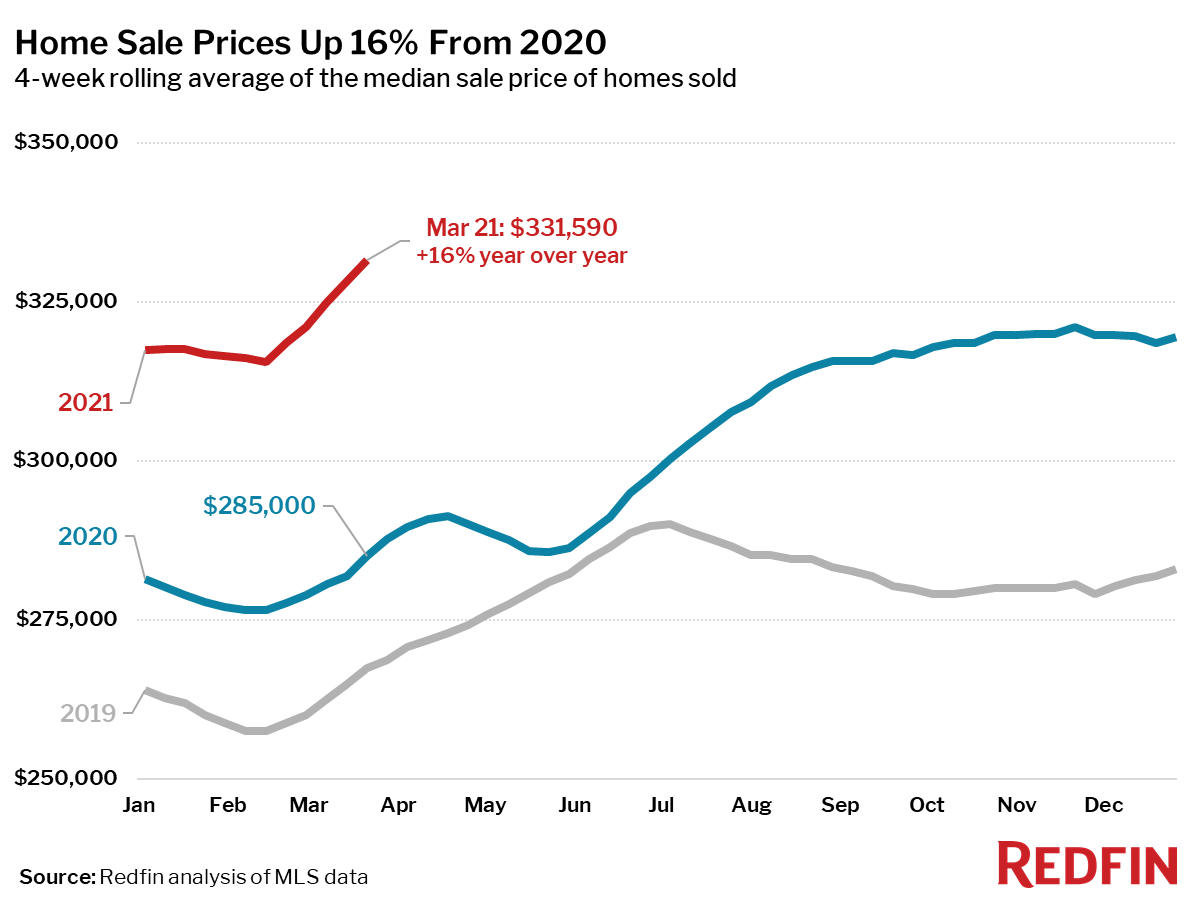

Home prices rose 16% to a new all-time high.

Key housing market takeaways for 400+ U.S. metro areas during the 4-week period ending March 21:

Note: Year-over-year comparisons in this report may be more a reflection of the fact that this time last year stay-at-home-orders halted both home-buying and selling activity than of how the housing market has changed over the past year.”

- The median home-sale price increased 16% year over year to $331,590, an all-time high.

