-

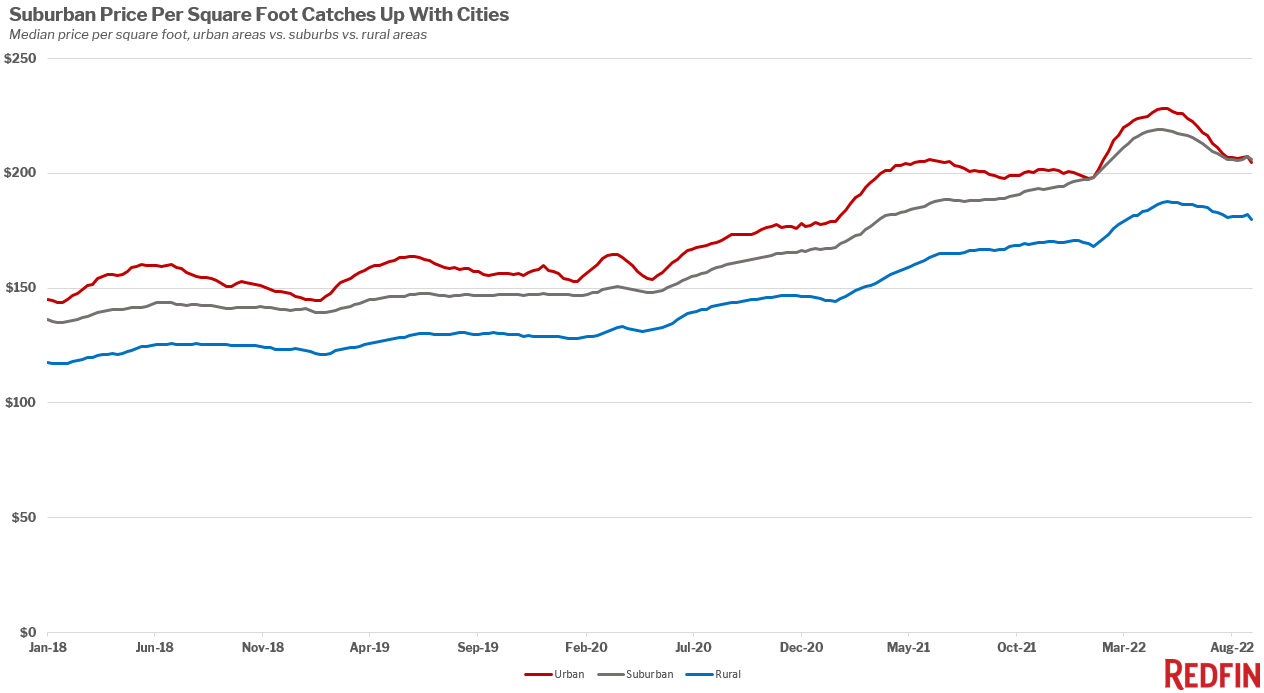

As home prices fall fastest in cities and mortgage rates rise, the value of a square foot in the suburbs has caught up with that of urban centers.

-

Price per square foot has declined 6% in urban parts of San Francisco, the biggest dip in the U.S. Overall, it has dropped in nine of the 91 metros in this analysis.

Space in suburban homes was worth more than space in urban homes in September for the first time since Redfin started tracking this data in 2018. That’s because pandemic-driven remote work continues to attract Americans to the suburbs and prices in cities are falling quickly from their peak as the overall housing market cools.

The typical home in suburban neighborhoods nationwide was worth $206 per square foot during the four weeks ending September 25, just slightly higher than $205 in urban neighborhoods.

