-

One-third of homeowners have spent $5,000 or more to make their homes more resilient to climate risk.

-

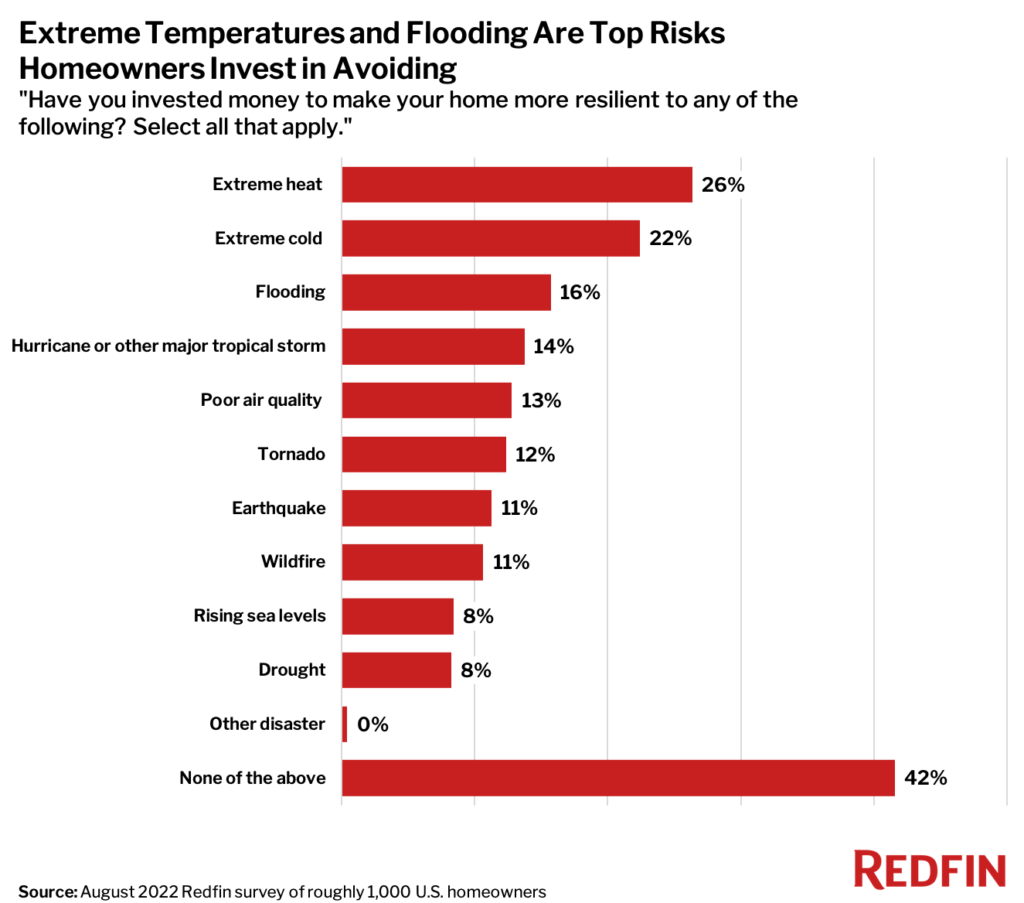

Overall, extreme temperatures are the most common climate risk homeowners invest to protect against, followed by flooding and hurricanes/other major tropical storms.

-

36% of homeowners say they have an insurance policy covering flooding—a higher share than other climate risks.

More than half (58%) of U.S. homeowners have invested in making their homes more resilient to climate threats, according to a survey of roughly 1,000 homeowners commissioned by Redfin in August 2022.

The share was higher among Florida homeowners, nearly three-quarters (71%) of whom have spent money to protect their homes from climate risk. While Floridians are more likely than the country as a whole to invest in climate resilience, many are still vulnerable to flooding and storms. Hurricane Ian, which tore across Florida last month, may turn out to be the costliest storm in state history.

Homeowners nationwide are most likely to invest in combating extreme heat, with roughly one-quarter (26%) saying they’ve spent money to make their home more resilient to this risk. Next comes extreme cold (22%), flooding (16%), hurricane/other major tropical storms (14%), poor air quality (13%) and tornadoes (12%). Earthquakes and wildfires both came in at 11%.

