In order to solve the housing shortage, the Biden administration should spend its affordable housing budget outside of expensive California cities and focus instead on building housing in already affordable places like the Midwest and South.

The U.S. currently faces a housing shortage of 2.5 million homes. The number of homes for sale is at an all-time low and home prices are growing a staggering 15% annually. We are in dire need of a plan to build homes that are affordable. The most effective plan would focus our resources on building affordable housing in places where it is currently affordable to build and where people want to move to. However, President Joe Biden’s plan is to target $65 billion federal dollars to places where housing is currently unaffordable– places like San Francisco, Los Angeles and San Jose. The federal government could build three times as many homes and create 36% more wealth for households currently living in poverty if it instead focused its investment on building affordable homes in affordable places like Houston, Atlanta or Cleveland.

Biden should build affordable housing in places where it is affordable to build like the Midwest and South

The federal government can’t get around the fact that land and labor cost more in places with unaffordable housing. New homes have lower price tags in the Midwest and South because of the low cost of land. For example, land only accounts for 18% of home values in Indianapolis and only 21% in San Antonio, compared to 51% in San Francisco. Additionally, it costs less to employ construction workers in the Midwest and South. Construction laborers earn a median salary of $36,300 per year in Indianapolis and $30,800 in San Antonio, compared to $56,400 per year in the Bay Area.

If the federal government prioritized building homes in places where it is the most affordable to build new housing instead of prioritizing building homes in places with the most expensive housing, we could build 10 times as many housing units in Indianapolis, nine times as many housing units in Houston, and eight times as many housing units in Atlanta, Cleveland, and Cincinnati. We could build more housing everywhere except the metros where it is most expensive to build new housing, which are all located in coastal California: San Francisco, San Jose, Los Angeles, Oakland, Anaheim and San Diego. Overall, we would be able to build three times as many housing units nationwide.

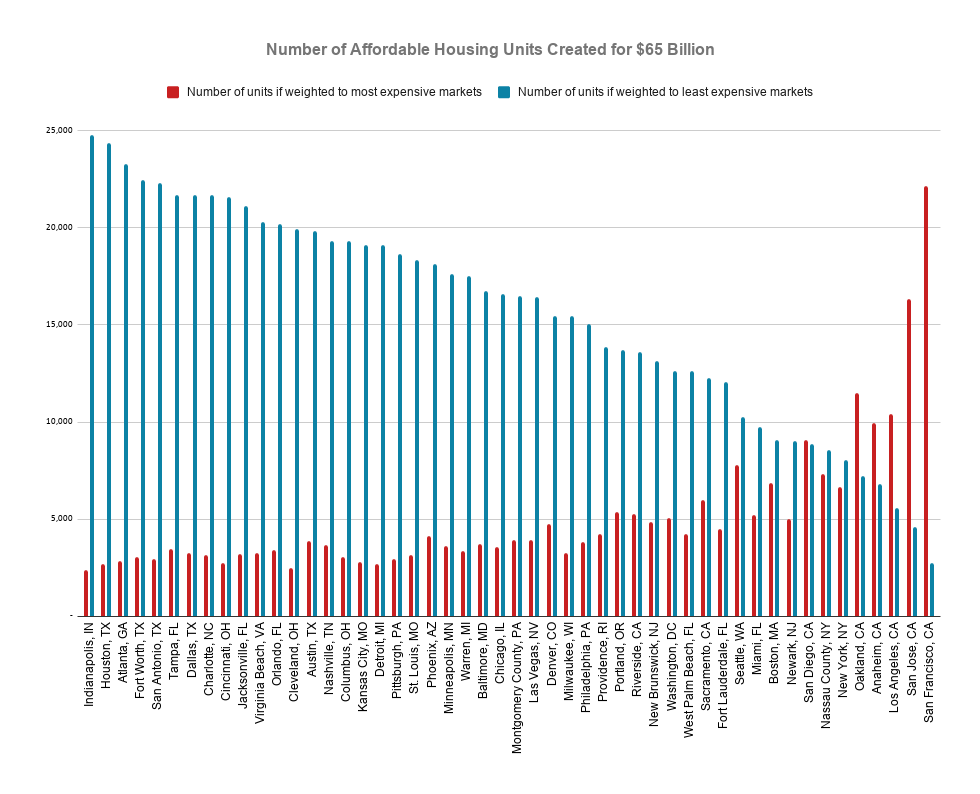

If President Biden’s proposed $65 billion budget for building affordable housing was allocated to metros according to how expensive housing is in each metro, the greatest number of affordable homes would be built in San Francisco, San Jose, and Oakland, receiving 22,137, 16,316, and 10,421 units respectively. But because new homes are so expensive in those metros–$988,000, $728,000 and $514,000 respectively for a 1,000 square-foot home–the budget for affordable housing would be quickly eaten up. If instead the budget were allocated to metros by affordability, Indianapolis, Houston, and Atlanta would receive 24,761, 24,380, and 23,304 housing units, respectively. Because new construction is affordable in these metros–$107,000, $120,000 and $128,000 respectively for a 1,000 square-foot home–there would be much more money left over to build even more affordable homes across the country. As a result, more housing could be built in all metros outside of coastal California.

