The share of homebuyers moving to a different metro area is coming down from a peak as it becomes less feasible to work remotely. For those who are relocating, the most popular destinations are relatively affordable places like Sacramento, Las Vegas and Spokane, WA.

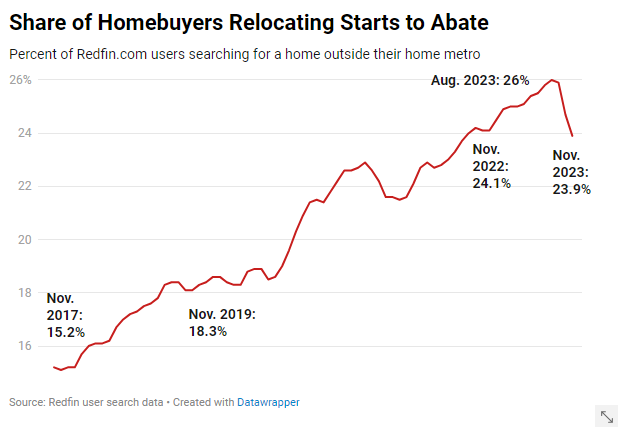

The share of U.S. homebuyers looking to move to a different metro area declined for the third straight month in November, dropping to 23.9%, the lowest share in a year and a half. That’s down from 24.1% a year earlier–a tiny drop, but the first annual decline in Redfin’s records–and down from a record high of 26% over the summer.

The data in this report is based on the searches of about 2 million Redfin.com users who viewed for-sale homes online across more than 100 metro areas from September 2023 to November 2023. Redfin’s records go back through 2017. Scroll down for the full methodology.

Overall homebuying slowed in 2023 because it was the least affordable year on record and there was a severe supply shortage. There were 4% fewer Redfin.com users looking to move to a new metro in November than a year ago, compared with a 3% year-over-year drop for Redfin.com users searching within their home metro. The slightly bigger drop for house hunters looking to relocate explains why migrants are making up a smaller share of overall home searchers. It will be interesting to see whether the migration rate declines or increases in the new year, as we expect home sales to increase as mortgage rates come down.

The portion of house hunters who are relocating to a new area is coming down for a few reasons. One, there’s less flexibility to work remotely as employers call workers back to the office. That means the flow of homebuyers moving from the Bay Area to Austin, TX or Boise, ID, for example, has slowed. Two, home prices generally increased more in popular migration destinations than they did in expensive coastal metros during the pandemic, making the case for moving a bit less compelling. For example, prices in Sacramento–the most popular destination this month–are up about 35% since before the pandemic, compared with an 8% increase in the Bay Area.

Still, the migration rate remains above pre-pandemic levels of around 19% as some Americans are still chasing affordability. All 10 of the most popular migration destinations have lower prices than the most common origin of buyers moving in.

Spokane, WA lands on list of popular destinations for the first time

Spokane has made it onto Redfin’s list of popular migration destinations for the first time on record, landing at number 10. Popularity is determined by net inflow, a measure of how many more Redfin.com users looked to move into an area than leave.

The number-one origin of homebuyers moving to Spokane, the second most populous city in Washington, is Seattle, followed by Los Angeles and Portland, OR. Spokane has comparatively low housing costs: The typical Spokane home sells for $416,000, compared to $775,000 in Seattle.

Sacramento, CA, Las Vegas and North Port, FL–mainstays on the list of popular destinations–landed at one, two and three in November. Like Spokane, they’re all relatively affordable and popular with homebuyers moving in from expensive job centers.

| Top 10 Metros Homebuyers Are Moving Into, by Net Inflow

Net inflow = Number of Redfin.com home searchers looking to move into a metro area, minus the number of searchers looking to leave |

||||

| Metro* | Net Inflow, Nov. 2023 | Net Inflow, Nov. 2022 | Top Origin | Top Out-of-State Origin

|

| Sacramento, CA | 5,100 | 7,000 | San Francisco, CA | New York, NY |

| Las Vegas, NV | 3,800 | 6,400 | Los Angeles, CA | Los Angeles, CA |

| North Port-Sarasota, FL | 3,700 | 3,700 | New York, NY | New York, NY |

| Cape Coral, FL | 3,700 | 4,000 | Miami, FL | Chicago, IL |

| Salisbury, MD | 3,600 | 2,000 | Washington, D.C. | Washington, D.C. |

| Myrtle Beach, SC | 3,600 | 2,800 | Washington, D.C. | Washington, D.C. |

| Orlando, FL | 3,500 | 3,300 | New York, NY | New York, NY |

| Portland, ME | 3,400 | 2,800 | Boston, MA | Boston, MA |

| Nashville, TN | 3,000 | 2,800 | Los Angeles, CA | Los Angeles, CA |

| Spokane, WA | 2,500 | 2,300 | Seattle, WA | Los Angeles, CA |

| *Combined statistical areas with at least 500 users searching to and from the region in Sept. 2023-Nov. 2023 | ||||

