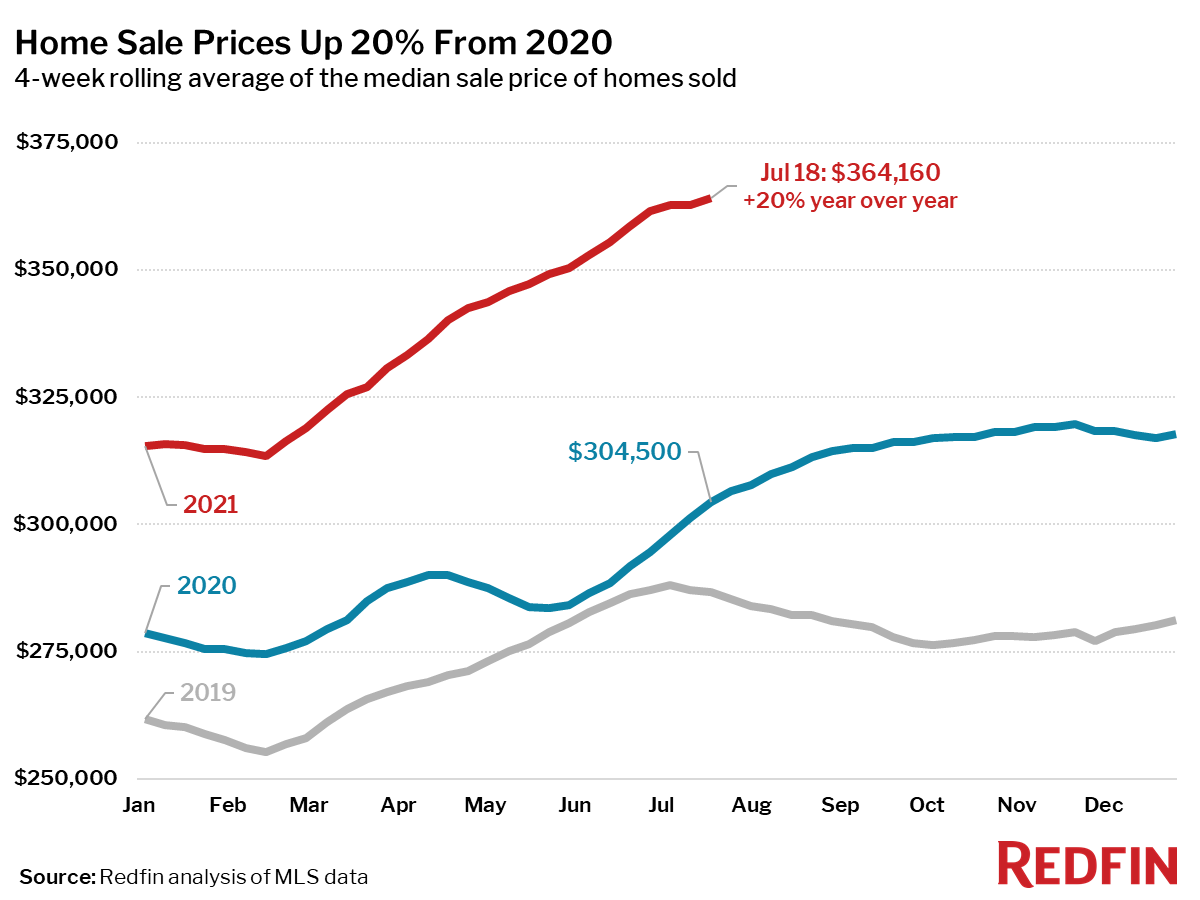

Home prices are still up 20% from a year ago even as fewer homes sell and the ones that do are sitting on the market longer and selling for less of a premium above list price.