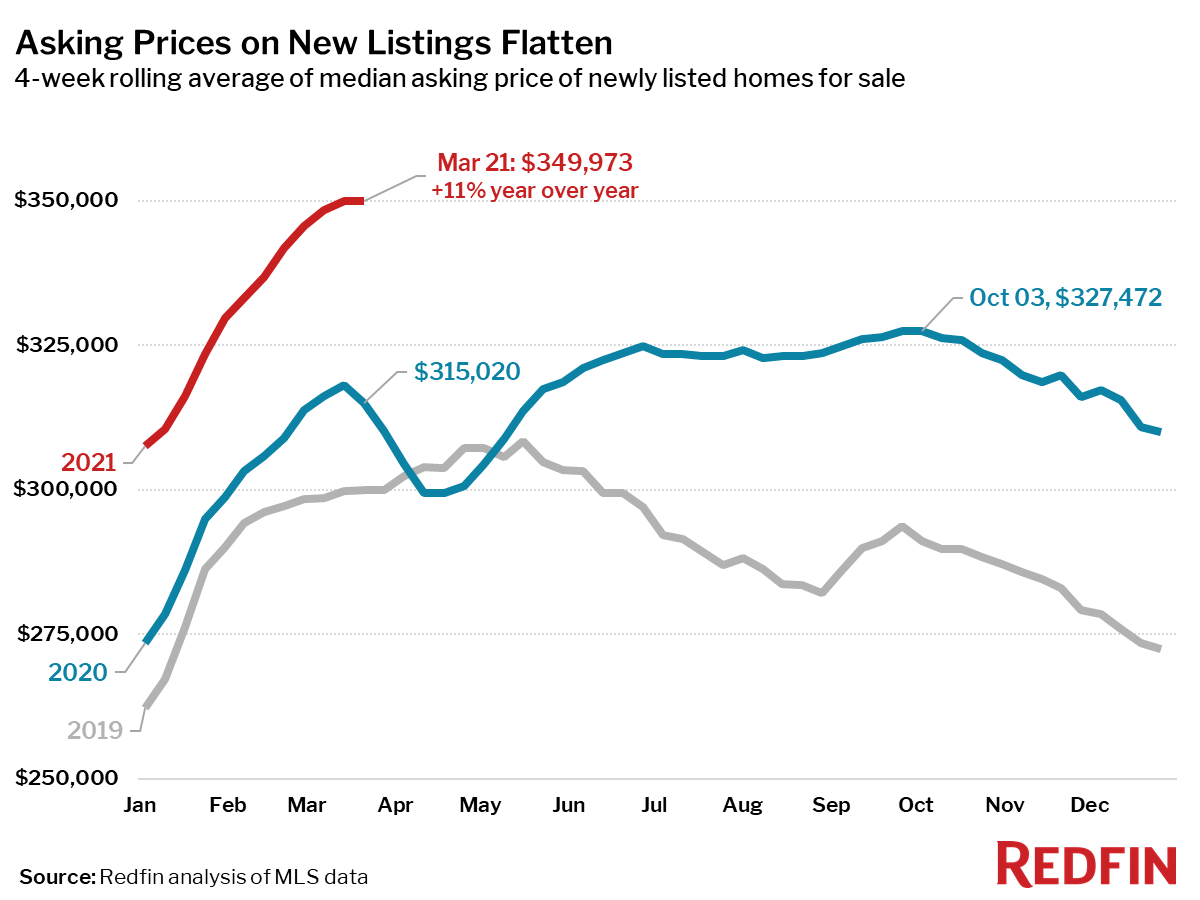

- Asking prices of newly listed homes were flat from the previous 4-week period at $349,973, and up 11% from the same time a year ago.

