The housing market has begun to recover after hitting a low point in the second week of November. We’re not out of the woods yet, but homebuyers are coming off the sidelines: The number of Redfin customers requesting first tours has improved 17 percentage points from the November trough, and the number of people contacting Redfin agents to start the homebuying process has improved 13 points. Compared with a year ago, home tours and requests for service are down 23% and 27% respectively, but that’s an improvement from the November trough, when both were down 40%.

This is already translating into more home sales. Redfin agents report that bidding wars are back in some markets, including Seattle, central Florida and Richmond, VA. Homebuyer demand remains down from its early 2022 highs, but the market has shifted into a new phase and well-priced listings are selling quickly.

Homebuyers Return as Power Dynamics Shift Toward Their Favor

Buyers have acclimated to the 6% mortgage rate, which feels like a relief after watching affordability erode as rates surpassed 7% in the fall. Some buyers are even scoring a rate that starts with a five, an important psychological threshold, while others are opting for an adjustable-rate mortgage or getting a rate buydown as a seller concession.

“I’ve seen more homes go under contract this month than in the entire fourth quarter. Listings that were stagnant in November and December are suddenly getting one to two offers,” said San Jose, CA Redfin agent Angela Langone. “I’m getting texts and emails from prospective buyers now that the new year is in full swing and the holidays are behind us. Mortgage rates aren’t stopping people as much as they were at the end of 2022 now that they’re down from their peak and sellers are more willing to negotiate. Some buyers are having luck winning a home for under asking price, especially if it has been on the market for several weeks, but those days may be numbered.”

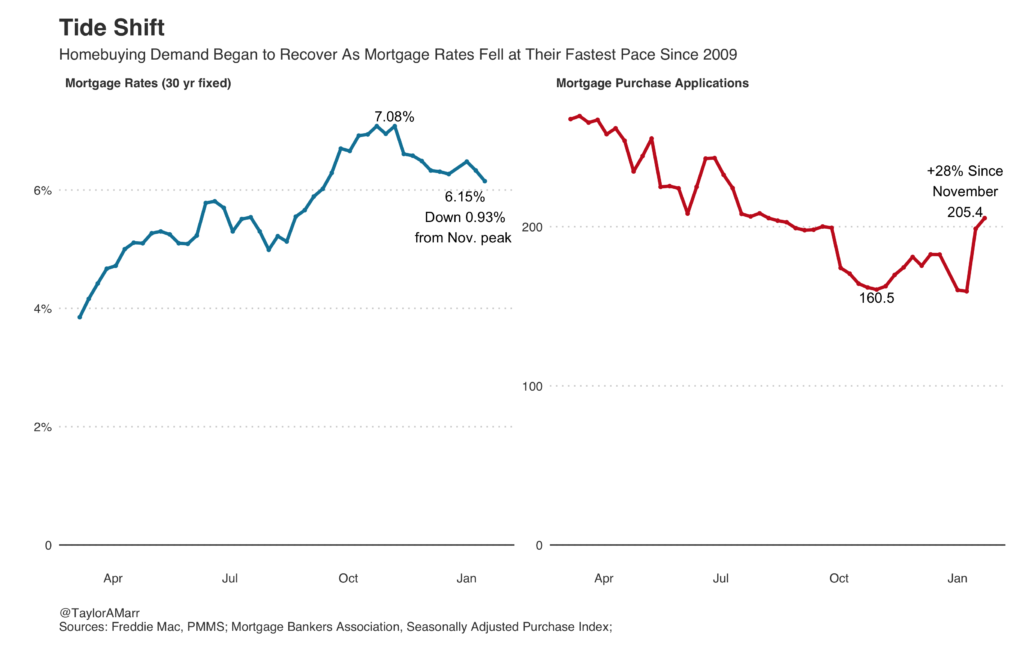

Mortgage applications are up 28% from early November as the average 30-year-fixed mortgage rate has declined to 6.15% from its November peak of 7.08%—the largest 10-week decline since 2009. That has sent the typical homebuyer’s mortgage payment down 10% (about $180) since fall. Pending home sales rose 3% in December from November on a seasonally-adjusted basis—the first month-over-month increase in 14 months.

Bidding Wars Are Back in Some Markets

While demand is coming back in some pockets of the country, it’s selective: Homes that are eliciting bidding wars tend to be affordable, suburban, single-family, move-in ready and most importantly, priced competitively. Most everything else is sitting.

Preliminary data on the share of Redfin agents’ offers facing bidding wars points to small upticks in the Seattle and Tampa markets this month. As this is an uneven trend, we expect it to take some time before bidding wars nationally show an upward trend.

“Bidding wars are back in Seattle,” said local Redfin real estate agent Shoshana Godwin. “One of our Issaquah listings got 12 offers and is under contract for $155,000 over the $1.4 million list price. The buyer waived every contingency, handed over $300,000 of earnest money and is letting the seller stay for free for two months after closing. Another home in Seattle’s popular Ballard neighborhood was recently delisted after sitting on the market for over three months. The seller relisted it last week and it went pending in under a day.”

Eric Auciello, Redfin’s team manager in Tampa, has seen three modest single-family homes priced around $300,000 wind up in bidding wars in central Florida this month, with 16, 17 and 23 competing offers, respectively.