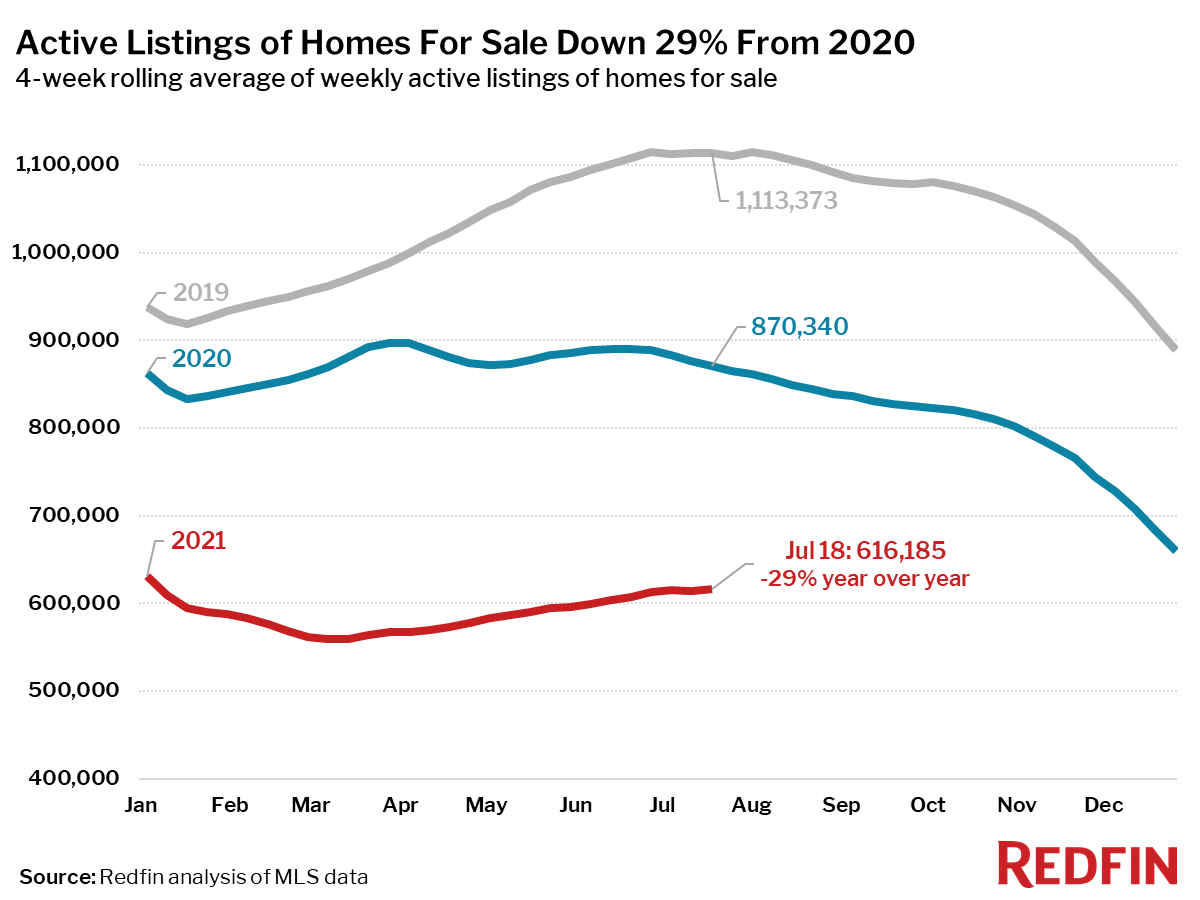

Like a slow turning ship, the housing market’s supply side is gradually gaining momentum as homes for sale begin to pile and pending sales continue a steady and seasonal decline. As both of these trends continue in the weeks ahead, prices will stop rising as rapidly as they have been and an increasing number of homes for sale will likely see price drops.

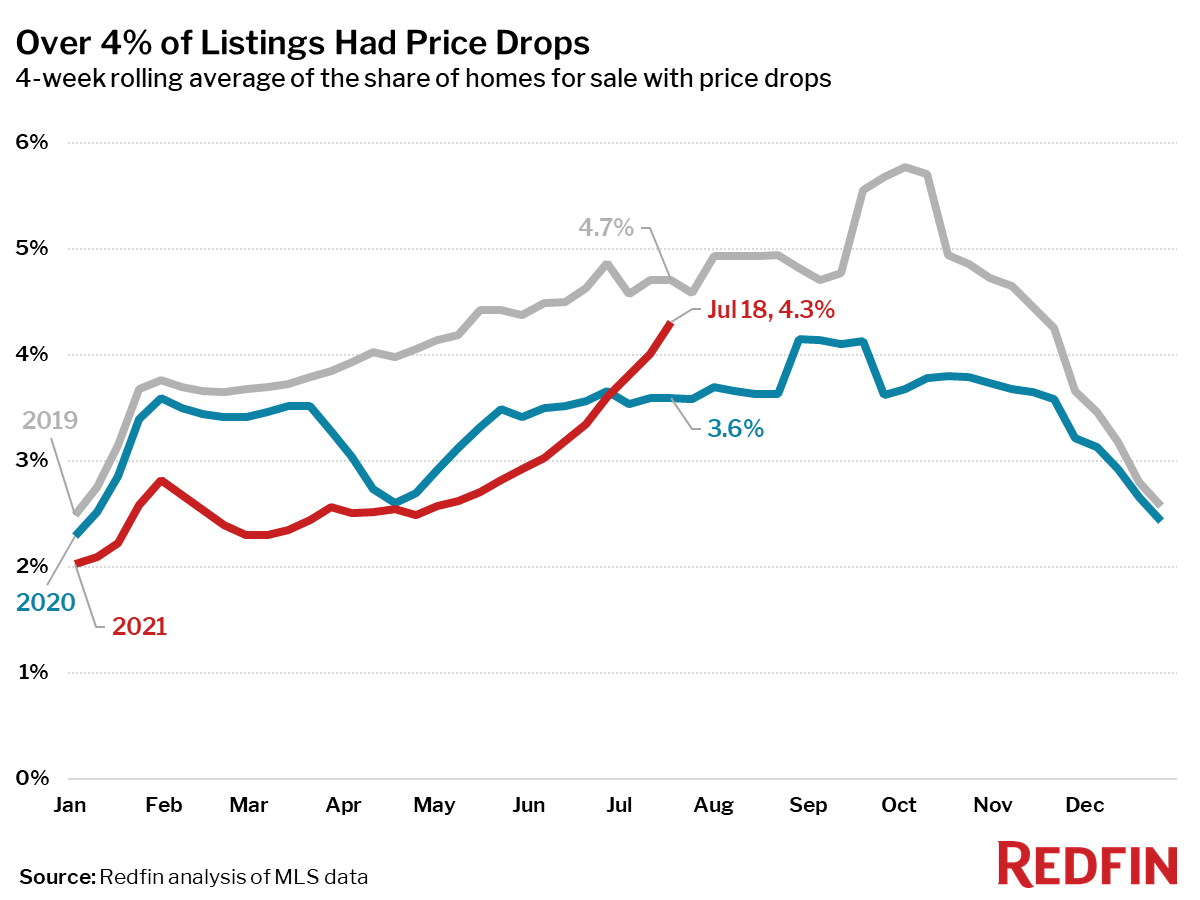

For the single week ending July 18, 4.9% of listings had price drops, on par with 2019 levels. Price drops are more common in places such as Phoenix, Austin and Bend, OR where prices rose the fastest due to an influx of Californians during the pandemic.

Even with the share of homes with price drops increasing, overall prices continue to rise. One factor contributing to that is falling mortgage rates, which hit their lowest level this week (2.78%) since early February.

