- Sellers are offering to cover the cost of repairs, mortgage-rate buydowns and closing costs as rising interest rates dampen homebuyer demand.

- Pandemic boomtowns and pricey coastal markets, including Phoenix and Seattle, have seen the biggest increases in concessions.

- A record 13% of home sales include a price cut and a final sale price below the list price in addition to a concession.

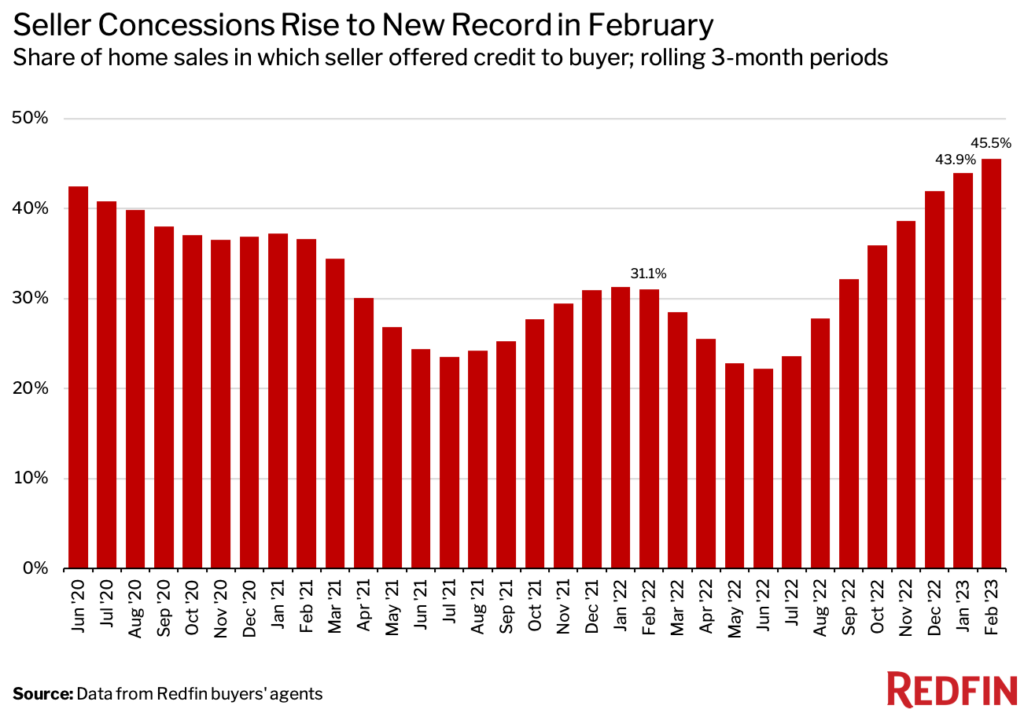

Home sellers gave concessions to buyers in 45.5% of home sales recorded by Redfin agents during the three months ending February 28, up from 31.1% one year earlier. That’s the highest share of any three-month period in Redfin’s records, which date back to June 2020.

This is according to data submitted by Redfin buyers’ agents across the U.S. A concession is recorded when an agent reports a seller provided something that helped reduce the buyers’ total cost of purchasing the home. For the purposes of this report, a seller lowering the list price of their home does not count as a concession.

Concessions have become increasingly common because rising mortgage rates and stubbornly high home prices have caused many buyers to put their plans on hold, which has motivated sellers to throw in freebies to attract the buyers who remain. Redfin agents report that sellers are offering to fund repairs, cover closing costs and pay for bidders to buy down their mortgage rates.

The housing market has done a 180 since 2021, when a surge in homebuyer competition fueled by rock-bottom mortgage rates forced buyers to offer everything but the kitchen sink to win. The average 30-year-fixed mortgage rate is now 6.73%, up from 3.85% a year ago, which has increased the typical homebuyer’s monthly mortgage payment by nearly $600.

“Buyers today are way more demanding and selective. They’re willing to wait to find the perfect house, which wasn’t the case during the pandemic homebuying boom,” said Elena Fleck, a Redfin real estate agent in Palm Beach, FL. “During the peak of Covid, it took two to three days to sell anything regardless of the condition, location, or square footage. Now, a home that’s not perfect may stay on the market for three to four months if the seller doesn’t throw in something to sweeten the deal.”

Fleck continued: “Any home with a roof that’s over eight years old is just sitting— buyers don’t want to put any additional funds into repairs. I had a few sellers offer credits for new roofs to close the deal. We’re also seeing more buyers ask for credits toward their closing costs.”

