Pending sales posted their first annual decline since June 2020, stalled due to a lack of supply. Early spring has the potential to be even hotter and more volatile: stock-market declines, mortgage-rate increases and mounting affordability pressures may eventually leave overpriced listings piling up on the market.

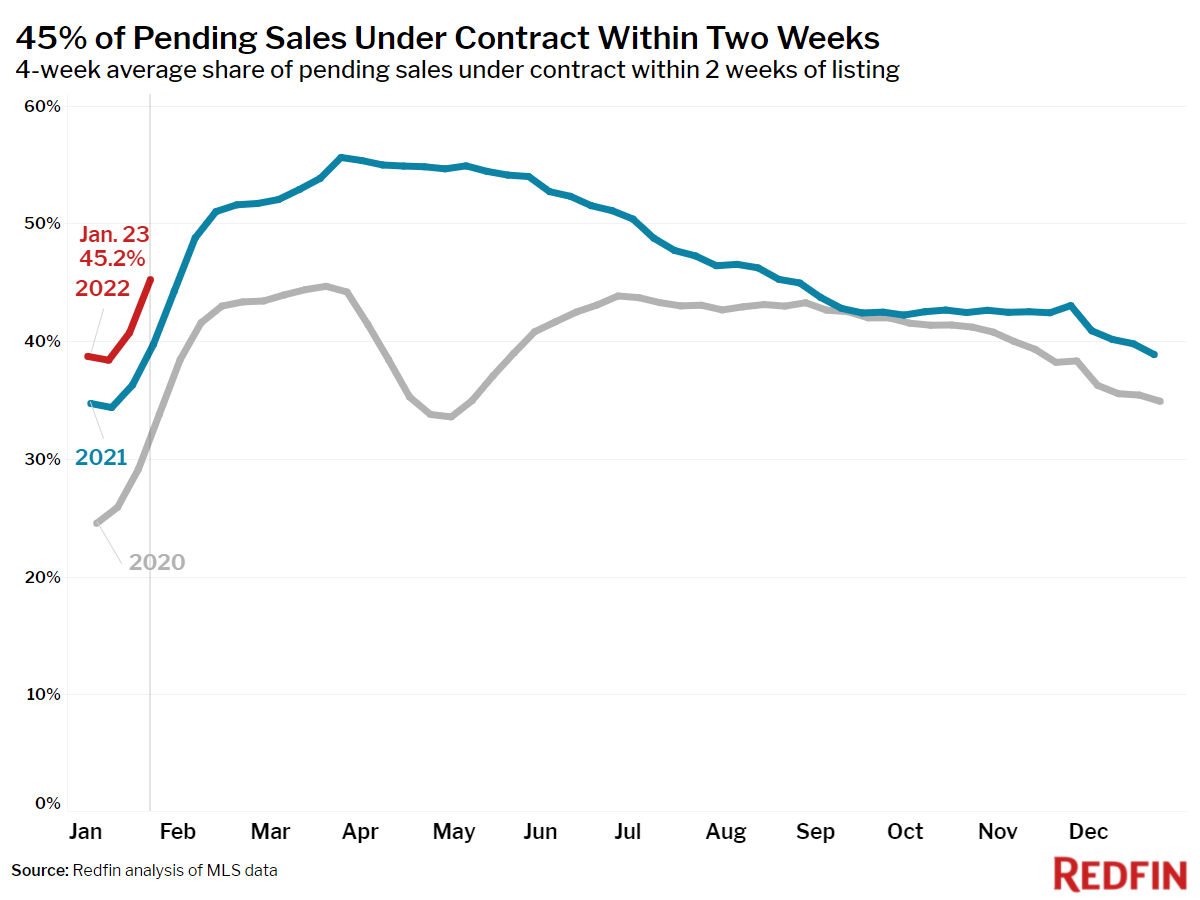

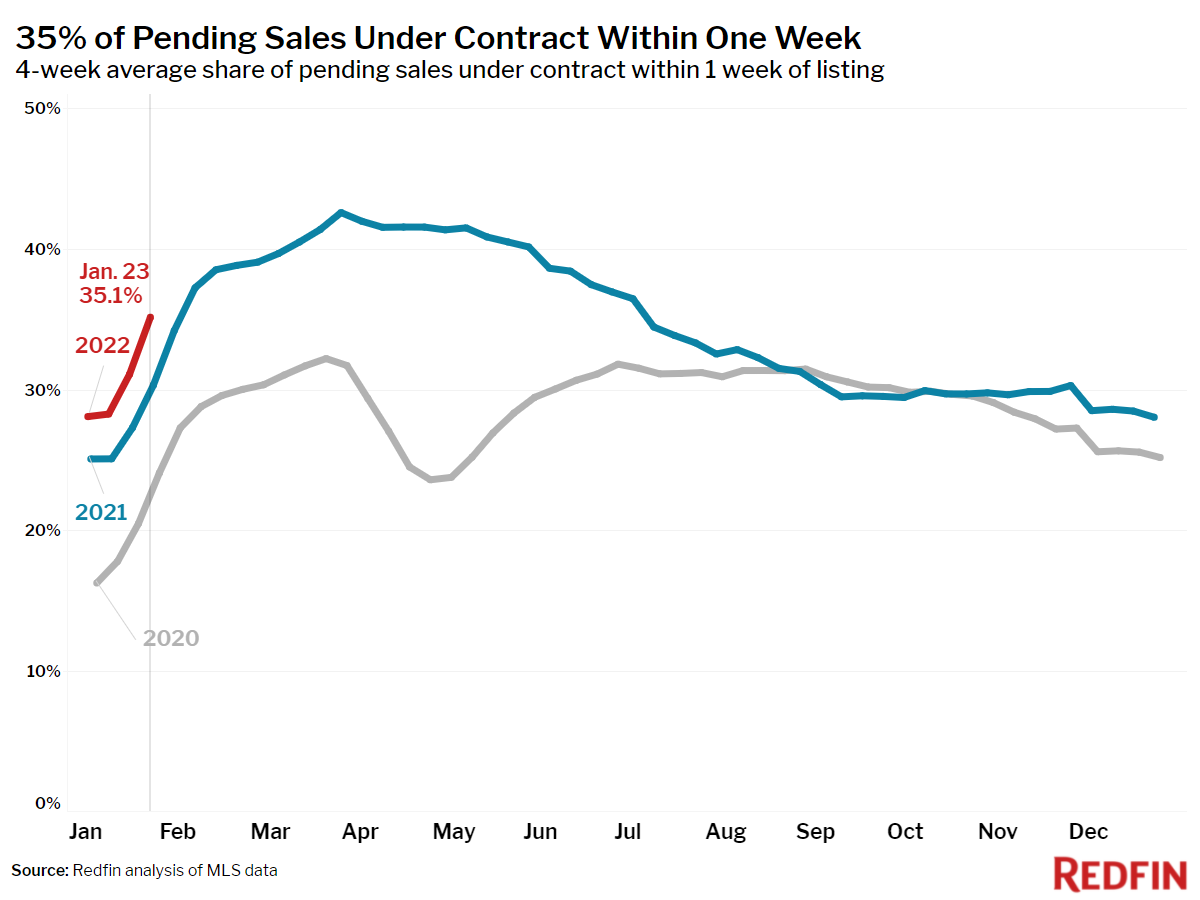

Homebuyers are grappling with the hottest January on record, as 45% of homes now find a buyer within two weeks on the market. Thirty-five percent go under contract within a week. Both rates are the highest we’ve ever seen for this time of year.

