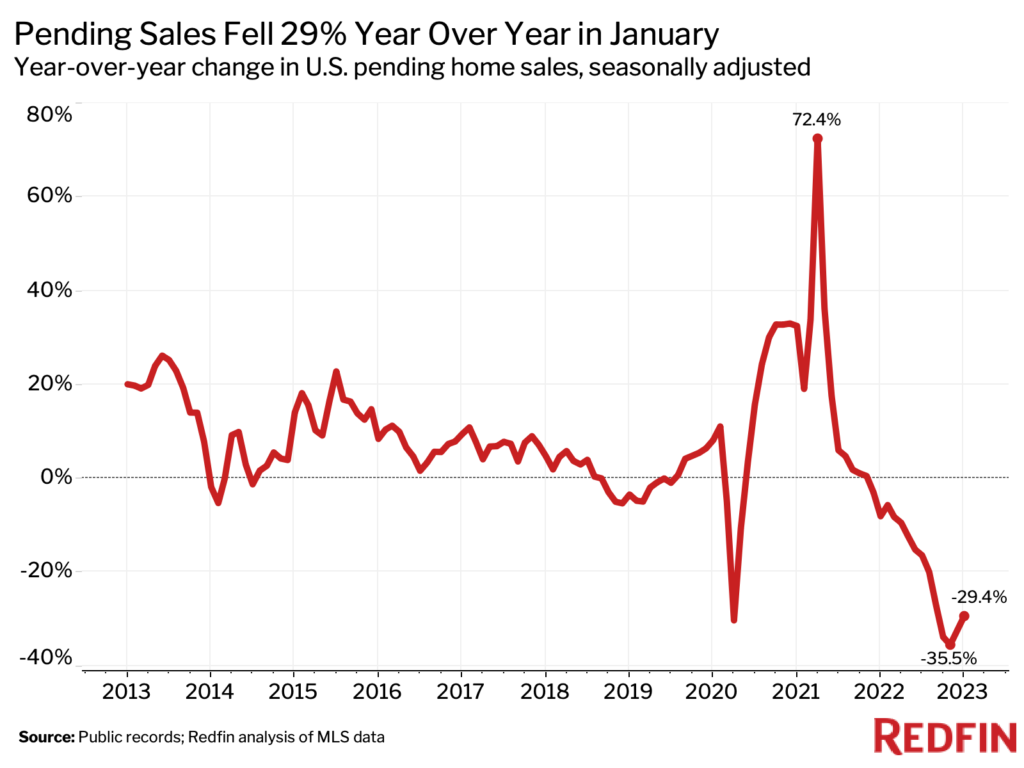

Pending home sales improved slightly, but an ongoing affordability crisis and lack of homes for sale kept many house hunters on the sidelines.

Pending home sales rose 0.5% from a month earlier in January on a seasonally-adjusted basis. That compares with December’s revised month-over-month increase of 1.4%, which was the first gain in 14 months.

Pending sales fell from a year earlier, but the decline eased for the second month in a row—to 29.4% in January from 32.5% in December and a record 35.5% drop in November. Redfin’s records date back to 2012.

“A dip in mortgage rates brought some buyers off the bench in January, but the housing-market recovery was tempered by still-high housing costs and a limited number of homes being listed for sale,” said Redfin Deputy Chief Economist Taylor Marr. “There were fewer new listings in January than at any point on record, with the exception of the start of the pandemic. That hampered demand because it meant that many of the buyers who were still in the market had a tough time finding a home that met their needs. The shortage of homes for sale also buoyed home prices.”

Marr continued: “The housing market took two steps forward in December and January, but has taken one step back in February. Mortgage rates crept back up this month, which is prompting more buyers and sellers to back off.”

Home-purchase applications dropped to the lowest level since 1995 last week as mortgage rates jumped on expectations that the Federal Reserve will need to raise interest rates again to combat inflation. The average 30-year-fixed mortgage rate is now 6.5%, up from an average of 6.27% in January and 3.89% a year ago. That has caused the typical homebuyer’s monthly payment to rise more than $500 year over year.

