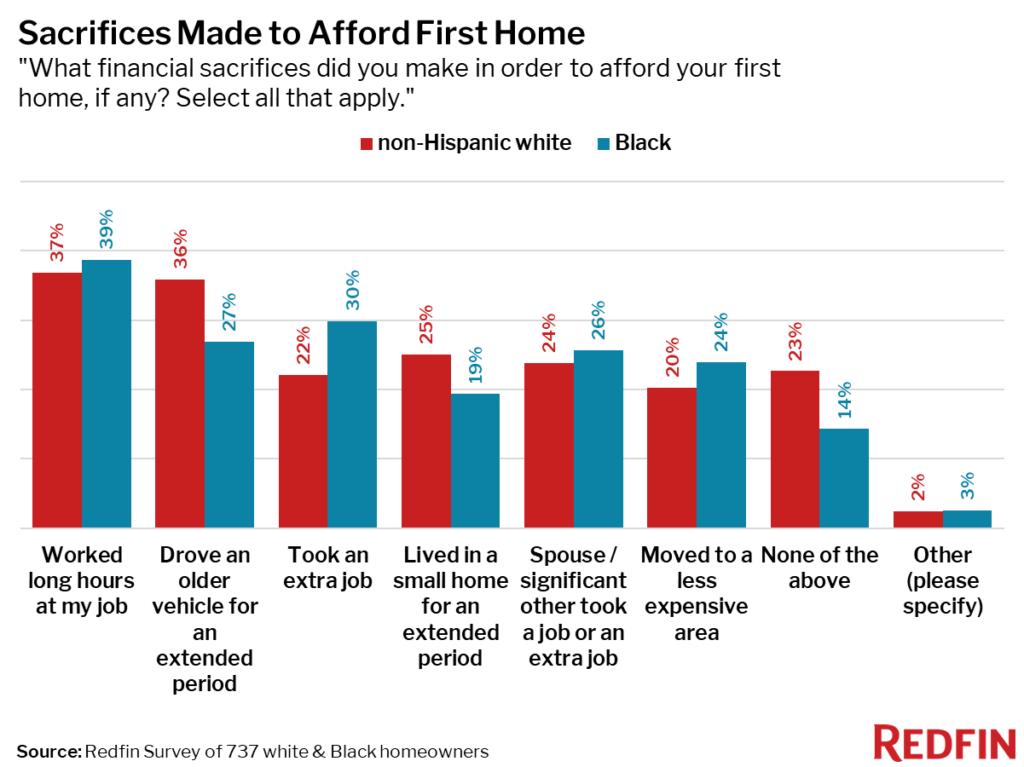

23% of white homeowners report making no financial sacrifices to buy their first home, versus 14% of Black homeowners. The fact that Black Americans are more likely to face hurdles when purchasing a home is one reason for the substantial racial homeownership gap in the U.S.

The homebuying process is “absolutely different for a person of color,” according to Thomas Loving, a cybersecurity professional who spoke at Redfin’s recent Homebuying: The Black Experience symposium.

“It’s not an easy journey. I really struggled trying to get an offer accepted on a house when I arrived in Houston,” said Loving. “I earn more than $400,000 a year, even without taking my spouse’s income into account, and I was in a position where I had to jump through hoops to prove that I could afford even a starter home. It was outrageous. Black homebuyers are the exception, not the standard, and people often assume we can’t afford to buy a home even when we have successful careers and earn high incomes.”

That’s just one example of a Black American facing unequal hurdles in the homebuying journey. A June Redfin survey of 1,500 homeowners found that there’s a measurable difference in the homebuying experience for Black and white people, with Black Americans facing greater financial and generational barriers to homeownership. Here are the key takeaways:

- Black homeowners were more likely than white homeowners to have made financial sacrifices—like taking on an extra job—to afford their first home.