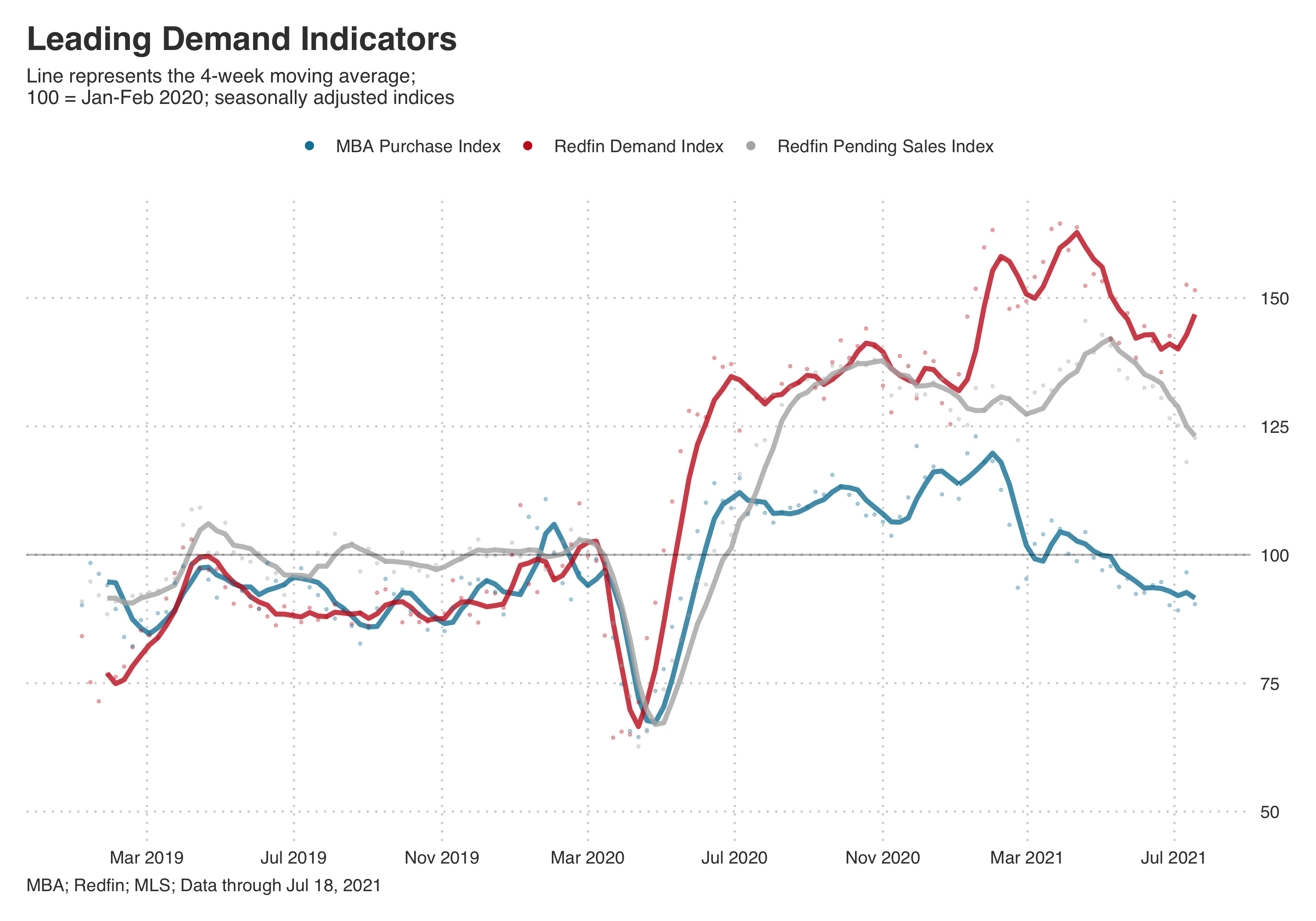

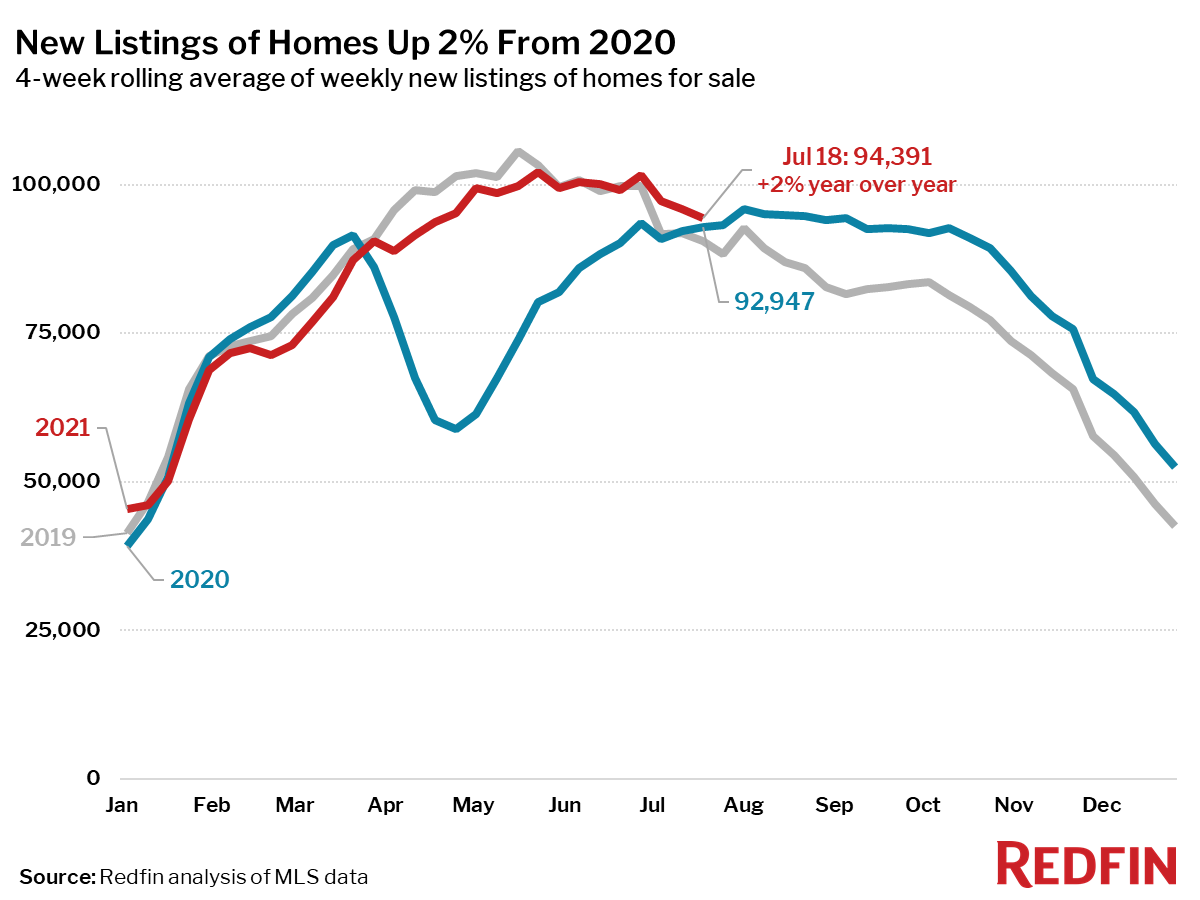

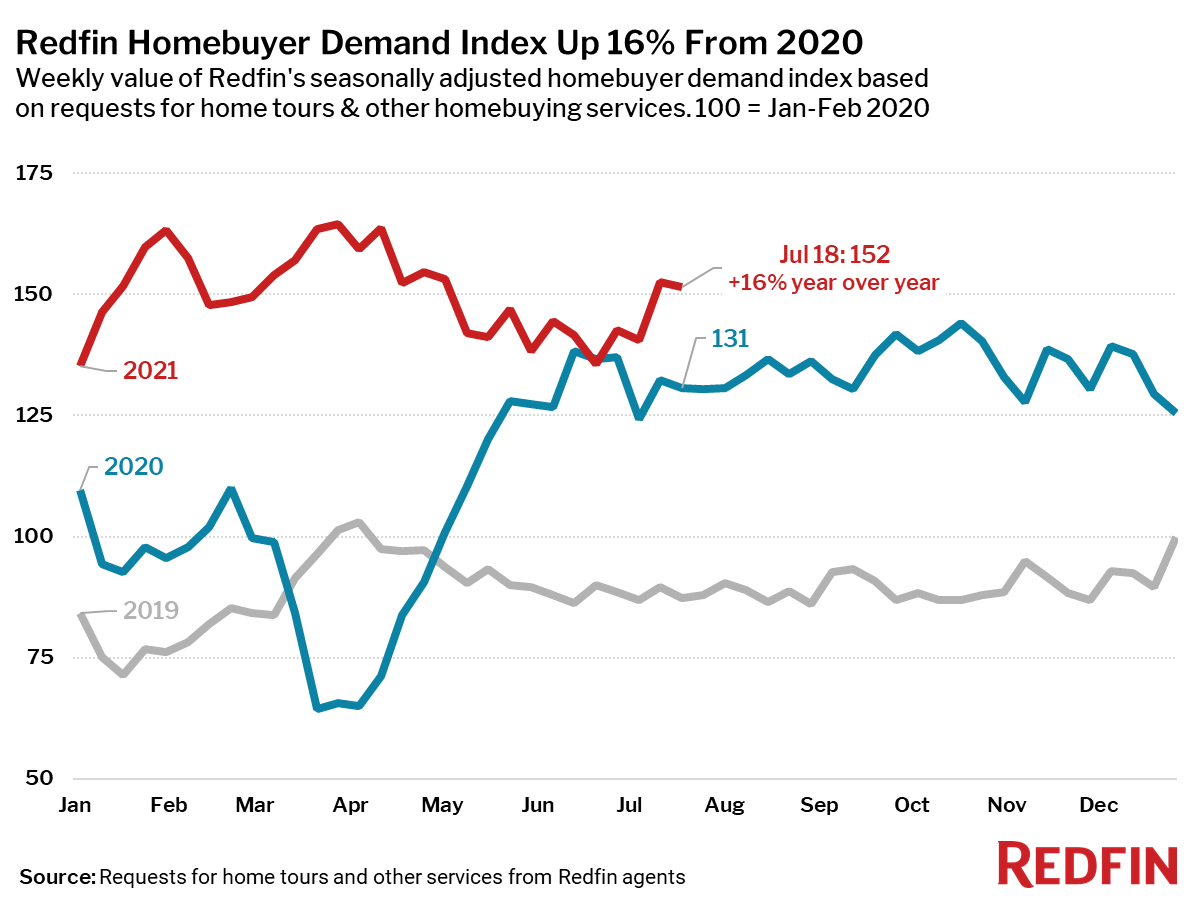

The Redfin Homebuyer Demand Index remains higher than a year ago and has been trending up in recent weeks, suggesting that interest in homebuying remains high (real estate searches on Google trends also show a recent bump). However, mortgage purchase applications are trending down. Growth in new listings, which are still up 2% from a year ago, should offer some relief to potential homebuyers.

“Just as buyers are pulling back, more listings are hitting the market,” said Redfin Chief Economist Daryl Fairweather. “I’m optimistic this will create conditions for a little bit of rain in this inventory drought. A homeowner who is thinking of selling to buy again is going to have a much easier time now than they would have back in March. That’s because it’s becoming less competitive to buy and it is still a historically good time to sell.”

Key housing market takeaways for 400+ U.S. metro areas:

Unless otherwise noted, the data in this report covers the four-week period ending July 18. Redfin’s housing market data goes back through 2012.

Data based on homes listed and/or sold during the period:

- The median home-sale price increased 20% year over year to $364,160, a record high.

