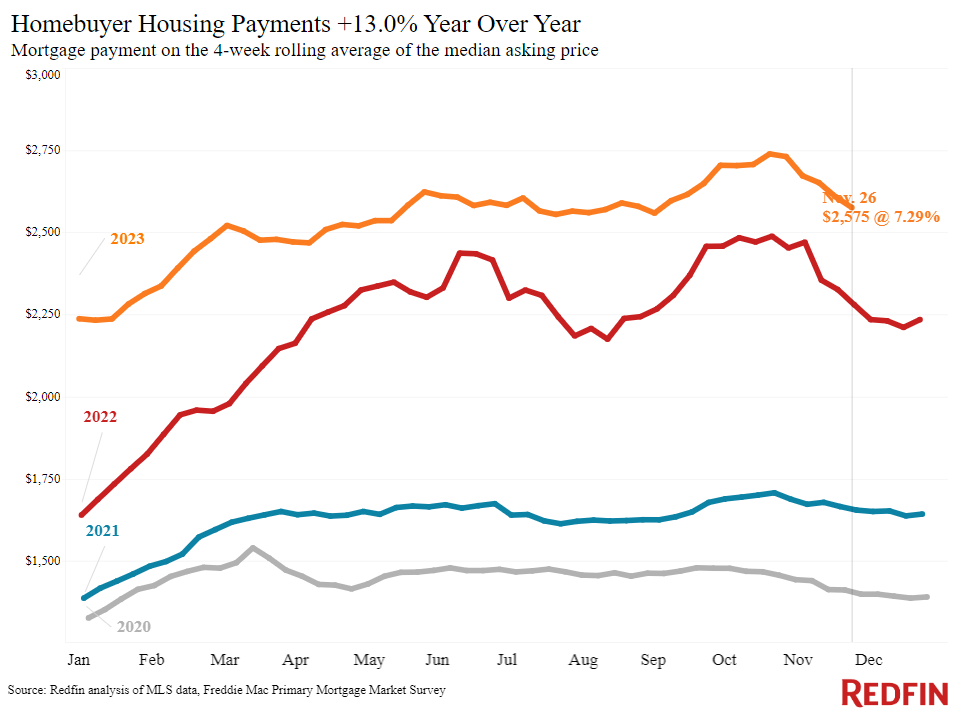

The median monthly mortgage payment has declined more than $150 from its peak to its lowest level since August. Another piece of good news for buyers: New listings are seeing their biggest year-over-year increase since summer 2021.

Housing payments have declined for the fifth week in a row. The typical U.S. homebuyer’s monthly mortgage payment was $2,575 during the four weeks ending November 26, down $164 from a peak of $2,739 last month but up 13% year over year.