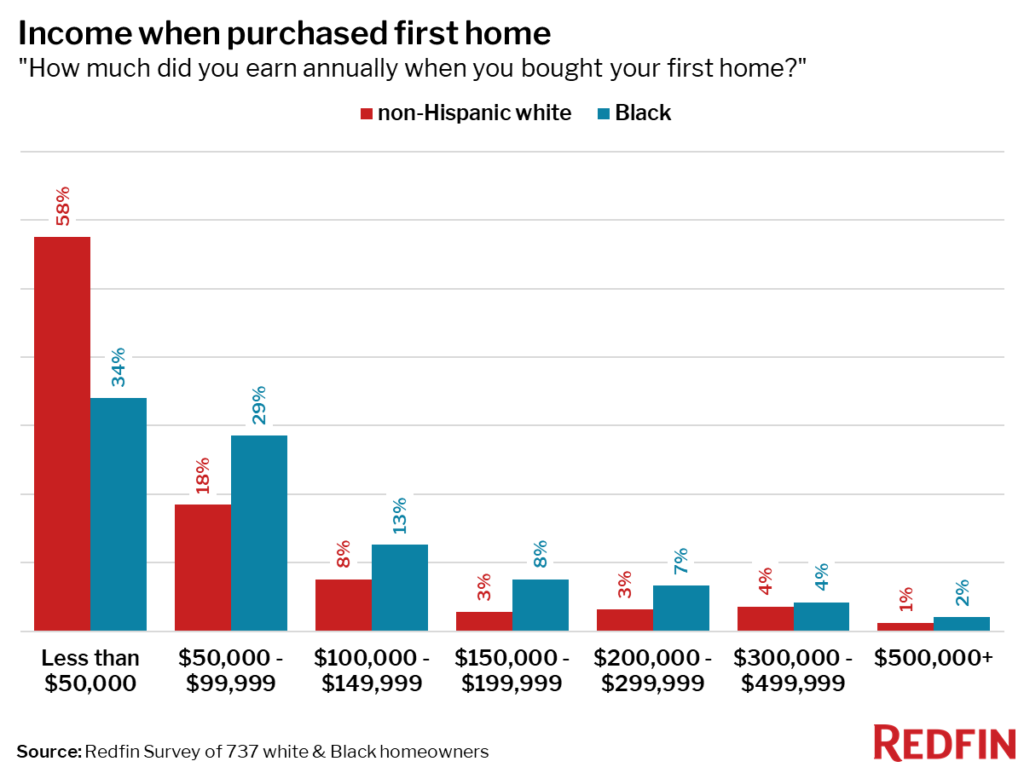

- Black homeowners were about twice as likely as white homeowners to have been high earners when they bought their first home.

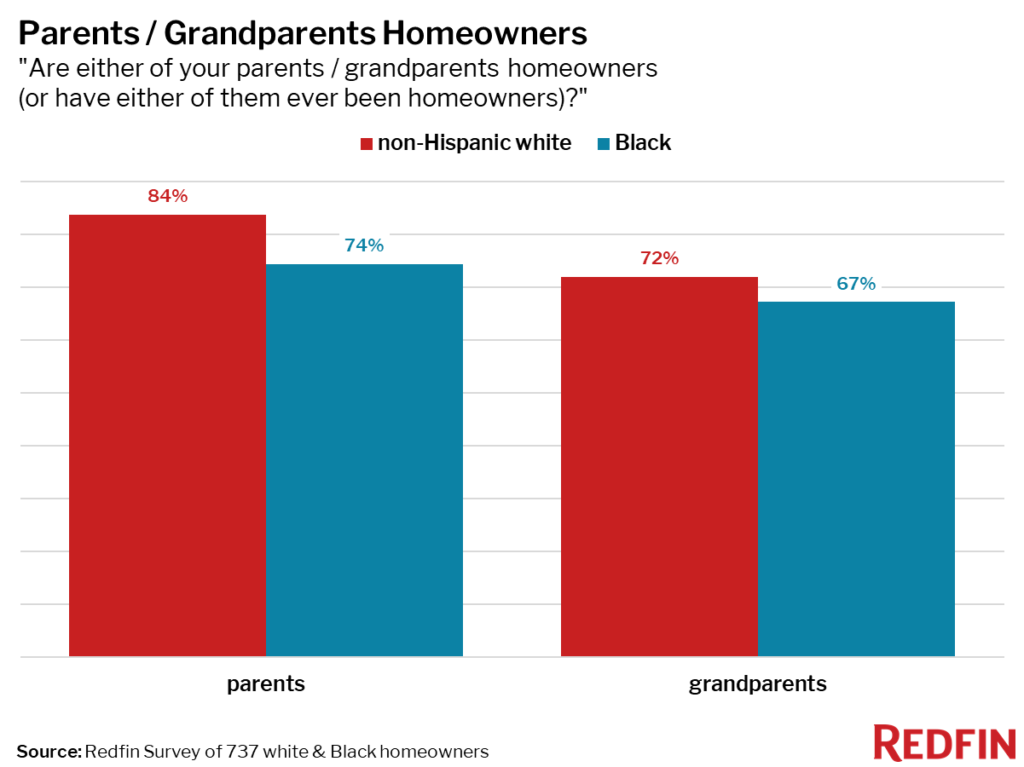

- Black homeowners were less likely than white homeowners to have parents and grandparents who are homeowners, which means they’re more likely to benefit from generational wealth when they’re purchasing a home.

