The fees that sellers pay to buyers’ agents are expected to decline as a federal legal battle ushers in a new era of transparency around real estate commissions. Some home-selling businesses have already started offering lower commission rates. Buyers also stand to benefit, as lower commissions can translate to lower home prices.

The typical U.S. home seller in 2020 paid the brokerage repping the buyer a commission equal to 2.7% of the sale price—down only slightly from 2.8% in 2012. These fees will likely drop further in 2021 and beyond, resulting in savings for folks who are putting their homes on the market. Here’s why:

Data on agent commissions is about to become widely available for the first time in U.S. history, setting the stage for a new era of transparency and pricing competition in the housing industry. In the coming months, real estate websites will begin to publish commission rates that sellers offer to the broker who brings a buyer—the result of an antitrust settlement between the National Association of Realtors (NAR) and the Department of Justice (DOJ). Consequently, consumers will discover that some home sellers and home-selling companies (iBuyers) are already paying lower commissions, and will likely follow suit.

This month, Redfin began displaying the buyer’s agent commission for more than 700,000 home listings and plans to add more data as it becomes available.

In a typical home sale transaction, the seller pays the fees of both their agent and the buyer’s agent. The total commission is normally 5%–6%, with about half paid to the seller’s agent and half to the buyer’s agent. The DOJ settlement only impacts buyer’s agent commissions, which are the focus of this report.

Technology and a Red-Hot Housing Market Are Already Prompting Some Sellers to Offer Lower Commissions

Home sellers typically rely on their listing agents for guidance on what commission to offer the broker representing the buyer. As a result of the DOJ settlement, sellers will soon be able to see for themselves what the going rate is when they visit real estate websites, helping them make more independent and informed decisions. Research has indicated that price transparency across industries often leads to lower prices. Americans pay twice as much in real estate commissions as residents of other developed countries, but this may start to change once commission data becomes widely available to the general public.

“When a homeowner can see that their neighbor offered a 2.5% buyer’s agent commission rate, it makes it much easier to justify offering a similar rate when they sell their home,” said Redfin Chief Economist Daryl Fairweather.

Some sellers have started paying lower commissions because they’re no longer as reliant on buyers’ agents to bring in buyers. A record 97% of homebuyers searched for a home online last year, and they were twice as likely to have searched online than contacted an agent as the first step in their home-buying process, according to NAR.

Today’s hot housing market is accelerating the decline in commissions. Demand for homes is sky-high, with thousands of Americans moving and taking advantage of record-low mortgage rates during the coronavirus pandemic. At the same time, there aren’t enough homes for sale, fueling fierce bidding wars. As a result, some sellers have realized that finding a buyer will be a cinch, regardless of the commission they offer to the buyer’s agent.

“I’ve been talking with some of my sellers about offering no more than 2.5% given the lack of inventory,” said Sylva Khayalian, a Redfin real estate agent in Los Angeles. “There’s such a huge shortage of houses for sale that most homes will attract a long line of eager buyers no matter what. As a result, many sellers feel they don’t need to compensate the buyer’s agent as much for that part of the process.”

As an example, the owner of a $750,000 home could save $3,750 by paying the buyer’s agent 2.5% rather than 3%. In many cases, these savings will also be passed onto the buyer in the form of lower home prices; sellers typically factor the buyer’s agent commission into their listing price, so if they’re paying a lower commission, that may also mean they’re listing their home for less money. Additionally, lower commissions should expand the pool of homeowners who are willing to sell since high commissions make moving more expensive—a benefit for buyers who are grappling with an acute shortage of homes on the market.

Commission Savings Calculator

| Home Sale Price | 3.0% Buyer’s Agent Commission | 2.5% Buyer’s Agent Commission | Savings for Seller (Dollar-Value Difference Between Two Commission Rates) |

|---|---|---|---|

| $250,000 | $7,500 | $6,250 | $1,250 |

| $500,000 | $15,000 | $12,500 | $2,500 |

| $750,000 | $22,500 | $18,750 | $3,750 |

| $1,000,000 | $30,000 | $25,000 | $5,000 |

“Increased transparency can also help buyers negotiate,” Fairweather said. “When a buyer can see that their agent will get paid $10,000 if they purchase one home and $15,000 if they purchase a different home, it makes it easier for the buyer to ask their agent for a refund of a few thousand dollars if they opt for the home with the higher commission.”

iBuyers Pave the Way for Lower Commissions

Homes are increasingly being sold by thrifty businesses like iBuyers instead of individual sellers’ agents. The term “iBuyer” (short for instant buyer) is used to describe a real estate company that purchases houses from homeowners in quick cash transactions, makes any necessary improvements to the homes, and then resells them.