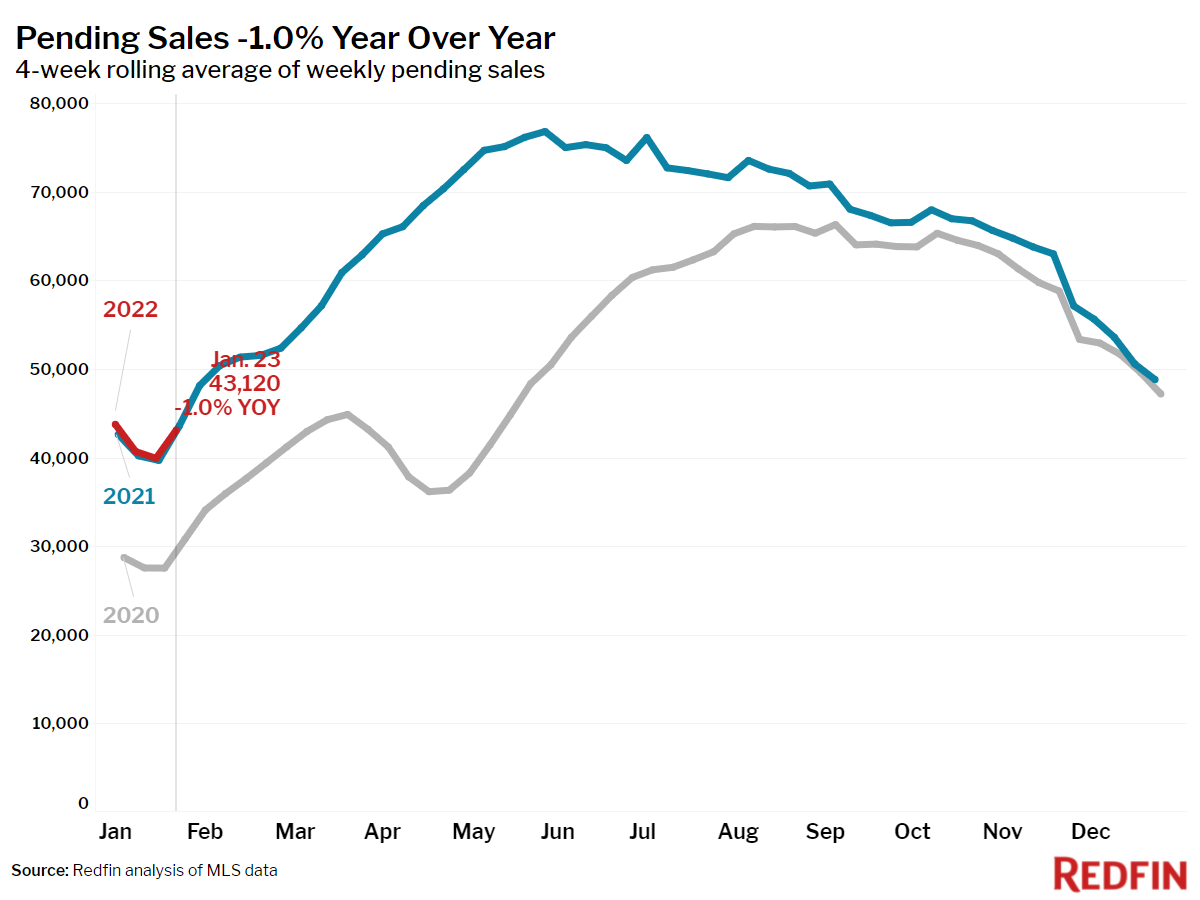

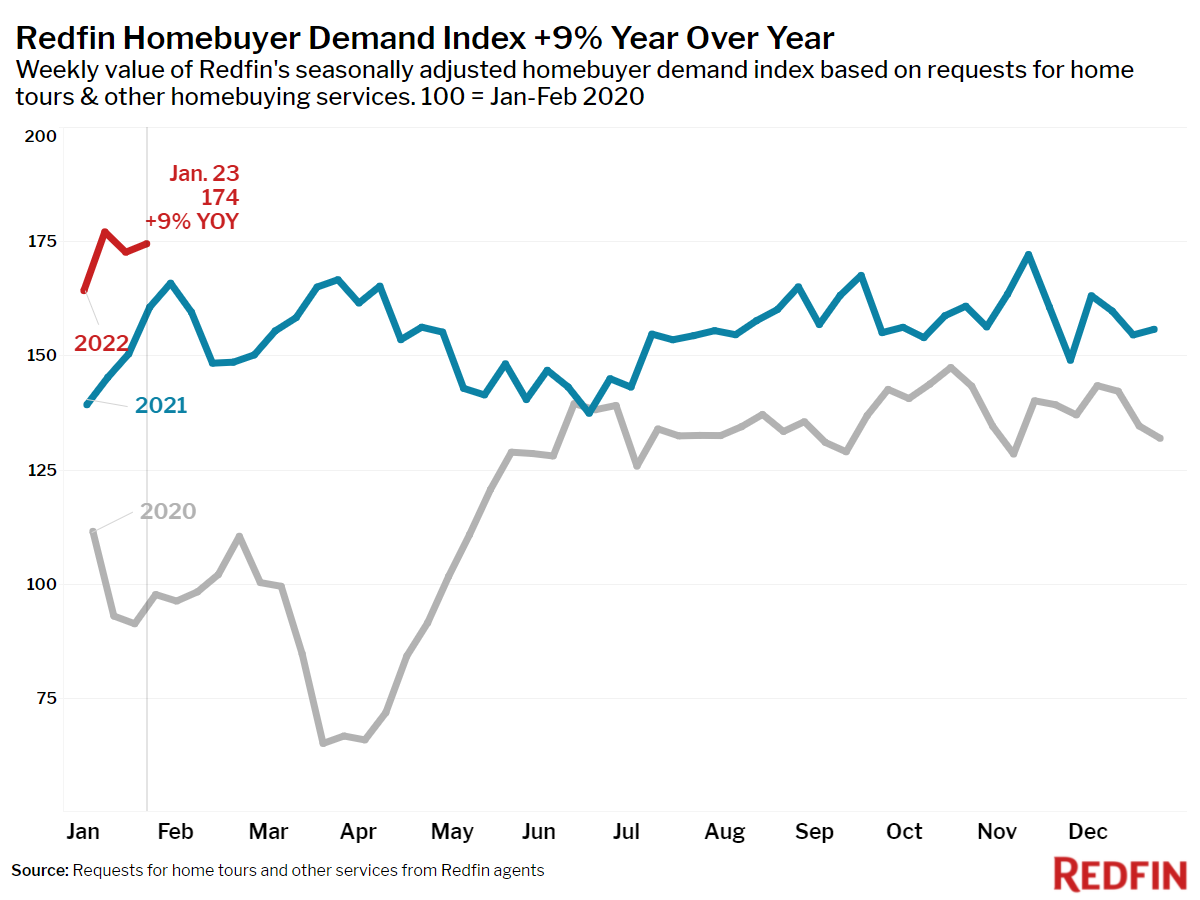

Despite the market’s unprecedented intensity, pending home sales were down 1% during the four weeks ending January 23, the first year-over-year decline since June 2020. The stalling sales are not for a lack of buyers–the Redfin Homebuyer Demand Index was up 9%—but rather a lack of sellers.

“Buyers who have been looking for a home since last year are tired of the search and just want to be done,” said Indianapolis Redfin real estate agent Jill Thompson. “Many sellers seem to be waiting until spring, so the inventory shortage is especially intense right now, leading to a renewed surge of bidding wars and buyers making offers that waive inspection and financing contingencies.”