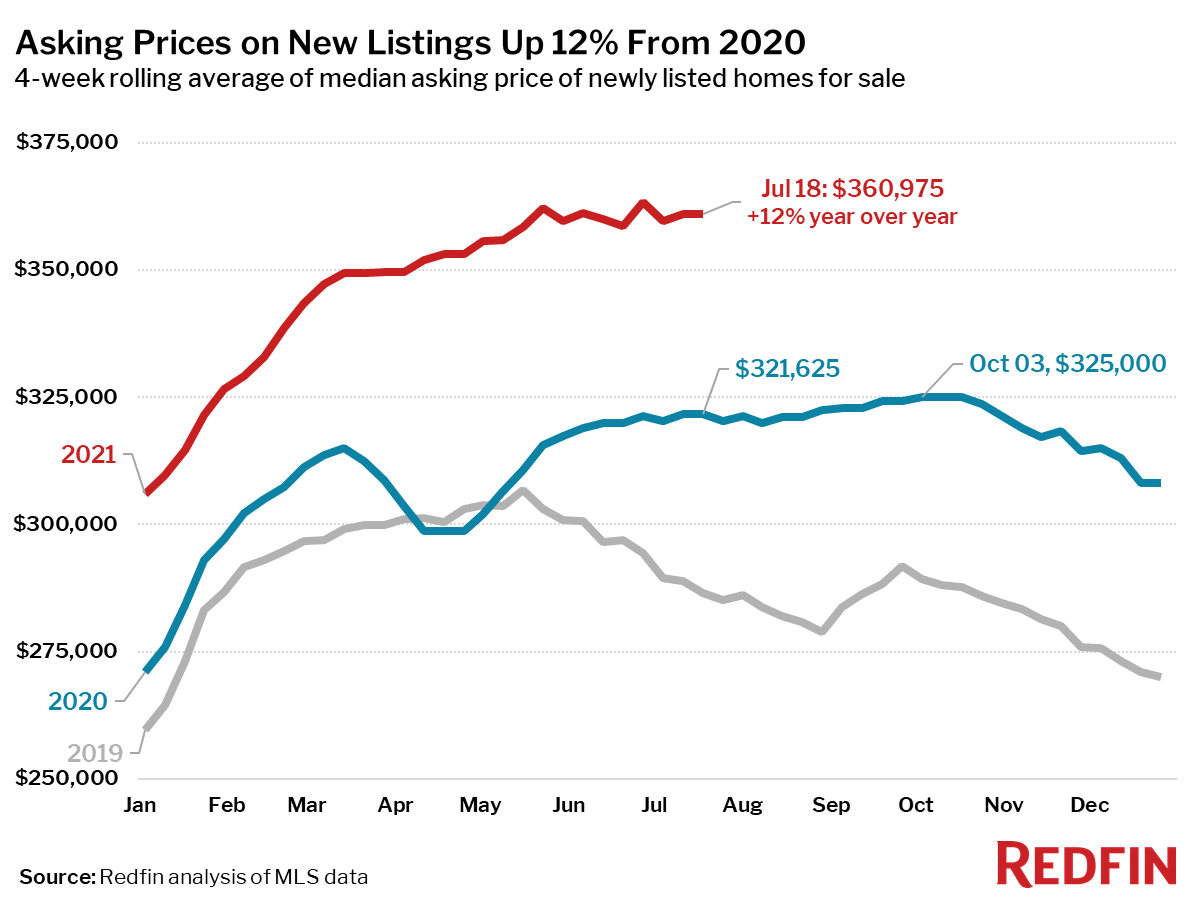

- Asking prices of newly listed homes were up 12% from the same time a year ago to a median of $360,975. This is shy of the all-time high set during the four-week period ending June 27, and asking prices have been basically flat since late May.

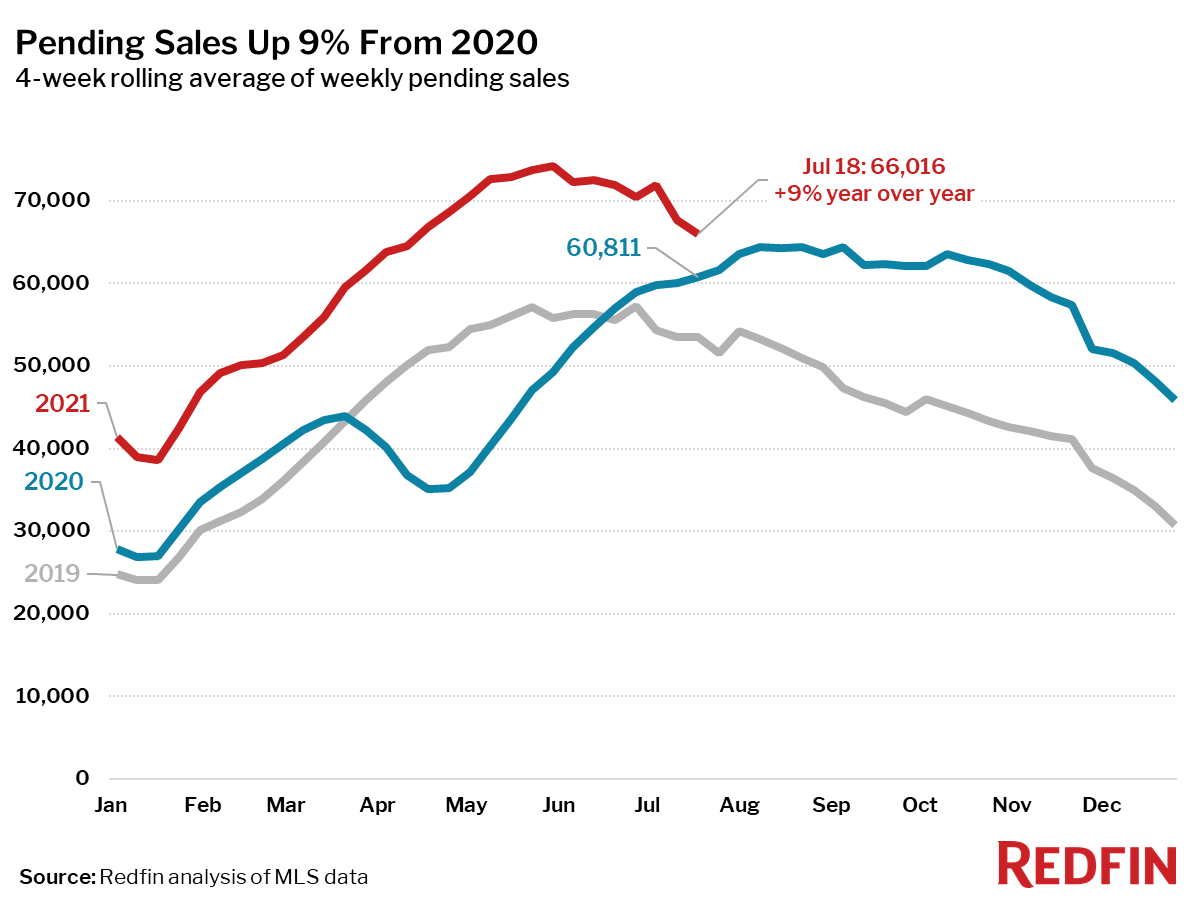

- Pending home sales were up 9% year over year, the smallest increase since the four-week period ending June 28, 2020. Pending sales were down 11% from their 2021 peak during the four-week period ending May 30, compared to a 4% decrease over the same period in 2019.

- New listings of homes for sale were up 2% from a year earlier. The number of homes being listed is in a typical seasonal decline, down 8% from the 2021 peak during the four-week period ending May 23, compared to a 12% decline over the same period in 2019.

- Active listings (the number of homes listed for sale at any point during the period) fell 29% from 2020—the smallest decline since the four-week period ending January 17—and have climbed 10% since their 2021 low during the four week period ending March 7.

