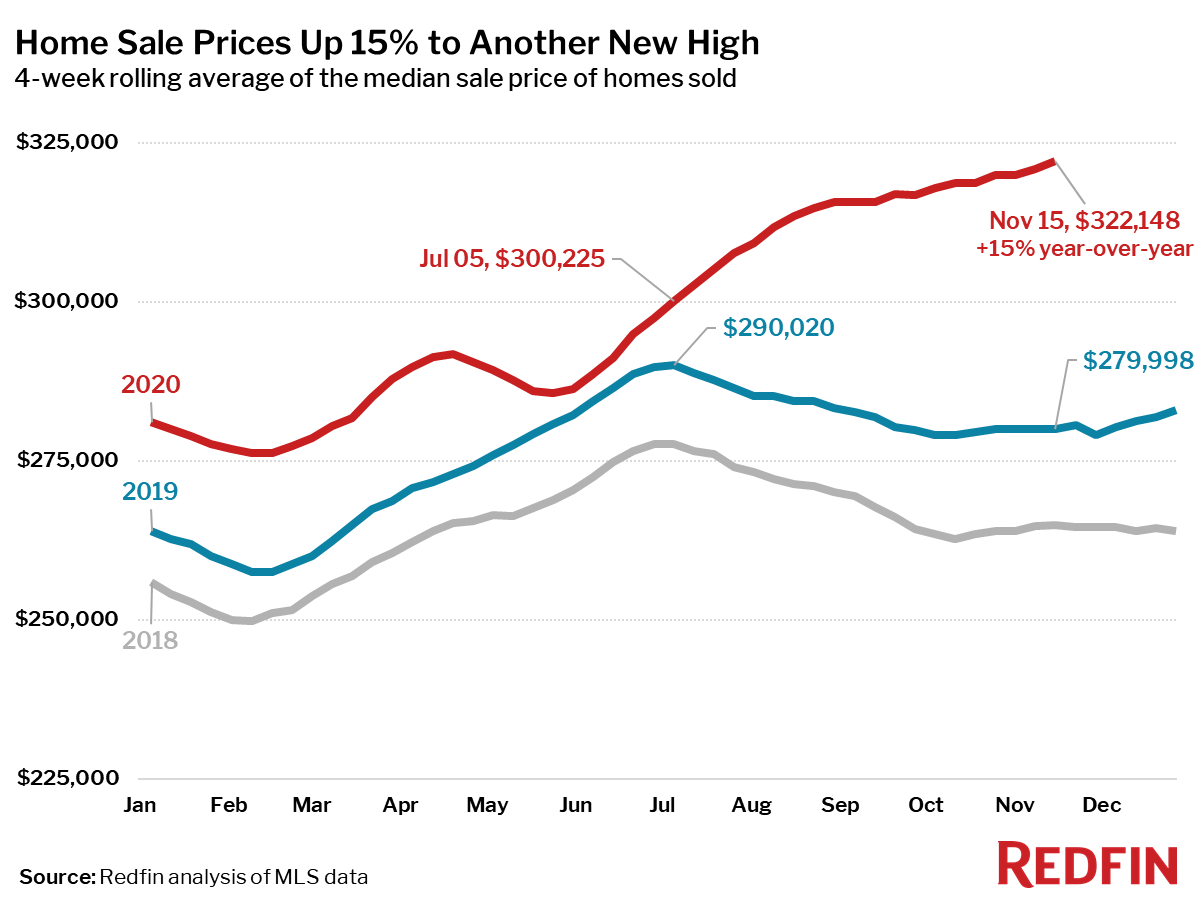

Home prices rose 15% and new listings were up just 7%.

Key housing market takeaways for 400+ U.S. metro areas during the 4-week period ending November 15:

- The median home sale price increased 15% year over year to $322,148, the highest on record. Home prices rose 16% year over year in the single week ending November 15.