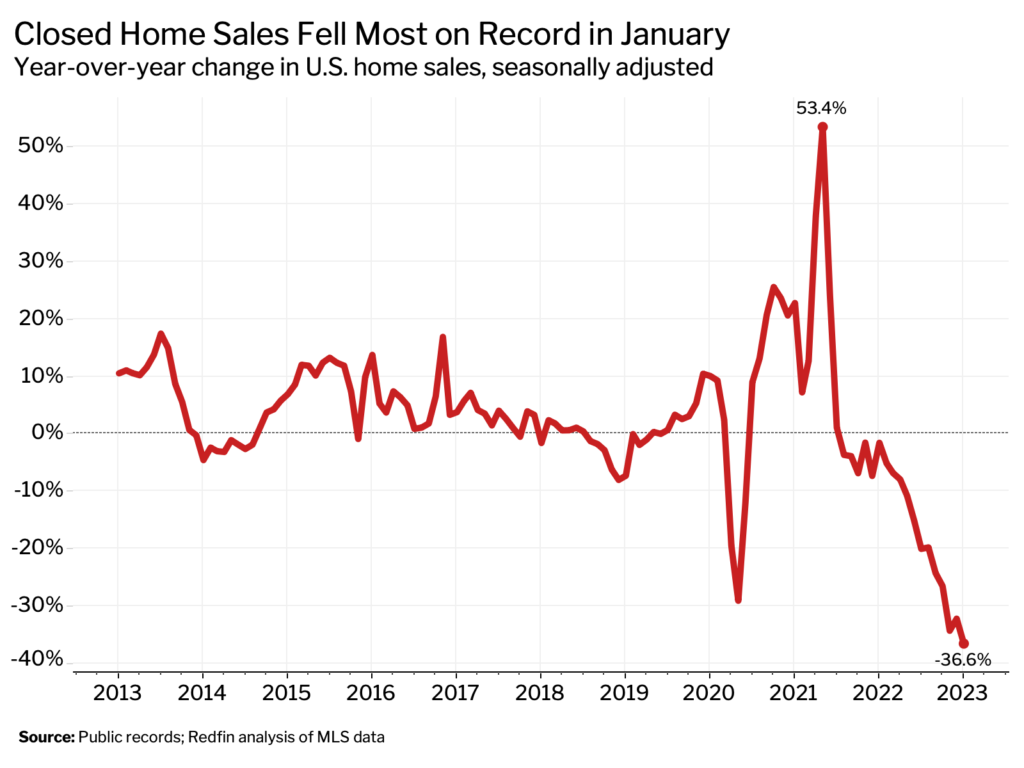

Closed home sales fell 1.4% from a month earlier in January and slumped a record 36.6% from a year earlier. In our December market report, we noted that the year-over-year decline in closed sales had eased slightly, but that didn’t continue into the new year. The large drop in closed sales is partly due to the fact that many of the home purchases that closed in January went under contract in the fall, when mortgage rates hit a 20-year high.

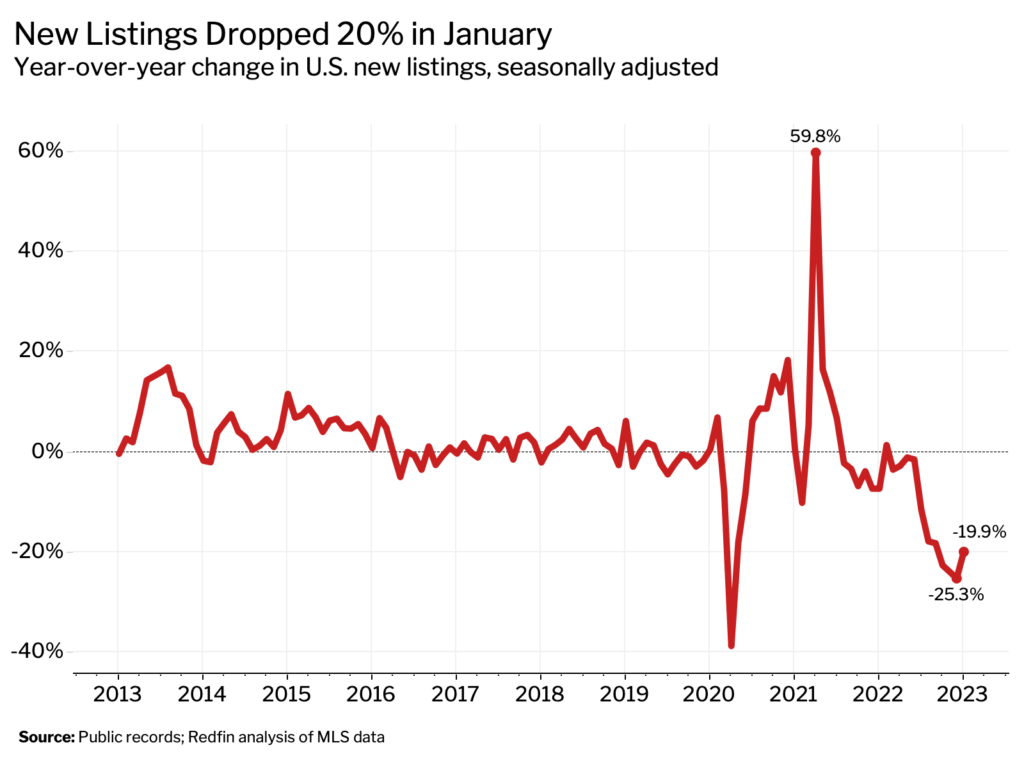

New Listings Hit Second-Lowest Level on Record as Sellers Held on to Low Rates

New listings fell 1.6% from a month earlier in January and dropped 19.9% from a year earlier. While that’s an improvement from the 25.3% year-over-year decline in December—the largest drop on record aside from the pandemic start—listings remained scarce. There were fewer new listings in January than any other month on record aside from April 2020, when the onset of the pandemic brought the housing market to a halt.

