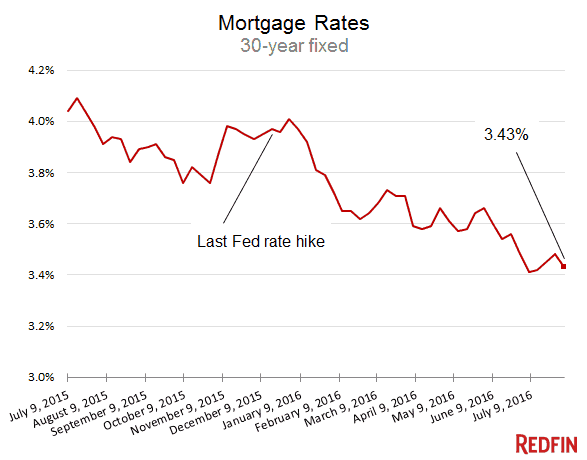

Mortgage rates fell this week for the first time in a month, averaging 3.43 percent for a 30-year, fixed-rate loan, down from 3.48 percent. A year ago, rates averaged 3.91 percent, according to Freddie Mac’s weekly survey.

Rates had been going up for most of July, but this week’s dramatic drop erased most of that increase. That’s good for both homebuyers and sellers.

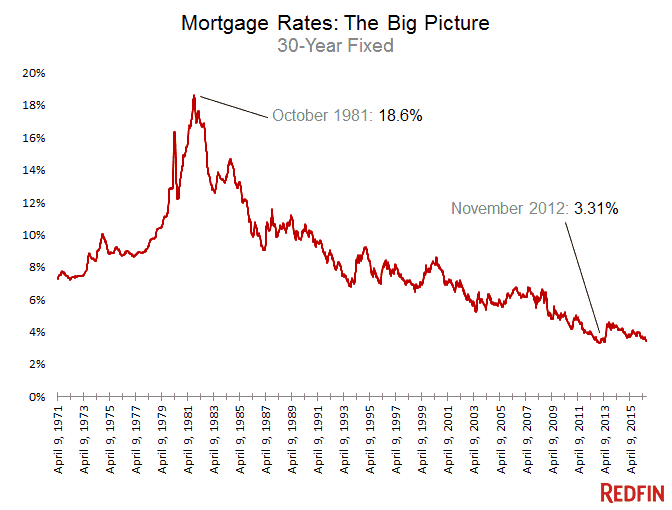

Rates have held below 4 percent for 31 weeks, the second-longest run of cheap borrowing the U.S. has ever had. The record was set from March 2012 to June 2013, when the cost of a 30-year loan held below 4 percent for 65 weeks, hitting a historic low of 3.31 percent in November 2012.

Homeowners are refinancing in droves and new programs made it a little easier for lower-credit borrowers to refinance last month, according to the Mortgage Bankers Association. Refinancing activity is up 55 percent from this time last year.

Rates fell this week after new data showed the U.S. economy growing at a much slower pace than analysts thought. Consumers are taking advantage of cheap borrowing to buy things like cars and houses. But businesses aren’t spending, which is holding the economy back.

“If you can’t borrow money at these rates and find something useful to invest in, what does that say about the prospects for the global economy?” Scott Brown, chief economist at Raymond James & Associates, wrote in a note to clients. “Hopefully, this is temporary.”

The upshot

Borrowing will remain cheap for now and home price growth is slowing. Nationally, housing still hasn’t fully recovered from the credit bubble but the National Association of Homebuilders found 97 percent of the market at or above “normal” levels in the second quarter of this year.

“With a strengthening economy, solid job growth and low mortgage interest rates, the market should continue on an upward trajectory throughout the rest of the year,” NAHB Chairman Ed Brady said.

Mortgage rates fluctuate constantly, but expect them to stay comfortably low for a while.

United States

United States Canada

Canada