Housing Market News

Investor Home Purchases Fell 30% in Third Quarter, Largest Drop Since Great Recession Aside From Pandemic Start

Investors are pumping the brakes—especially in pandemic boomtowns including Phoenix and Las Vegas—as economic uncertainty and the prospect of falling home prices raise the risk of real estate investing. Investor home purchases fell 30.2% year over year nationwide in the third quarter, the largest decline since the Great Recession aside from the second quarter of

Investor Home Purchases Plateau But Remain Well Above Pre-Pandemic Levels

Investors scooped up more homes in the second quarter than before the pandemic, but purchases leveled off from their 2021 peak as investors reacted to the slowing housing market in different ways. Some took advantage of cooling competition and elevated rental demand, while others pressed pause in hopes of lower prices and more economic certainty

Investor Home Purchases Slump 17% From Pandemic Peak as Interest Rates Rise

Surging borrowing costs and home prices prompted real estate investors to pump the brakes in the first quarter. Many are hoping prices will drop so they can get better deals. Still, investors bought a record 20% of homes sold in metros tracked by Redfin as a slowdown in homebuying nationwide allowed them to continue growing

Real Estate Investors Are Buying a Record Share of U.S. Homes

Investors bought 18.4% of the U.S. homes that were purchased in the fourth quarter, a record high. Investor demand is stronger than ever as home prices increase, allowing investors to charge higher rents and sell flipped homes for higher prices. Real estate investors bought roughly 80,000 U.S. homes worth a total of $50 billion in

Real-Estate Investors Bought a Record 18% of the U.S. Homes That Sold in the Third Quarter

Investors purchased a record $64 billion worth of homes as growing housing and rental prices boosted prospects for returns. Single-family homes made up nearly three-quarters of investor purchases—an all-time high. Low-priced properties represented 36% of investor purchases, the smallest share on record. Investors had the largest market share in Atlanta, Phoenix, Charlotte, Jacksonville and Miami,

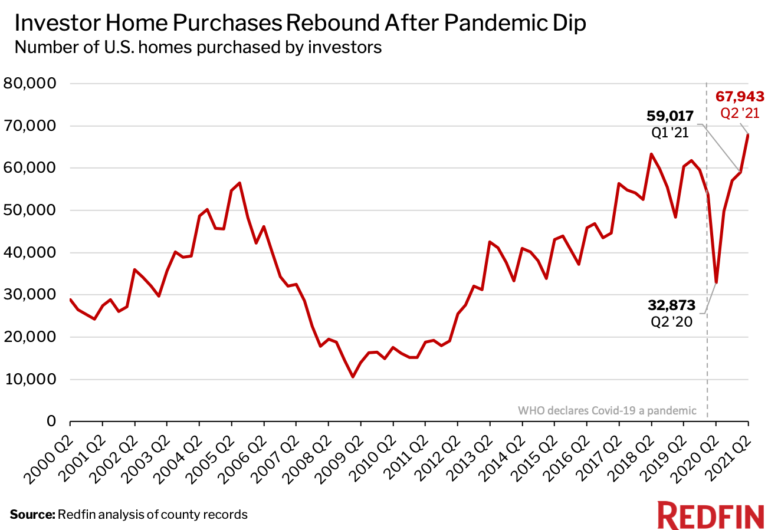

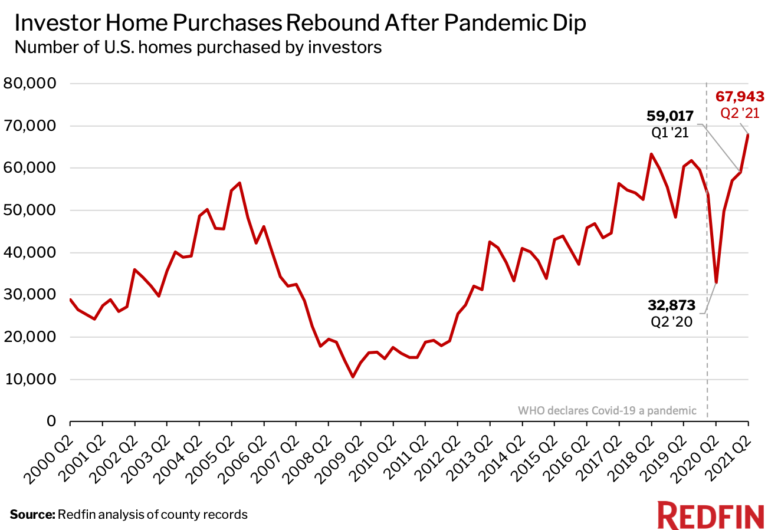

Investor Home Purchases Hit Record, Surpassing Pre-Pandemic Levels

Investors took the housing market by storm in the second quarter—buying up $49 billion worth of homes—as surging property prices and rental demand created opportunities for hefty profits. Multifamily properties remain the most popular among investors, but single-family homes and condos are gaining steam. Relatively affordable metros including Phoenix and Miami, which have jumped in

Investor Home Purchases Fell 30% in Third Quarter, Largest Drop Since Great Recession Aside From Pandemic Start

Investors are pumping the brakes—especially in pandemic boomtowns including Phoenix and Las Vegas—as economic uncertainty and the prospect of falling home prices raise the risk of real estate investing. Investor home purchases fell 30.2% year over year nationwide in the third quarter, the largest decline since the Great Recession aside from the second quarter of

Investor Home Purchases Plateau But Remain Well Above Pre-Pandemic Levels

Investors scooped up more homes in the second quarter than before the pandemic, but purchases leveled off from their 2021 peak as investors reacted to the slowing housing market in different ways. Some took advantage of cooling competition and elevated rental demand, while others pressed pause in hopes of lower prices and more economic certainty

Investor Home Purchases Slump 17% From Pandemic Peak as Interest Rates Rise

Surging borrowing costs and home prices prompted real estate investors to pump the brakes in the first quarter. Many are hoping prices will drop so they can get better deals. Still, investors bought a record 20% of homes sold in metros tracked by Redfin as a slowdown in homebuying nationwide allowed them to continue growing

Real Estate Investors Are Buying a Record Share of U.S. Homes

Investors bought 18.4% of the U.S. homes that were purchased in the fourth quarter, a record high. Investor demand is stronger than ever as home prices increase, allowing investors to charge higher rents and sell flipped homes for higher prices. Real estate investors bought roughly 80,000 U.S. homes worth a total of $50 billion in

Real-Estate Investors Bought a Record 18% of the U.S. Homes That Sold in the Third Quarter

Investors purchased a record $64 billion worth of homes as growing housing and rental prices boosted prospects for returns. Single-family homes made up nearly three-quarters of investor purchases—an all-time high. Low-priced properties represented 36% of investor purchases, the smallest share on record. Investors had the largest market share in Atlanta, Phoenix, Charlotte, Jacksonville and Miami,

Investor Home Purchases Hit Record, Surpassing Pre-Pandemic Levels

Investors took the housing market by storm in the second quarter—buying up $49 billion worth of homes—as surging property prices and rental demand created opportunities for hefty profits. Multifamily properties remain the most popular among investors, but single-family homes and condos are gaining steam. Relatively affordable metros including Phoenix and Miami, which have jumped in

United States

United States Canada

Canada