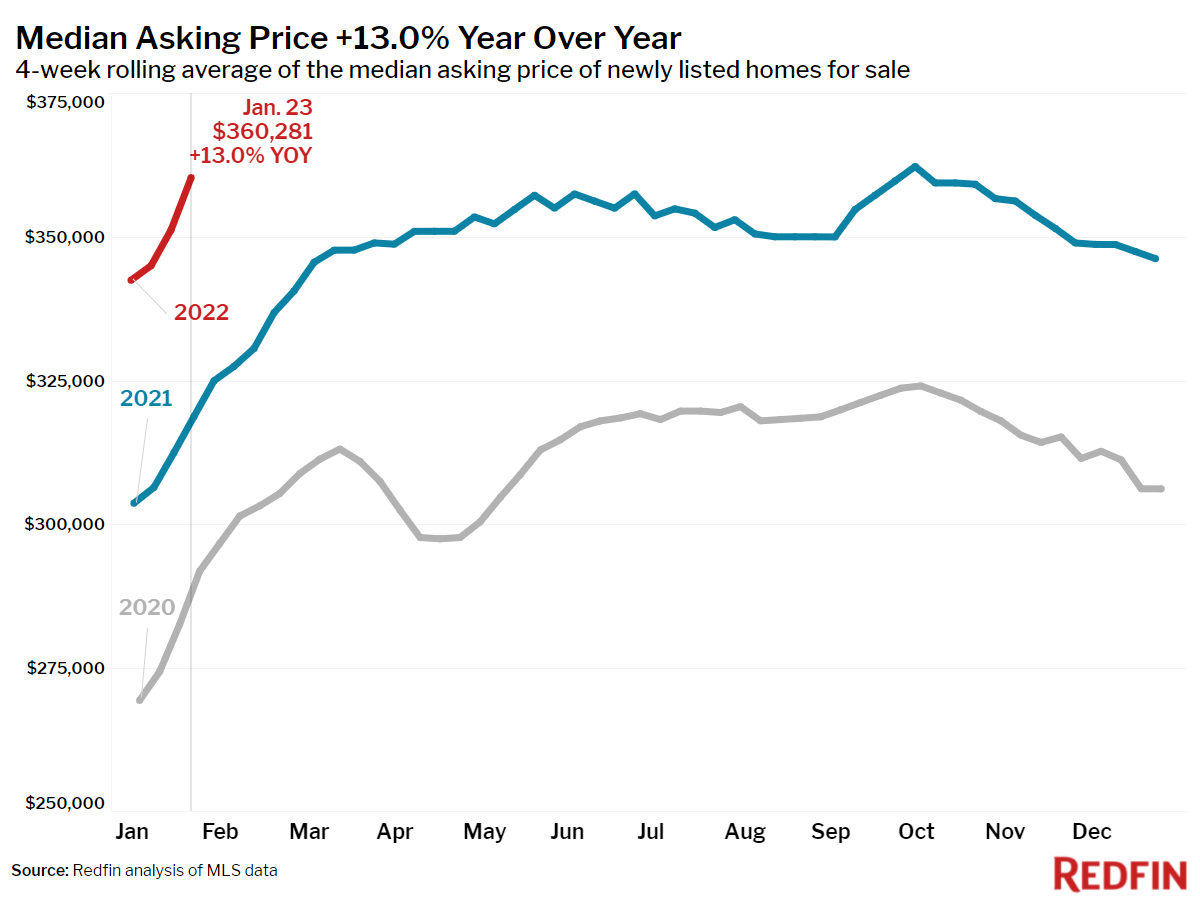

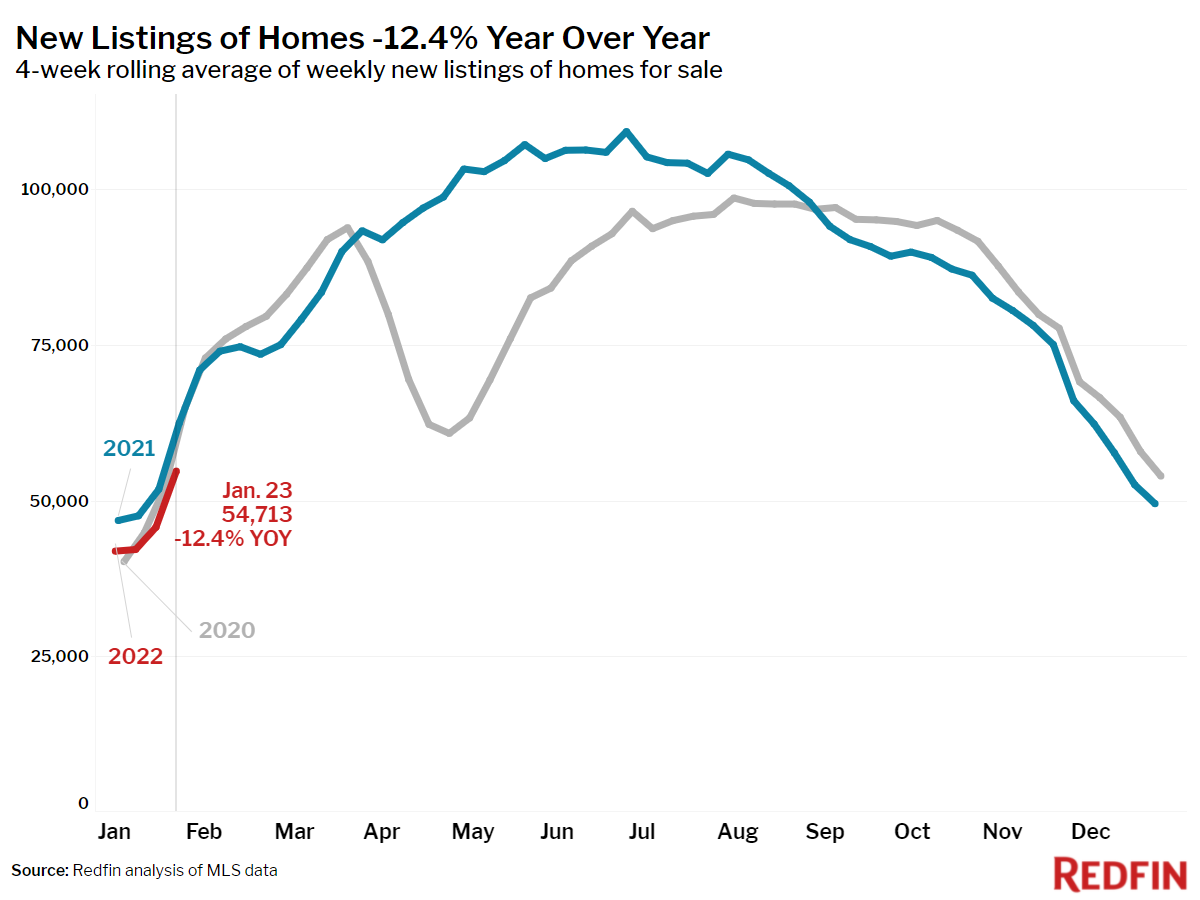

New listings fell 12%, the largest drop since June 2020, dragging the total number of homes for sale to another new low. Homeowners who are on the market appear to be feeling quite confident; the median asking price climbed 13% to $360,281, just shy of October’s all-time high.

“The early spring is poised to be the hottest housing market on record; we may start to see most homes going under contract within two weeks, but these conditions are likely to be short-lived,” said Redfin Chief Economist Daryl Fairweather. “Now that the stock market is down about 10% from the start of the year and mortgage rates are up nearly half a point, the housing market could lose its luster soon. If that happens, I expect the inventory shortage to finally reach its nadir because overpriced homes will start to pile up on the market.”

Key housing market takeaways for 400+ U.S. metro areas:

Unless otherwise noted, the data in this report covers the four-week period ending January 23. Redfin’s housing market data goes back through 2012.