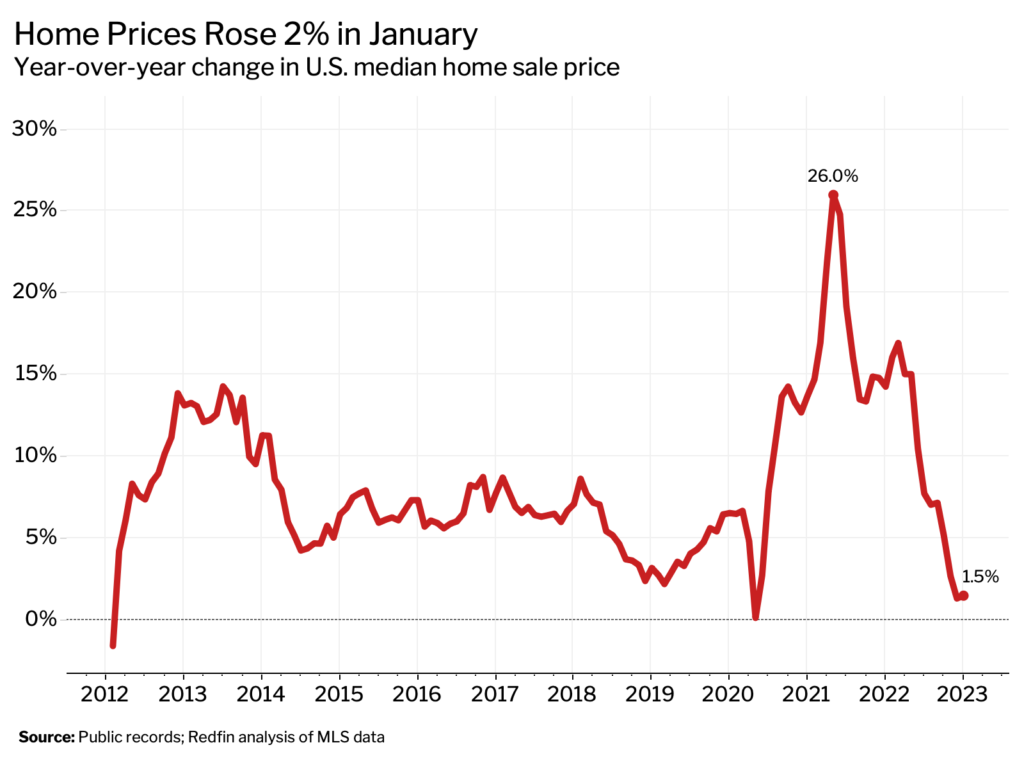

Many homeowners are reluctant to sell because they don’t want to give up their relatively low mortgage rates. About 85% of mortgage holders have a rate far below today’s level of roughly 6%. Homeowners are also hesitant to put their homes on the market due to soft homebuyer demand that’s forcing sellers to cut prices. The median sale price of U.S. homes was $383,249 in January, down 1.4% from December and 11.5% below the May all-time high. Still, prices were up 1.5% from a year earlier, in part because low supply kept prices afloat.