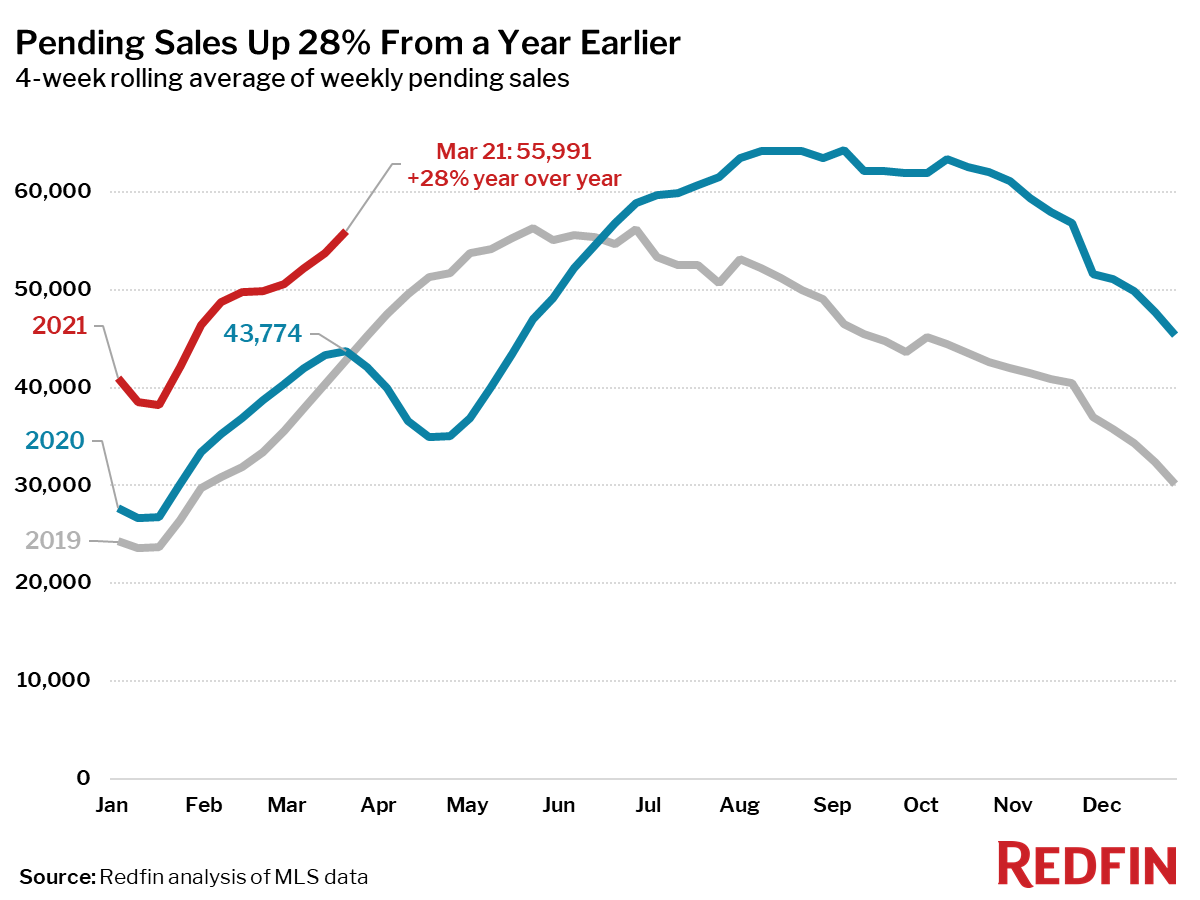

- Pending home sales were up 28% year over year.

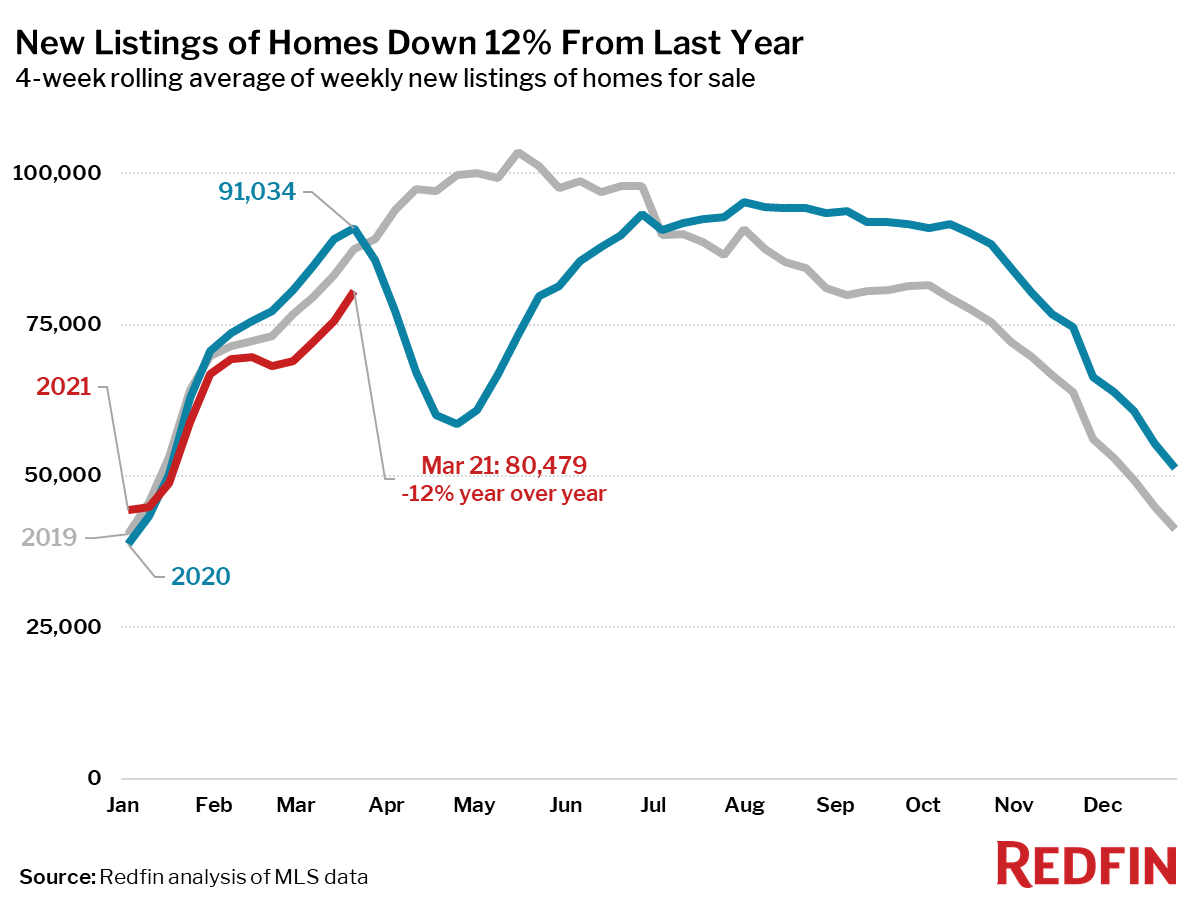

- New listings of homes for sale were down 12% from a year earlier.