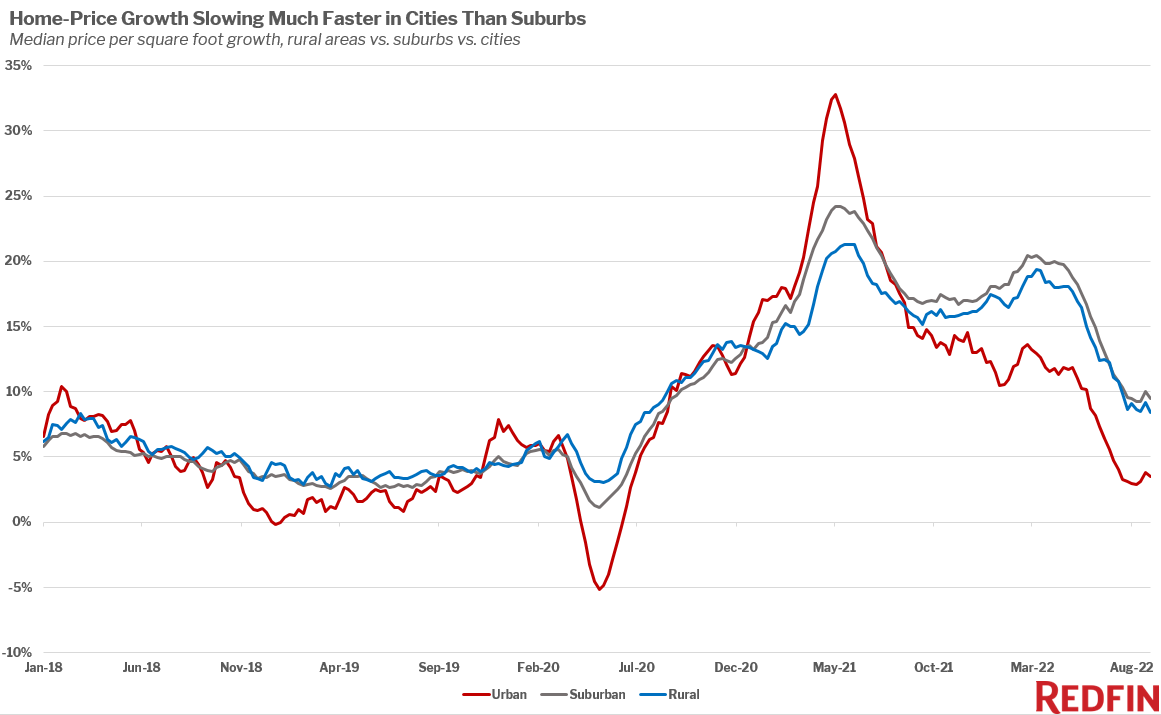

Price growth is falling much faster in urban areas than other types of neighborhoods amid the overall housing-market slowdown.

In urban neighborhoods nationwide, price per square foot increased 3.5% year over year–that’s still up from a year ago, but down significantly from its pandemic peak. That’s much smaller than the 9.5% growth in suburban areas. It grew 8.4% to $180 in rural areas.

Price per square foot is a valuable tool for comparing price growth across different neighborhood types because it’s a direct comparison of how the value of space is changing in one neighborhood type versus another.

Growth in overall home-sale prices is also slowing fastest in cities. The typical home in urban areas nationwide sold for $310,000, up 2.7% from a year earlier. That’s compared with a 6.6% increase to $385,000 in the suburbs and 4% to $333,000 in rural neighborhoods. Homes are the least expensive in urban areas because they’re typically the smallest.

Prices are falling from their peak quickest in cities partly because the remote-work trend has solidified. It has shifted from a pandemic necessity to a common arrangement as studies show that many employees prefer to work remotely either full time or part time. That makes homes in the suburbs and rural areas more desirable, appealing to house hunters searching for more space and a quieter lifestyle. Millennials in particular are keeping the suburban housing market afloat, as many are remote workers with young children who see the opportunity to live in highly rated school districts and skip commuting.

Although space now costs just as much in the suburbs as it does in urban neighborhoods, moving farther from city centers has historically meant that homebuyers could get more space for their money. That mindset is still common, and today’s house hunters are searching for deals as high mortgage rates, inflation and high home prices cut into their budgets. Another reason why price growth is slowing particularly fast in cities is because it rose so much last year.

“Urban home prices soared in 2021 as homebuyers gravitated back to city centers as the pandemic waned and affluent Americans–motivated by record-low rates–decided they wanted the best of both worlds: Homes with plenty of space for working from home, but located in walkable areas near shops and restaurants,” said Redfin Senior Economist Sheharyar Bokhari. “Today’s buyers can’t afford everything on their wish list, so many are prioritizing space over walkability.”

“Urban neighborhoods will likely see prices–and price per square foot–fall on a year-over-year basis before suburbs and rural areas,” Bokhari continued. “House hunters may want to shift their search to urban neighborhoods, where they may find lower prices to help counteract the costliness of today’s mortgage rates. And now that space is just as valuable in the suburbs, it’s less likely that they’ll sacrifice space.”

Housing activity has slowed in all three neighborhood types since the market started cooling in the spring. Home sales are down more than 15% year over year in urban, suburban and rural areas as many prospective buyers are priced out of the market. Sellers are pulling back, too, with new listings down at least 7% in all neighborhood types.

