San Francisco home sellers are four times more likely than the average U.S. home seller to take a loss, as the Bay Area metro reels from an outsized drop in home prices. The typical San Francisco seller who takes a loss sells their home for $100,000 less than they bought it for.

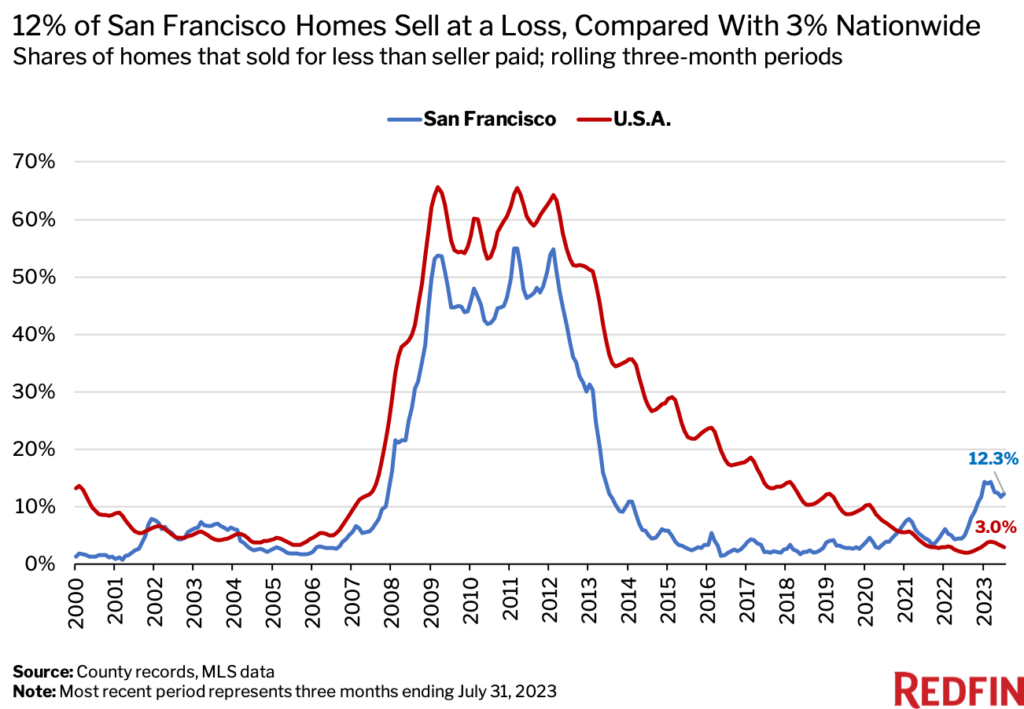

Roughly one of every eight (12.3%) homes that sold in San Francisco during the three months ending July 31 was purchased for less than the seller bought it for, up from 5% a year earlier. That’s a higher share than any other major U.S. metro and is quadruple the national rate of 3%.

Next came Detroit (6.9%), Chicago (6.5%), New York (5.9%) and Cleveland (5.8%).

In San Francisco, the typical homeowner who took a loss sold their home for $100,000 less than they bought it for. San Francisco tied with New York for the largest median loss in dollar terms. Nationwide, the typical homeowner who sold their home for less than they bought it for lost $35,538.

Homeowners were least likely to sell at a loss in San Diego, Boston, Providence, RI, Kansas City, MO and Fort Lauderdale, FL. In each of those metros, roughly 1% of homes sold for less than the seller originally paid.

This is according to a Redfin analysis of county records and MLS data across the 50 most populous U.S. metropolitan areas. To be included in this analysis, a home must have been owned by the same party for at least nine months leading up to the sale. This data is subject to revision.

San Francisco Homeowners Take Hit From Plunge in Home Prices

San Francisco home sellers were most likely to lose money because the region has experienced outsized home-price declines. It was one of the first markets to see prices sink when high mortgage rates triggered a slowdown in the housing market last year. By April 2023, San Francisco’s median home sale price was down a record 13.3% year over year, more than triple the nationwide drop of 4.2%. As of July, it was down just 4.3% year over year to $1.4 million, but that compared with a national gain of 1.6%. The total value of homes in San Francisco has fallen by roughly $60 billion since last summer, a separate Redfin analysis found.