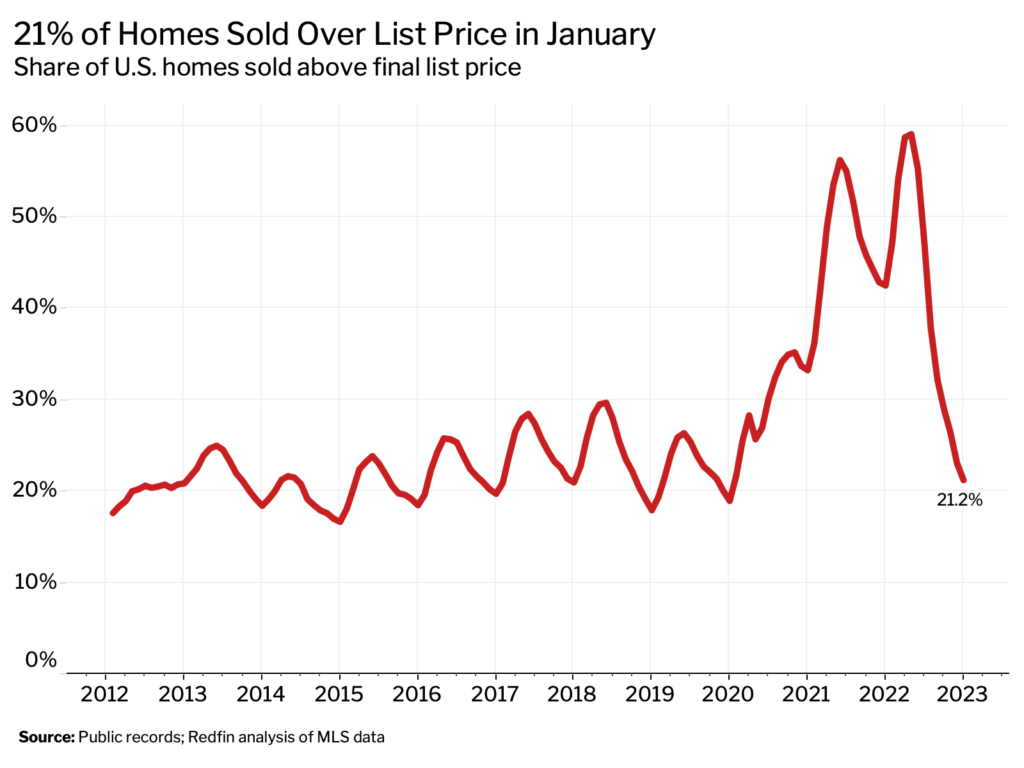

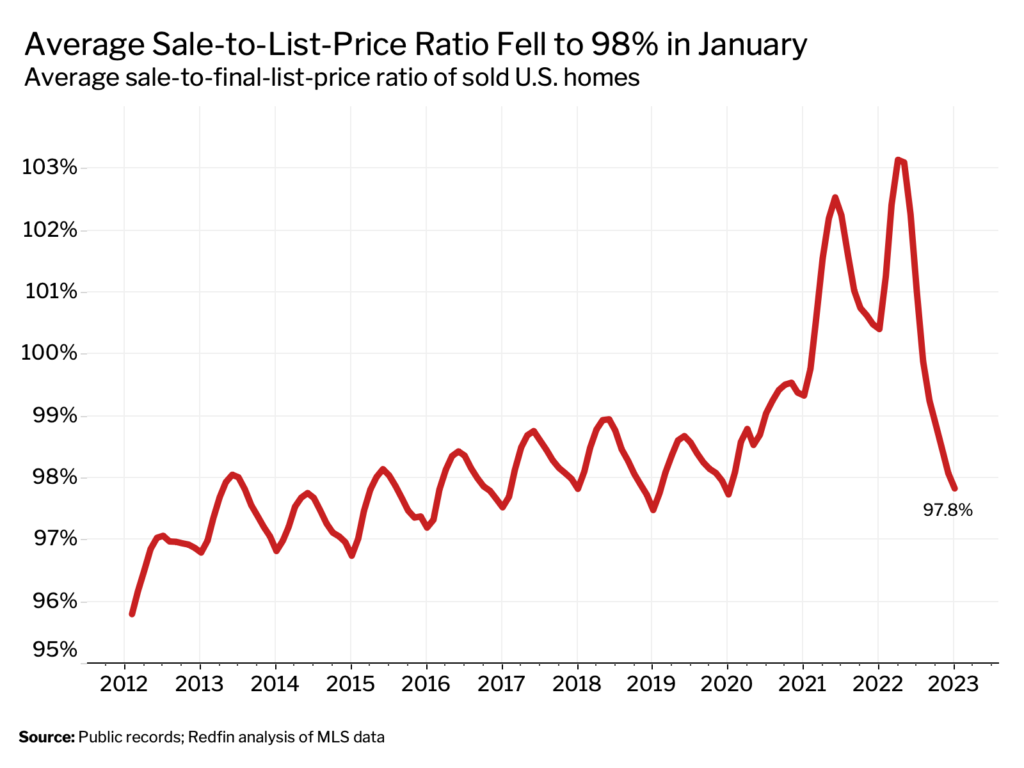

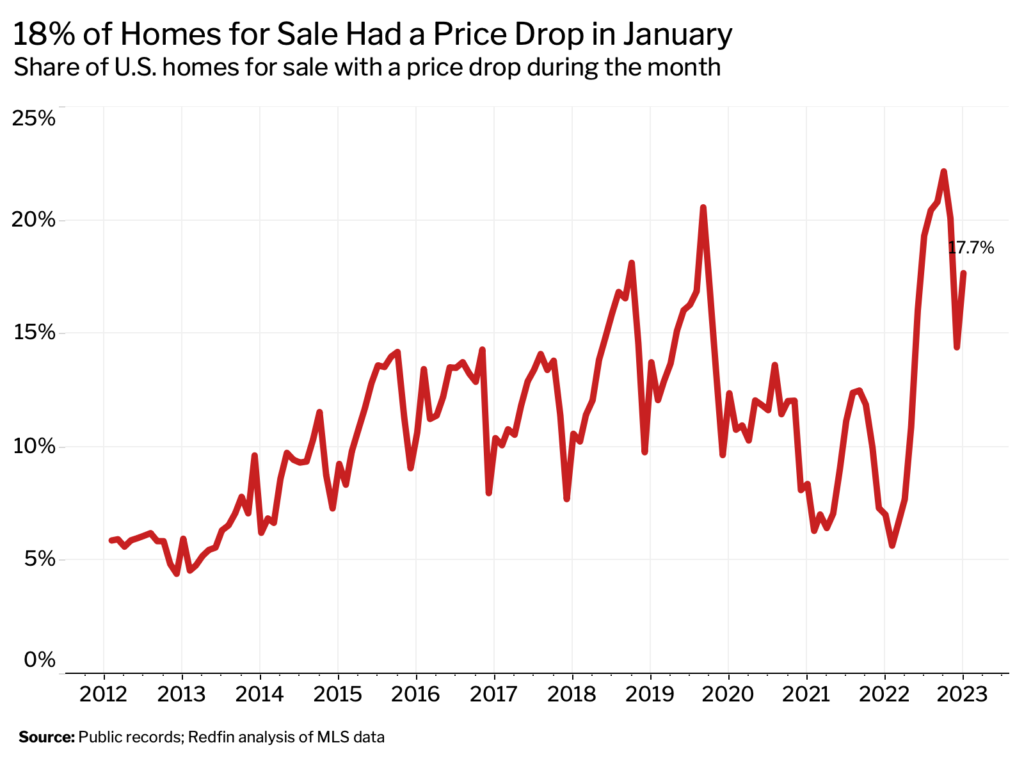

Almost one in every five home listings (17.7%) had a price drop last month. While that’s down from the record high of 22.2% in October, it’s up from 7% in January 2022—the largest year-over-year increase on record. Just 21.2% of homes sold above their final list price, the lowest level in two years.

“Nice homes that are priced fairly are selling, but homes that are overpriced or poorly maintained are lingering on the market,” said Shay Stein, a Redfin real estate agent in the Las Vegas area. “A lot of sellers who don’t get the price they had hoped for are taking their homes off the market. Many of them have a rock-bottom mortgage rate and figure they can wait to sell.”

