The median U.S. asking rent rose 1% from a year earlier. By comparison, rents jumped 5% in the Midwest—in part because the region hasn’t seen as big of a construction boom as other parts of the country.

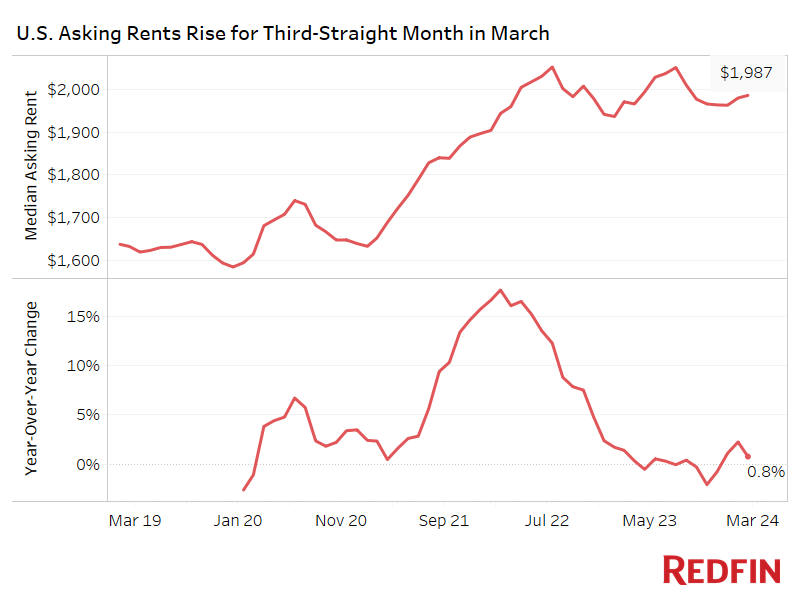

The median U.S. asking rent rose 0.8% year over year to $1,987 in March, marking the third consecutive increase following three months of decreases. Asking rents were little changed from February (+0.3%).

Rising rents in the Midwest and Northeast helped drive the national uptick in rents, which we will discuss further in the next section.

Elevated mortgage rates also likely contributed. The average 30-year-fixed mortgage rate is 6.82%, below the 23-year high of almost 8% in October, but still more than double the all-time low of 2.65% during the pandemic. Many people are delaying home purchasing plans because monthly payments for homebuyers are near their record high. That’s bolstering rental demand, and as a result, rent prices.

Housing costs are so high that many Americans can’t afford to buy homes, but rents are also elevated, putting a lot of people searching for housing between a rock and a hard place. The median asking rent in March was just 3.3% ($67) below the record high of $2,054 in August 2022.

The good news for renters is that prices aren’t growing nearly as fast as they were during the pandemic, and are more predictable. Rents soared by as much as 17.7% year over year in 2022 due to the pandemic moving frenzy and then quickly cooled in 2023, falling by as much as 2.1% as an influx of apartment supply drove up vacancies. Year-over-year rent growth has stayed below 3% since the start of 2023. The number of apartments under construction remains near a record high, meaning there’s still a lot of supply in the pipeline, which will likely prevent rents from increasing dramatically in the near future.

“During the pandemic, you saw property owners charging $2,800 a month in rent for a house that a year earlier cost $2,000,” said Heather Mahmood-Corley, a Redfin real estate agent in Phoenix. “But the economy has changed and many people are trying to curb their spending, which means it’s harder for property owners to get renters to agree to big rent hikes.”

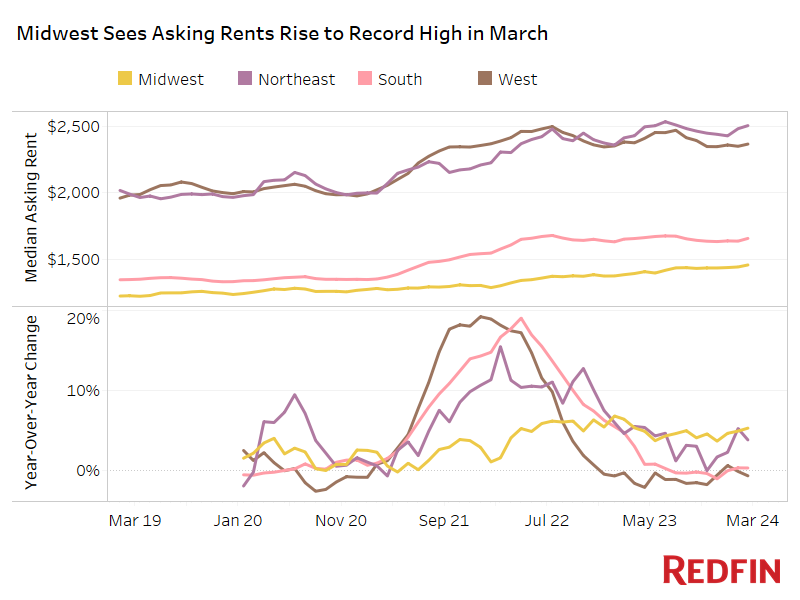

Midwest Sees Asking Rents Rise 5% to Record High

The median asking rent in the Midwest hit a record $1,456 in March, up 5.3% from a year earlier—a larger gain than any other region. The second biggest increase was in the Northeast, where asking rents climbed 3.8% to $2,504. Rents were roughly flat in the South (+0.3% to $1,656), and fell slightly in the West (-0.7% to $2,365).

Rents are likely holding up best in the Midwest and Northeast because those regions haven’t been building as much housing as the South and West, meaning landlords aren’t under as much pressure to fill vacancies. Fewer vacancies means more competition between renters, which makes it easier for property owners to raise rents.

The Midwest is also the most affordable region to live in, which helps keep demand afloat at a time when housing affordability is so strained. It has a lower-than-average unemployment rate and has recently attracted major tech companies.

Methodology

Asking price data includes single-family homes, multi-family units, condos/co-ops and townhouses from Rent.com and Redfin.com.

Redfin has removed metro-level data from monthly rental reports for the time being as it works to expand its rental analysis.

Prices reflect the current costs of new leases during each time period. In other words, the amount shown as the median rent is not the median of what all renters are paying, but the median asking price of apartments that were available for new renters during the report month.

United States

United States Canada

Canada