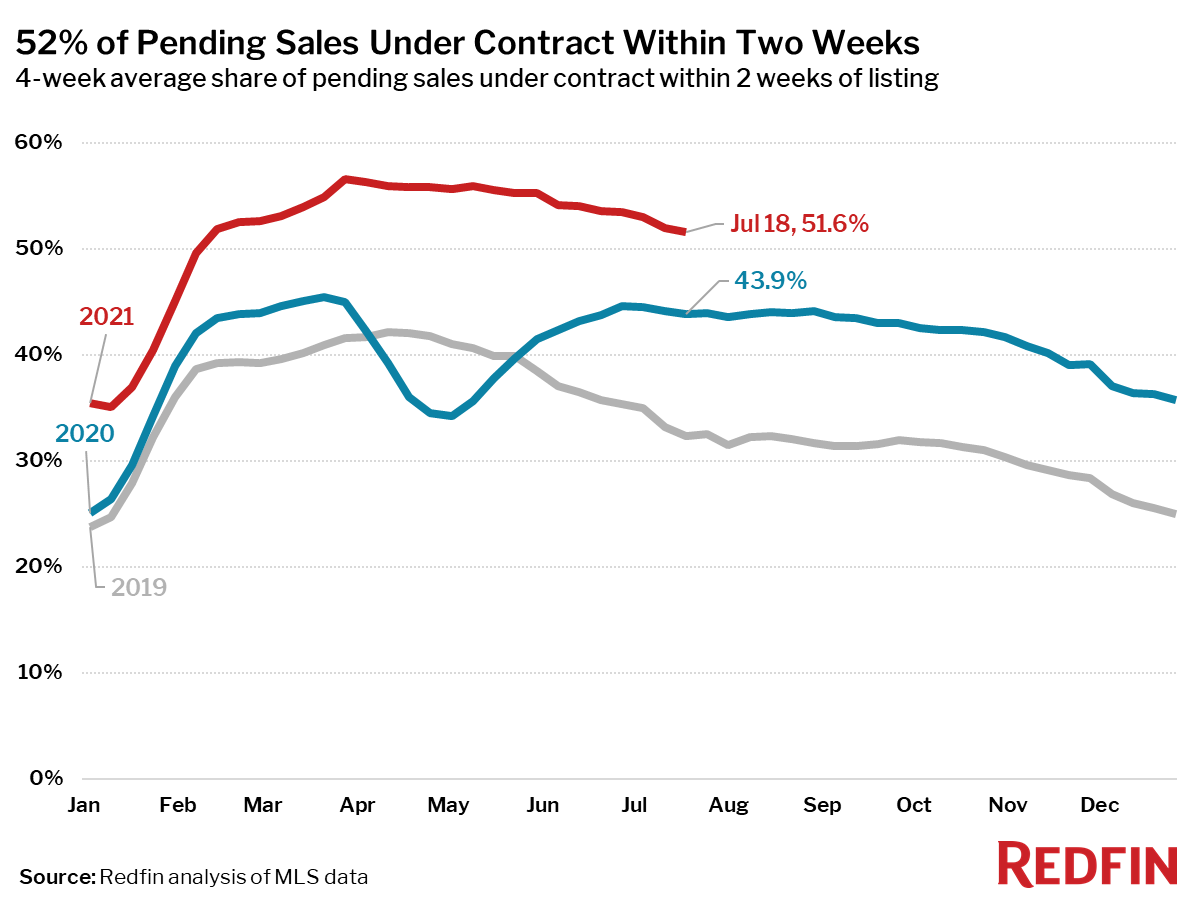

- 52% of homes that went under contract had an accepted offer within the first two weeks on the market, well above the 44% rate during the same period a year ago, but down 5 percentage points from the high point of the year, set during the four-week period ending March 28.

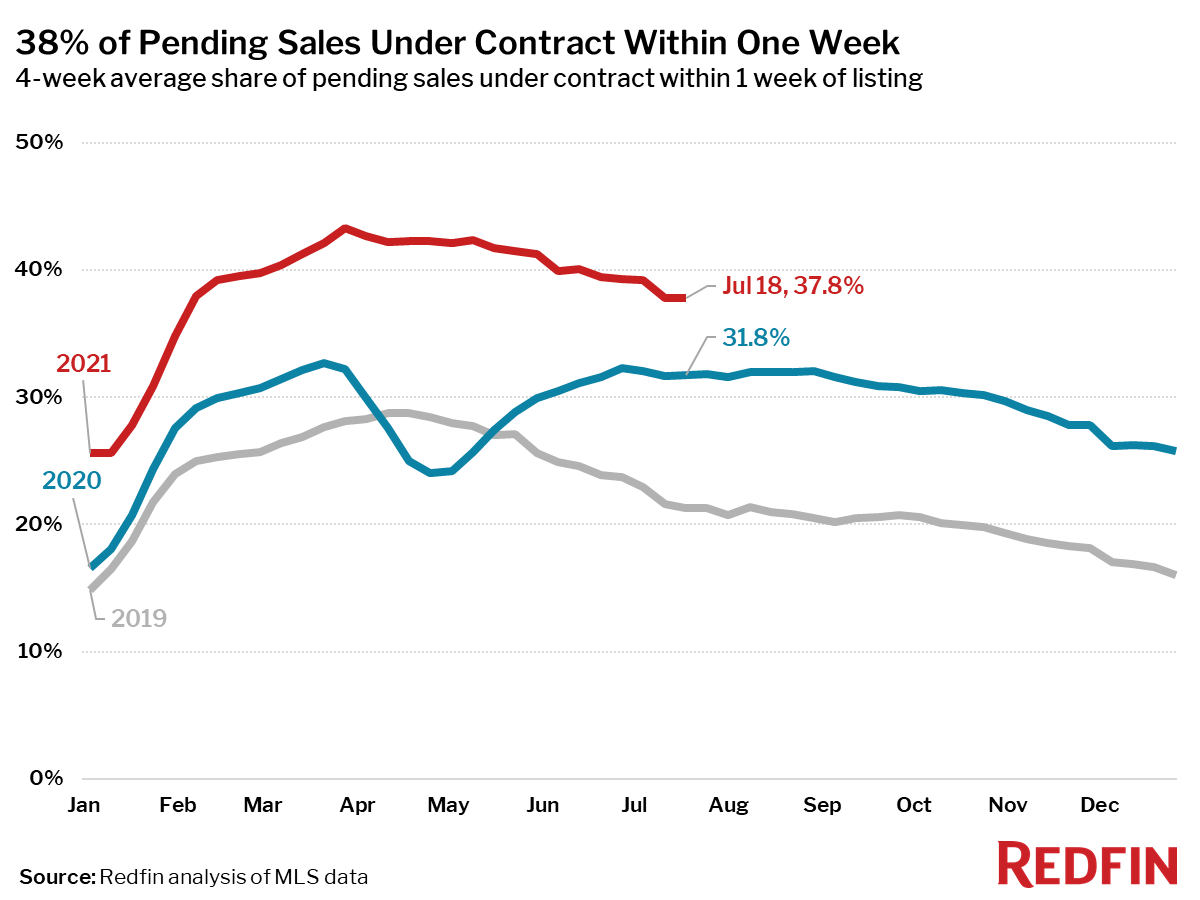

- 38% of homes that went under contract had an accepted offer within one week of hitting the market, up from 32% during the same period a year earlier, but down 5.5 percentage points from the high point of the year, set during the four-week period ending March 28.

