With Amazon’s highly anticipated HQ2 announcement set to go public sometime before the end of the year, many are wondering how the Seattle area will be impacted by the big shift. There are still many unknowns, but even before the final decision has been announced, Amazon HQ2 is already beginning to tap the brakes on Seattle’s frenzied housing market.

“From my conversations, it seems that some would-be buyers are waiting on the sidelines for the announcement of where HQ2 will be located,” said Seattle Redfin agent Jessie Culbert. “If they work for Amazon now, they may decide to relocate to be closer to family and friends. If they don’t work for Amazon and plan to stay in Seattle, they may wait to see how additional inventory on the market could impact pricing.”

Over the past 10 years, Amazon has grown more than tenfold in the city of Seattle, from about 4,000 employees in its hometown to over 45,000. During the same time, the median home price in the city has shot up from $420,000 to $720,000 (according to the Northwest MLS) and home prices in the metro area as a whole have gone up 47 percent. That’s nearly twice as high as the national increase of 24 percent according to the S&P Case-Shiller Home Price Index.

Between 2008 and 2018, over 535,000 homes have sold in the entire Seattle metro area. For comparison, that’s 41 percent more than in the similarly-sized San Diego metro area. Much of this growth in the local housing market can likely be attributed to growth at Amazon.

Not every new Amazon hire in Seattle also buys a home in Seattle (or at all), but with an average salary of over $110,000, they could certainly afford to. If every new employee Amazon hired in Seattle over the past decade had bought a home in the city, they would have accounted for 38 percent of home sales in Seattle over the past 10 years.

Once Amazon announces the location of its HQ2 and begins hiring there in earnest, it will inevitably slow the Seattle housing market, at a time when inventory is already on the rise and a historic rental building boom is leading to a surging apartment vacancy rate.

“All of this is happening at a fascinating time for Seattle as we’re about five months past a period of frenzied multiple-offer and escalated-price scenarios,” added Culbert. “The market is already quite sedate compared to last fall, and any dramatic shifts prompted by Amazon HQ2 could have a significant impact.”

Amazon has said that HQ2 will “include as many as 50,000 high-paying jobs” and will be “a full equal to our current campus in Seattle.” Since current estimates put employment at their Seattle HQ at around 45,000, these statements imply that we can guess most of their new hiring in the coming years will be at HQ2, and growth at the Seattle HQ will slow significantly, gaining only around 5,000 additional jobs during the time it takes HQ2 to ramp up to 50,000.

In Seattle, the difference between a frenzied seller’s market with only one or two months of supply (calculated by dividing the number of homes listed for sale at the end of a month by the number of homes sold during said month) and a relaxed buyer’s market with five or six months of supply is just 300 to 600 sales per month. Amazon’s growth of 40,000 people over the past 10 years averages out to roughly 330 people per month–easily enough to dramatically swing the local housing market.

So what could Amazon HQ2 mean for Seattle? Let’s consider some hypotheticals on opposite ends of the spectrum.

Extreme scenario

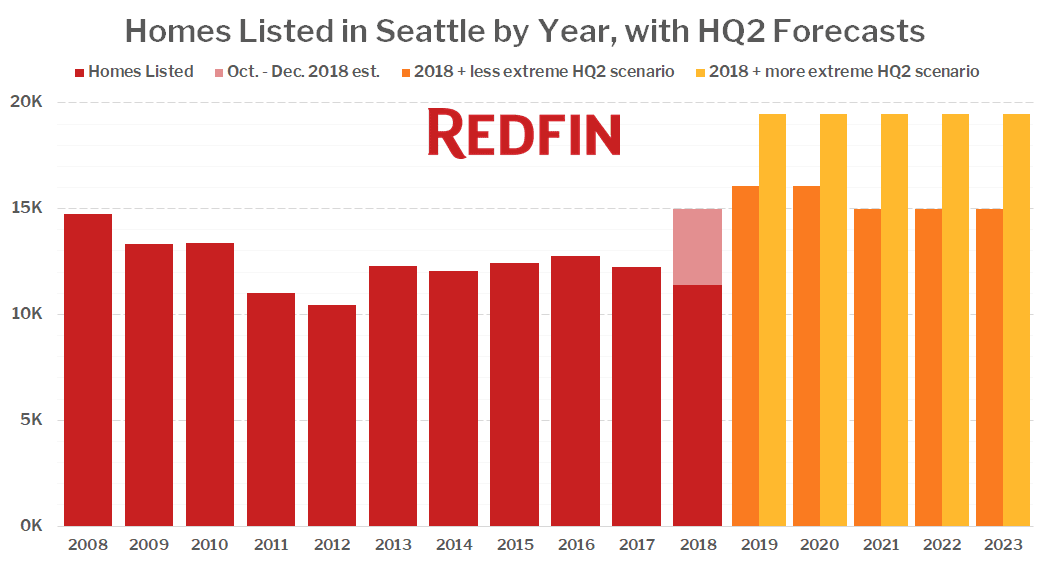

At the most, let’s say that Amazon HQ2 rapidly overtakes the Seattle HQ, hiring at Seattle HQ drops to near-zero, and HQ2 draws half of the current Seattle employees away over the course of the next five years.

This scenario would result in a net outflow of 4,500 Amazonians per year leaving Seattle. If most of those people are also selling homes, that would be an average of 375 new listings every month. For context, the city of Seattle has seen an average of around 1,100 new listings per month over the last 12 months, so that would be a 34 percent jump, sending listings to their highest levels since 2009. If we add 375 new listings and cut around 330 sales per month, months of supply in Seattle would shoot up from an average of 1.1 over the past 12 months to well over 6 by the end of 2019.

Less extreme scenario

At the least, let’s say that Amazon slows hiring in Seattle to half of its previous level and 5 percent (one in 20) of Amazon Seattle employees decide to leave for HQ2, spread over the next two years.

If one out of every 20 employees at Amazon HQ decided to sell their home in Seattle and transfer to HQ2 over the next two years, that would result in around 94 additional new listings each month. Combined with a drop in sales due to decreased hiring at the Seattle HQ, even this scenario has the potential to shift the balance of the Seattle housing market into buyers’ favor by 2020.

It’s anybody’s guess…

If Amazon does slow hiring in Seattle as it grows HQ2, the local housing market won’t collapse, but we will definitely see a noticeable slowdown. Unless hiring by other local technology firms dramatically picks up, we can expect to see more listings, fewer sales, slower price growth and a relatively rapid move back to a more balanced market in Seattle over the next few years.

United States

United States Canada

Canada