Rising rates will likely drive up housing-market competition in the short term.

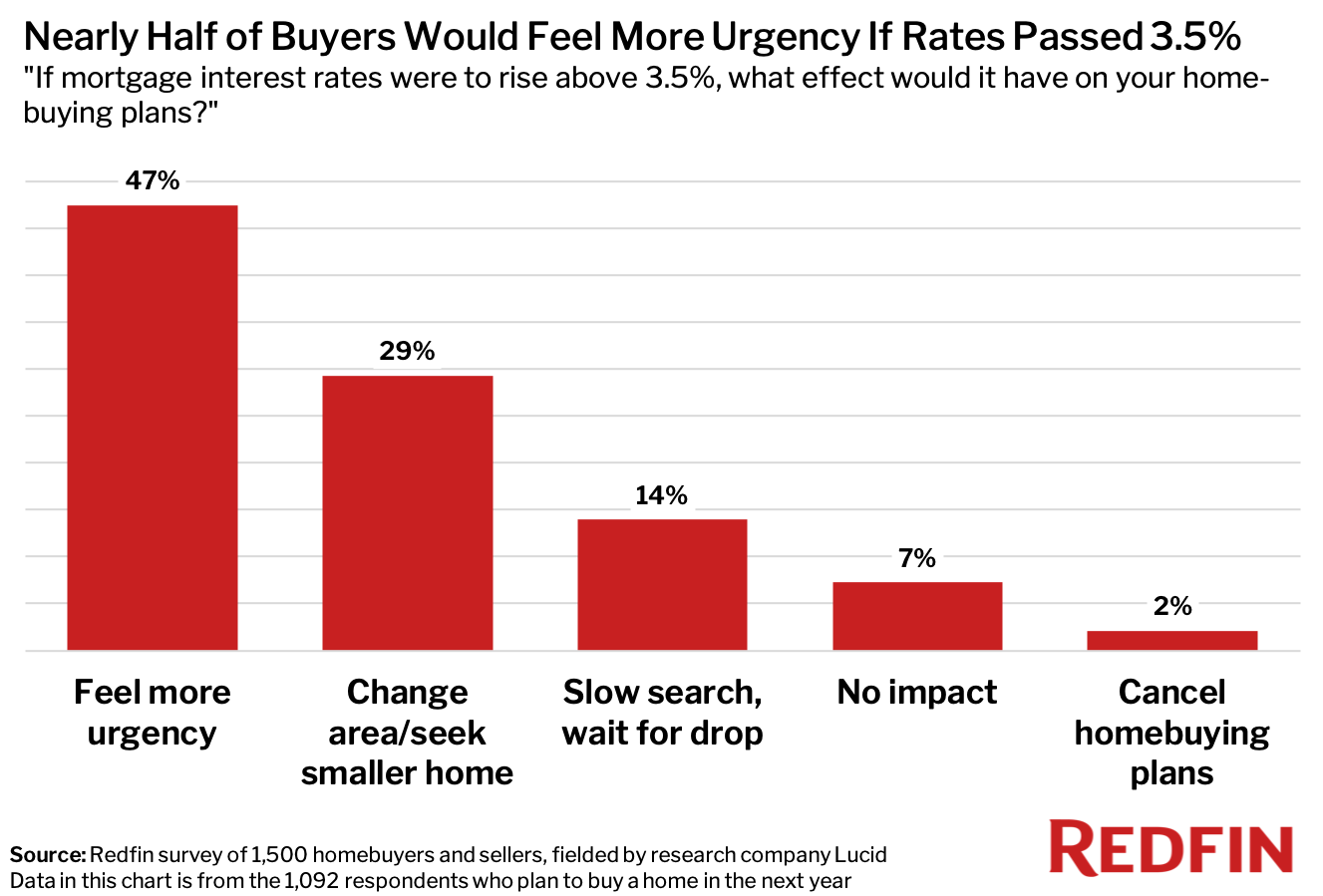

Almost half (47%) of house hunters say they would feel more urgency to buy a home if mortgage rates rose above 3.5%. A lower share (29%) would look for homes in different areas or consider smaller houses, while 14% would slow their search in hopes of rates coming down again.

Meanwhile, 7% of respondents wouldn’t change their plans at all. Just 2% said they would cancel their plans to purchase a home if mortgage rates surpassed 3.5%.

That’s according to a Redfin-commissioned survey of 1,500 U.S. residents planning to buy or sell a home in the next 12 months. This report focuses on the 1,092 of those respondents who indicated they were planning to buy a home in the next year. The survey was fielded by research technology company Lucid from Dec. 10 to Dec. 13, 2021.

The interest rate on a 30-year fixed mortgage rose to 3.22% during the first week of 2022 from 3.11% the prior week, Freddie Mac said Thursday. That’s the highest level since May 2020, when the pandemic was just beginning. Redfin Chief Economist Daryl Fairweather expects rates to hit about 3.6% by the end of 2022.

“Mortgage rates increasing will make homebuying less affordable. Over time, that will put the brakes on demand and put an end to double digit annual price growth,” Fairweather said. “But in the short term, this increase will light a fire under homebuyers and make for an extremely competitive January.”

Rising rates are the main driver for homebuyers in Houston right now, according to local Redfin real estate agent Faith Floyd.

“Buyers are worried mortgage rates will go up and they’ll no longer be able to afford a home,” Floyd said. “They also feel a sense of urgency because they don’t want to have to compete with spring and summer buyers and end up overpaying five months down the road.”

The potential for higher mortgage rates is motivating sellers to act quickly as well, according to Seattle Redfin agent Shoshana Godwin.

“Sellers want to get their homes on the market ASAP,” Godwin said. “They’re concerned that if rates rise too much, it could impact their chances of getting good offers since buyers may be worried about overall costs increasing.”

This first interactive mortgage rates chart shows how much you could afford to spend on a home at different mortgage interest rates, with each line representing a different fixed monthly payment. You can view or download a static version of this chart here.

This second interactive mortgage rates chart shows how much your total monthly payment would be at different mortgage interest rates, with each line representing a different fixed home price.

United States

United States Canada

Canada