Data based on homes listed and/or sold during the period:

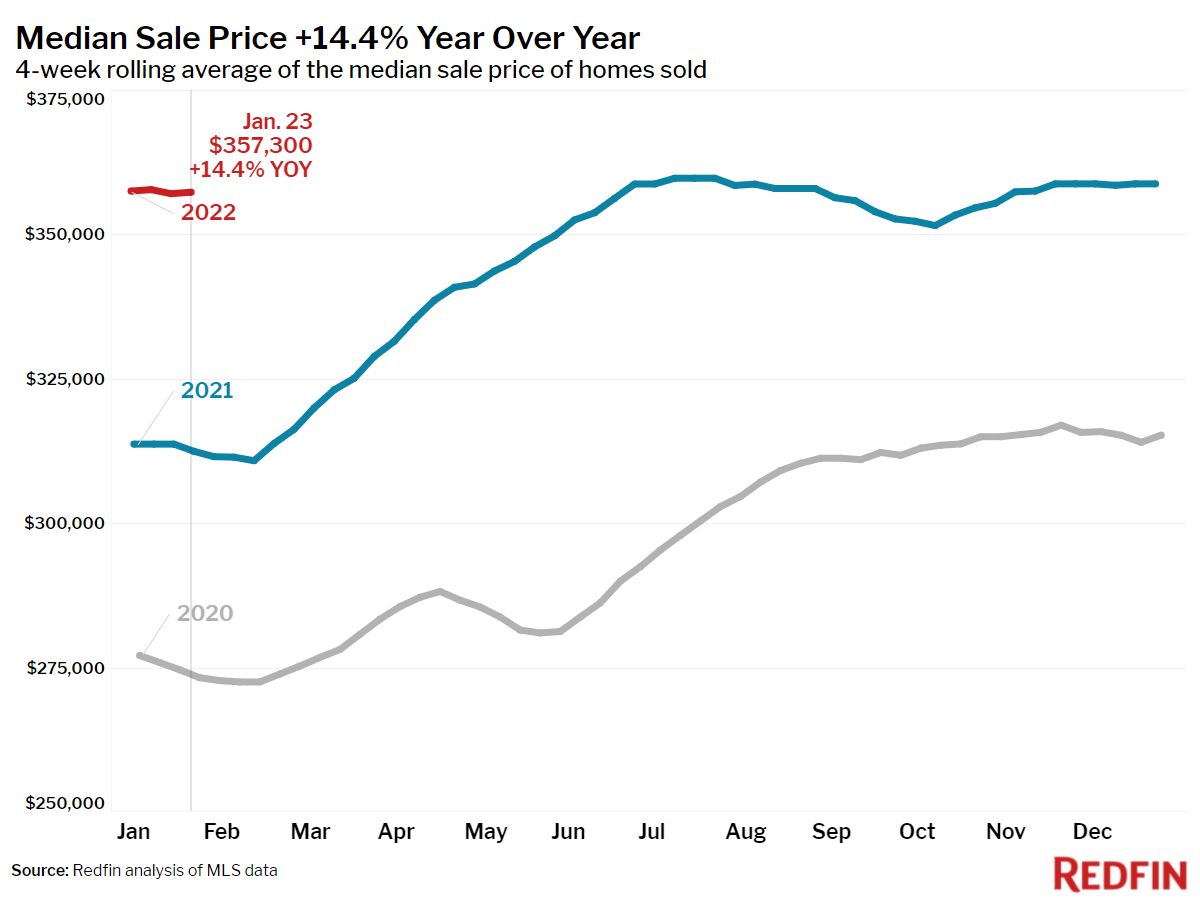

- The median home sale price was up 14% year over year to $357,300.

- The median asking price of newly listed homes increased 13% year over year to $360,281.

- Pending home sales were down 1% year over year, the first year-over-year decline since June 2020.

- New listings of homes for sale were down 12% from a year earlier, the largest decline since June 2020.