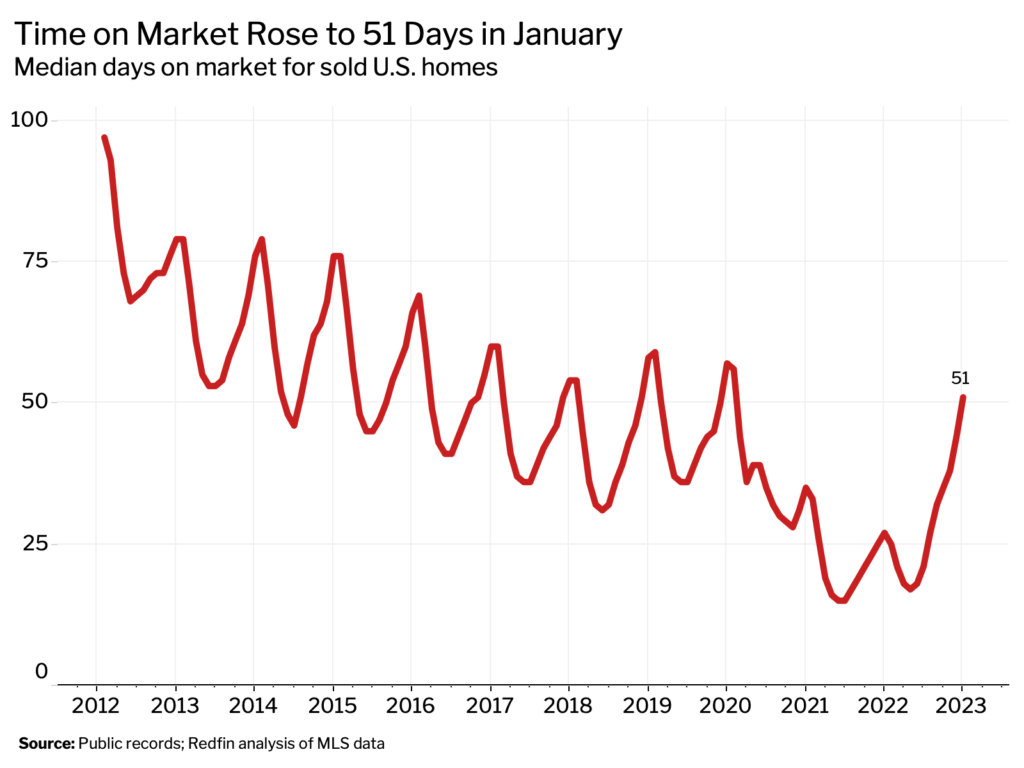

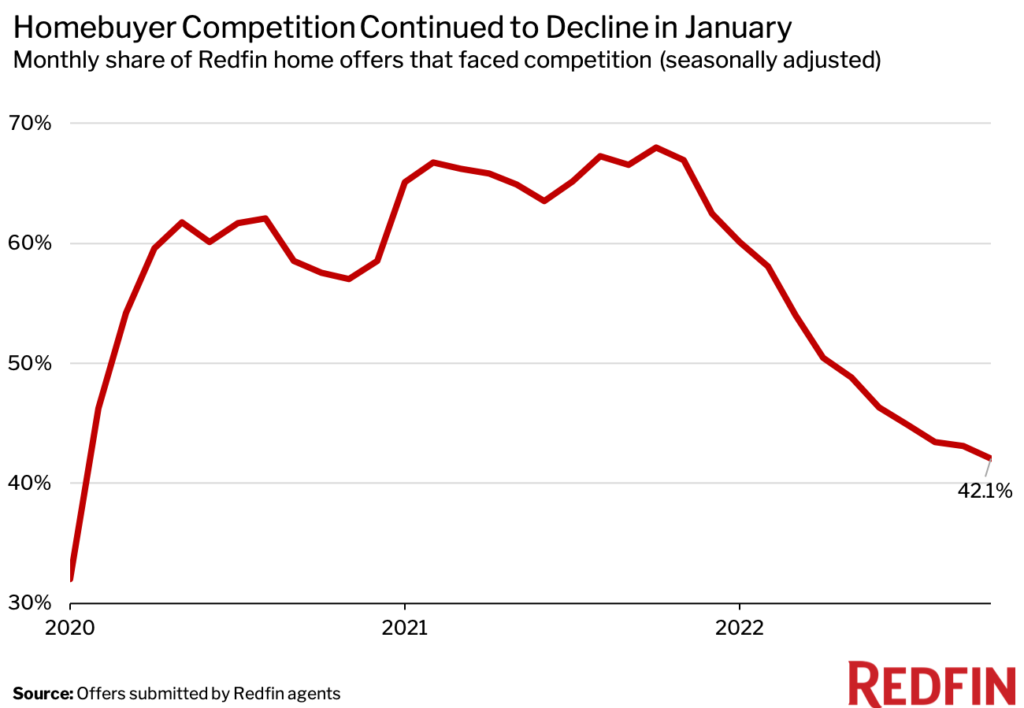

The typical home that sold was on the market for 51 days—the highest level since February 2020. That’s up from 27 days in January 2022. Homes are taking longer to sell in part because homebuyer competition has dwindled. Roughly two of every five home offers (42.1%) written by Redfin agents faced a bidding war in January, the lowest level since April 2020. That’s down from 43.1% a month earlier and 68% a year earlier. Pandemic boomtowns including Austin and Tampa saw among the largest declines in competition, as many homebuyers have been priced out.