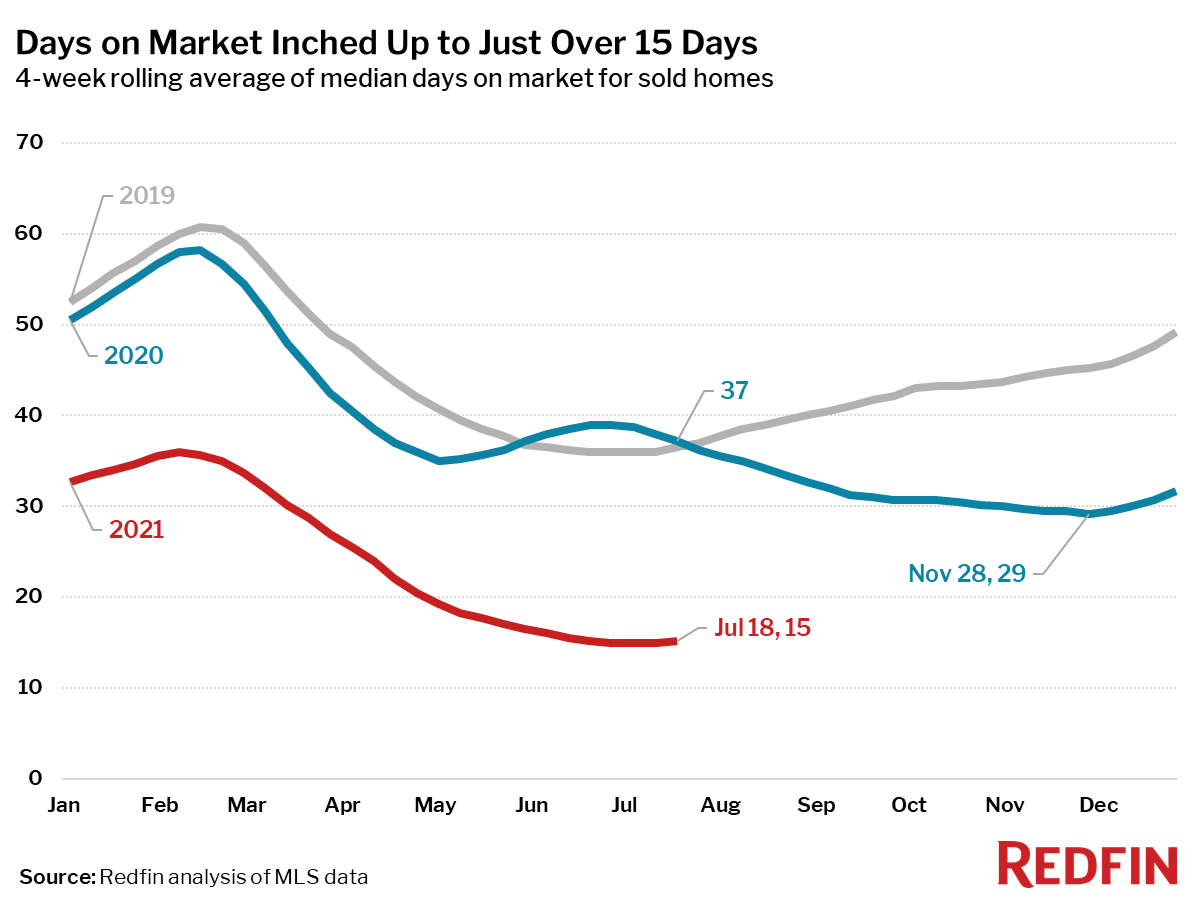

- Homes that sold were on the market for a median of 15.2 days, up from the all-time low of 15 days that had held for the previous month, and down from 37 days a year earlier.