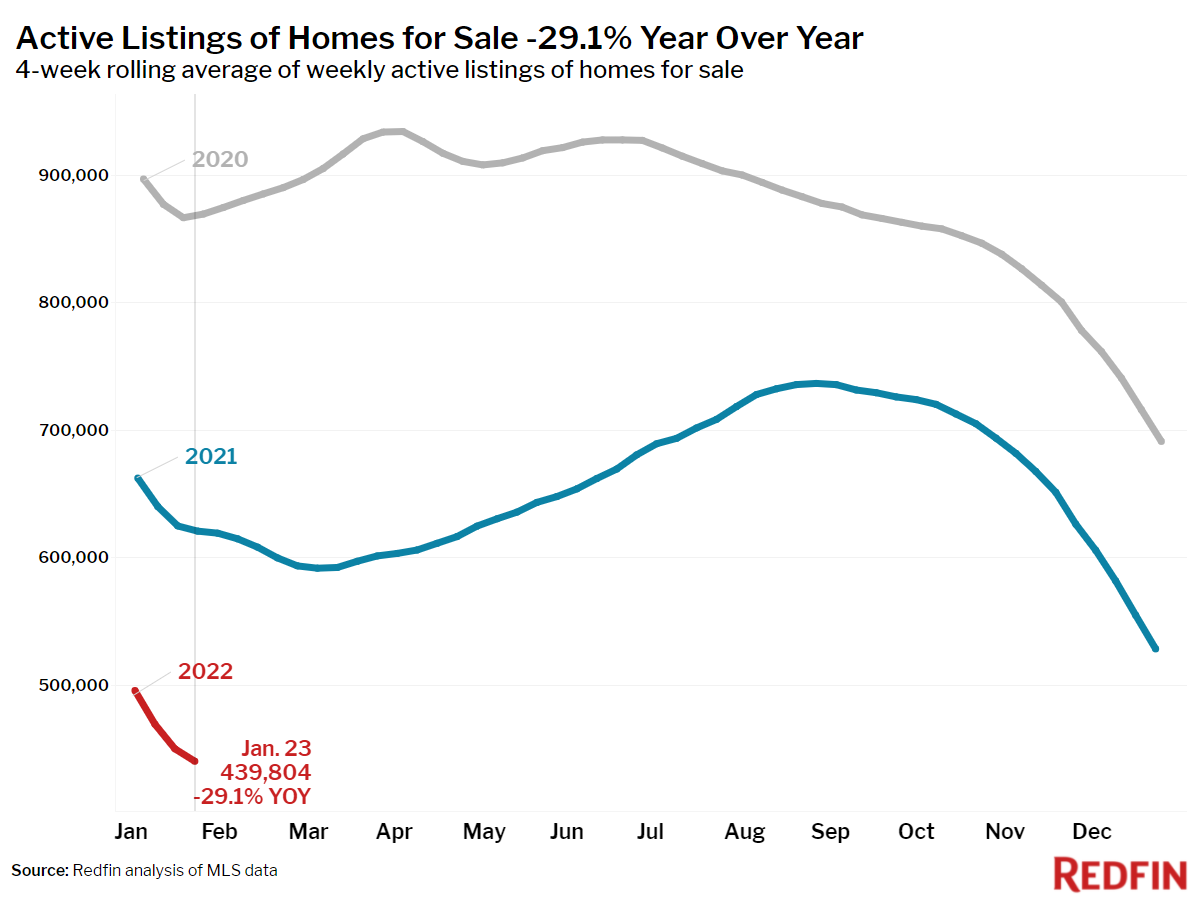

- Active listings (the number of homes listed for sale at any point during the period) fell 29% year over year, dropping to an all-time low of 440,000.

- 45% of homes that went under contract that had an accepted offer within the first two weeks on the market, above the 40% rate of a year earlier.

- 35% of homes that went under contract had an accepted offer within one week of hitting the market, up from 30% during the same period a year earlier.

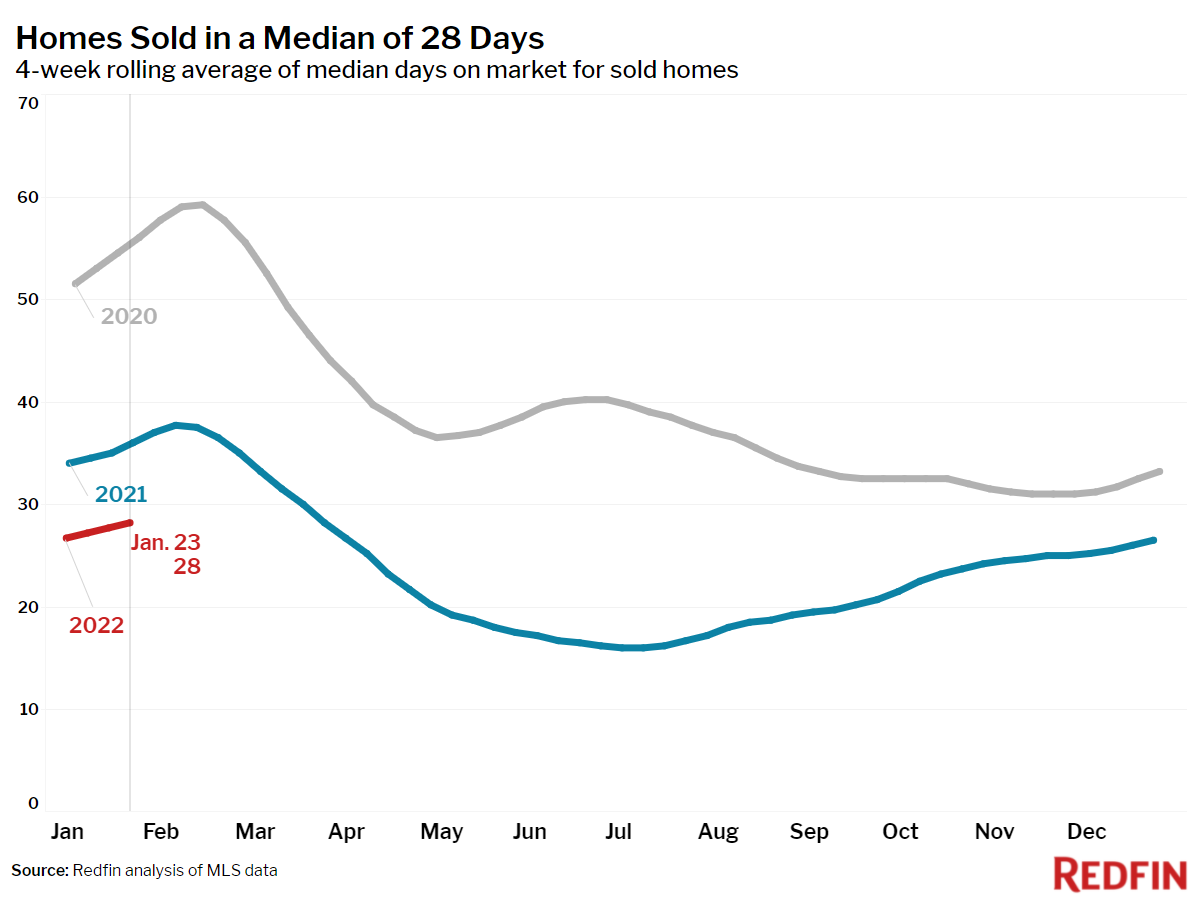

- Homes that sold were on the market for a median of 28 days, down from 36 days a year earlier.