Housing market data, by neighborhood type

Four weeks ending September 25, 2022

| Urban neighborhoods | Suburban neighborhoods | Rural neighborhoods | |

|---|---|---|---|

| Median sale price | $310,000 | $385,000 | $333,000 |

| Median sale price, YoY | 2.7% | 6.6% | 4% |

| Median price per square foot | $205 | $206 | $180 |

| Median price per square foot, YoY | 3.5% | 9.5% | 8.4% |

| Home sales, YoY | -23.1% | -25.1% | -16% |

| Number of homes for sale, YoY | 2.2% | 12.5% | 19.4% |

| New listings, YoY | -14% | -16.8% | -7.2% |

| Average sale-to-list price ratio | 98.8% (-1.5 pts. YoY) | 99.5% (-1.8 pts. YoY) | 98.7% (-1.5 pts. YoY) |

| Share of homes for sale with price drops | 6.4% (+2.1 pts. YoY) | 7.5% (+3.4 pts. YoY) | 6.5% (+2.6 pts. YoY) |

Price per square foot is down 6% in the Bay Area’s urban neighborhoods

Price per square foot has declined from a year ago in urban parts of nine of the 91 metros in this analysis.

Urban neighborhoods in the San Francisco metro saw their median price per square foot decline 6.2% year over year in the 12 weeks ending September 25. Though that’s the biggest dip of the metros in this analysis, urban San Francisco homes still cost $976 per square foot–the most expensive in the U.S. by far.

“Many Bay Area residents thought buying a home would never be in the cards, but that’s changing now that prices are coming down and competition is rare,” said Oakland Redfin agent Ken Hogan. “Buyers are savvy now. They’re often able to negotiate prices down and even get things to sweeten the deal like sellers paying for closing costs or repairs, perks we haven’t seen since the 2008 recession. For the buyers who can afford high mortgage rates, it’s a good time to negotiate.”

Next comes New Orleans, which saw a 6% drop to $187 per square foot. It’s followed by Philadelphia (3.2% decline to $188), New York (2.7% decline to $557) and Oakland, CA (2.2% decline to $603). Price per square foot also dropped in urban parts of Pittsburgh, Boise, ID, Chicago and Washington, D.C.

San Francisco, New Orleans and Oakland are the only metros in the U.S. that saw their overall sale prices decline in September.

Price per square foot rose most in Florida city centers

Price per square foot increased most from a year ago in urban parts of Florida, especially in places hit hard by Hurricane Ian in September.

In urban neighborhoods in Cape Coral, price per square foot rose 31.4% to $278 in the 12 weeks ending September 25. It’s followed by North Port (27.9% to $444), Lakeland (25.1% to $201), Tampa (22.4% to $272), Fort Lauderdale (22.2% to $300) and Orlando (19.3% to $219).

Cape Coral, North Port and Tampa have consistently been among the places with the nation’s highest price growth this year as scores of homebuyers move into coastal Florida from other parts of the U.S. The area is popular with remote workers, retirees and second-home buyers even though it faces a high risk of climate-related disasters such as hurricanes.

Metro-level summary: Change in price per square foot

Year-over-year changes, 12 weeks ending September 25, 2022 versus a year earlier

Ranked by biggest declines to biggest increases

| U.S. metro area | Median sale price per square foot, YoY | Median sale price per square foot |