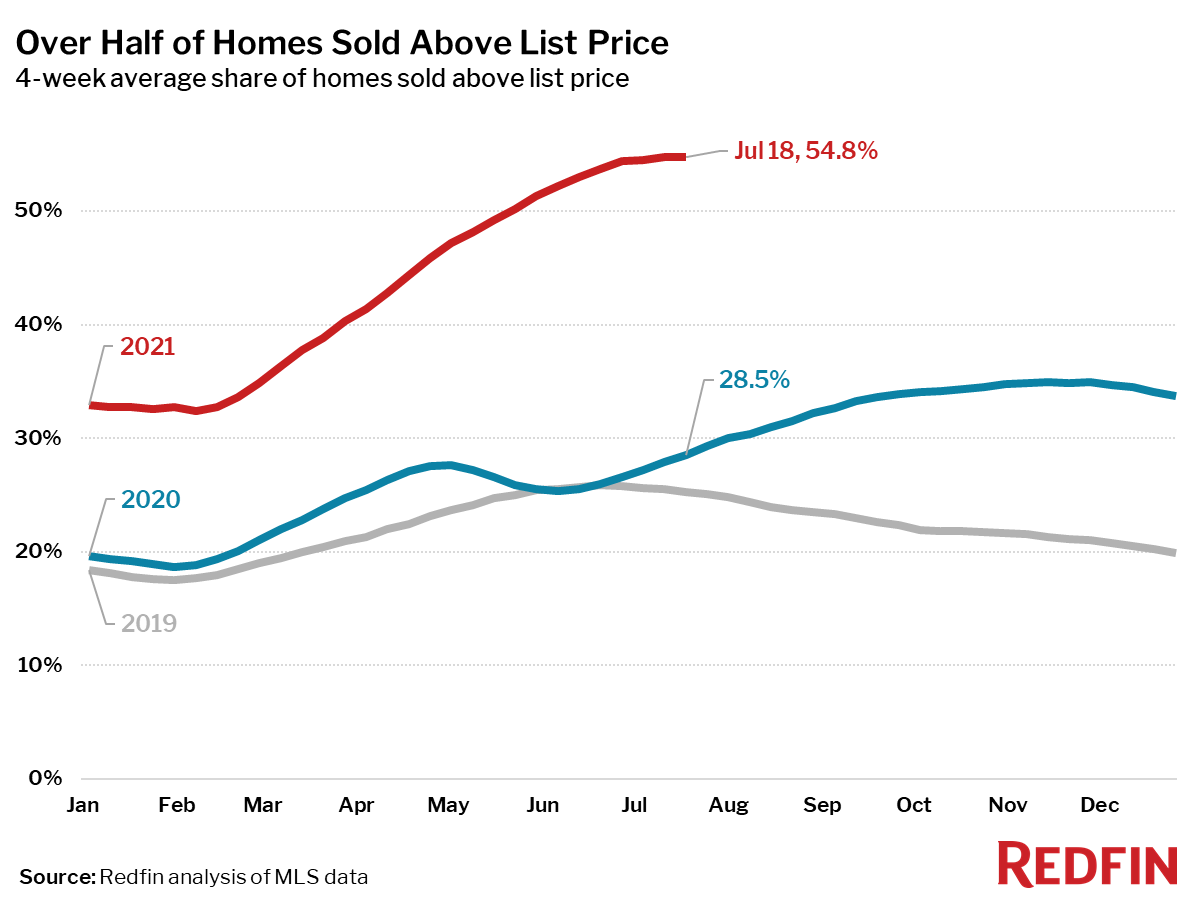

- 55% of homes sold above list price, up from 29% a year earlier. This measure is plateauing, having been 54-55% since the four-week period ending June 27.

- The share of homes for sale with price drops rose to 4.3%, continuing to surpass 2020 level, and climbing closer to 2019 levels (4.7% at this time in 2019).

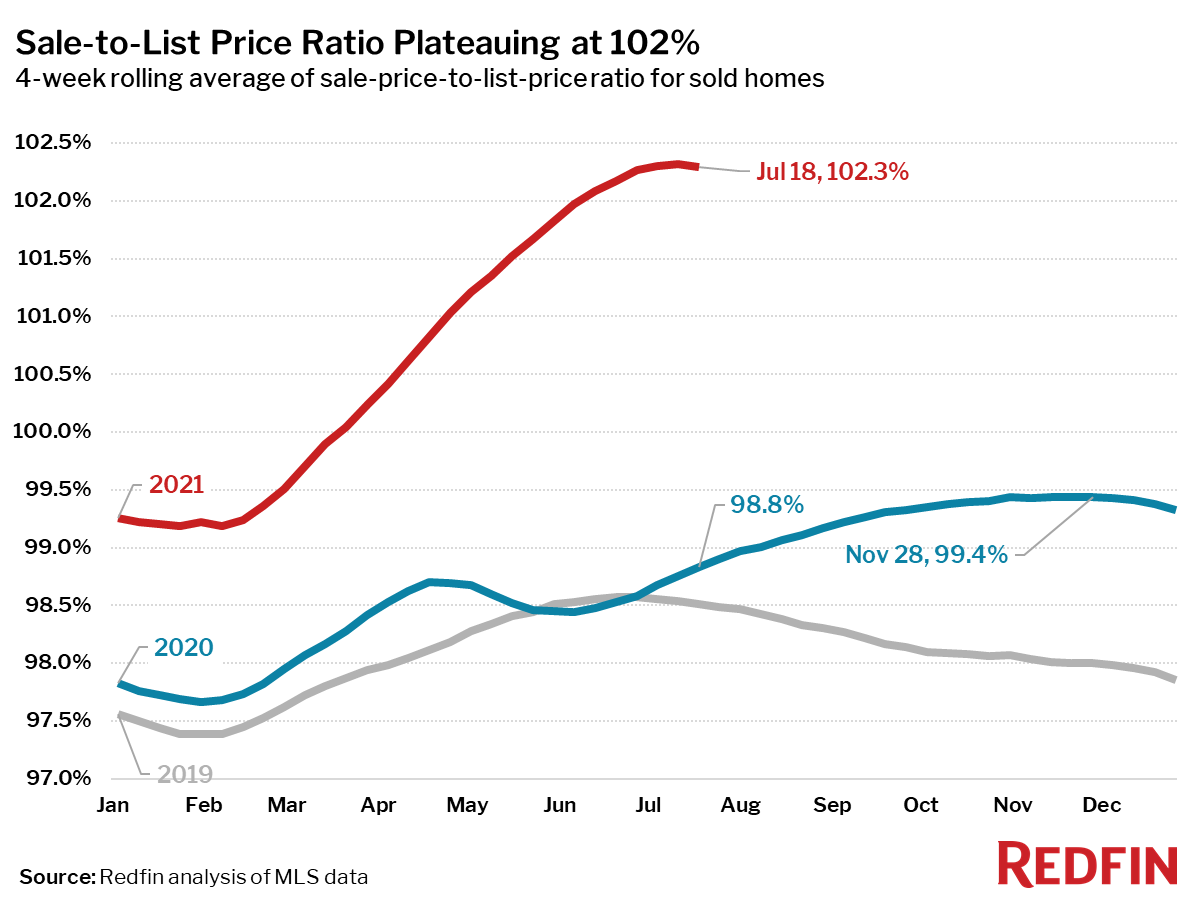

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, decreased less than a tenth of a percentage point from the peak during the four-week period ending July 11 to 102.3%. In other words, the average home sold for 2.3% above its asking price. This measure is 3.5 percentage points higher than a year earlier.

Other other leading indicators of homebuying activity:

- Mortgage purchase applications decreased 6% week over week (seasonally adjusted) during the week ending July 16. For the week ending July 22 30-year mortgage rates fell to 2.78%, the lowest level since early February.

- From January 1 to July 18, home tours went up 21%, compared to a 48% increase over the same period last year according to home tour technology company ShowingTime.

- The seasonally adjusted Redfin Homebuyer Demand Index—a measure of requests for home tours and other services from Redfin agents—dipped slightly during the week ending July 18, and was up 16% from a year earlier.

Refer to our metrics definition page for explanations of all the metrics used in this report.

United States

United States Canada

Canada