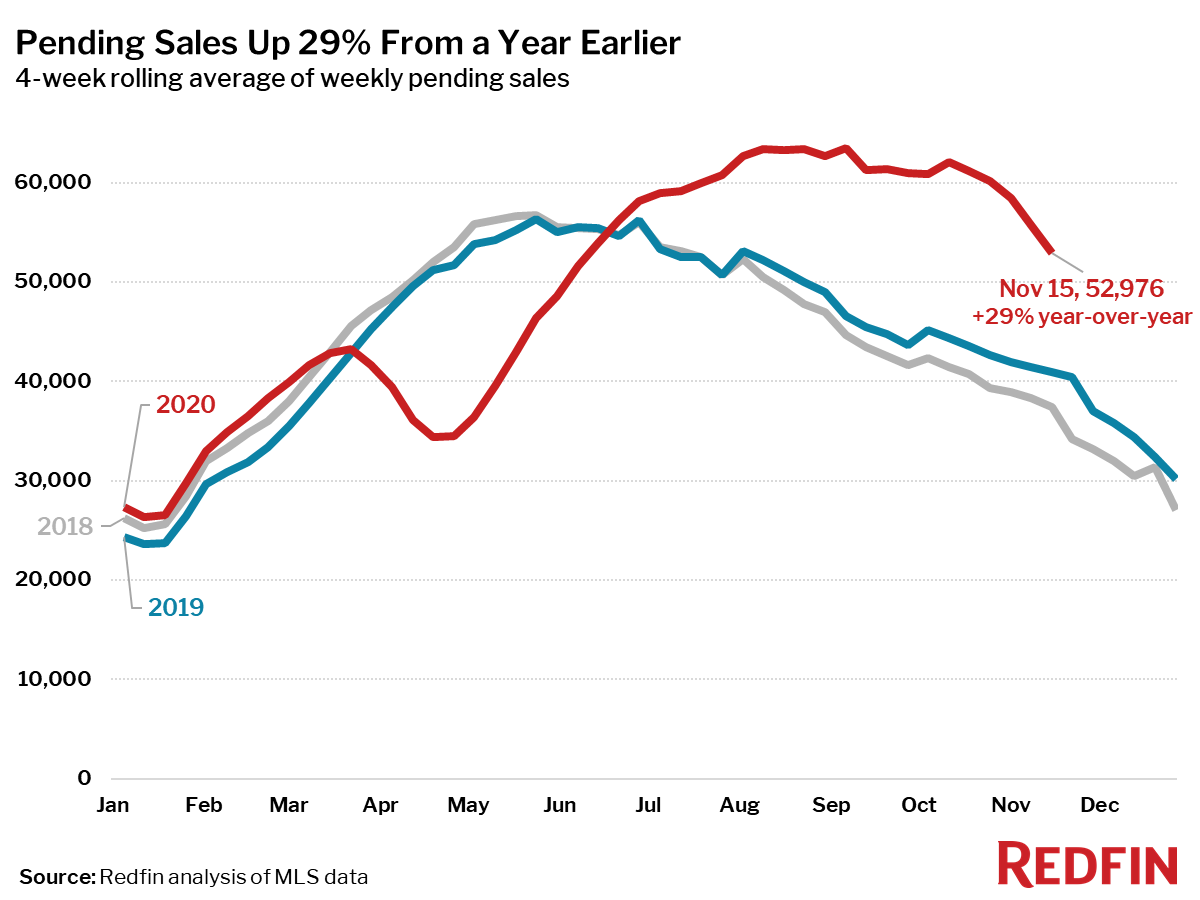

- Pending home sales climbed 29% year over year even as the number of pending sales continued a typical seasonal decline. In the single week ending November 15, pending sales were up 22% from the same week a year earlier. This is a slight increase compared to the previous week’s growth.