|---|---|---|

| San Francisco, CA | -6.2% | $976.36 |

| New Orleans, LA | -6.0% | $187.28 |

| Philadelphia, PA | -3.2% | $187.50 |

| New York, NY | -2.7% | $557.44 |

| Oakland, CA | -2.2% | $602.97 |

| Pittsburgh, PA | -1.5% | $126.93 |

| Boise, ID | -1.2% | $294.30 |

| Chicago, IL | -1.0% | $225.89 |

| Washington, D.C. | -0.5% | $385.17 |

| Birmingham, AL | 0.5% | $109.33 |

| San Jose, CA | 1.3% | $785.17 |

| Minneapolis, MN | 1.7% | $202.21 |

| Seattle, WA | 2.3% | $531.29 |

| Stockton, CA | 3.0% | $282.51 |

| Boston, MA | 3.1% | $454.38 |

| Portland, OR | 3.2% | $314.06 |

| Sacramento, CA | 3.2% | $348.59 |

| Warren, MI | 3.4% | $158.29 |

| Frederick, MD | 3.8% | $271.50 |

| Nassau County, NY | 4.2% | $377.43 |

| Gary, IN | 4.7% | $105.32 |

| Cleveland, OH | 4.8% | $99.00 |

| Denver, CO | 4.8% | $361.91 |

| Baltimore, MD | 5.2% | $162.62 |

| Los Angeles, CA | 5.9% | $598.23 |

| Atlanta, GA | 6.2% | $232.89 |

| New Haven, CT | 6.2% | $148.89 |

| Tacoma, WA | 6.4% | $310.86 |

| Wilmington, DE | 6.7% | $145.10 |

| Honolulu, HI | 7.3% | $685.76 |

| Austin, TX | 7.7% | $394.99 |

| Richmond, VA | 8.5% | $204.26 |

| Indianapolis, IN | 8.7% | $114.39 |

| Des Moines, IA | 8.9% | $178.15 |

| Buffalo, NY | 8.9% | $112.69 |

| Houston, TX | 8.9% | $175.59 |

| Cincinnati, OH | 9.0% | $138.96 |

| San Diego, CA | 9.1% | $615.48 |

| Fresno, CA | 9.2% | $227.90 |

| Dayton, OH | 9.4% | $101.17 |

| Rochester, NY | 9.5% | $97.86 |

| Akron, OH | 9.7% | $92.21 |

| New Brunswick, NJ | 9.8% | $290.97 |

| Omaha, NE | 10.0% | $135.47 |

| Elgin, IL | 10.1% | $157.82 |

| Louisville, KY | 10.2% | $136.92 |

| Virginia Beach, VA | 10.8% | $177.46 |

| Anaheim, CA | 10.9% | $588.52 |

| Oxnard, CA | 11.3% | $484.81 |

| Oklahoma City, OK | 11.3% | $135.07 |

| Detroit, MI | 11.3% | $82.74 |

| Worcester, MA | 11.4% | $205.01 |

| Columbus, OH | 11.4% | $161.61 |

| Tulsa, OK | 11.5% | $130.77 |

| Lake County, IL | 11.5% | $139.78 |

| Bridgeport, CT | 11.6% | $247.37 |

| McAllen, TX | 11.6% | $123.87 |

| Newark, NJ | 11.7% | $237.36 |

| San Antonio, TX | 11.8% | $166.04 |

| Grand Rapids, MI | 12.0% | $172.33 |

| Providence, RI | 12.5% | $183.52 |

| Little Rock, AR | 12.6% | $122.97 |

| Riverside, CA | 12.8% | $338.33 |

| Charleston, SC | 13.0% | $277.29 |

| Greenville, SC | 13.1% | $183.81 |

| Albany, NY | 13.4% | $134.17 |

| Nashville, TN | 13.7% | $305.02 |

| Bakersfield, CA | 13.8% | $204.61 |

| Montgomery County, PA | 13.9% | $155.54 |

| Hartford, CT | 14.0% | $122.65 |

| West Palm Beach, FL | 14.1% | $295.31 |

| Milwaukee, WI | 14.5% | $150.13 |

| Dallas, TX | 15.2% | $216.06 |

| Memphis, TN | 15.3% | $124.81 |

| Phoenix, AZ | 15.4% | $279.88 |

| Jacksonville, FL | 15.5% | $186.64 |

| Tucson, AZ | 15.7% | $210.90 |

| Raleigh, NC | 16.3% | $238.34 |

| Greensboro, NC | 16.4% | $144.69 |

| Allentown, PA | 17.2% | $143.06 |

| Miami, FL | 17.6% | $354.39 |

| El Paso, TX | 17.6% | $129.27 |

| Camden, NJ | 18.1% | $136.50 |

| Fort Worth, TX | 18.2% | $186.98 |

| Las Vegas, NV | 18.4% | $246.33 |

| Knoxville, TN | 18.4% | $189.30 |

| Orlando, FL | 19.3% | $218.60 |

| Fort Lauderdale, FL | 22.2% | $300.12 |

| Tampa, FL | 22.4% | $271.94 |

| Lakeland, FL | 25.1% | $200.97 |

| North Port, FL | 27.9% | $444.39 |

| Cape Coral, FL | 31.4% | $227.78 |

Methodology

The housing-market data in this report divides rural, suburban and urban based on categories from the U.S. Department of Housing and Urban Development, which built a model to describe neighborhood types based on responses to the 2017 American Housing Survey.

United States

United States Canada

Canada