Prices in the Bay Area have fallen fast for a few reasons: First, it’s home to the most expensive real estate in the country, meaning housing costs had a lot of room to come down. It has also been hit hard by layoffs in the technology sector. Additionally, it’s not as popular as it once was; remote work has allowed scores of people to relocate to more affordable areas.

San Francisco, Detroit, Chicago and New York, which top the list of metros where home sellers are most likely to take a loss, all rank among the top 10 metros Redfin.com users are looking to leave.

“Some condos in the Bay Area are now worth less than their owners bought them for in 2018 and 2019, in part because commuting from Oakland and other outlying areas into downtown San Francisco isn’t really a thing anymore,” said local Redfin Premier real estate agent Andrea Chopp, who focuses on Oakland and other East Bay neighborhoods. “There are buyers out there, but they’re a lot more cautious and picky than they were when mortgage rates were low. The Bay Area housing market was unsustainable before, so this correction is probably healthy, but the unfortunate thing is prices remain unaffordable for a lot of people—especially with rates now above 7%.”

The Vast Majority of U.S. Home Sellers Are Still Reaping Gains

Even though home prices have fallen from their peak, a majority of home sellers are still reaping significant financial gains. Nationwide, 97% of home sellers sold for a profit during the three months ending July 31, with the typical home that sold going for 78.4% ($203,232) more than the seller bought it for.

Even in San Francisco, most homeowners are still making a lot of money. The typical home that sold in the metro went for 70.5% ($625,500) more than the seller bought it for.

Today’s home sellers are making money despite an ongoing housing downturn in part because a scarcity of homes for sale is fueling bidding wars and propping up home values. Most people who bought when home prices peaked would lose money if they sold now, so they’re not selling. Many of the homeowners who are selling today have owned their homes for long enough to make a profit regardless of month-to-month fluctuations in housing values.

In Boise, ID, Redfin Premier agent Shauna Pendleton has clients who will likely have to take a $100,000 loss on their home because they’re selling it after only about a year. They’re moving back to Seattle because their employer is requiring them to return to the office. Pendleton noted that it’s not common for homeowners to sell at a loss in Boise, but when it does happen, it often involves homes selling for upwards of $750,000.

Metro-Level Summary: 50 Most Populous U.S. Metro Areas

Statistics in the table below represent the three months ending July 31, 2023, unless otherwise noted.

| U.S. Metro Area | Share of Homes Sold at a Loss | Share of Homes Sold at a Loss, One Year Earlier | Median Loss of Homeowners Who Sold at a Loss | Median Capital Gain ($) | Median Capital Gain (%) |

