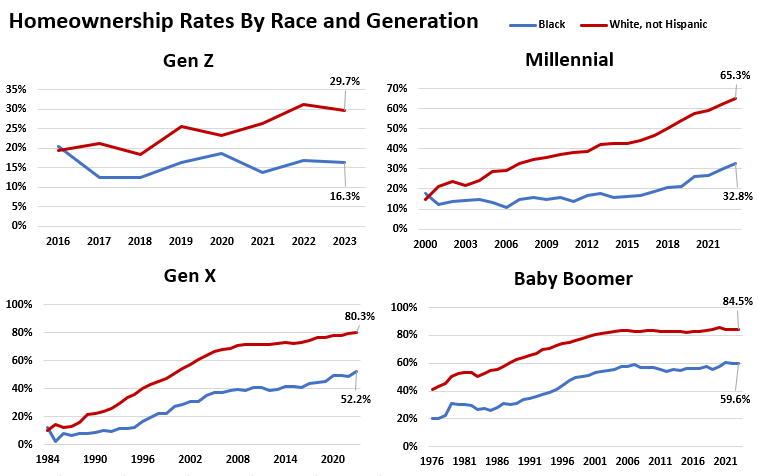

The racial homeownership gap is biggest for millennials, but it exists in every generation. Redfin economists expect the gap to shrink for millennials in the near future.

Just one-third (33%) of Black millennials own their home, compared to two-thirds (65%) of white millennials.

That’s the largest gap of any generation, but Black Americans are much less likely to own their home than white Americans at every age. White adult Gen Zers are nearly twice as likely as Black adult Gen Zers to own their home, with respective homeownership rates of 30% and 16%.

The racial homeownership gap is smaller for older generations, but it’s still substantial. Just over half (52%) of Black Gen Xers own their home, compared to 80% of white Gen Xers. Baby boomers have the smallest percent gap, but white boomers are still much more likely to own their home: Six in 10 (60%) Black boomers own their home, compared to 85% of white boomers.

This data is from a Redfin analysis of the Current Population Survey’s Annual Social and Economic Supplement as of 2023.

The homebuying landscape is challenging for most Americans today because of high home prices, elevated mortgage rates and a supply shortage. It’s especially challenging for Black Americans: Just 7% of homes for sale in 2023 were affordable for the typical Black household, compared to 22% for the typical white household.

Racist policies from the early to mid 1900s like redlining and discriminatory housing covenants have caused generations of Black families to miss out on owning property, and on sizable property-value gains. Black Americans still face barriers to buying real estate today. Black homebuyers are twice as likely to have their mortgage applications rejected than white homebuyers and they often have higher mortgage rates when they do buy a home. Investigations have found that Black Americans frequently face discrimination when going through the homebuying process.

The persistent racial wage and wealth gaps are other major contributors to the racial homeownership gap. The median Black worker earns 79 cents for every dollar earned by a white worker, and for every $100 in wealth held by white households, Black households have $15. That makes it harder to save money for a down payment and to make monthly mortgage payments. The racial homeownership gap is biggest for millennials because they have come of age during topsy-turvy economic times including the Great Recession, which had a bigger financial impact on the Black population than the white population. During the Great Recession, the Black unemployment rate rose to roughly 16%, compared to 9% for white Americans, setting Black millennials, who were early in their careers, further back. Another factor contributing to the outsized gap for millennials: Tight lending standards in the wake of the Great Recession, just as millennials were entering homebuying age, disproportionately held back Black buyers.

“Millennials have consistently tracked behind their parents’ generation when it comes to homeownership because they’ve faced significant financial obstacles and an historic inventory shortage,” said Redfin Chief Economist Daryl Fairweather. “But that number doesn’t tell the whole story: Black millennials have borne the brunt of those challenges because they’re at an unfair financial disadvantage due to the country’s history of racial discrimination. Young Black Americans started out behind largely because they’re less likely to have property and money passed down from their parents or grandparents, who faced racial discrimination themselves, and they have stayed behind because they’re still facing discrimination and unfair economic circumstances.”

Racial homeownership gap may shrink for millennials in the near future

The homeownership rate for Black millennials and Gen Xers has grown fairly quickly for the last several years. But the racial homeownership gap persists because it has grown at a similar pace for white millennials and Gen Xers. The homeownership rate for young and middle-aged adults has grown over the last several years because that group is in prime homebuying age, and mortgage rates dropped to record lows in 2020 and 2021. Even when mortgage rates jumped in 2022 and 2023, both Black and white millennials and Gen Xers gained ground.

“Although young Black Americans face outsized barriers to homeownership, I expect the racial homeownership gap to start narrowing for millennials and Gen Zers in the near future,” Fairweather said. “The Black unemployment rate is at an all-time low and the racial wage gap is shrinking, which should help more young Black Americans get their feet in the homeownership door.”

Although it’s still difficult for most Americans to afford a home, Redfin economists expect it to become slightly easier to buy a home as the year goes on, with mortgage rates declining by the end of 2024 and more homes hitting the market.

Methodology

Data on homeownership rates by race (Black versus non-Hispanic white) and generation was calculated from the Current Population Survey’s Annual Social and Economic Supplement (March Supplement), from 1976 to 2023, conducted by the U.S. Bureau of Census for the Bureau of Labor Statistics. Homeownership rates are calculated for ages 19 and above. The data was accessed using IPUMS-CPS*.

Gen Zers were 11-26 years old in 2023 (born 1997-2012); only adult Gen Zers (19-26 years old) were included in this analysis. Millennials were 27-42 (born 1981-1996) in 2023, Gen Xers (born 1965-1980) were 43-58 and baby boomers were 59-77 (born 1946-1964).

The homeownership rate is the percentage of occupied homes that are owned rather than rented.

*Sarah Flood, Miriam King, Renae Rodgers, Steven Ruggles, J. Robert Warren, Daniel Backman, Annie Chen, Grace Cooper, Stephanie Richards, Megan Schouweiler, and Michael Westberry. IPUMS CPS: Version 11.0 [dataset]. Minneapolis, MN: IPUMS, 2023. https://doi.org/10.18128/D030.V11.0

United States

United States Canada

Canada