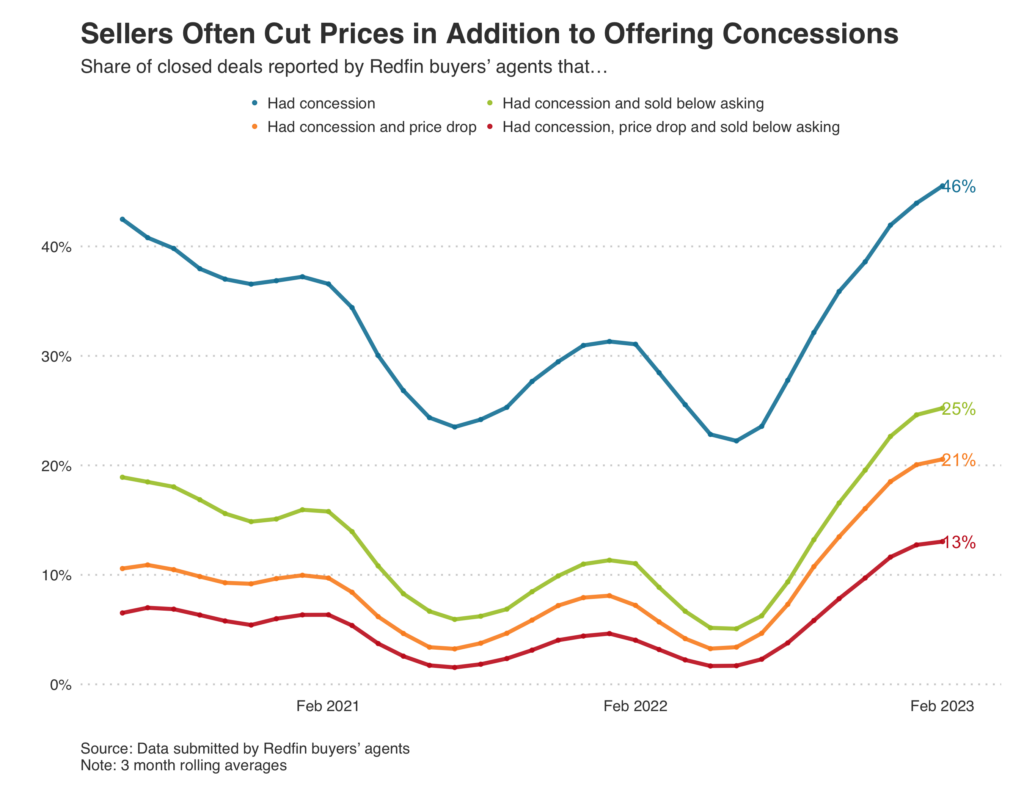

Home Sellers Are Also Slashing Their Prices to Lure Buyers

In addition to offering more concessions, sellers have become increasingly likely to sell their home for less money than they originally hoped for. That can happen when a seller cuts their asking price, accepts an offer below the asking price or both.

A record 25.2% of home sales recorded by Redfin buyers’ agents included both a concession and a final sale price below the list price during the three months ending February 28. A record 20.6% included both a concession and a listing-price cut that occurred while the home was on the market. A record 13% included all three.

Seattle Sees the Biggest Increase in Seller Concessions

In Seattle, sellers gave concessions to buyers in 51.6% of home sales during the three months ending February 28, up from 20.1% a year earlier. That’s the largest percentage-point increase among the 22 U.S. metropolitan areas for which there was sufficient data. Next came Las Vegas (30.6 ppts), Denver (26.2 ppts), San Diego (23.3 ppts) and Phoenix (22.4 ppts).

Pandemic boomtowns and expensive coastal markets have seen homebuyer demand cool relatively quickly because rising interest rates have added fuel to the fire of high home prices. Remote work allowed scores of homebuyers to relocate to warm, relatively affordable locales in recent years, causing prices to surge in Sun Belt markets including Las Vegas and Phoenix. But now, dwindling demand in these areas has left sellers scrambling to find buyers.

There were only two metros in which concessions were less common than they were a year earlier: Austin, TX (-3 ppts) and Chicago (-2.1 ppts).

Concessions Are Most Common in Las Vegas

In Las Vegas, sellers gave concessions to buyers in 77.4% of home sales during the three months ending February 28—the highest share among the metros Redfin analyzed. Next came San Diego (74.8%), Sacramento, CA (70.9%), Phoenix (63.7%) and Denver (60.9%).

In New York, sellers gave concessions to buyers in 16.7% of home sales—the lowest share among the metros Redfin analyzed. It was followed by San Jose, CA (21%), Boston (23.1%), Philadelphia (30%) and Austin (33.9%).

Metro-Level Summary: Three Months Ending Feb. 28

The table below includes 22 metros for which Redfin buyers’ agents recorded at least 50 closed deals during the three months ending Feb. 28 in both 2023 and 2022. The national statistics in the first section of the report are representative of the entire country.

| U.S. metro area | 2023: Share of home sales with concession | 2022: Share of home sales with concession | Year-over-year change (percentage points) |

| Atlanta, GA | 55.4% | 41.7% | 13.6 ppts |

| Austin, TX | 33.9% | 37.0% | -3.0 ppts |

| Boston, MA | 23.1% | 15.3% | 7.8 ppts |

| Charlotte, NC | 52.0% | 32.0% | 20.0 ppts |

| Chicago, IL | 43.6% | 45.7% | -2.1 ppts |

| Dallas, TX | 54.5% | 32.6% | 21.9 ppts |

| Denver, CO | 60.9% | 34.7% | 26.2 ppts |

| Houston, TX | 50.0% | 34.3% | 15.7 ppts |

| Las Vegas, NV | 77.4% | 46.8% | 30.6 ppts |

| Los Angeles, CA | 55.3% | 42.3% | 13.0 ppts |

| Miami, FL | 41.7% | 31.8% | 9.9 ppts |

| New York, NY | 16.7% | 15.6% | 1.1 ppts |

| Orlando, FL | 41.3% | 33.3% | 8.0 ppts |

| Philadelphia, PA | 30.0% | 30.5% | -0.5 ppts |

| Phoenix, AZ | 63.7% | 41.3% | 22.4 ppts |

| Portland, OR | 60.0% | 38.8% | 21.2 ppts |

| Raleigh, NC | 55.7% | 43.3% | 12.4 ppts |

| Sacramento, CA | 70.9% | 49.0% | 21.9 ppts |

| San Diego, CA | 74.8% | 51.4% | 23.3 ppts |

| San Jose, CA | 21.0% | 8.9% | 12.0 ppts |

| Seattle, WA | 51.6% | 20.1% | 31.6 ppts |

| Washington, D.C. | 45.8% | 29.2% | 16.7 ppts |

United States

United States Canada

Canada