These findings suggest the financial standard for becoming a homeowner is higher for Black people than white people, making it more difficult for Black Americans to buy homes and contributing to the substantial homeownership gap between the two groups, with 73.8% of white Americans owning their home in the first quarter of 2021 versus just 45.1% of Black Americans.

“Homeownership is closely tied to the American ideal of freedom, and specifically financial freedom,” said Redfin Chief Economist Daryl Fairweather. “The fact that Black buyers report earning more money and making more financial sacrifices to enter the homeowner class is one example of how difficult it is for Black people in this country to achieve the American dream.”

“Black homebuyers may believe they face higher standards than their white counterparts for getting a mortgage and getting their offer accepted, so they don’t even try to buy a home until they’re earning a significant amount of money,” Fairweather continued. “And some Black buyers assume they need to earn more than is necessary to buy a home because they don’t have parents or role models teaching them the finances of homeownership.”

Black homeowners more likely to make financial sacrifices, earn high incomes to buy their first home

Twenty-three percent of white homeowners made no financial sacrifices to buy their first home, versus 14% of Black homeowners. Meanwhile, 30% of Black respondents took an extra job to afford their first home, versus 22% of white respondents.

Meanwhile, 21% of Black homeowners earned $150,000 or more when they bought their first home, versus 11% of white homeowners. And 58% of white homeowners earned less than $50,000 when they purchased their first home, versus just 34% of Black homeowners.

A recent Redfin analysis of mortgage denials supports the idea that there are higher financial hurdles for Black Americans to buy homes: Nationwide, 16% of Black Americans who apply for mortgages are rejected, compared with 7% of white Americans. Black homebuyers are more frequently turned down due to debt and credit scores than their white counterparts.

While the June Redfin survey found that Black homeowners are slightly more likely to have debt—40% of Black homeowners had more than $5,000 worth of debt when they bought their first home, versus 35% of white respondents—biases held by lenders and the algorithms they use may also play a part in denying loans to certain groups.

“Black people who succeed in buying a home have to be Superman or Superwoman,” said Bryan Greene, vice president of policy advocacy for the National Association of Realtors, said at Redfin’s symposium. “They need to have higher degrees, they have more debt, they face persistent rejection and generally carry around bigger burdens to achieve the same goal as white people.”

A recent survey from NAR found that 30% of Black homeowners have advanced degrees, versus 24% of white homeowners. Meanwhile, 43% of Black homeowners have student debt, versus 21% of white homeowners. That supports the notion that Black homebuyers are held to a higher standard than their white counterparts, and at the same time they carry bigger financial burdens.

Black homeowners less likely to have parents who are homeowners

Seventy-four percent of Black respondents to the survey have parents who are homeowners, versus 84% of white respondents. And 67% of Black respondents have grandparents who are homeowners, versus 72% of white respondents.

Note that all respondents to this survey are homeowners, so the likelihood of having parents and grandparents who are also homeowners is higher than it is for the general population for both races.

Redlining, the racist housing policy that effectively blocked many Black families from obtaining mortgages throughout the middle of the 20th century, is one reason Black homeowners are less likely to have parents and grandparents who are also homeowners. It’s also a significant factor in the comparatively low Black homeownership rate.

“Homeownership is one of the most common ways to build wealth in this country, and parents who own their own homes can take advantage of that financial stability to help their children become homeowners,” Fairweather said. “Many Black Americans don’t have a generational legacy of homeownership, which means they have one more barrier to break down before purchasing a home.”

For more on the Black homebuying experience and ways the real estate industry can address inequalities in the housing market, here’s a recap of Redfin’s recent symposium on the topic.

Methodology

This report is based on a June Redfin survey of about 1,500 homeowners. The survey, fielded during the first week of June, had more than 1,500 respondents: 238 of the respondents identified themselves as Black, and 499 identified themselves as white, 385 identified themselves as Hispanic and 387 identified themselves as another race. We plan to publish additional findings from the survey in the coming weeks.

United States

United States Canada

Canada