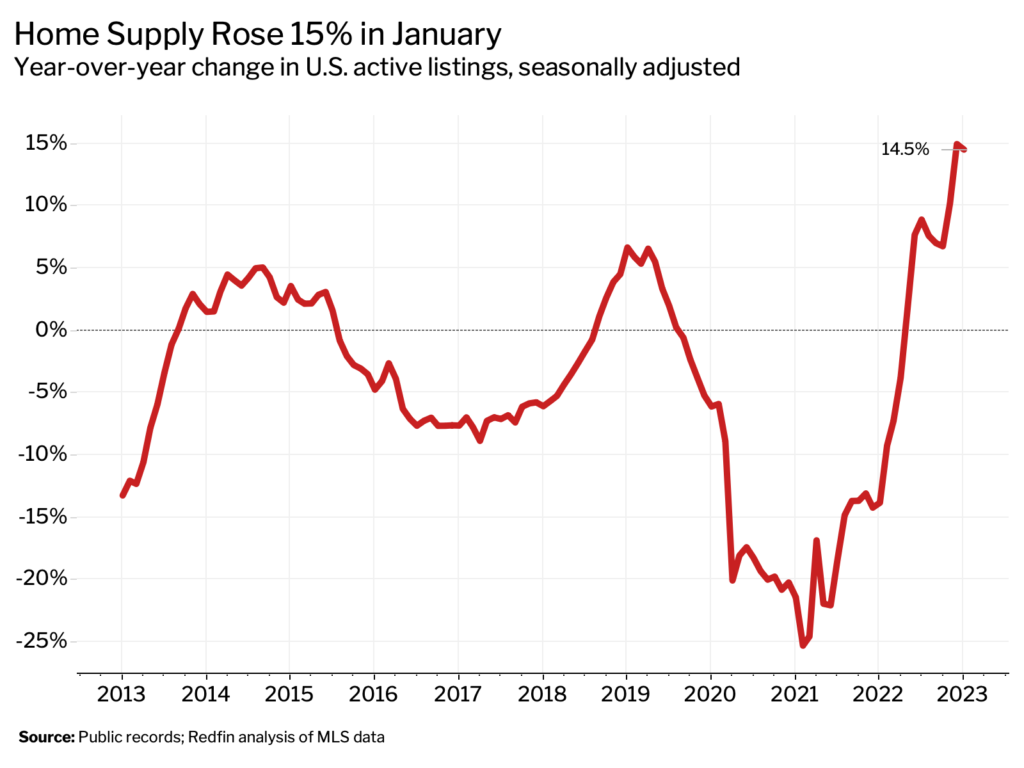

With many homes now lingering on the market, overall housing supply has ticked up. While active listings fell 1.2% from a month earlier in January, they were up 14.5% from a year earlier—just shy of the 15% record year-over-year gain in December. Active listings hit a record low in January 2022, which is one reason the year-over-year increase is so dramatic.

January Highlights

| January 2023 | Month-Over-Month Change | Year-Over-Year Change | |

| Median sale price | $383,249 | -1.4% | 1.5% |

| Pending home sales, seasonally adjusted | 397,838 | 0.5% | -29.4% |

| Homes sold, seasonally adjusted | 405,602 | -1.4% | -36.6% |

| New listings, seasonally adjusted | 475,381 | -1.6% | -19.9% |

| All homes for sale, seasonally adjusted | 1,606,974 | -1.2% | 14.5% |

| Months of supply | 3.2 | 0.7 | 1.7 |

| Median days on market | 51 | 7 | 24 |

| Share of for-sale homes with a price drop | 17.7% | 3.3 ppts | 10.7 ppts |

| Share of homes sold above final list price | 21.2% | -1.9 ppts | -21.3 ppts |

| Average sale-to-final-list-price ratio | 97.8% | -0.2 ppts | -2.6 ppts |

| Share of home offers written by Redfin agents that faced competition, seasonally adjusted | 42.1% | -1 ppt | -25.9 ppts |