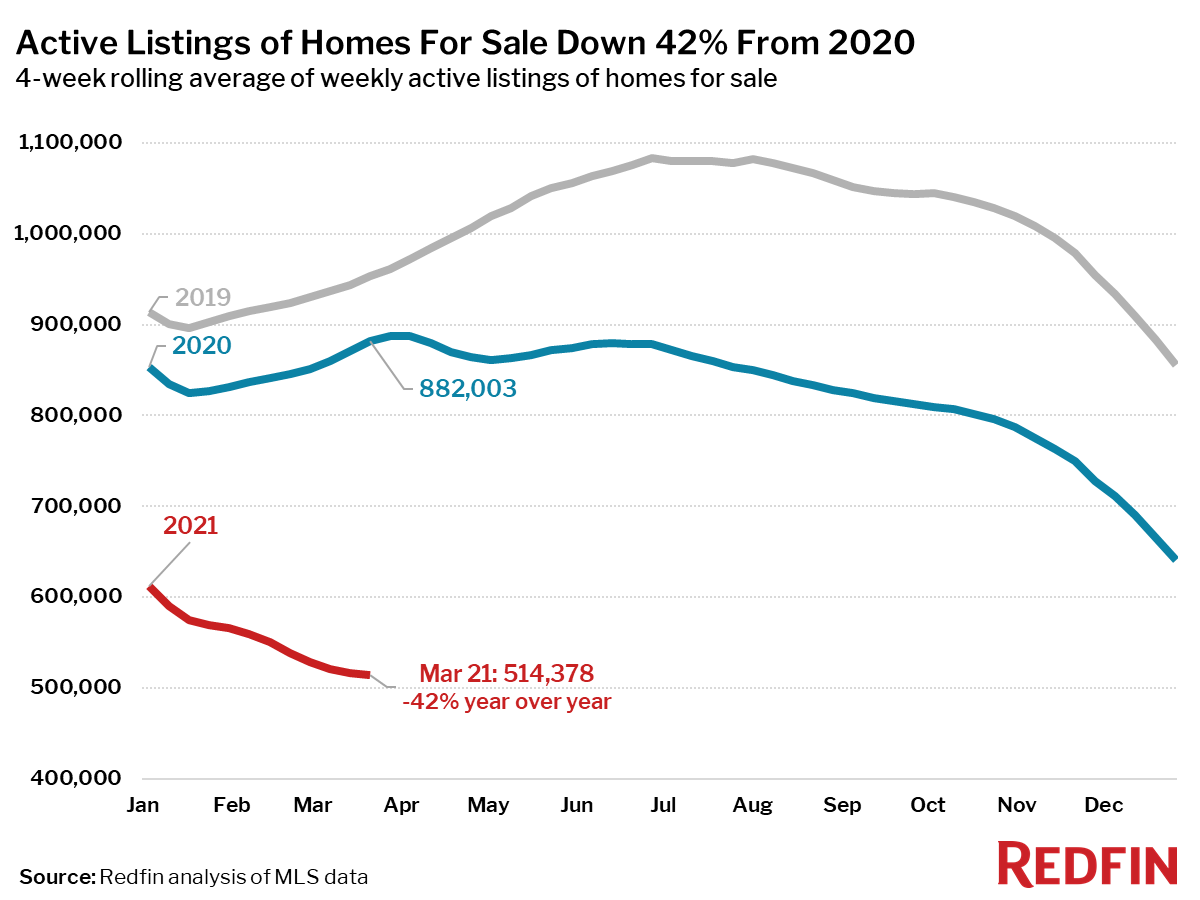

- Active listings (the number of homes listed for sale at any point during the period) fell 42% from 2020 to a new all-time low. This is the largest decrease on record in this data, which goes back through 2016.