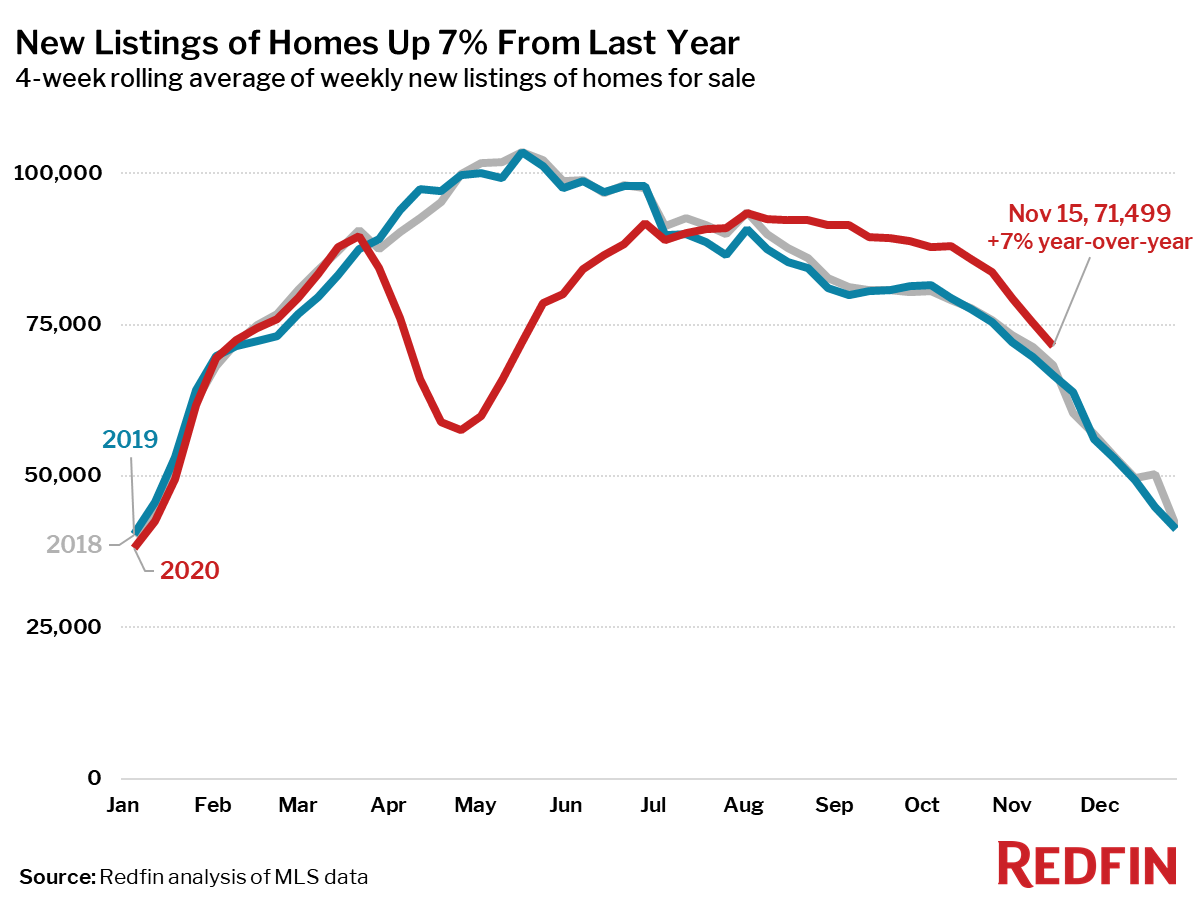

- New listings of homes for sale were up 7% from a year earlier. The one-week year-over-year increase also rebounded to 6% for the week ending November 15 from 3% during election week The number of new listings was the lowest it has been since May.