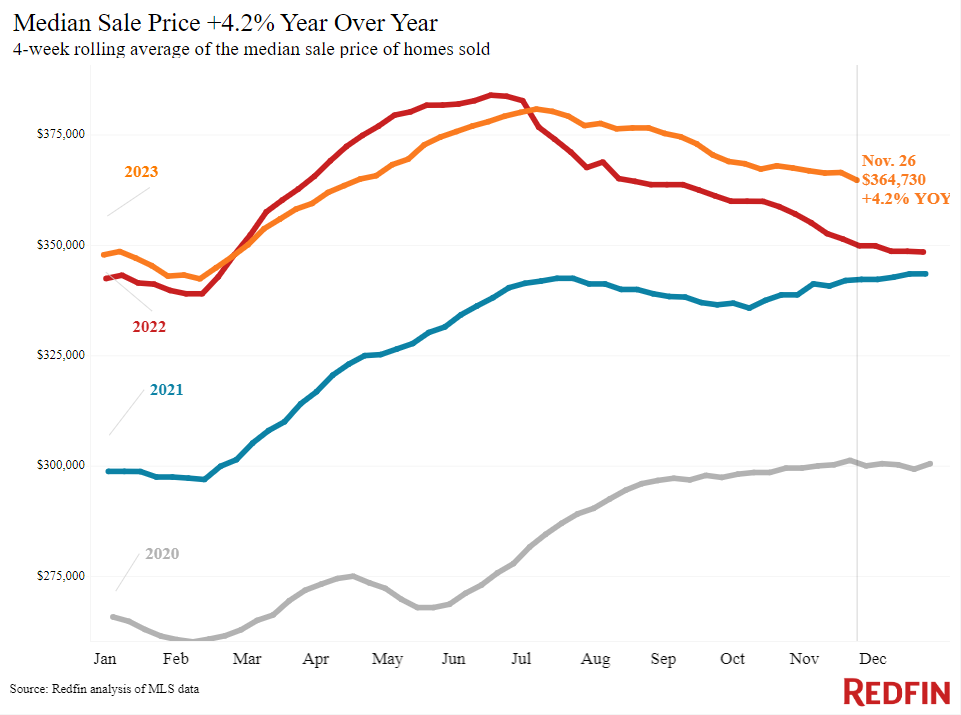

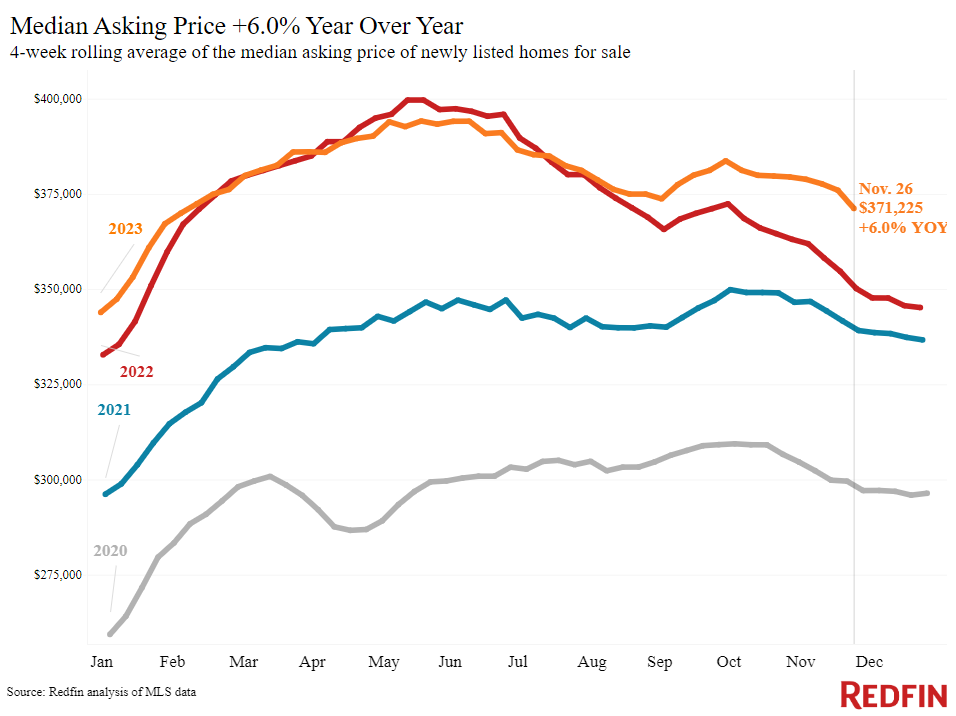

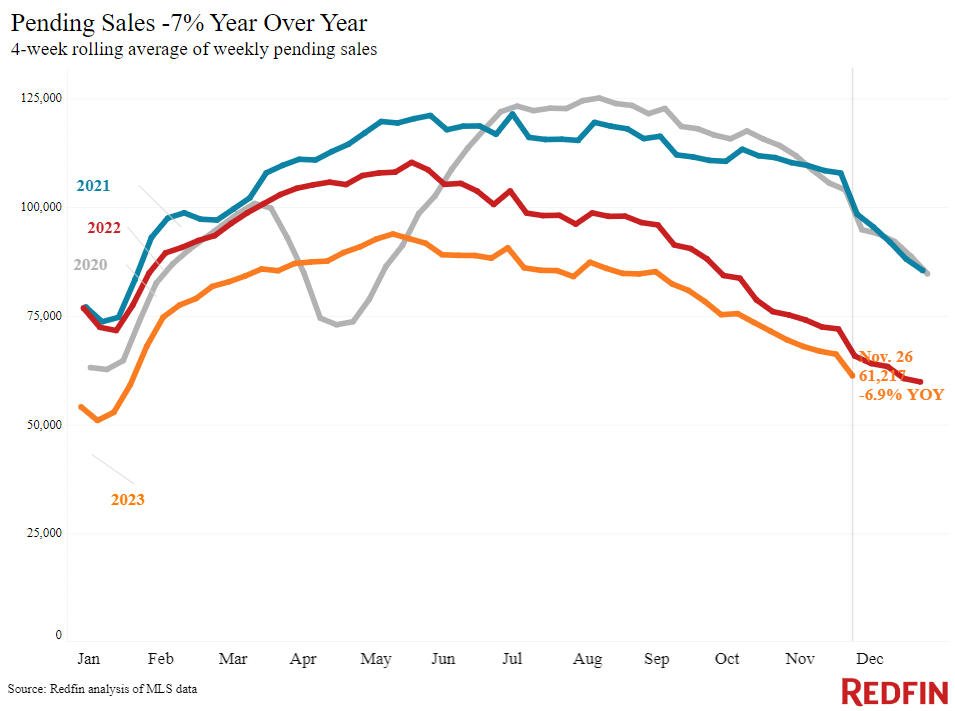

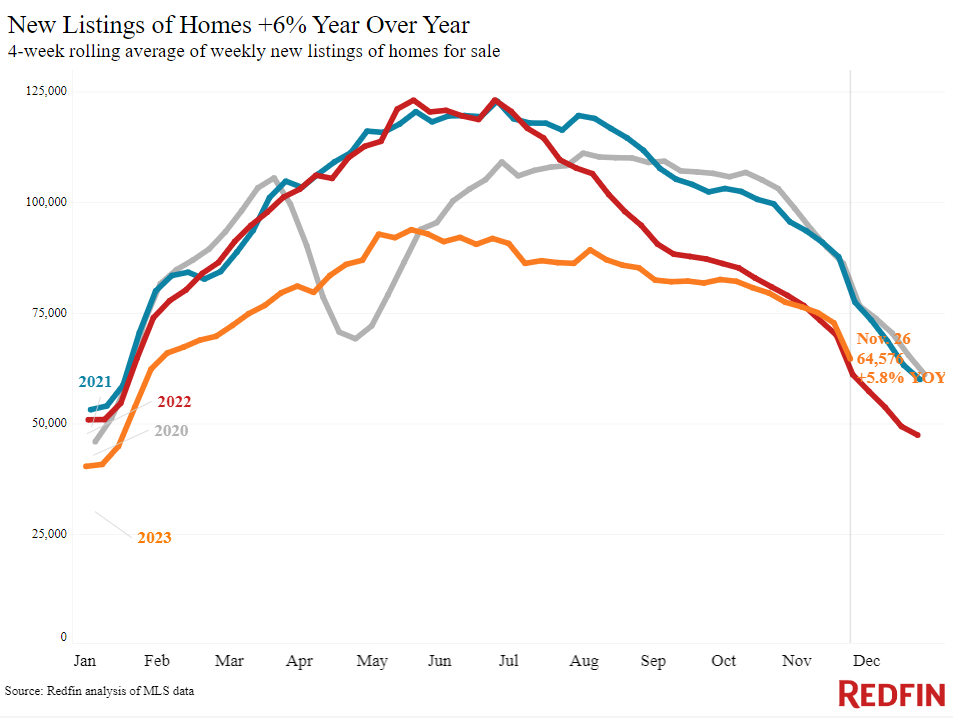

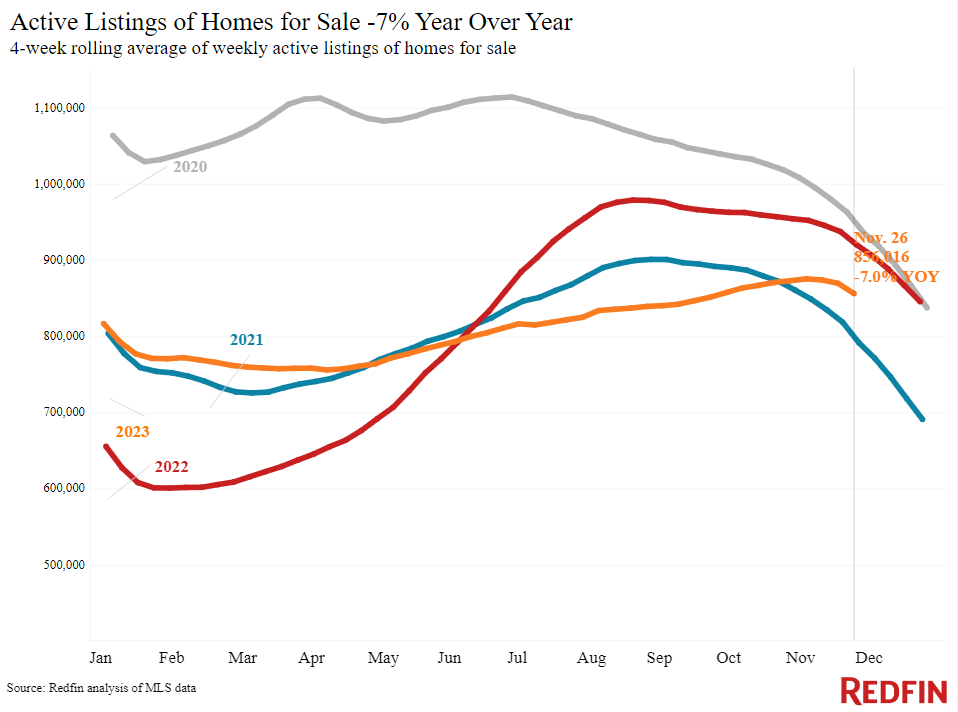

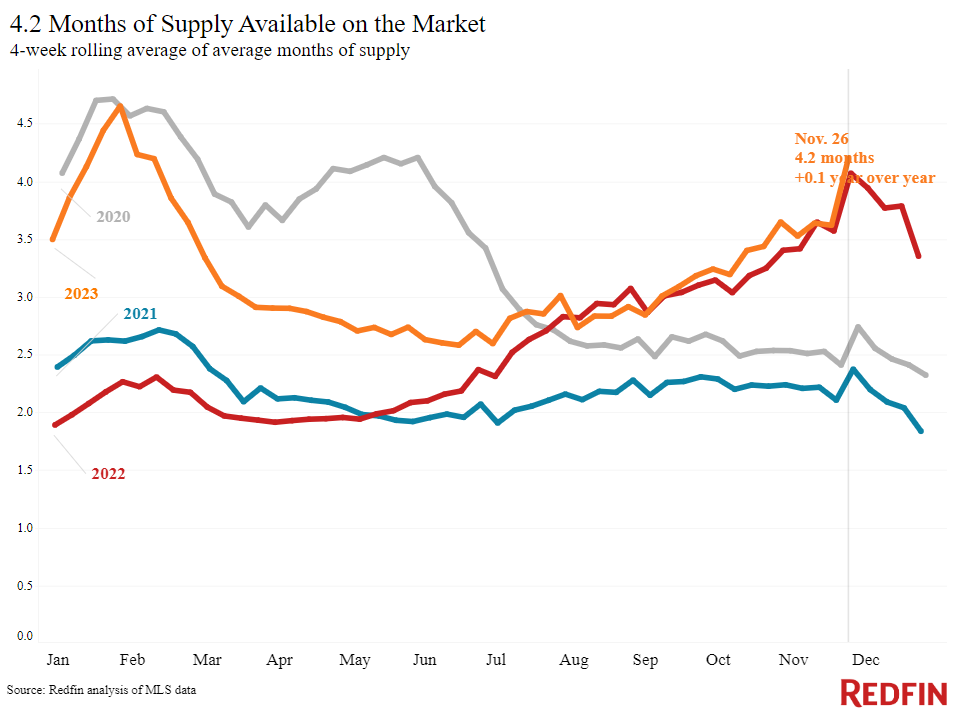

Monthly payments are falling from their peak because mortgage rates are falling from their peak. The weekly average 30-year mortgage rate is 7.29%, down from a high of 7.79% in October, and the daily average is 7.13% as of November 29, its lowest level since the start of September. Rates have declined enough to offset rising home prices; the median sale price is up 4%. Prices are up because inventory is low; the total number of homes for sale is down 7% year over year. But there is hope for buyers wanting more homes to choose from: New listings are up 6%, the biggest uptick in over two years. Buyers are taking note of slightly improved conditions: Mortgage-purchase applications are up 5% week over week.

“Mortgage rates are dropping due to easing inflation and investors betting the Fed will cut interest rates sooner than expected,” said Redfin Economics Research Lead Chen Zhao. “Declining rates, along with a sizable year-over-year increase in new listings, are leading to more favorable conditions for some buyers. My advice for serious homebuyers is to compare housing costs to recent highs instead of long-ago lows. Housing costs are at their lowest level in three months and it’s unlikely they will drop significantly anytime soon. That makes it a relatively good time to lock in a rate.”