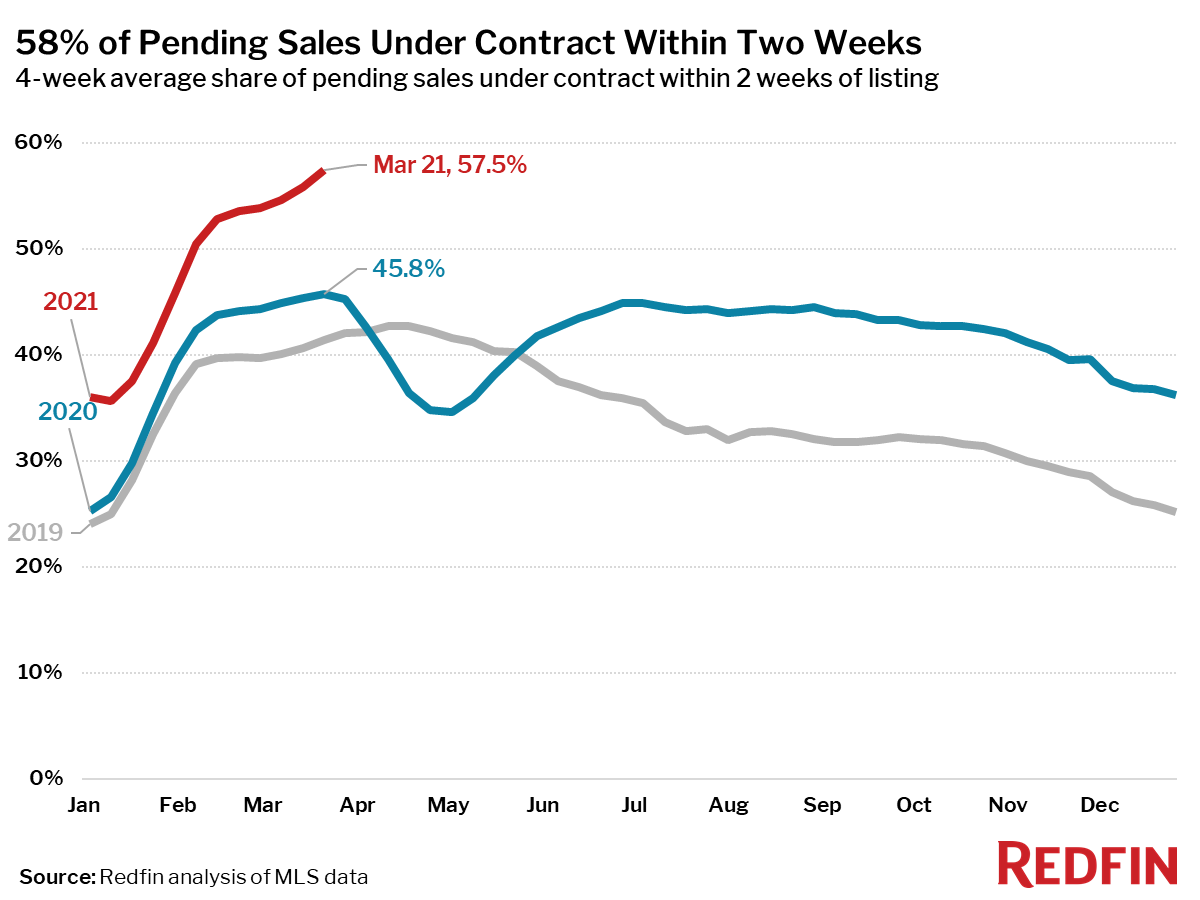

- 58% of homes that went under contract had an accepted offer within the first two weeks on the market This is a new all-time high for this measure since at least 2012 (as far back as Redfin’s data for this measure goes) and well above the 46% rate during the same period a year ago. During the 7-day period ending March 21, 61% of homes sold in two weeks or less.

