspot where demand has since dropped, experienced the next-smallest increase: up 9% to $127,000. Salt Lake City, Fort Worth, TX and Lakeland, FL come next, with year-over-year increases of about 13% each. Home prices are down from a year ago in all those metros.

- Homebuyers must earn six figures to buy a home in half the major metros in the country: In 50 of the 100 metros in this analysis, buyers must earn at least $100,000 to afford the median-priced home in their area. Buyers must earn at least $50,000 everywhere in the country.

- Bay Area buyers must earn $400,000: Buyers in the most expensive markets in the country–San Francisco and San Jose, CA–must earn more than $400,000 to afford the median-priced home in their area, both up nearly 25% year over year. The next five metros are all in California: Anaheim ($300,000), Oakland ($250,000), San Diego ($241,000), Los Angeles ($237,000) and Oxnard ($233,000).

- Rust Belt buyers need the least income–but it’s still up from a year ago: Detroit homebuyers must earn about $52,000 to afford the area’s median-priced home, up 19% from a year ago. That’s the lowest income required to afford a home in the U.S. Next come three Ohio metros (Akron, Dayton and Cleveland) and Little Rock, AR, all of which require roughly $60,000 in annual income to buy a home.

| Metro-level summary: Annual income needed to afford a home, August 2023

Analysis is based on 100 most populous U.S. metros for which data is available Alphabetical order |

||||

| U.S. metro area | Annual income required to afford median-priced home | YoY change, annual income required to afford median-priced home | Median monthly mortgage payment | Median home-sale price |