Further south, in Palm Beach, most well-priced homes are getting multiple offers, but competition is nowhere near 2021 levels, according to local Redfin agent Elena Fleck: “Homes in coveted locations with recent upgrades or renovations–those are the homes getting multiple offers.”

“Homes that are in desirable school districts, priced well and in good condition are going off the market within days or even hours,” said Richmond Redfin agent Blake Edwards. “Anything under $400,000 will sell within the weekend. Even the $1 million houses that are in great condition are selling within days. It really is property specific right now.”

But in Boise, ID, bidding wars are still almost non-existent—despite the fact that prices have been falling year over year since November, according to local Redfin agent Shauna Pendleton. It’s taking between one and two weeks to get an offer after a showing, she said.

Pendleton continued: “Buyers are out there, but they’re making low offers and asking for concessions. They don’t seem ultra committed to homes like they used to. If they write an offer and they don’t get exactly what they want, they’re happy walking away. I recently heard about one seller who offered to pay the first three months of a new owner’s mortgage payment. There’s still a lot of cautiousness on both sides of the deal.”

The Market for Condos and Expensive Homes Lags Behind

Condos and higher-priced homes are still a struggle to sell. Redfin agents report that sellers of expensive homes and condos are offering buyers incentives to close deals.

“The condo market in Washington, D.C. has been hit hard,” said local Redfin agent Marshall Carey. “Condo sellers are searching for ways to incentivize buyers. One of my buyers recently purchased a condo, and we got the seller to give them 3% of the list price back in cash. My buyer used 2% of that to buy down their mortgage rate.”

“There’s a ton of demand for affordable suburban homes, but the super high end isn’t in demand,” said Chicago Redfin agent Dan Close. “Property taxes are very expensive here, so buying a $2 million home isn’t practical for most people.”

Sellers Have Been Slower to Return Than Buyers

Even though homebuyer demand is improving, the main factor driving bidding wars is low inventory. It’s not surprising that sellers are slower to embrace the shifting market, as buyers tend to react first to falling mortgage rates, with sellers following suit months later. This effect is likely to be pronounced in 2023: Would-be sellers are more sensitive to elevated rates because 85% of mortgage holders have a rate far below today’s level of roughly 6%. This “lock-in” effect and still-high rental prices are motivating many potential move-up buyers to become landlords instead of home sellers.

That being said, our measure of people contacting Redfin agents to sell their home has improved slightly; it’s up 10 percentage points from the November trough. But there hasn’t yet been a significant boost in listings nationwide.

New listings fell 18% year over year during the four weeks ending Jan. 22. That’s the smallest decrease in almost three months, but much steeper than the 8% decline a year earlier.

Redfin agents have observed in their conversations with homeowners that there’s fear around listing at a time when home-price growth has been shrinking and buyers are regaining power.

“Homeowners are scared to list because they previously heard that there’s no demand from buyers,” said Godwin in Seattle. “That’s making the market competitive again because there’s just no inventory.”

In Richmond, fear among sellers is making homes sell faster.

“Sellers are jumping on the first viable offer because they’ve heard from the media, friends, and family that the housing market is slowing,” Edwards said. “It all feels very urgent. We prioritize educating sellers in real time so they understand how the market dynamics are shifting, with more buyers now coming back.”

We’ll likely see more sellers return to the market as homebuyer demand increases and price growth stabilizes—especially given that there’s pent-up supply from sellers who delisted their homes in the fall when the market was slowing.

The Recovery Will Be Touch and Go and Vary From Block to Block

The housing market will likely continue to thaw in the coming weeks and months, especially if inflation and mortgage rates ebb further, but there’s still a long way to go. Some neighborhoods will see fierce bidding wars while others hear crickets. The market is warming up, but is still cold compared to the pandemic homebuying frenzy and even pre-pandemic times. It may never again hit the scalding-hot temperatures of 2021.

The housing market rebound could stall or slip if the progress the Fed has made toward cooling inflation slows or reverses course. The labor market is likely to weaken this year, perhaps to the point where we’re in a recession. Higher unemployment will hurt the housing market recovery, but that damage may be offset by any rate cuts from the Fed.

The factor most likely to slow or reverse the housing market recovery is that there are too few homes for sale, which could hold back total sales volumes and price people out of homebuying. Even though housing costs are declining, they remain significantly higher than they were two years ago. Home prices will likely be sticky this year in many places where there are still plenty of stale listings; once they finally sell they will hold back price growth while overall low inventory keeps prices from going down much.

Methodology

This report is based on an analysis of proprietary data from Redfin real estate agents and Redfin partner agents, multiple listing services, public records, Freddie Mac, the Mortgage Bankers Association, and dozens of interviews with Redfin agents. When we discuss first tours, that refers to people who requested their first Redfin-agent led home tour. When we discuss people contacting our agents to start the homebuying process, that includes online requests to tour homes, requests to talk to an agent about buying a home and requests for help making an offer on a home. When we discuss listing consults, that refers to homeowners who consult with one of our agents about selling their home before listing. For the aforementioned Redfin metrics, we compare the week ending Jan. 22 to the week ending Nov. 13.

United States

United States Canada

Canada