When an iBuyer resells a home, it pays a commission to the buyer’s agent, just like an individual home seller does. The average commission rate paid by iBuyers dropped to 2.5% in 2020 from 2.8% in 2019 as these companies experimented with paying lower fees to trim costs.

RedfinNow (Redfin’s iBuying business) has experimented with offering lower commissions to buyers’ agents when it sells homes. On more than 70% of its new listings this year, RedfinNow has offered 0.5% less to the buyer’s agent than it has historically, according to RedfinNow Vice President Jason Aleem.

“So far, offering a lower commission has not impacted our ability to attract buyers and sell homes for top dollar. Paying lower commissions means we can make even stronger offers to homeowners who request a cash offer from RedfinNow,” Aleem said. “We’re excited to share this strategy with our brokerage clients, who can hopefully save a chunk of change when they sell their home with a local Redfin agent.”

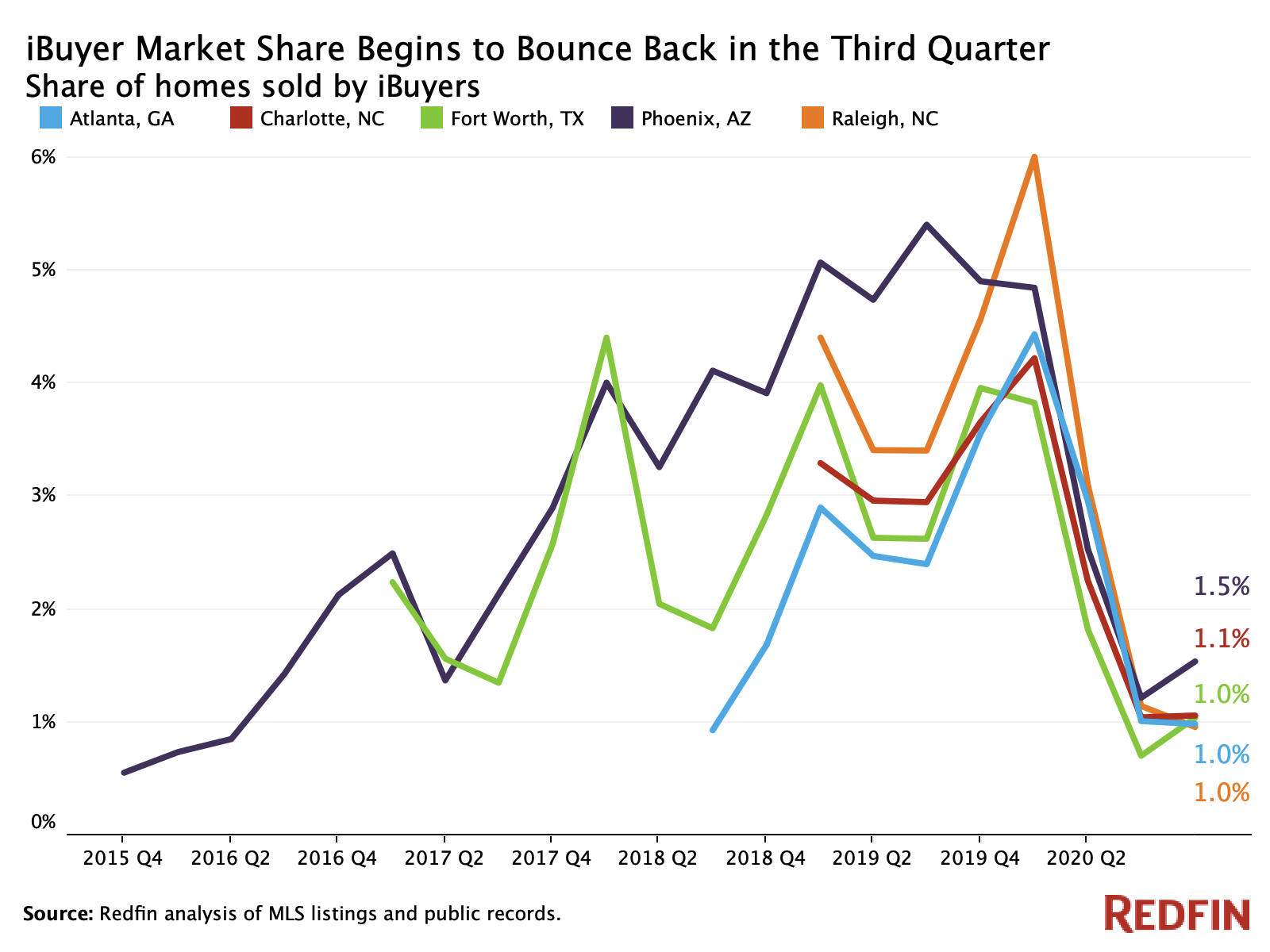

The relatively low commissions paid by iBuyers may put downward pressure on industry commissions overall—especially in markets where iBuyers have the largest footprints. The biggest market for iBuying is Phoenix, where iBuyers sold 1.5% of the homes that were purchased in the third quarter—the most recent period for which data was available. Next come Charlotte, NC (1.1%), Fort Worth, TX (1%) Raleigh, NC (1%) and Atlanta (1%). These numbers may seem low, but that’s largely because iBuyers temporarily shut down business at the onset of the pandemic. They have since been ramping back up, which should ultimately drive their market share back up near the 4%-6% levels we saw before the pandemic.

In many of the top iBuyer markets last year, iBuyers paid lower commissions to buyers’ agents than individual sellers did. In Phoenix, iBuyers paid 2.6% on average, while individual sellers paid 2.8%. When the DOJ settlement goes into effect and sellers can see what other sellers—including iBuyers—are paying in commissions, many of them may opt to pay a lower fee as well.

What iBuyers In Top iBuying Markets Paid In 2020 Versus What Individual Home Sellers Paid

| Average Commission iBuyer Paid to Buyer’s Agent When Selling a Home | Average Commission Individual Seller Paid to Buyer’s Agent When Selling a Home | |

|---|---|---|

| Phoenix | 2.6% | 2.8% |

| Raleigh | 2.4% | 2.5% |

| Atlanta | 2.9% | 3.0% |

| Fort Worth | 2.9% | 3.0% |