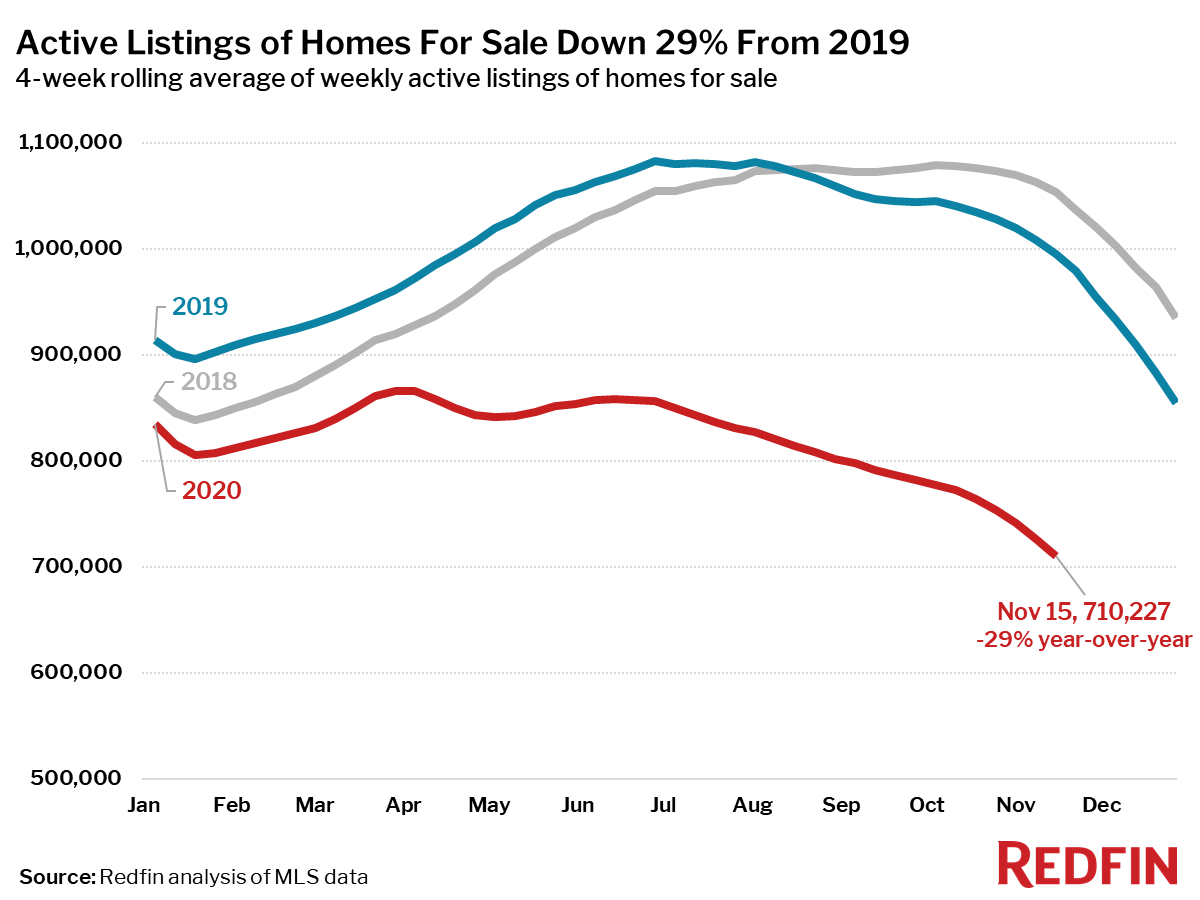

- Active listings (the number of homes listed for sale at any point during the period) fell 29% from 2019 to a new all-time low.

