Single women build less home equity overtime than single men, according to a new Redfin analysis of 79,517 homes in purchased in 18 of the largest metros by single women in 2012. On those home purchases, women earned a median $171,313 of home equity over five years compared to $186,403 of equity earned by men—a difference of $15,090 or 8.1 percent. If we look at it the same way we look at the pay gap in the workplace, single women earned 92 cents of home equity for every $1 of equity earned by single men.

To calculate home equity, Redfin added the initial equity from the down payment and the principal paid on the mortgage to the appreciation of the home since purchase date. Appreciation was determined by subtracting the original purchase price of the home from the current Redfin Estimate.

The Best Places for Single Female Home Equity

New Orleans, LA was the best metro on our list for single women homeowners; women there actually earned $8,784 or 8 percent more than men in home equity over the five-year period. Omaha, NE was the next best with women earning 0.5 percent less equity than men. Portland, OR (0.8% less); Denver, CO (2.0% less) and Oakland, CA (2.0% less) rounded out the top five best places for single female home equity.

| Rank | Metro | % Difference in Equity Earned by Men vs. Women | Median Equity Earned by Women | Median Equity Earned by Men | Median Purchase Price Difference Between Men & Women | Median % Put Down by Women |

| #1 | New Orleans, LA | 8.0% | $118,995 | $110,211 | $14,250 | 29.7% |

| #2 | Omaha, NE | (0.5%) | $65,839 | $66,194 | $0 | 9.8% |

| #3 | Portland, OR | (0.8%) | $215,675 | $217,354 | ($12,000) | 20.0% |

| #4 | Denver, CO | (2.0%) | $206,147 | $210,352 | ($12,500) | 20.0% |

| #5 | Oakland, CA | (2.0%) | $397,656 | $405,913 | ($2,000) | 25.0% |

| #6 | Atlanta, GA | (3.2%) | $114,630 | $118,457 | $2,000 | 20.0% |

| #7 | Orange County, CA | (4.0%) | $350,804 | $365,281 | ($35,000) | 30.0% |

| #8 | Los Angeles, CA | (4.6%) | $285,457 | $299,195 | ($15,000) | 20.0% |

| #9 | Miami, FL | (4.8%) | $178,153 | $187,204 | ($15,000) | 100% |

Where the Gender Equity Gap was Largest

Of all the metros Redfin looked at, the percent difference in equity was greatest in Seattle, WA, where women earned 6.3 percent or $20,983 less equity over the five-year period. Columbus, OH (6.2% less); Baltimore, MD (6.2% less); San Francisco (6.0% less) and San Diego (5.8% less) topped the list of metros where single women fare worst compared to single men.

| Rank | Metro | % Difference in Equity Earned by Men vs. Women | Median Equity Earned by Women | Median Equity Earned by Men | Median Purchase Price Difference Between Men & Women | Median % Put Down by Women |

| #1 | Seattle, WA | (6.3%) | $310,868 | $331,851 | ($35,350) | 20.0% |

| #2 | Columbus, OH | (6.2%) | $76,312 | $81,370 | $3,000 | 11.1% |

| #3 | Baltimore, MD | (6.2%) | $77,729 | $82,843 | ($15,000) | 5.7% |

| #4 | San Francisco, CA | (6.0%) | $722,879 | $768,864 | ($52,250) | 30.0% |

| #5 | San Diego, CA | (5.8%) | $275,661 | $292,572 | ($21,000) | 25.0% |

| #6 | Washington, D.C. | (5.5%) | $128,499 | $136,030 | ($30,000) | 10.0% |

| #7 | Phoenix, AZ | (5.2%) | $129,663 | $136,729 | ($5,000) | 20.0% |

| #8 | Boston, MA | (4.9%) | $240,182 | $252,619 | ($50,900) | 21.9% |

| #9 | Chicago, IL | (4.9%) | $97,607 | $102,632 | ($9,000) | 20.0% |

So what causes this disparity in home equity between men and women? Understanding the reasons may help women approach homeownership differently.

Men Spend More on Homes

The first major cause behind the home equity accumulation gap is income. Women’s median income has flattened since 1979, according to a recent report by the National Bureau of Economic Research. Coupled with a continuing gender pay gap in the workplace, women are typically unable to save and therefore spend as much as men on housing. Our analysis revealed that women spent around $25,000 less on homes than their male counterparts. The median price of a home purchased by a single woman in 2012 was $195,000, compared to $220,000 for a single man. In several cities, men spent much more; $52,250 more in San Francisco, $50,900 more in Boston and $35,350 more in Seattle. We can assume that these more expensive homes purchased by men were larger or better located, and more likely to appreciate faster.