Leading indicators

| Indicators of homebuying demand and activity | ||||

| Value (if applicable) | Recent change | Year-over-year change | Source | |

| Daily average 30-year fixed mortgage rate | 7.13% (Nov. 29) | Down from 7.3% a week earlier; near lowest level since start if September | Up from 6.62% | Mortgage News Daily |

| Weekly average 30-year fixed mortgage rate | 7.29% (week ending Nov. 22) | Down from two-decade high of 7.79% a month earlier; fourth straight week of declines | Up from 6.61% | Freddie Mac |

| Mortgage-purchase applications (seasonally adjusted) | Up 5% from a week earlier (as of week ending Nov. 24) | Down 19% | Mortgage Bankers Association | |

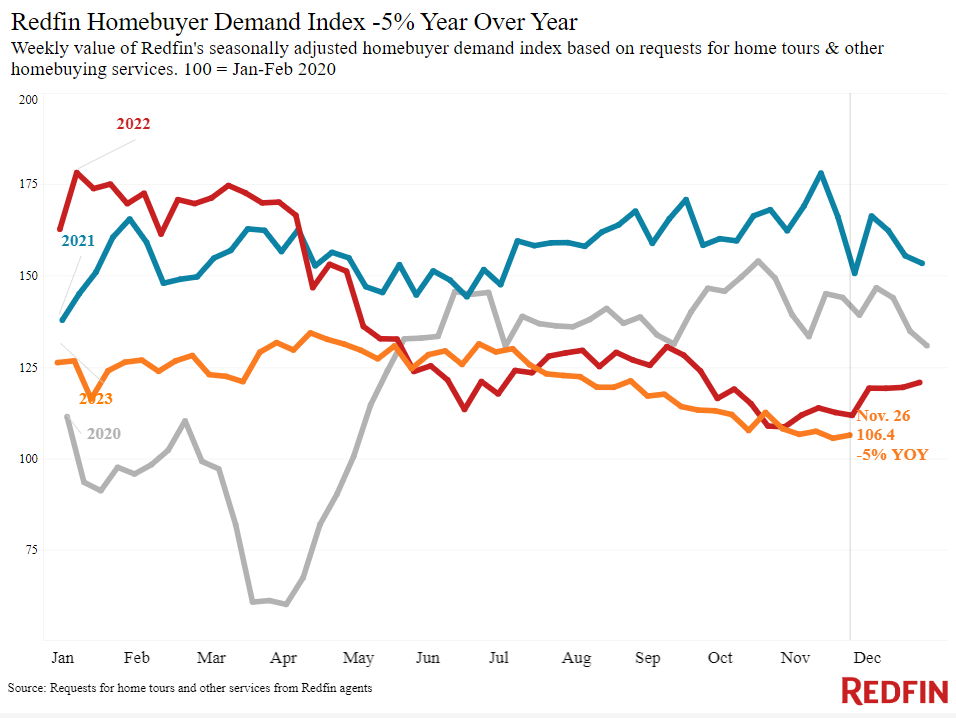

| Redfin Homebuyer Demand Index (seasonally adjusted) | Down 2% from a month earlier (as of the week ending Nov. 26) | Down 5% | Redfin Homebuyer Demand Index, a measure of requests for tours and other homebuying services from Redfin agents | |

| Google searches for “home for sale” | Down 13% from a month earlier (as of Nov. 25) | Flat | Google Trends | |

| Touring activity | Down 38% from the start of the year (as of Nov. 23) | At this time last year, it was down 40% from the start of 2022 | ShowingTime, a home touring technology company | |

Key housing-market data

| U.S. highlights: Four weeks ending November 26, 2023

Redfin’s national metrics include data from 400+ U.S. metro areas, and is based on homes listed and/or sold during the period. Weekly housing-market data goes back through 2015. Subject to revision. |

|||

| Four weeks ending November 26, 2023 | Year-over-year change | Notes | |

| Median sale price | $364,730 | 4.2% | Prices are up partly because elevated mortgage rates were hampering prices during this time last year |

| Median asking price | $371,225 | 6% | |

| Median monthly mortgage payment | $2,575 at a 7.29% mortgage rate | 13% | Down $164 from all-time high set a month earlier. Lowest level in 3 months. |

| Pending sales | 61,217 | -6.9% | |

| New listings | 64,576 | 5.8% | Biggest uptick in over two years. The increase is partly because new listings were falling at this time last year. |

| Active listings | 856,016 | -7% | Smallest decline since June. |

| Months of supply | 4.2 months | +0.1 pt. | 4 to 5 months of supply is considered balanced, with a lower number indicating seller’s market conditions. |