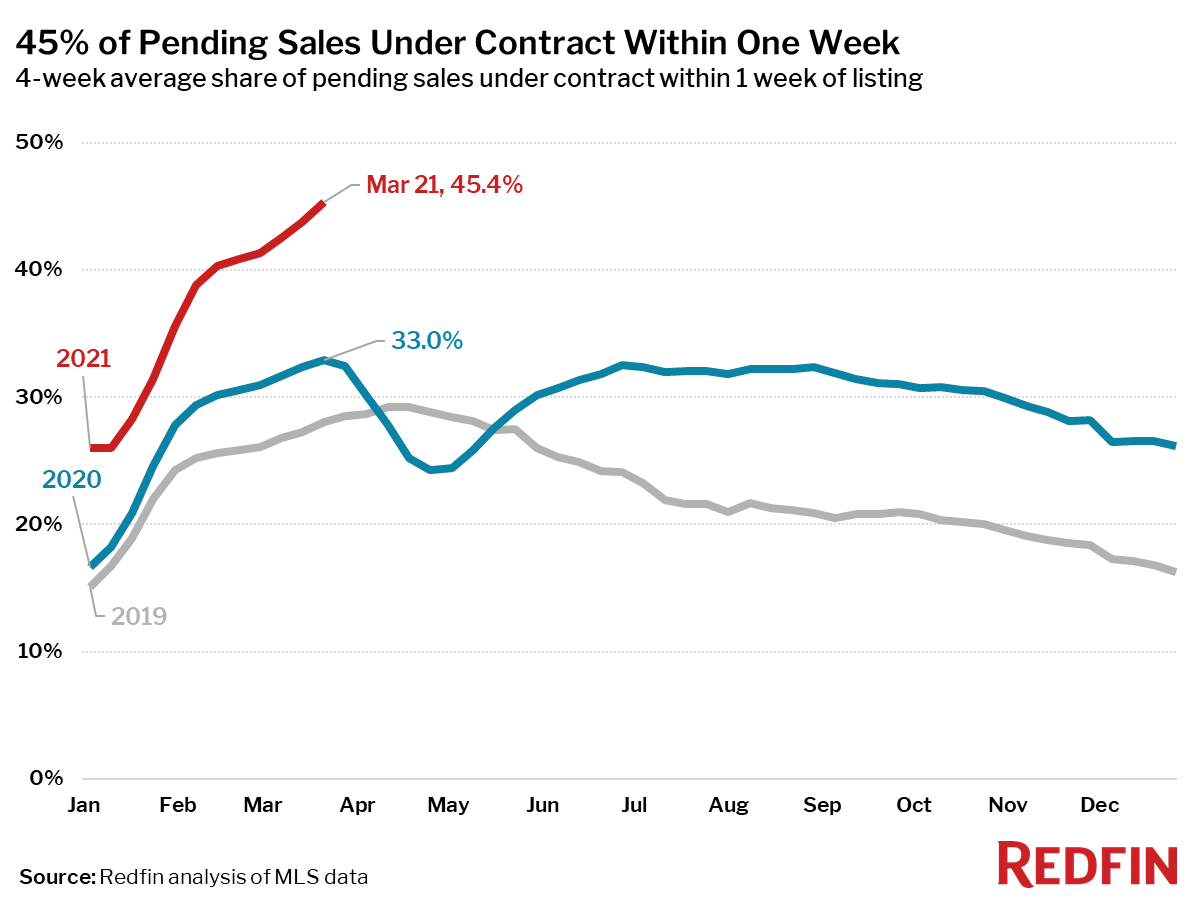

- 45% of homes that went under contract had an accepted offer within one week of hitting the market, an all-time high and up from 33% during the same period a year earlier. During the 7-day period ending March 21, 48% sold in one week or less.