Women Start Out with Less Equity

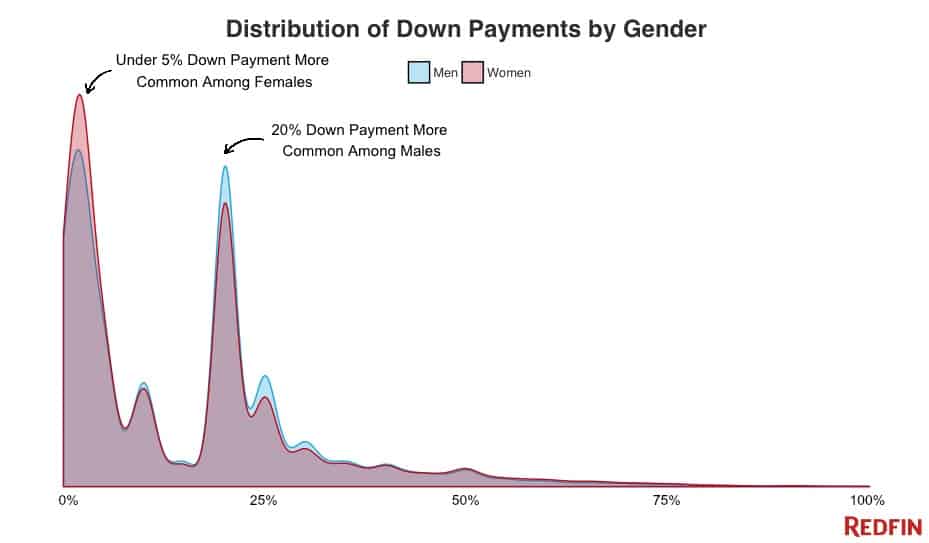

Another factor that plays into home equity is the initial down payment on a home, and our study shows women are investing less up front. While the median down payment for both men and women was 20 percent, the distribution graph shows a spike at 3.5 percent down for single female buyers and 20 percent down for single male buyers.

Debt and Other Expenses

Women are now more likely to go to college than men and currently hold nearly 65 percent of the United States’ $1.3 trillion of student debt. A study by the American Association of University Women showed it took women two years longer on average to pay off that debt, in part due to the gender pay gap. Not only does this debt affect how much home women can afford, it directly affects their access to credit, and thus loan application approval and mortgage rates. Home Mortgage Disclosure Act (HMDA) data from 2015 shows that a single woman’s likelihood of mortgage denial due to debt-to-income ratio was slightly higher than a single man’s: 30.3 percent compared to 28.1 percent. Overall, women originated fewer loans in 2015; 61.2 percent of single women who applied originated loans, compared to 61.8 percent of single men.

Another expense likely affecting some single women’s spending power is children. According to a 2016 Census report on child support, 82.5 percent of single parents with custody were women; one of every six custodial parents (17.5 percent) was a man. We were not able to identify how many, if any, of the women in this study were single parents.

Tips to Help Single Women Build More Equity

Homeownership is one of the most common ways to build wealth and more and more single women are entering the market to claim their share. Here are a few things single women can do to build more home equity.

- Start planning early. Speak with a lender or financial planner as soon as you start thinking about homeownership, so you can understand the costs and determine how much you can realistically borrow.

- Save or borrow for a bigger down payment. By making a larger down payment at the outset, you’ll automatically have more equity in your home and may qualify for a lower interest rate to boot.

- Don’t stretch your budget. As a single homeowner, it’s important that you plan ahead for the unexpected. Save room in your housing budget for maintenance costs and home improvement.

- Pay a little extra toward your mortgage each month. If you’re able to make larger payments each month, you’ll start paying toward the principal instead of just paying interest. This will allow you to pay your mortgage off faster and gain equity more quickly.

- Shop aggressively for financing. Check rates at several mortgage lenders to make sure you’re getting the best deal.

“Despite differences in equity appreciation, purchasing a home can help level the playing field between men and women,” said Redfin chief economist Nela Richardson. “Homeownership remains the single biggest engine for middle-class workers to create wealth over the long-term. In addition to setting labor standards that encourage pay equity, more can and should be done at the federal and local levels to support female homeownership through affordable housing policies like down payment assistance.”

Methodology

For this analysis Redfin looked at county sale records for homes purchased at anytime during 2012 that have not sold since 2012. Using the first name of the buyer when only one name was present on the sale record, we identified whether they were male or female (for example, the most common male name was Christopher and the most common female name was Maria). Home appreciation was measured using the Redfin Estimate in the last week of July minus the original purchase price of the home. We assumed a 30-year fixed mortgage at 4 percent interest, which allowed us to infer that 10 percent of the principal will have been paid by 2017, for non all-cash buyers. Current housing equity was then calculated using the initial equity from the down payment or purchase of the property plus the principal paid on the mortgage in addition to the appreciation of the home since the purchase date.

United States

United States Canada

Canada