|---|---|---|---|---|---|

| Anaheim, CA | 1.8% | 0.5% | $-53,750 | $470,000 | 88.7% |

| Atlanta, GA | 2.8% | 1.1% | $-26,494 | $170,000 | 82.9% |

| Austin, TX | 3.0% | 0.2% | $-41,882 | $223,780 | 82.5% |

| Baltimore, MD | 4.3% | 4.3% | $-23,000 | $132,000 | 60.0% |

| Boston, MA | 1.2% | 0.8% | $-50,000 | $315,100 | 81.9% |

| Charlotte, NC | 2.4% | 1.1% | $-27,500 | $174,000 | 84.5% |

| Chicago, IL | 6.5% | 7.2% | $-26,000 | $115,000 | 53.5% |

| Cincinnati, OH | 2.6% | 2.7% | $-18,130 | $122,050 | 82.5% |

| Cleveland, OH | 5.8% | 4.9% | $-18,000 | $86,500 | 73.0% |

| Columbus, OH | 1.9% | 1.6% | $-25,000 | $150,700 | 92.7% |

| Dallas, TX | 1.7% | 0.3% | $-24,000 | $184,950 | 69.8% |

| Denver, CO | 1.8% | 0.5% | $-39,000 | $245,100 | 74.3% |

| Detroit, MI | 6.9% | 5.8% | $-18,000 | $80,500 | 89.0% |

| Fort Lauderdale, FL | 1.3% | 1.6% | $-30,000 | $220,000 | 122.2% |

| Fort Worth, TX | 1.4% | 0.4% | $-20,000 | $141,000 | 64.4% |

| Houston, TX | 2.2% | 1.1% | $-18,000 | $119,910 | 52.1% |

| Indianapolis, IN | 1.6% | 0.7% | $-20,500 | $121,500 | 72.8% |

| Jacksonville, FL | 3.0% | 1.3% | $-25,000 | $157,050 | 77.4% |

| Kansas City, MO | 1.2% | 0.6% | $-16,000 | $138,000 | 73.8% |

| Las Vegas, NV | 3.7% | 1.0% | $-31,000 | $169,800 | 75.4% |

| Los Angeles, CA | 2.3% | 1.0% | $-77,250 | $389,651 | 84.6% |

| Miami, FL | 2.0% | 1.9% | $-60,000 | $252,500 | 104.1% |

| Milwaukee, WI | 3.3% | 3.5% | $-23,667 | $120,000 | 70.6% |

| Minneapolis, MN | 2.8% | 2.0% | $-18,454 | $140,100 | 63.7% |

| Montgomery County, PA | 2.2% | 2.5% | $-35,000 | $200,000 | 80.0% |

| Nashville, TN | 2.7% | 0.8% | $-37,500 | $181,285 | 75.0% |

| Nassau County, NY | 2.8% | 2.3% | $-69,500 | $285,000 | 80.3% |

| National—U.S.A. | 3.0% | 2.0% | $-35,538 | $203,232 | 78.4% |

| New Brunswick, NJ | 2.7% | 2.3% | $-50,000 | $215,000 | 84.3% |

| New York, NY | 5.9% | 4.7% | $-100,000 | $313,000 | 79.8% |

| Newark, NJ | 3.2% | 3.7% | $-69,400 | $230,600 | 76.9% |

| Oakland, CA | 3.5% | 1.0% | $-54,250 | $412,250 | 82.0% |

| Orlando, FL | 2.2% | 1.6% | $-33,000 | $175,000 | 85.4% |

| Philadelphia, PA | 4.2% | 3.4% | $-18,398 | $127,000 | 87.0% |

| Phoenix, AZ | 4.3% | 0.4% | $-42,400 | $195,000 | 79.6% |

| Pittsburgh, PA | 3.2% | 3.5% | $-19,000 | $116,900 | 89.2% |

| Portland, OR | 3.0% | 1.2% | $-35,000 | $244,925 | 80.3% |

| Providence, RI | 1.2% | 1.1% | $-67,000 | $200,000 | 83.3% |

| Riverside, CA | 2.4% | 0.7% | $-39,000 | $248,500 | 86.4% |

| Sacramento, CA | 3.1% | 1.1% | $-30,000 | $225,000 | 69.2% |

| San Antonio, TX | 2.0% | 0.3% | $-19,750 | $104,000 | 47.1% |

| San Diego, CA | 1.1% | 0.5% | $-66,500 | $400,000 | 88.9% |

| San Francisco, CA | 12.3% | 5.0% | $-100,000 | $625,500 | 70.5% |

| San Jose, CA | 3.3% | 1.2% | $-72,000 | $755,000 | 108.6% |

| Seattle, WA | 2.6% | 0.8% | $-50,100 | $385,000 | 98.7% |

| St. Louis, MO | 4.3% | 3.7% | $-18,000 | $105,100 | 70.1% |

| Tampa, FL | 2.3% | 1.0% | $-30,000 | $183,500 | 99.2% |

| Virginia Beach, VA | 2.4% | 2.6% | $-20,000 | $113,000 | 50.9% |

| Warren, MI | 2.4% | 2.1% | $-19,000 | $118,000 | 72.8% |

| Washington, DC | 3.5% | 2.7% | $-25,500 | $195,000 | 56.5% |

| West Palm Beach, FL | 1.9% | 1.0% | $-31,137 | $220,000 | 102.3% |

United States

United States Canada

Canada