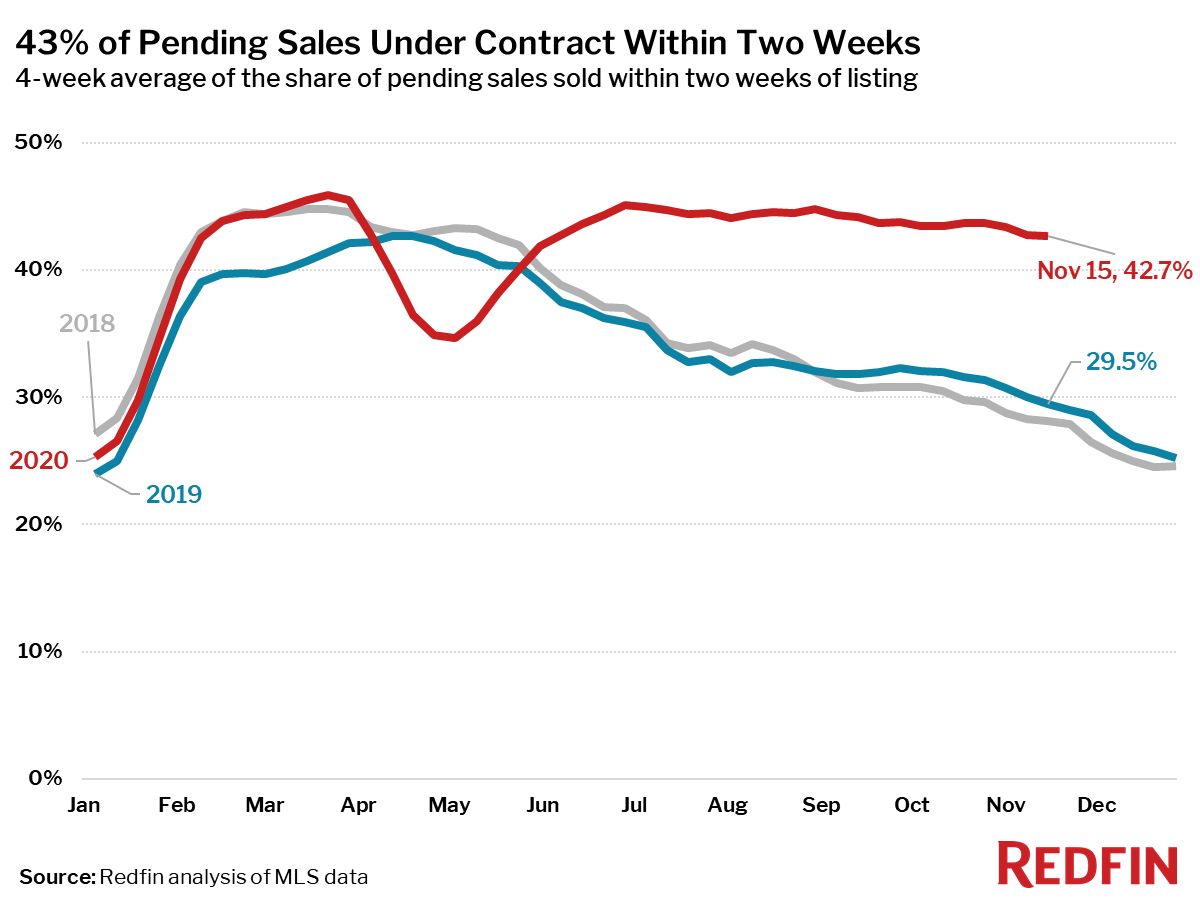

- 43% of homes that went under contract had an accepted offer within the first two weeks on the market. This measure typically peaks in April or May and declines through the end of the year, but this year it held relatively between late June and October, and has only recently begun to decline slightly.