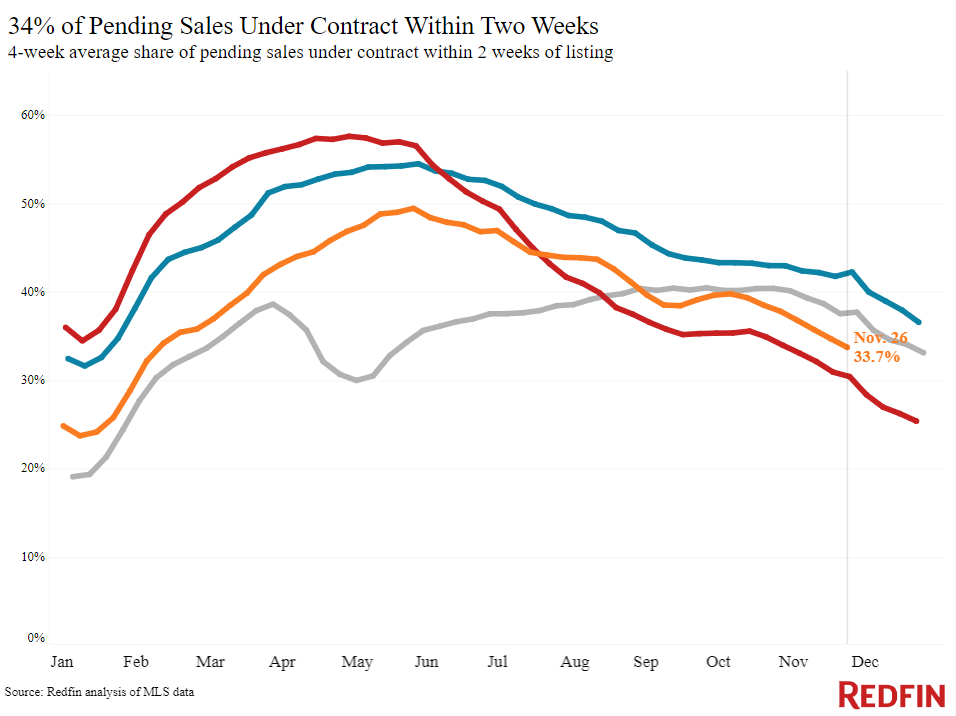

| Share of homes off market in two weeks | 33.7% | Up from 30% | |

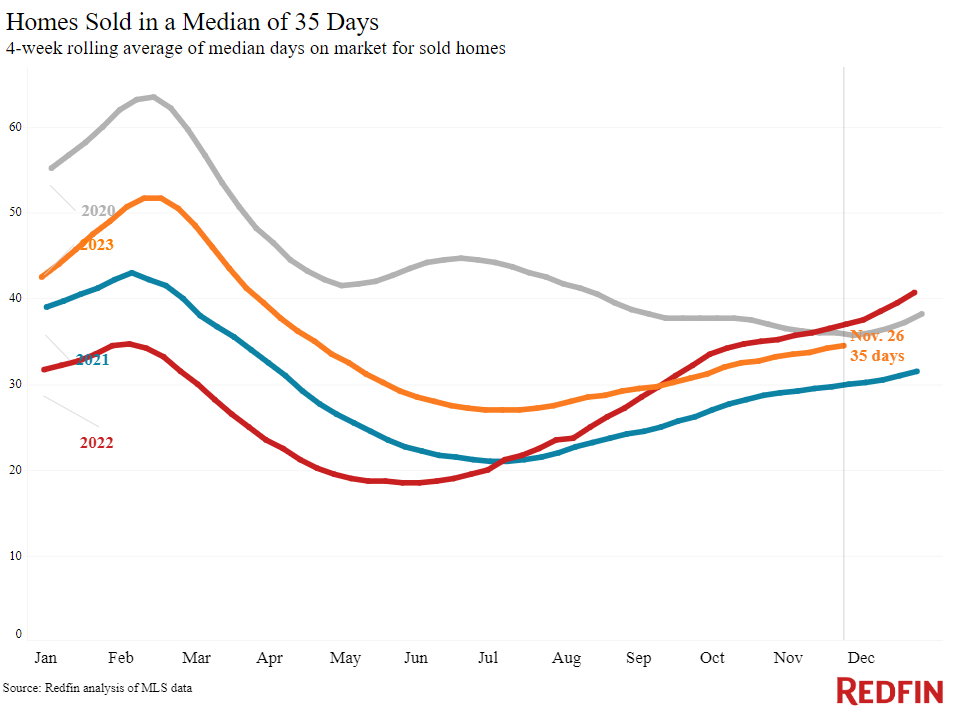

| Median days on market | 35 | -2 days | |

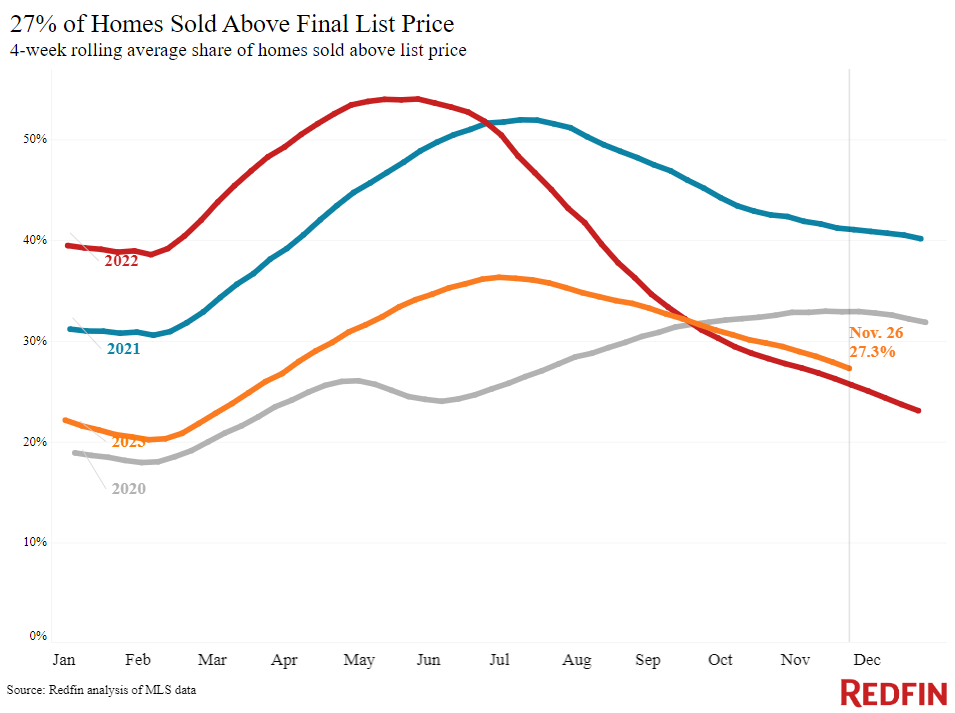

| Share of homes sold above list price | 27.3% | Up from 26% | |

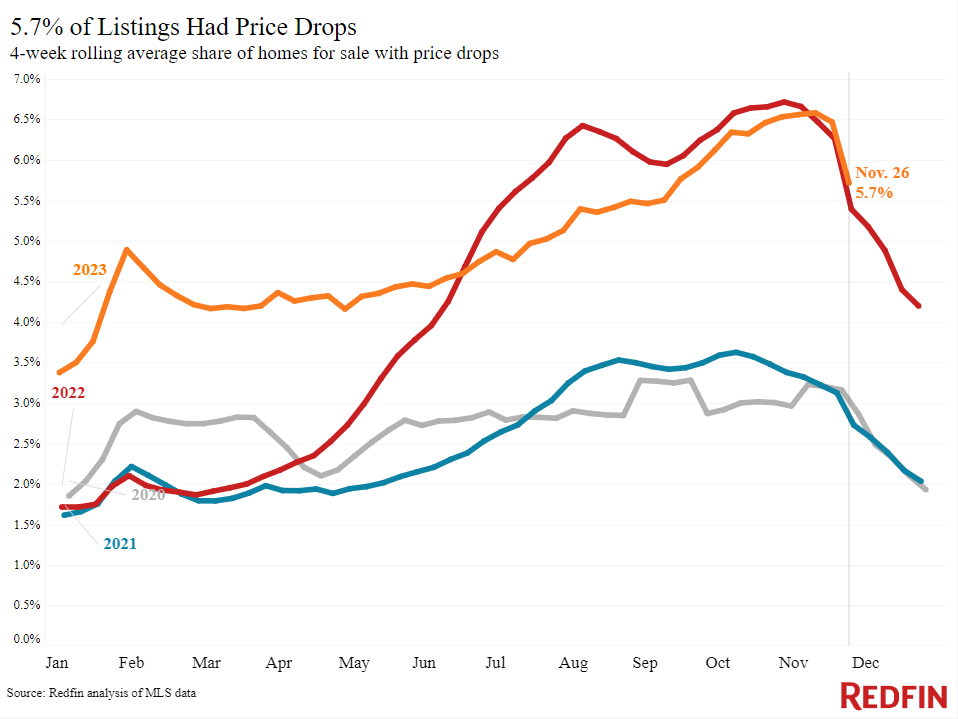

| Share of homes with a price drop | 5.7% | +0.3 pts. | |

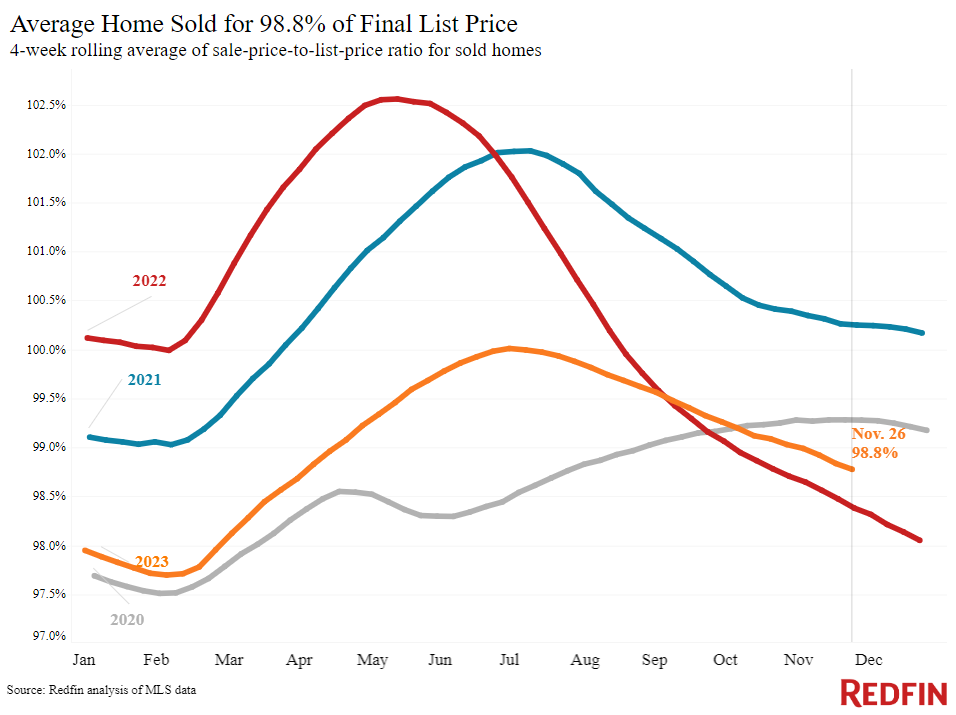

| Average sale-to-list price ratio | 98.8% | +0.4 pts. | Lowest level since April |

| Metro-level highlights: Four weeks ending November 26, 2023