“iBuyers may have started the trend of offering lower commissions, but other sellers will follow,” said Sabrina Archolecas, an asset manager for RedfinNow in Texas.

The trend of offering lower commissions to buyers’ agents may also catch on among homebuilders, which are taking up an increasingly large portion of the for-sale market, Archolecas said. New-construction homes represented 22% of available U.S. housing inventory in December—the highest share on record. Historically, homebuilders in the top 10 new-construction markets have paid buyer’s agent commissions of around 3%, but that figure fell to 2.8% in 2020—a potential sign that builders are beginning to get more aggressive.

“We are experiencing record-low numbers of homes for sale, so it’s likely that builders are offering agents lower commissions—especially in places where those builders are the only game in town,” said Connie Durnal, a Redfin real estate agent in Dallas. “It will be interesting to see if this trend persists if inventory makes a comeback.”

What Does This Mean for Buyers’ Agents?

Nearly two-thirds of homebuyers don’t fully understand how their agent is paid, according to a 2019 survey commissioned by Redfin. That may change if commissions decline. If sellers start offering lower commissions to buyers’ agents, buyers’ agents may need to have more in-depth conversations with their clients about who pays them and how much. For instance, a buyer and her agent may agree upfront that the agent should be compensated at a certain level, with the buyer making up any difference between the commission paid by the seller and the agreed-upon fee. As Fairweather noted, this could also mean the agent refunds the buyer any commission that exceeds the agreed upon level.

Lower commissions may also drive buyers to seek out service packages that make the most sense for them individually. Not every buyer needs a full-service agent, and may realize this if they are asked to cover a portion of their agent’s fee. They may opt for more bespoke services that align with their needs and budget, such as hiring an agent solely to handle the contract and negotiation, or paying an agent an hourly fee for their time.

Lastly, if sellers start paying lower commissions to buyers’ agents and buyers are asked to make up the difference, it could put homeownership further out of reach for families that lack the funds to pay their own agent. We may see lenders start to offer the option to wrap agent fees into mortgages so that buyers who need help with the homebuying process can still seek counsel from an agent.