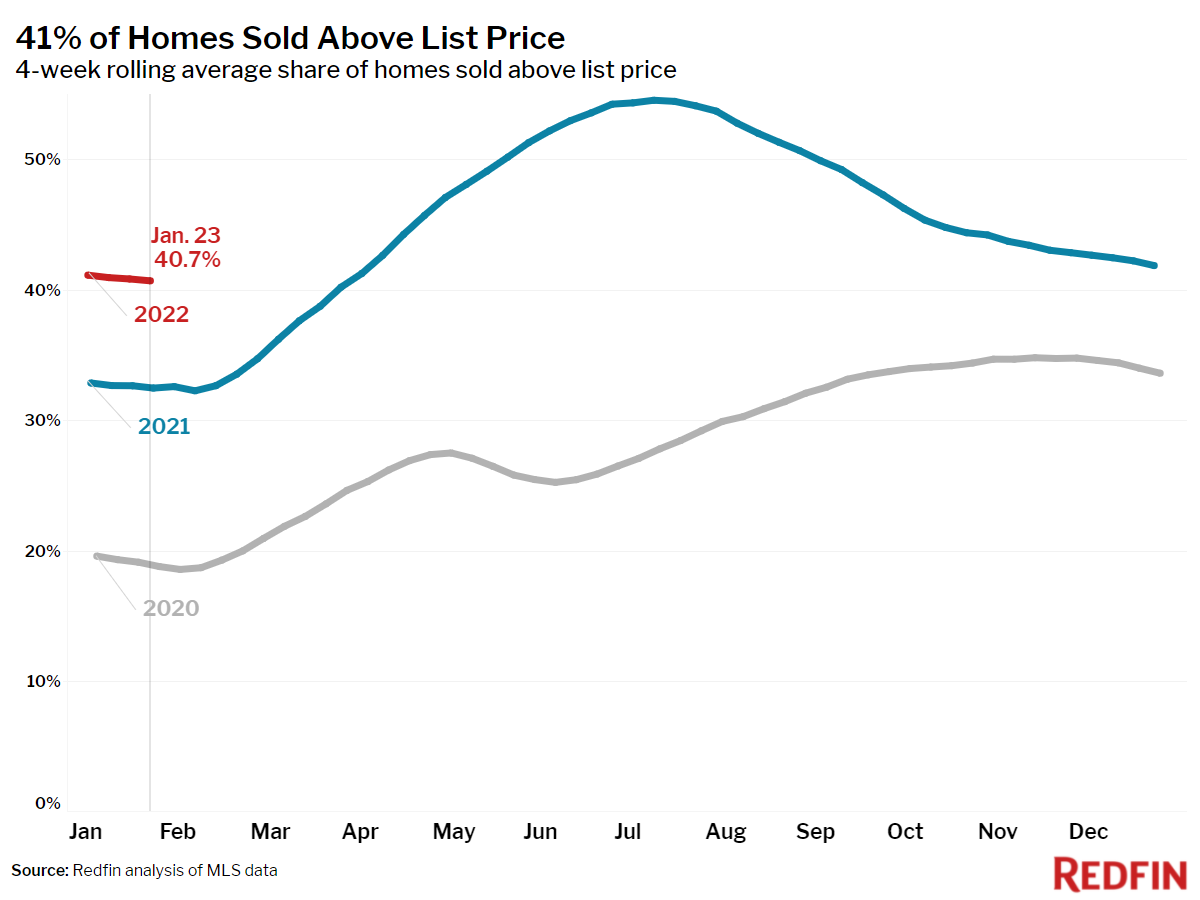

- 41% of homes sold above list price, up from 32% a year earlier.