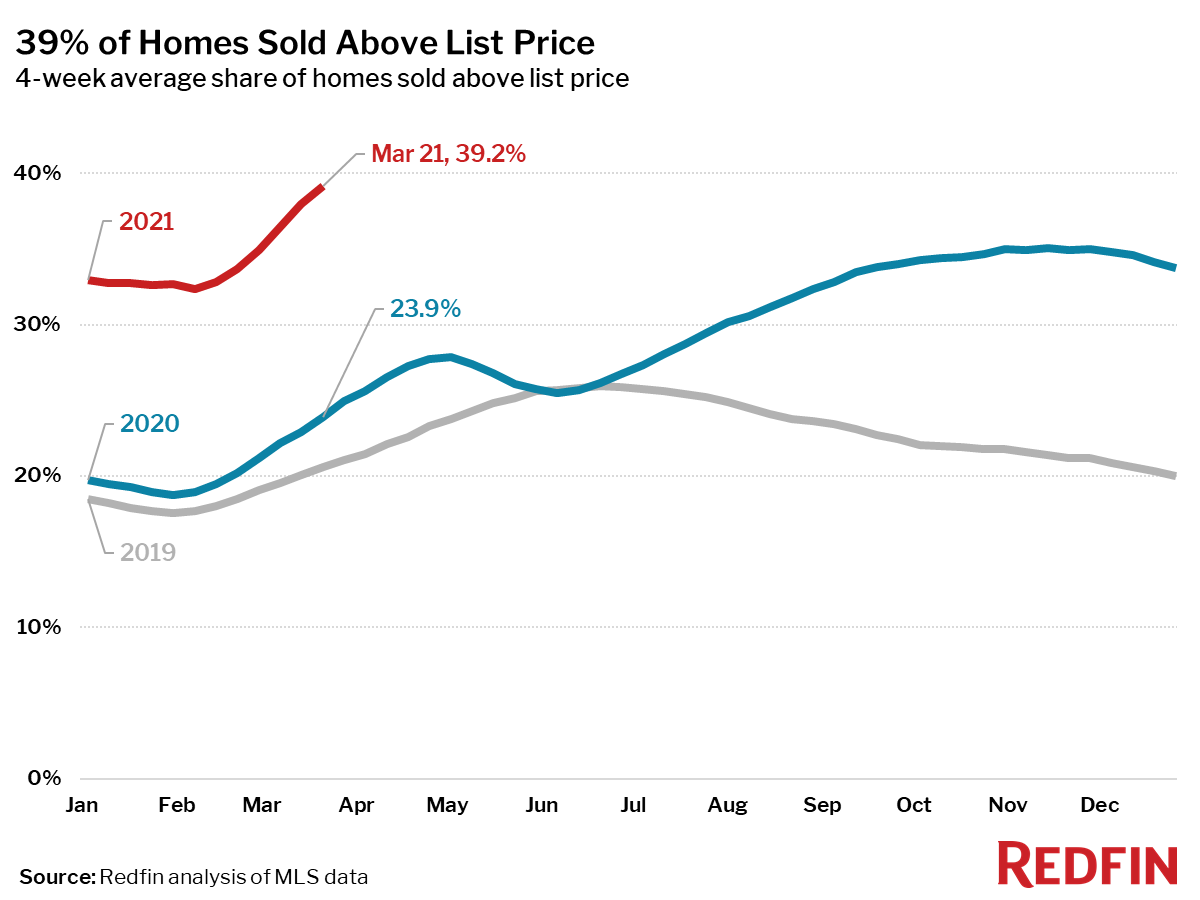

- 39% of homes sold above their list price, an all-time high and 15 percentage points higher than the same period a year earlier.

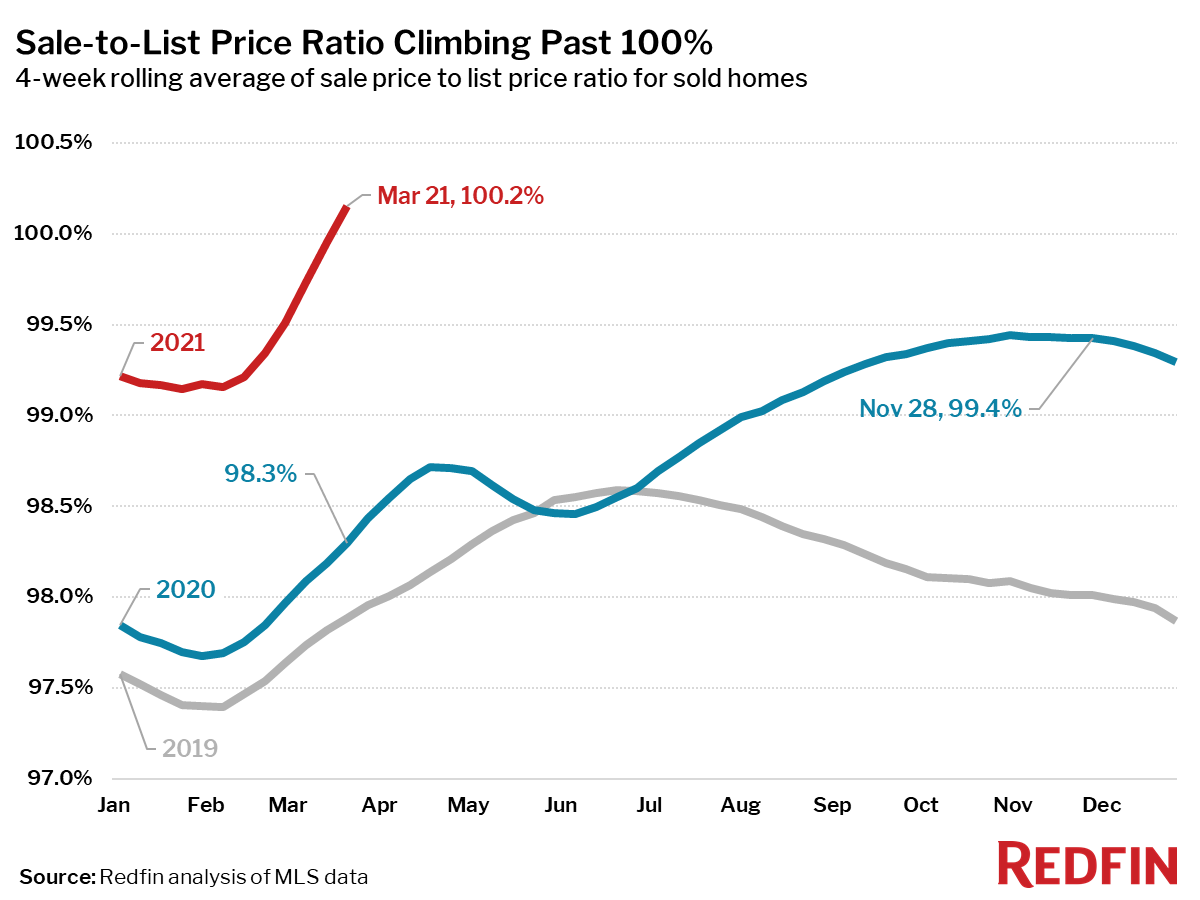

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, increased to 100.2%, an all-time high and 1.9 percentage points higher than a year earlier.