Commission Summary By Metro Area

50 largest metros by number of home sales in 2020. Data* represents all homes sold in a given metro, including those sold by iBuyers and homebuilders.

| Metro Area | Average Commission Rate Sellers Offered to Buyers’ Agents (2020) | Share of Sellers Offering Commission of 3% or More to Buyers’ Agents (2012) | Share of Sellers Offering Commission of 3% or More to Buyers’ Agents (2020) |

|---|---|---|---|

| Anaheim, CA | 2.4% | 33.0% | 5.7% |

| Atlanta, GA | 3.0% | 89.3% | 92.3% |

| Austin, TX | 3.0% | 96.4% | 95.3% |

| Baltimore, MD | 2.5% | 33.0% | 7.1% |

| Boston, MA | 2.2% | 8.1% | 0.9% |

| Buffalo, NY | 2.9% | 93.4% | 80.7% |

| Camden, NJ | 2.8% | 25.0% | 55.6% |

| Chicago, IL | 2.4% | 19.9% | 1.9% |

| Columbus, OH | 3.0% | 93.4% | 94.5% |

| Dallas, TX | 3.0% | 95.0% | 95.4% |

| Dayton, OH | 3.0% | 95.9% | 96.1% |

| Denver, CO | 2.8% | 17.2% | 5.3% |

| Elgin, IL | 2.4% | 25.8% | 1.9% |

| Fort Lauderdale, FL | 2.8% | 86.7% | 68.1% |

| Fort Worth, TX | 3.0% | 94.5% | 92.3% |

| Frederick, MD | 2.5% | 47.5% | 12.2% |

| Grand Rapids, MI | 3.0% | 93.1% | 94.2% |

| Houston, TX | 3.0% | 94.3% | 94.5% |

| Indianapolis, IN | 3.0% | 89.5% | 83.4% |

| Kansas City, MO | 3.0% | 94.4% | 92.8% |

| Lakeland, FL | 2.6% | 57.0% | 32.0% |

| Little Rock, AR | 2.4% | 14.4% | 7.8% |

| Los Angeles, CA | 2.4% | 33.2% | 4.1% |

| Minneapolis, MN | 2.7% | 22.6% | 1.6% |

| Montgomery County, PA | 2.6% | 63.2% | 32.9% |

| Naples, FL | 2.9% | 84.1% | 67.7% |

| Nashville, TN | 3.0% | 94.6% | 91.9% |

| Nassau County, NY | 2.0% | 6.0% | 3.1% |

| New Brunswick, NJ | 2.4% | 24.7% | 7.8% |

| New York, NY | 2.3% | 23.2% | 15.3% |

| North Port, FL | 2.9% | 90.6% | 81.9% |

| Oakland, CA | 2.5% | 35.3% | 4.4% |

| Orlando, FL | 2.7% | 80.4% | 39.5% |

| Philadelphia, PA | 2.7% | 74.2% | 42.0% |

| Phoenix, AZ | 2.8% | 64.0% | 57.7% |

| Portland, OR | 2.4% | 16.4% | 1.0% |

| Raleigh, NC | 2.5% | 20.1% | 4.6% |

| Riverside, CA | 2.5% | 59.4% | 19.7% |

| Rochester, NY | 3.0% | 96.7% | 94.4% |

| Salisbury, MD | 2.6% | 51.8% | 27.6% |

| San Diego, CA | 2.5% | 33.9% | 4.1% |

| San Francisco, CA | 2.5% | 18.2% | 3.9% |

| San Jose, CA | 2.5% | 30.1% | 3.9% |

| Seattle, WA | 2.8% | 87.8% | 58.1% |

| St. Louis, MO | 2.7% | 35.8% | 5.8% |

| Tacoma, WA | 2.6% | 68.6% | 22.1% |

| Tampa, FL | 2.6% | 32.6% | 12.3% |

| Virginia Beach, VA | 2.9% | 91.0% | 90.6% |

| Washington, D.C. | 2.6% | 72.9% | 18.2% |

| West Palm Beach, FL | 2.7% | 85.3% | 50.1% |

| National—U.S.A. | 2.7% | 59.7% | 44.8% |

*Data filters out home-sale records with commissions of between 0.1% and 0.5% and home-sale records with commissions of more than 10%, which we consider outliers.

United States

United States Canada

Canada