Los Angeles tops list of metros homebuyers are leaving for the first time

More homebuyers are leaving Los Angeles than any other metro area in the country. That marks the first time on record it has been the number-one place homebuyers are leaving, and the first time in over two years the Bay Area has dropped out of the number-one spot. The Bay Area comes in second, followed by New York. That’s based on net outflow, a measure of how many more Redfin.com users are looking to leave a metro than move in.

Migration out of both Los Angeles and the Bay Area has slowed since the height of the pandemic, when remote workers were fleeing both California metros in favor of more affordable places. But Los Angeles has surpassed the Bay Area because the flow out of the Bay Area has steadily slowed, while the flow out of Los Angeles has picked back up in recent months.

Coastal job centers typically top the list of metros homebuyers are leaving, mainly because they’re expensive. The median sale price in Los Angeles, for instance, is roughly double that of Las Vegas, the most common destination for homebuyers leaving the City of Angels.

| Top 10 Metros Homebuyers Are Leaving, by Net Outflow

Net outflow = Number of Redfin.com home searchers looking to leave a metro area, minus the number of searchers looking to move in |

||||

| Metro* | Net Outflow, Nov. 2023 | Net Outflow, Nov. 2022 | Top Destination | Top Out-of-State Destination

|

| Los Angeles, CA | 26,100 | 30,300 | Las Vegas, NV | Las Vegas, NV |

| San Francisco, CA | 25,400 | 32,000 | Sacramento, CA | Seattle, WA |

| New York, NY | 24,900 | 20,700 | Miami, FL | Miami, FL |

| Washington, D.C. | 13,300 | 16,100 | Salisbury, MD | Salisbury, MD |

| Seattle, WA | 11,900 | 1,300 | Spokane, WA | Phoenix, AZ |

| Chicago, IL | 7,600 | 7,100 | Cape Coral, FL | Cape Coral, FL |

| Boston, MA | 5,000 | 6,100 | Portland, ME | Portland, ME |

| Philadelphia, PA | 3,000 | 1,300 | Salisbury, MD | Salisbury, MD |

| Detroit, MI | 2,100 | 3,400 | Washington, D.C. | Washington, D.C. |

| Denver, CO | 2,000 | 3,200 | Chicago, IL | Chicago, IL |

| *Combined statistical areas with at least 500 users searching to and from the region in Sept. 2023-Nov. 2023 | ||||

Below is a map of the most common origins of Redfin.com users who are moving to the Sacramento metro. To view similar maps for the metros in this report and other metros, please visit the area’s Redfin housing market page and scroll down to the “migration” section.

Methodology

Our migration analysis is based on about two million Redfin.com users who viewed for-sale homes online across more than 100 metro areas from September 2023 to November 2023. To measure the share of homebuyers looking to relocate from one metro to another, we calculate the portion of overall home searchers that are migrants.

A Redfin.com user counts as a migrant if they viewed at least 10 for-sale homes in the relevant three-month period and at least one of those homes was outside their home metro area. For instance, if a Redfin.com user based in Seattle views 10 homes in a three-month period and all of them are in Phoenix, that user counts as a full migrant to Phoenix. If a user based in Seattle views 10 homes in a three-month period and five are in Phoenix but five are in San Diego, that user counts as half of a migrant to Phoenix and half of a migrant to San Diego. If a user based in Seattle views 10 homes in a three-month period, nine in Seattle and one in Phoenix, that user counts as one-tenth of a migrant to Phoenix.

The analysis includes combined statistical areas with at least 500 Redfin.com users based in that region and at least 500 users searching for homes in that region. For instance, a user based in Seattle searching for a home in Phoenix counts toward the first condition, a user based in Phoenix searching for a home in Seattle counts toward the second condition, and a user based in Seattle searching for a home in Seattle counts toward both. Redfin’s migration data goes back to 2017.

United States

United States Canada

Canada