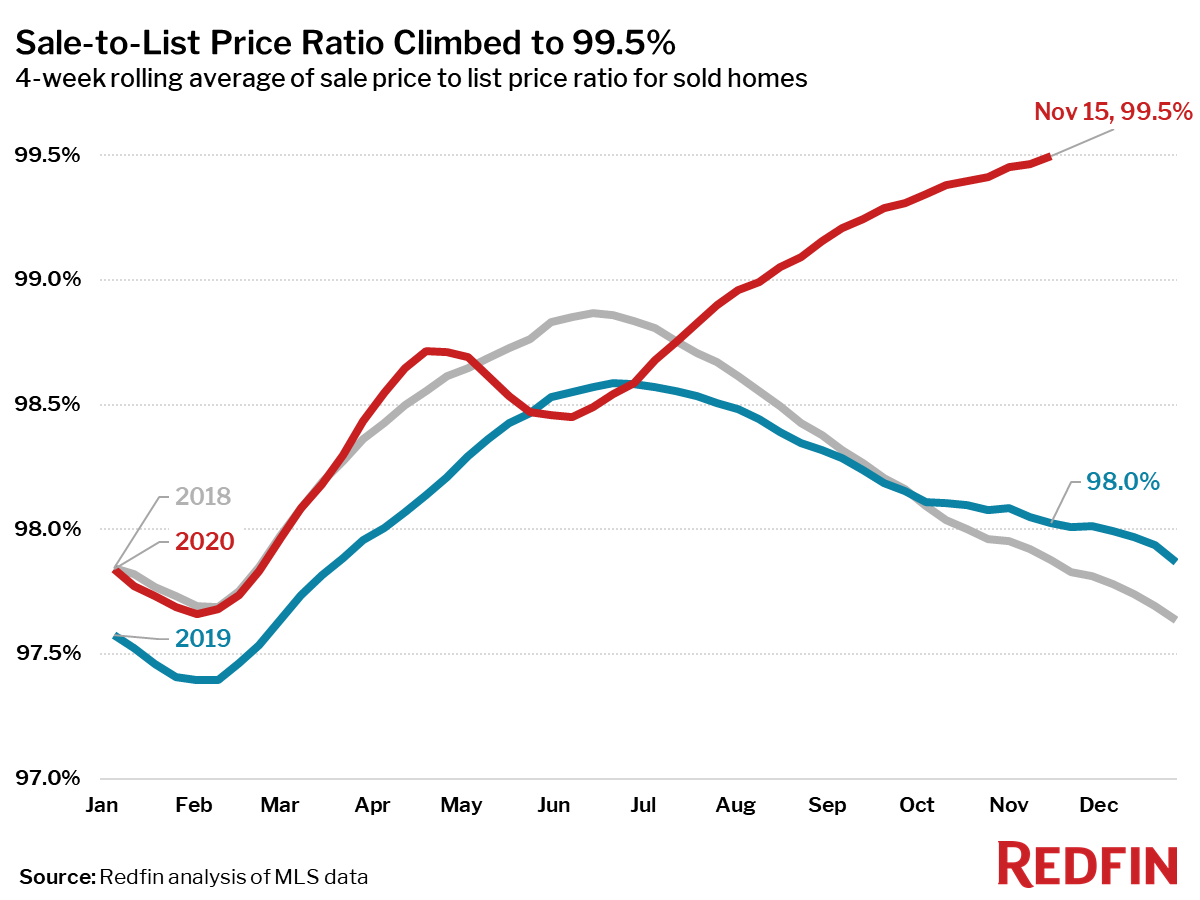

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, rose to 99.5%—an all-time high and 1.5 percentage points higher than a year earlier.

- For the week ending November 15, the seasonally adjusted Redfin Homebuyer Demand Index was up 35% from pre-pandemic levels in January and February.

- Mortgage purchase applications increased 4% week over week (seasonally-adjusted) and were up 26% from a year earlier (unadjusted) during the week ending November 13. For the week ending November 19, 30-year mortgage rates dropped to 2.72%, the thirteenth record low this year. Rates have been below 3% since late July.

“In early November, few homeowners decided to list amidst all of the uncertainty and anxiety about the election outcome,” said Redfin chief economist Daryl Fairweather. “But that anxiety didn’t stop buyers from scooping up the homes that were left for sale. However, our data is starting to show a slowdown in the number of people viewing homes, which is typical for this time of year. If that trend continues the way we’d expect it to, buyers who remain in the market may start to encounter less competition than we’ve grown accustomed to since the summer, before the market likely returns to full speed in the new year.”

United States

United States Canada

Canada