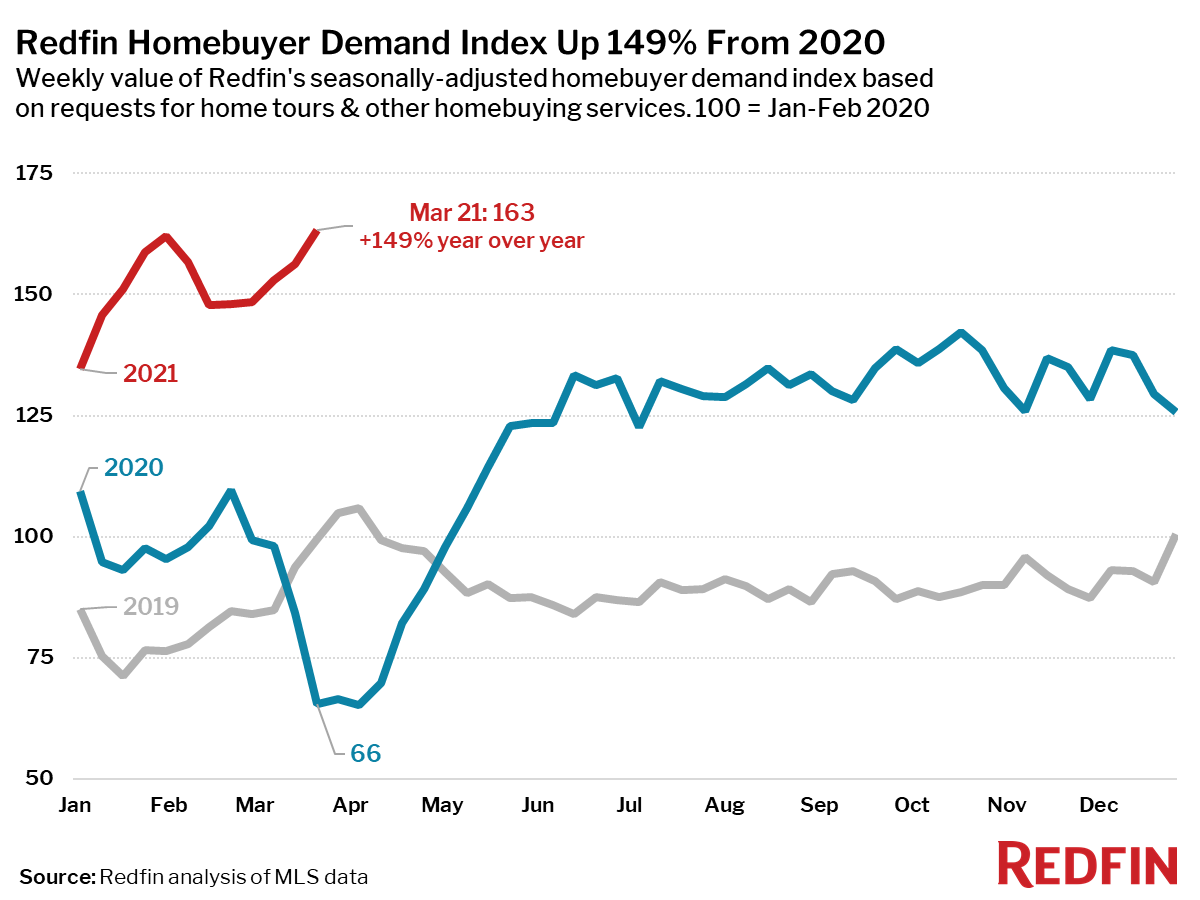

- For the 7-day period ending March 21, the seasonally adjusted Redfin Homebuyer Demand Index—a measure of requests for home tours and other services from Redfin agents—was up 149% from the same period a year ago, when housing demand was near the lowest point it would hit during the pandemic.

- Mortgage purchase applications increased 3% week over week (seasonally adjusted) and were up 26% from a year earlier (unadjusted) during the week ending March 19. For the week ending March 25, 30-year mortgage rates increased to 3.17%, the highest level since June.

“It’s concerning how much home prices have risen during the pandemic,” said Redfin Chief Economist Daryl Fairweather. “When the pandemic is over, purchasing a home is going to cost much more than ever before, putting homeownership much further out of reach for many Americans. That means a future in which most Americans will not have the opportunity to build wealth through home equity, which will worsen inequality in our society. The Biden administration is putting together an infrastructure bill right now that includes building 1.5 million sustainable homes, but there is no guarantee the bill will be passed with every policy proposal intact. America needs an audacious goal to increase the housing supply, given the U.S. is short 2.5 million homes. It may be expensive to build millions of homes, but ignoring the problem would only cause housing to become more unaffordable and worsen housing insecurity.”

Refer to our metrics definition page for explanations of all the metrics used in this report.

United States

United States Canada

Canada