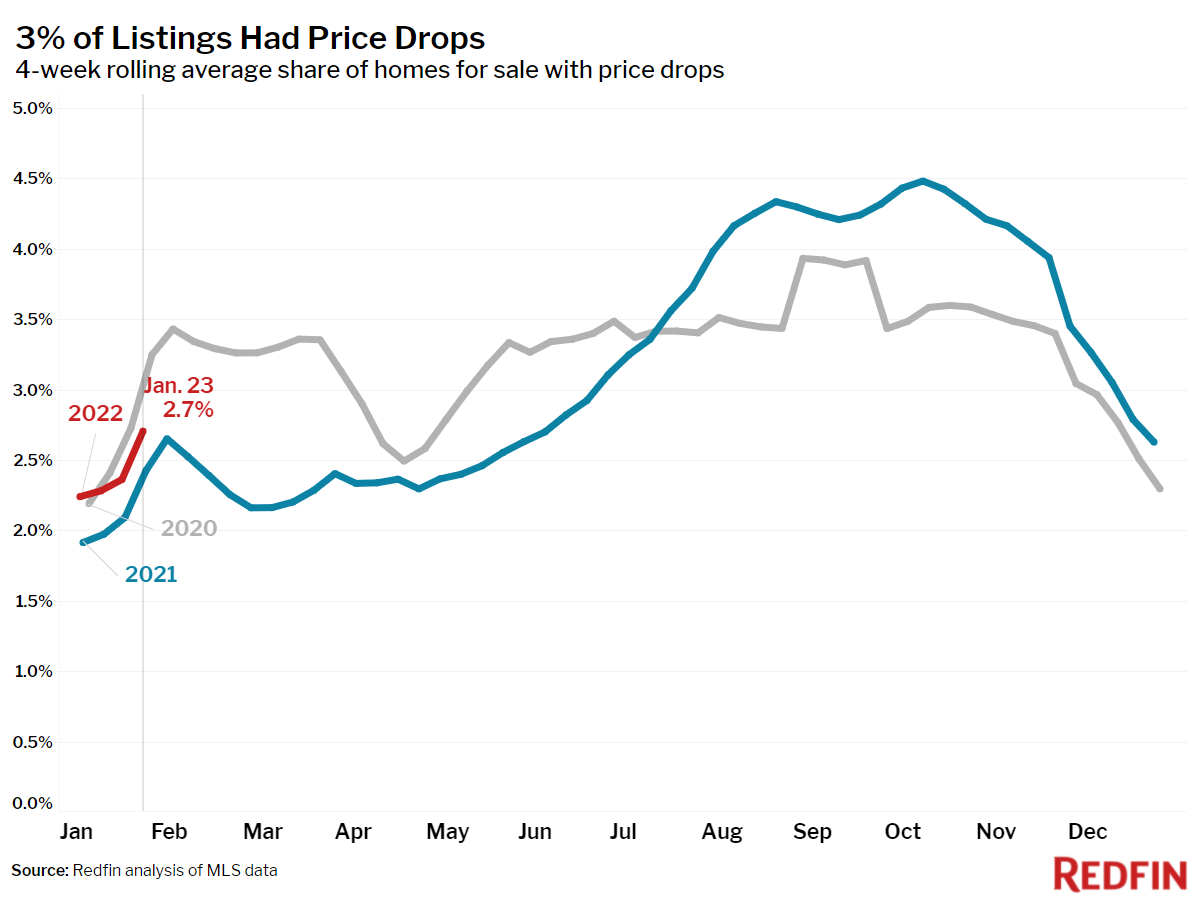

- On average, 2.7% of homes for sale each week had a price drop, up 0.3 percentage points from the same time in 2021.

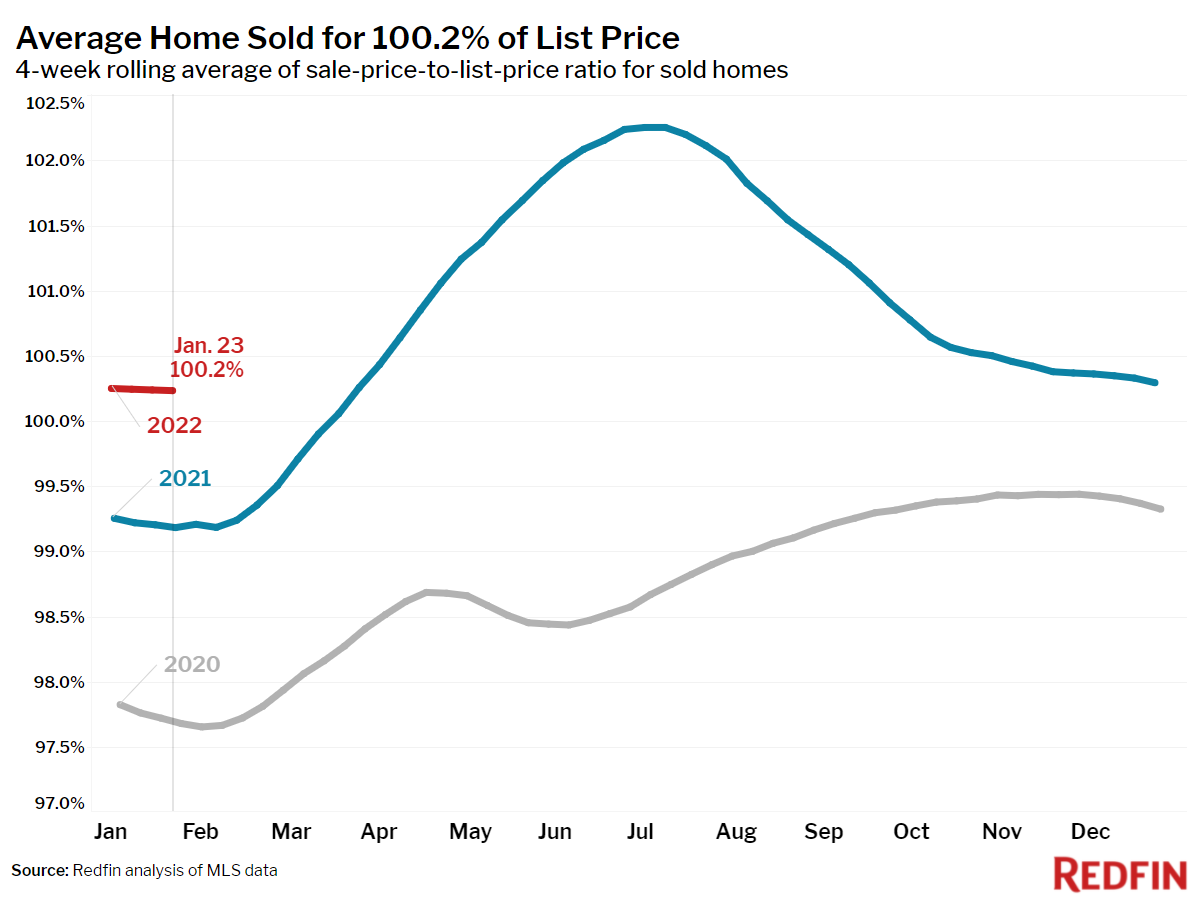

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, was 100.2%. In other words, the average home sold for 0.2% above its asking price.

Other leading indicators of homebuying activity:

- Mortgage purchase applications decreased 2% week over week (seasonally adjusted) during the week ending January 21. For the week ending January 27, 30-year mortgage rates were flat at 3.55%, the highest level since March 2020.

- Touring activity through January 23 was 5 percentage points behind 2021 and 1 point behind 2020 relative to the first week of January according to home tour technology company ShowingTime.

- The Redfin Homebuyer Demand Index rose 1% during the week ending January 23 and was up 9% from a year earlier. The seasonally adjusted Redfin Homebuyer Demand Index is a measure of requests for home tours and other home-buying services from Redfin agents.

Refer to our metrics definition page for explanations of all the metrics used in this report.

United States

United States Canada

Canada