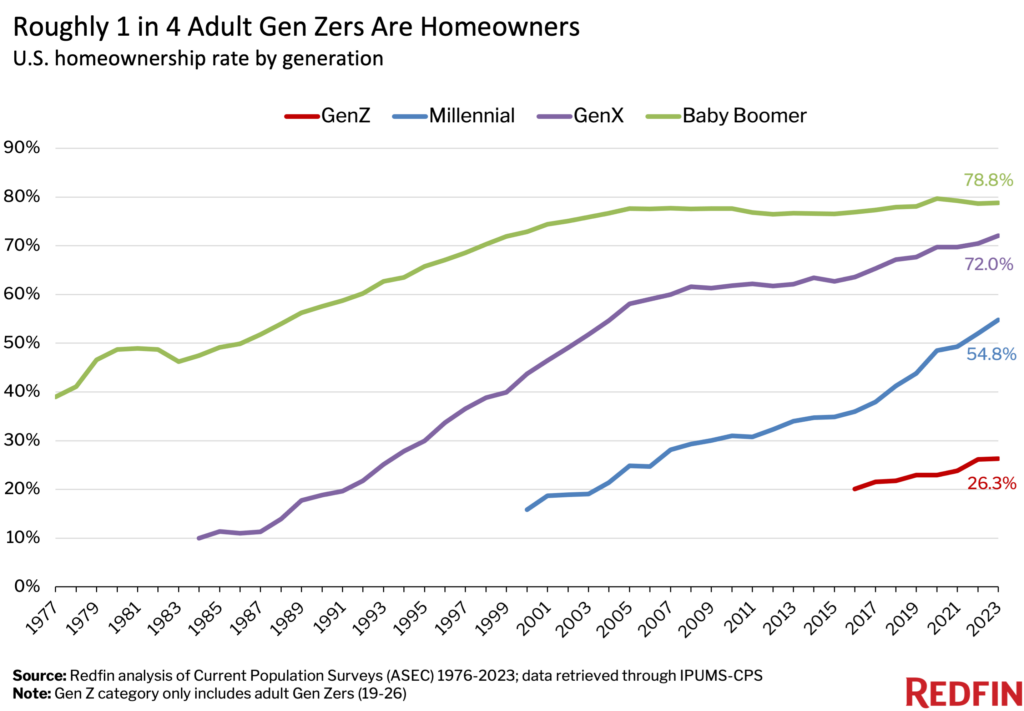

- 26% of adult Gen Zers owned a home in 2023, little changed from 2022. Meanwhile, the homeownership rate for millennials rose to 55% from 52%, and the rate for Gen X climbed to 72% from 70%.

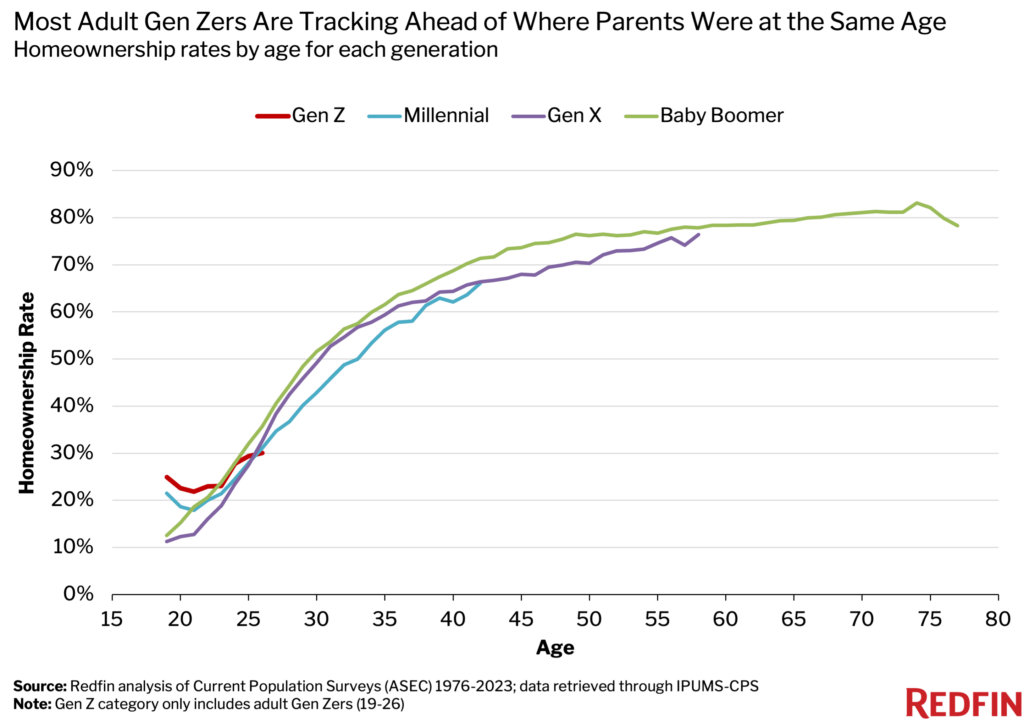

- Still, most adult Gen Zers are tracking ahead of where their parents were at the same age. That’s likely because many Gen Z homeowners were able to buy when rates were near record lows.