Under Biden’s plan, which prioritizes building affordable housing in expensive areas, it would cost the government an average of $372,000 to acquire each new 1,000-square-foot home. Compare that with $203,000 under my proposed plan, which prioritizes building housing in metros with affordable new housing. If the government sold those new housing units at an affordable price of $120,000, the government would have an average net cost per housing unit of $252,897 under Biden’s plan and $83,450 under my proposed plan. Therefore with a $65 billion budget, the government could create 257,022 housing units under Biden’s plan and 778,913 housing units under my proposed plan. Because the homes created under Biden’s plan would be in more expensive metros, those homes would be worth more and would create more equity after 30 years: $675,471 of equity per housing unit under Biden’s plan compared to $368,521 of equity per housing unit under my plan. After the $120,000 price paid by the families occupying these homes, Biden’s plan would create $555,451 in wealth per household and my plan would create $248,521 in wealth per household. But because more housing units would be created under my plan, more households would benefit and more wealth would be created in total: Biden’s plan would create $143 billion in wealth, and my plan would create $194 billion in wealth. The return on the initial $65 billion investment from the government would be $78 billion under Biden’s plan and $129 billion under my plan.

Table of Housing Units and Wealth Created Under Different Plans

| Biden’s plan – prioritizes building housing in expensive metros | Proposed plan – prioritizes building housing in metros with affordable new housing | Difference | |

| Initial average cost to the government of acquiring new 1,000 sq ft unit at market price |

$372,897 |

$203,450 |

-45% |

| Average cost to the government after selling at affordable Price |

$252,897 |

$83,450 |

-67% |

| Number of affordable housing units |

257,022 |

778,913 |

3x |

| Value of housing units created |

$95,842,589,816 |

$158,469,542,014 |

+65% |

| Average value of housing units after 30 years (present value) |

$675,451 |

$368,521 |

-45% |

| Average wealth created per household (present value) |

$555,451 |

$248,521 |

-55% |

| Total wealth created for households (present value) |

$142,762,995,498 |

$193,576,098,641 |

+36% |

| Return on initial investment |

$77,762,995,498 |

$128,576,098,641 |

+65% |

| Note: Assumes a budget of $65 Billion and an affordable sale price of $120,000, and a real rate of appreciation of 2%, which is net of inflation and depreciation. | |||

Instead of renting out its low-income homes as public housing, the federal government could sell homes at an affordable price with down payment assistance at a monthly payment of approximately $500 over 30 years. That would give the average low-income household the opportunity to earn approximately $555,000 in home equity over 30 years. That wealth could be passed down through generations and lift their children out of poverty.

Americans already want to move to places where housing is affordable, the government should encourage that

In order to recover from this pandemic recession and solve the affordable housing crisis at the same time, we have to make it easier for people to transition into a new location with more economic opportunities and a lower cost of living than where they currently live. In 2021, the number of Americans relocating out-of-town will be the highest it has been in 16 years. Many of the places where new houses are most affordable are already growing migration destinations, such as Dallas, Kansas City, and Cleveland where the number of homebuyers moving in more than doubled from last year. In addition to building housing in affordable places, the federal government could help pay moving costs for families relocating, and give tax subsidies to companies that create jobs with incomes high enough to afford housing.

During the pandemic, it has been the most affluent Americans who have been able to adjust and move– luxury home sales have increased 61% since last year and second home sales have increased 100%. We should support less affluent Americans who also want to move, instead of leaving them financially stuck in places with exorbitant housing costs and declining economic opportunities.

A pro-migration housing policy would also set a precedent for encouraging households to move away from areas where housing is unsustainable due to climate change. As the frequency and severity of wildfires, hurricanes and rising sea levels grow, the federal government could help households relocate out of areas impacted by climate change and discourage building housing in areas at high-risk of climate disasters.

It will be more politically feasible to build housing in the Midwest and South

President Biden wants to enact policies with bipartisan support. Under the policy I am proposing, Democrats will achieve their goal of reducing housing costs at a national level, and Republicans will be able to spend federal dollars in their own states, creating jobs and economic growth. Democrats could benefit in the long run because making it easier for Californians to move to swing states like Texas, Ohio and Michigan could give Democrats an electoral advantage over time.

Biden’s plan to build housing in expensive areas is not likely to be politically feasible because current homeowners in these places have a vested interest in keeping home prices high to increase their own wealth. And Biden’s other housing policy to give up to $15,000 in down payment assistance to first-time homebuyers won’t move the needle on making homeownership more attainable in a place like Los Angeles, where the median price of homes is nearly $700,000 and more than half of offers for homes face bidding wars. In order to make homeownership more attainable in expensive cities, it may be more politically feasible to raise the minimum wage, and promote more migration out of expensive cities to reduce pressure on housing prices.

Methodology

This analysis assumes that if expensive areas are prioritized, the number of housing units built is weighted by the metro-area seasonally adjusted median price per square foot of home sales in September 2020, and if affordable areas are prioritized, the number of housing units built is weighted by the inverse of the median price per square foot of new construction home sales in third quarter of 2020. Homes are assumed to be 1,000 square feet and sold at a price of $120,000, which is below the market sale price of new homes in every metro. The revenue from the sale would go towards construction of additional units. Households purchasing at the affordable price of $120,000 could acquire a mortgage for a monthly payment of $506 with zero percent down at an interest rate of 3% over 30 years, which would amount to less than 30% of income for a household earning at least $20,240 per year (for comparison the Federal poverty threshold four a household of two adults and two children is $25,926). This analysis assumes homes would appreciate at a rate of 2% after deducting the rate of deflation and depreciation.

United States

United States Canada

Canada