In Florida, 40% of homeowners have invested in making their homes more resilient to hurricanes or other major tropical storms—nearly triple the national share.

“Americans are shelling out cash to fortify their homes against natural disasters as they increasingly move to at-risk areas despite intensifying climate change. Unfortunately, their investments aren’t always enough—a reality that came into focus when Hurricane Ian destroyed scores of homes, many of which lacked flood insurance,” said Redfin Chief Economist Daryl Fairweather. “Homeowners should be aware that their property value could drop over time if their area becomes uninsurable and/or uninhabitable due to climate change.”

Fairweather continued: “The increasing cost of adapting to climate change is amplifying housing affordability challenges. Take coastal Florida, where homes have become significantly more expensive during the pandemic. Many people will spend hundreds of thousands of dollars rebuilding their homes after Hurricane Ian, and they’ll have to decide whether to invest in costly improvements to make their properties more resilient. Those who decide to sell instead of rebuild will likely make less money than they would have earlier this year due to the housing-market slowdown and any damages to their home, and will also have to pay to move.”

A 2021 Redfin analysis found that more people have been moving into than out of the U.S. counties with the largest share of homes at high risk of natural disasters. Many of these areas are attracting homebuyers because they’re relatively affordable, have lower property taxes and access to nature and sunshine. Cape Coral, North Port and Tampa—three Florida metros hit hard by Hurricane Ian—consistently rank on Redfin’s list of top migration destinations, which is based on how many more Redfin.com users are looking to move in than leave.

Redfin.com publishes climate-risk data for nearly every U.S. home, with the exception of rentals, to help house hunters make more informed decisions. A recent Redfin experiment found that house hunters with access to flood-risk data bid on lower-risk homes than those without access.

One-Third of Homeowners Have Spent $5,000 or More to Protect Against Climate Risk

One-third (33%) of homeowners have spent $5,000 or more to fortify their homes against climate risk, while roughly one-quarter have spent up to $4,999 and 42% have invested nothing.

“Many of the newer homes are still standing after Hurricane Ian, but even those have damage after getting inundated with nine feet or more of water. But a lot of the old houses are gone,” said Isabel Arias-Squires, a Redfin real estate agent in Cape Coral, which was hit hard by Hurricane Ian. “In the past, storms have destroyed fences and roofs in Cape Coral. This time, people lost their entire home.”

Arias-Squires continued: “A lot of homeowners may just end up walking away because the cost of rebuilding is too high. Let’s say you need a new $20,000 roof and insurance only covers $15,000. You might not have the additional $5,000 out of pocket, and by the time the roofers show up in six months, the total cost of the new roof might have increased to $30,000.”

Flooding Is Most Common Climate Risk Homeowners Are Insured Against

More than one-third (36%) of homeowners have an insurance policy covering flooding, making it the most common climate risk homeowners have coverage for. Next came tornadoes (33%), hurricanes/other major tropical storms (29%), wildfires (24%) and earthquakes (18%).

The share of homeowners with coverage has increased over the last year and a half for most risks. We posed the same question in a February 2021 survey. Hurricanes/other major tropical storms saw the biggest jump; the share of homeowners with coverage rose from 19% to 29%. Wildfires came next, with the share climbing from 15% to 24%.

It’s worth noting that hurricanes and wildfires may have been top of mind for many homebuyers in August 2022, which coincided with fire and hurricane season, while they may not have been in February 2021.

While flooding is the top risk homeowners said they had coverage for, much of flood-prone America remains underinsured. Just 18.5% of homes in the Florida counties whose residents were told to evacuate due to Hurricane Ian have coverage through FEMA’s National Flood Insurance Program, which recently increased prices for many Americans. Even with coverage, homeowners often aren’t able to rebuild due to insufficient payouts.

“I always recommend my buyers purchase flood insurance, but I have many clients who still choose not to. I know someone who bought a $3.5 million home and didn’t purchase coverage,” Arias-Squires said. “The biggest question is which insurance companies will remain. In the last year, a number of insurers sent letters to customers saying they were dropping coverage because their roofs were too old or the companies were leaving the state altogether. As it is, very few insurers will cover Florida homes that are at sea level.”

United States

United States Canada

Canada