Just over one-quarter (26.3%) of adult Gen Zers owned a home in 2023, little changed from 26.2% in 2022. Meanwhile, the homeownership rate for millennials rose to 54.8% from 52%, and the homeownership rate for Gen X rose to 72% from 70.5%. The rate for baby boomers was little changed (78.8% vs 78.7% in 2022), down from a record 79.7% in 2020, as some boomers have passed away or moved into retirement homes.

Gen Zers were 11-26 years old in 2023 (born 1997-2012); only adult Gen Zers (19-26 years old) were included in this analysis. Millennials were 27-42 (born 1981-1996) in 2023, Gen Xers (born 1965-1980) were 43-58 and baby boomers were 59-77 (born 1946-1964). Scroll down for a more detailed methodology.

The homeownership rate for adult Gen Zers likely moved sideways in 2023 because it was an especially hard year to buy a home; mortgage rates surpassed 8% for the first time since 2000 and housing prices remained stubbornly high, causing homebuyer mortgage payments to soar. While that posed challenges for house hunters across generations, it was particularly difficult for America’s youngest homebuyers, many of whom are just starting their careers and don’t have significant savings or wealth from the sale of a previous home.

The good news is that 2024 is shaping up to be a more affordable year for homebuying than 2023. Mortgage rates have dropped from over 8% in October to 6.8% as of mid January, pushing homebuyers’ monthly payments down more than $300 from their 2022 record high. The drop in rates is bringing both buyers and sellers off the sidelines. And an increase in sellers has fueled a jump in new listings, which is giving buyers more options to choose from and could ultimately put downward pressure on prices.

“Housing affordability remains strained, but things are looking up for Gen Z,” said Redfin Chief Economist Daryl Fairweather. “The recent decline in rents means Gen Zers can put more money toward saving for a down payment. Plus, the job market is strong, and career opportunities have become less concentrated in expensive cities during the remote work era, meaning many Gen Zers can choose to live somewhere more affordable.”

Most Adult Gen Zers Are Tracking Ahead of Where Their Parents Were at the Same Age

While the homeownership rate for adult Gen Zers has stagnated, a majority of them are still outpacing young people of the past.

The homeownership rates for 19-to-25-year-old Gen Zers are higher than the homeownership rates were for millennials and Gen Xers when they were the same age. For example, the rate for 24-year-old Gen Zers is 27.8%, compared with 24.5% for millennials when they were 24 and 23.5% of Gen Xers when they were 24.

This is likely because many Gen Z homeowners bought during the pandemic, when mortgage rates hit a record low. When many millennials were in their early twenties, many were struggling to find work due to the Great Recession, which made it harder to afford a home. And when Gen Xers were in their early twenties, they were grappling with some of the highest mortgage rates in history; for example, rates were around 11% in 1989, when the oldest Gen Xers were 24.

America’s youngest homebuyers are also financially savvy, which makes the process easier, said Jon Byram, a Redfin Premier real estate agent in Northern Virginia.

“Gen Zers have done their research. They know all of the real estate jargon and are entering the housing market more educated than prior generations,” he said. “Some young first-time buyers are also coming in with financial help from family, or co-buying with family members, which boosts their buying power. And some have savings because they’ve been living with their family rent free.”

Byram continued: “My youngest buyers handled the pandemic homebuying frenzy the best. Some older buyers had trouble grappling with the significant changes that had occurred in the market since the last time they purchased a house.”

The only Gen Zers who are tracking behind prior generations are 26-year-olds, who were the oldest Gen Zers as of 2023. The homeownership rate for 26-year-old Gen Zers is 30%, below 31% for millennials at 26, 32.5% of Gen Xers at 26, and 35.6% of boomers at 26.

It’s possible that younger Gen Zers are more likely to track ahead of older generations because many of them are receiving financial help from family members, while many older Gen Zers are being weaned off of their parents’ wallets.

Methodology

Data on generational homeownership rates was calculated from the Current Population Survey’s Annual Social and Economic Supplement (March Supplement), from 1976 to 2023. Homeownership rates are calculated for ages 19 and above. The data was accessed using IPUMS-CPS*.

The homeownership rate is the percentage of occupied homes that are owned rather than rented.

*Sarah Flood, Miriam King, Renae Rodgers, Steven Ruggles, J. Robert Warren, Daniel Backman, Annie Chen, Grace Cooper, Stephanie Richards, Megan Schouweiler, and Michael Westberry. IPUMS CPS: Version 11.0 [dataset]. Minneapolis, MN: IPUMS, 2023. https://doi.org/10.18128/D030.V11.0

United States

United States Canada

Canada