| Akron, OH | $59,702 | 18.4% | $1,493 | $218,900 |

| Albany, NY | $87,276 | 26.0% | $2,182 | $320,000 |

| Allentown, PA | $88,639 | 23.2% | $2,216 | $325,000 |

| Anaheim, CA | $300,010 | 28.6% | $7,500 | $1,100,000 |

| Atlanta, GA | $107,731 | 19.4% | $2,693 | $395,000 |

| Austin, TX | $126,208 | 7.7% | $3,155 | $462,748 |

| Bakersfield, CA | $100,258 | 22.2% | $2,506 | $367,600 |

| Baltimore, MD | $103,640 | 21.1% | $2,591 | $380,000 |

| Baton Rouge, LA | $71,184 | 21.5% | $1,780 | $261,000 |

| Birmingham, AL | $76,912 | 16.3% | $1,923 | $282,000 |

| Boise City, ID | $126,869 | 9.1% | $3,172 | $465,170 |

| Boston, MA | $194,188 | 22.7% | $4,855 | $712,000 |

| Bridgeport, CT | $182,734 | 32.1% | $4,568 | $670,000 |

| Buffalo, NY | $70,093 | 25.1% | $1,752 | $257,000 |

| Camden, NJ | $91,367 | 27.8% | $2,284 | $335,000 |

| Cape Coral, FL | $108,249 | 16.9% | $2,706 | $396,900 |

| Charleston, SC | $112,231 | 17.9% | $2,806 | $411,500 |

| Charlotte, NC | $108,822 | 16.0% | $2,721 | $399,000 |

| Chicago, IL | $91,367 | 25.7% | $2,284 | $335,000 |

| Cincinnati, OH | $77,730 | 27.5% | $1,943 | $285,000 |

| Cleveland, OH | $61,536 | 22.1% | $1,538 | $225,625 |

| Columbus, OH | $90,276 | 23.8% | $2,257 | $331,000 |

| Dallas, TX | $115,913 | 15.0% | $2,898 | $425,000 |

| Dayton, OH | $60,002 | 31.2% | $1,500 | $220,000 |

| Denver, CO | $158,187 | 17.3% | $3,955 | $579,999 |

| Des Moines, IA | $79,094 | 25.0% | $1,977 | $290,000 |

| Detroit, MI | $51,793 | 19.4% | $1,295 | $189,900 |

| El Paso, TX | $69,548 | 23.6% | $1,739 | $255,000 |

| Elgin, IL | $92,730 | 27.6% | $2,318 | $340,000 |

| Fort Lauderdale, FL | $114,549 | 22.2% | $2,864 | $420,000 |

| Fort Worth, TX | $98,185 | 13.2% | $2,455 | $360,000 |

| Frederick, MD | $145,407 | 18.1% | $3,635 | $533,140 |

| Fresno, CA | $114,275 | 23.4% | $2,857 | $418,995 |

| Gary, IN | $72,125 | 18.3% | $1,803 | $264,450 |

| Grand Rapids, MI | $88,639 | 24.0% | $2,216 | $325,000 |

| Greensboro, NC | $76,503 | 23.1% | $1,913 | $280,500 |

| Greenville, SC | $87,821 | 18.9% | $2,196 | $322,000 |

| Hartford, CT | $94,640 | 30.2% | $2,366 | $347,000 |

| Honolulu, HI | $188,188 | 15.9% | $4,705 | $690,000 |

| Houston, TX | $92,185 | 15.6% | $2,305 | $338,000 |

| Indianapolis, IN | $81,794 | 23.7% | $2,045 | $299,900 |

| Jacksonville, FL | $99,549 | 15.2% | $2,489 | $365,000 |

| Kansas City, MO | $89,185 | 23.1% | $2,230 | $327,000 |

| Knoxville, TN | $102,276 | 28.1% | $2,557 | $375,000 |

| Lake County, IL | $95,458 | 28.9% | $2,386 | $350,000 |

| Lakeland, FL | $88,639 | 13.4% | $2,216 | $325,000 |

| Las Vegas, NV | $113,186 | 14.9% | $2,830 | $415,000 |

| Little Rock, AR | $62,729 | 13.9% | $1,568 | $230,000 |

| Los Angeles, CA | $237,281 | 19.8% | $5,932 | $870,000 |

| Louisville, KY | $73,612 | 20.8% | $1,840 | $269,900 |

| McAllen, TX | $68,184 | 29.8% | $1,705 | $249,999 |

| Memphis, TN | $79,094 | 16.3% | $1,977 | $290,000 |

| Miami, FL | $143,187 | 33.4% | $3,580 | $525,000 |

| Milwaukee, WI | $87,548 | 28.8% | $2,189 | $321,000 |

| Minneapolis, MN | $103,640 | 19.5% | $2,591 | $380,000 |

| Montgomery County, PA | $130,886 | 28.3% | $3,272 | $479,900 |

| Nashville, TN | $124,095 | 19.0% | $3,102 | $455,000 |

| Nassau County, NY | $177,279 | 20.0% | $4,432 | $650,000 |

| New Brunswick, NJ | $141,823 | 26.9% | $3,546 | $520,000 |

| New Haven, CT | $91,367 | 21.8% | $2,284 | $335,000 |

| New Orleans, LA | $75,003 | 15.1% | $1,875 | $275,000 |

| New York, NY | $197,734 | 20.5% | $4,943 | $725,000 |

| Newark, NJ | $159,551 | 33.4% | $3,989 | $585,000 |

| North Port, FL | $123,888 | 17.4% | $3,097 | $454,240 |

| Oakland, CA | $249,554 | 17.0% | $6,239 | $915,000 |

| Oklahoma City, OK | $71,457 | 19.1% | $1,786 | $262,000 |

| Omaha, NE | $83,185 | 25.8% | $2,080 | $305,000 |

| Orlando, FL | $108,597 | 18.5% | $2,715 | $398,175 |

| Oxnard, CA | $233,190 | 23.6% | $5,830 | $855,000 |

| Philadelphia, PA | $75,003 | 16.3% | $1,875 | $275,000 |

| Phoenix, AZ | $121,368 | 13.6% | $3,034 | $445,000 |

| Pittsburgh, PA | $64,639 | 22.5% | $1,616 | $237,000 |

| Portland, OR | $149,023 | 15.6% | $3,726 | $546,400 |

| Providence, RI | $125,459 | 28.9% | $3,136 | $460,000 |

| Raleigh, NC | $120,004 | 17.4% | $3,000 | $440,000 |

| Richmond, VA | $102,276 | 24.6% | $2,557 | $375,000 |

| Riverside, CA | $151,369 | 17.6% | $3,784 | $555,000 |

| Rochester, NY | $65,866 | 30.7% | $1,647 | $241,500 |

| Sacramento, CA | $156,824 | 17.8% | $3,921 | $575,000 |

| Salt Lake City, UT | $139,096 | 13.0% | $3,477 | $510,000 |

| San Antonio, TX | $87,273 | 14.5% | $2,182 | $319,990 |

| San Diego, CA | $241,372 | 28.7% | $6,034 | $885,000 |

| San Francisco, CA | $404,332 | 23.2% | $10,108 | $1,482,500 |

| San Jose, CA | $402,287 | 24.8% | $10,057 | $1,475,000 |

| Seattle, WA | $214,904 | 18.3% | $5,373 | $787,956 |

| St. Louis, MO | $70,912 | 21.0% | $1,773 | $260,000 |

| Stockton, CA | $144,550 | 15.2% | $3,614 | $530,000 |

| Tacoma, WA | $149,855 | 17.7% | $3,746 | $549,450 |

| Tampa, FL | $103,613 | 17.3% | $2,590 | $379,900 |

| Tucson, AZ | $99,549 | 21.3% | $2,489 | $365,000 |

| Tulsa, OK | $69,548 | 23.6% | $1,739 | $255,000 |

| Virginia Beach, VA | $93,003 | 25.9% | $2,325 | $341,000 |

| Warren, MI | $82,571 | 21.4% | $2,064 | $302,749 |

| Washington, DC | $150,005 | 23.0% | $3,750 | $550,000 |

| West Palm Beach, FL | $125,459 | 24.4% | $3,136 | $460,000 |

| Wilmington, DE | $90,412 | 21.5% | $2,260 | $331,500 |

| Worcester, MA | $118,640 | 23.4% | $2,966 | $435,000 |

Methodology

This is based on a Redfin analysis that compares median monthly mortgage payments in August 2023 and August 2022. A monthly mortgage payment is considered affordable if the homebuyer spends no more than 30% of their income on housing.

Monthly median mortgage payments are calculated assuming the buyer made a 20% down payment, and take that month’s median sale price and average mortgage-interest rate into account. The average mortgage rate in August 2023 was 7.07%, while the average rate in August 2022 was 5.22%. The national income data in this analysis is adjusted for inflation using the Consumer Price Index.

The typical mortgage payments noted in this report include principal, interest, taxes and insurance. In this report, the word “homebuyer” is used to refer to someone who is taking out a loan to finance their purchase.

Editor’s note: This report has been updated to clarify that the metro-level year-over-year increases in the income necessary to afford a home is not adjusted for inflation.

United States

United States Canada

Canada