Redfin’s metro-level data includes the 50 most populous U.S. metros. Select metros may be excluded from time to time to ensure data accuracy. |

|||

| Metros with biggest year-over-year increases | Metros with biggest year-over-year decreases | Notes | |

| Median sale price | Anaheim, CA (19.3%)

San Diego, CA (13%) Cincinnati, OH (12.3%) Miami (10.5%) Providence, RI (9.9%) |

Austin, TX (-9.2%)

San Antonio, TX (-1.7%) Portland, OR (-1.3%) Detroit (-0.8%) Houston (-0.5%) Nashville, TN (-0.2%) Denver (-0.1%) |

Declined in 7 metros |

| Pending sales | San Jose, CA (15.3%)

Columbus, OH (3.7%) Detroit (1.3%) |

Cincinnati, OH (-21.9%)

New York (-18.7%) New Brunswick, NJ (-15.4%) Providence, RI (-15.3%) Portland, OR (-14.1%) |

Increased in 3 metros |

| New listings | Orlando, FL (22.5%)

San Jose, CA (21.5%) Phoenix (16.9%) West Palm Beach, FL (16.7%) Houston (13.4%) |

Atlanta (-14.9%)

San Francisco (-11.7%) Seattle (-11%) Providence, RI (-8.4%) Portland, OR (-6.8%) |

Declined in 14 metros |

Refer to our metrics definition page for explanations of all the metrics used in this report.

United States

United States Canada

Canada