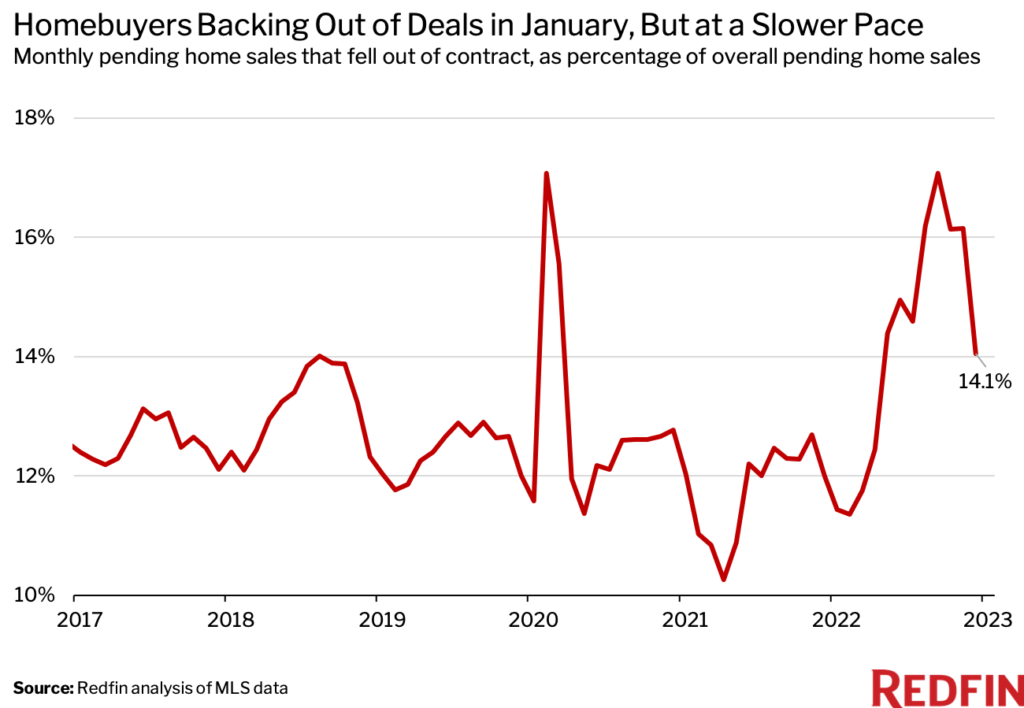

| Pending sales that fell out of contract, as % of overall pending sales | 14.1% | -2.1 ppts | 2 ppts |

| Average 30-year fixed mortgage rate | 6.27% | -0.09 ppts | 2.8 ppts |

Note: Data is subject to revision

Metro-Level Highlights: January 2023

Data in the bullets below came from a list of the 90 U.S. metro areas with populations of at least 750,000, unless otherwise noted. We have excluded Boise, ID and San Antonio, TX while we investigate a potential data issue. To find the full metro-level and national datasets, head to the monthly section of the Redfin Data Center. Refer to our metrics definition page for explanations of metrics used in this report. Metro-level data is not seasonally adjusted.

- Pending sales: In Baton Rouge, LA, pending sales fell 62.4% year over year, more than any other metro Redfin analyzed. It was followed by Honolulu (-60%), New Orleans (-54.7%), Las Vegas (-52.6%) and Phoenix (-48.8%). Pending sales rose in just five metros: Cincinnati (29.7%), Lake County, IL (19.7%), Chicago (10.1%), Detroit (4.7%) and Rochester, NY (3.6%).

- Prices: Median sale prices fell from a year earlier in 29 metros, led by San Francisco (-9.4%). Next came Honolulu (-8%), Detroit (-8%), Oakland, CA (-7.8%) and Fresno, CA (-6.7%). The biggest increases were Indianapolis (13.1%), West Palm Beach, FL (13.1%), Greensboro, NC (12.5%), Dayton, OH (11.1%) and Allentown, PA (10.7%).

- Listings: New listings fell the most from a year earlier in Greensboro (-43.6%), Allentown (-42.5%), Sacramento, CA (-40.6%), San Diego (-38.7%) and San Jose, CA (-38.4%). They rose in six metros: North Port, FL (12.5%), McAllen, TX (8.3%), Nashville, TN (5.4%), West Palm Beach (1.4%), Austin, TX (1.1%) and Dallas (0.8%).

- Supply: Active listings rose the most from a year earlier in North Port (95.5%), Austin (75.6%), Nashville (73.5%), Fort Worth, TX (64.5%) and Dallas (64.4%). They fell the most in Greensboro (-28.8%), Milwaukee (-25.6%), Allentown (-24%), Hartford, CT (-21.9%) and Bridgeport, CT (-18.7%).

- Competition: In Austin, 28.7% of home offers written by Redfin agents faced competition, down 47.7 ppts from a year earlier—the largest decline among the 33 metros Redfin analyzed. Other pandemic boomtowns rounded out the top five: Raleigh, NC (-47.3 ppts), Tampa, FL (-46.2 ppts), Honolulu (-42 ppts) and Colorado Springs, CO (-41.4%). Competition fell the least in Worcester, MA (-5 ppts), Providence, RI (-6 ppts), New York (-9.3 ppts), Boston (-10.7 ppts) and Washington, D.C. (-12.5 ppts).

Scroll down for market-by-market breakdowns on competition and home-purchase cancellations, which aren’t in the Data Center.

Competition

Data below came from a list of 33 metros that had a monthly average of at least 50 offers submitted by Redfin agents from March 2021 to March 2022. An offer is considered part of a bidding war if a Redfin agent reported that it received at least one competing bid.

| Metro Area | Jan. 2023: Share of Redfin Offers That Faced Competition | Dec. 2022: Share of Redfin Offers That Faced Competition | Jan. 2022: Share of Redfin Offers That Faced Competition |

| Atlanta, GA | 40.0% | 42.3% | 63.0% |

| Austin, TX | 28.7% | 13.9% | 76.5% |

| Baltimore, MD | 55.5% | 53.1% | 75.1% |

| Boston, MA | 62.6% | 51.6% | 73.3% |

| Charlotte, NC | 34.9% | 50.0% | 70.8% |

| Chicago, IL | 45.0% | 43.1% | 61.5% |

| Colorado Springs, CO | 30.4% | 35.7% | 71.8% |

| Dallas, TX | 39.0% | 25.8% | 79.6% |

| Denver, CO | 42.4% | 35.1% | 74.6% |

| Detroit, MI | 36.8% | 50.0% | 70.6% |

| Honolulu,HI | 21.4% | 38.5% | 63.5% |

| Houston, TX | 30.5% | 31.6% | 56.0% |

| Las Vegas, NV | 17.4% | 25.0% | 58.7% |

| Los Angeles, CA | 47.3% | 48.9% | 75.7% |

| Miami, FL | 41.8% | 29.0% | 67.4% |

| Minneapolis, MN | 55.6% | 57.9% | 68.8% |

| Nashville, TN | 29.0% | 22.7% | 56.6% |

| New York, NY | 50.2% | 48.5% | 59.5% |

| Orlando, FL | 43.2% | 22.5% | 71.1% |

| Philadelphia, PA | 51.7% | 41.7% | 74.6% |

| Phoenix, AZ | 24.9% | 20.9% | 57.8% |

| Portland, OR | 40.1% | 28.4% | 75.3% |

| Providence, RI | 61.5% | 63.2% | 67.6% |

| Raleigh, NC | 26.5% | 23.8% | 73.8% |

| Riverside, CA | 33.9% | 31.5% | 56.9% |

| Sacramento, CA | 38.2% | 39.0% | 78.6% |

| San Diego, CA | 56.2% | 49.1% | 76.4% |

| San Francisco, CA | 59.0% | 44.3% | 78.2% |

| San Jose, CA | 60.9% | 58.8% | 75.4% |

| Seattle, WA | 44.3% | 24.7% | 78.9% |

| Tampa, FL | 22.9% | 26.3% | 69.1% |

| Washington, D.C. | 59.2% | 43.3% | 71.7% |

| Worcester, MA | 74.6% | 57.1% | 79.6% |

| National—U.S.A. (seasonally adjusted) | 42.1% | 43.1% | 68% |

Note: Metro-level competition data is not seasonally adjusted.

Home-Purchase Cancellations

Data below came from a list of the 50 most populous metro areas. We have excluded San Antonio while we investigate a potential data issue.

| Metro Area | Jan. 2023: Pending Sales That Fell Out of Contract, as % of Overall Pending Sales | Dec. 2022: Pending Sales That Fell Out of Contract, as % of Overall Pending Sales | Jan. 2022: Pending Sales That Fell Out of Contract, as % of Overall Pending Sales |

| Anaheim, CA | 11.3% | 16.0% | 11.9% |

| Atlanta, GA | 19.8% | 22.4% | 7.8% |

| Austin, TX | 13.3% | 16.4% | 11.1% |

| Baltimore, MD | 13.9% | 14.5% | 12.6% |

| Boston, MA | 10.7% | 11.7% | 9.4% |

| Charlotte, NC | 10.9% | 13.6% | 9.0% |

| Chicago, IL | 14.9% | 17.5% | 13.8% |

| Cincinnati, OH | 12.5% | 14.4% | 14.3% |

| Cleveland, OH | 18.3% | 20.8% | 15.7% |

| Columbus, OH | 12.4% | 17.2% | 12.2% |

| Dallas, TX | 15.5% | 20.2% | 15.8% |

| Denver, CO | 13.0% | 19.2% | 6.8% |

| Detroit, MI | 16.6% | 17.4% | 16.8% |

| Fort Lauderdale, FL | 16.8% | 20.5% | 17.6% |

| Fort Worth, TX | 17.3% | 20.6% | 15.6% |

| Houston, TX | 17.4% | 19.9% | 17.6% |

| Indianapolis, IN | 13.2% | 17.2% | 12.8% |

| Jacksonville, FL | 20.0% | 26.0% | 19.2% |

| Kansas City, MO | 12.8% | 14.6% | 11.2% |

| Las Vegas, NV | 18.2% | 18.2% | 18.4% |

| Los Angeles, CA | 15.2% | 14.7% | 12.7% |

| Miami, FL | 15.6% | 18.1% | 15.7% |

| Milwaukee, WI | 9.5% | 11.9% | 9.2% |

| Minneapolis, MN | 8.2% | 10.0% | 8.8% |

| Montgomery County, PA | 8.5% | 11.2% | 7.7% |

| Nashville, TN | 13.1% | 14.8% | 13.0% |

| Nassau County, NY | 7.2% | 5.7% | 6.1% |

| New Brunswick, NJ | 12.8% | 13.3% | 7.8% |

| New York, NY | 9.9% | 8.5% | 6.8% |

| Newark, NJ | 12.8% | 11.0% | 1.7% |

| Oakland, CA | 9.7% | 11.7% | 7.2% |

| Orlando, FL | 19.7% | 20.4% | 19.8% |

| Philadelphia, PA | 11.8% | 12.8% | 11.6% |

| Phoenix, AZ | 16.1% | 18.7% | 15.0% |

| Pittsburgh, PA | 15.1% | 17.0% | 13.1% |

| Portland, OR | 9.9% | 15.2% | 10.9% |

| Providence, RI | 11.4% | 12.9% | 11.3% |

| Riverside, CA | 15.0% | 19.1% | 15.2% |

| Sacramento, CA | 13.0% | 16.6% | 12.6% |

| San Diego, CA | 12.9% | 13.7% | 11.6% |

| San Francisco, CA | 5.5% | 3.9% | 4.5% |

| San Jose, CA | 6.5% | 7.5% | 3.9% |

| Seattle, WA | 9.2% | 11.9% | 7.2% |

| St. Louis, MO | 13.9% | 17.1% | 12.7% |

| Tampa, FL | 17.3% | 21.7% | 17.6% |

| Virginia Beach, VA | 15.0% | 14.9% | 14.0% |

| Warren, MI | 11.6% | 13.0% | 11.5% |

| Washington, D.C. | 12.1% | 15.0% | 10.9% |

| West Palm Beach, FL | 15.3% | 18.0% | 16.8% |

| National—U.S.A. | 14.1% | 16.1% | 12% |

United States

United States Canada

Canada