The housing market is worked into a frenzy, unfazed by war in Ukraine, a faltering stock market, and fast-rising gas prices.

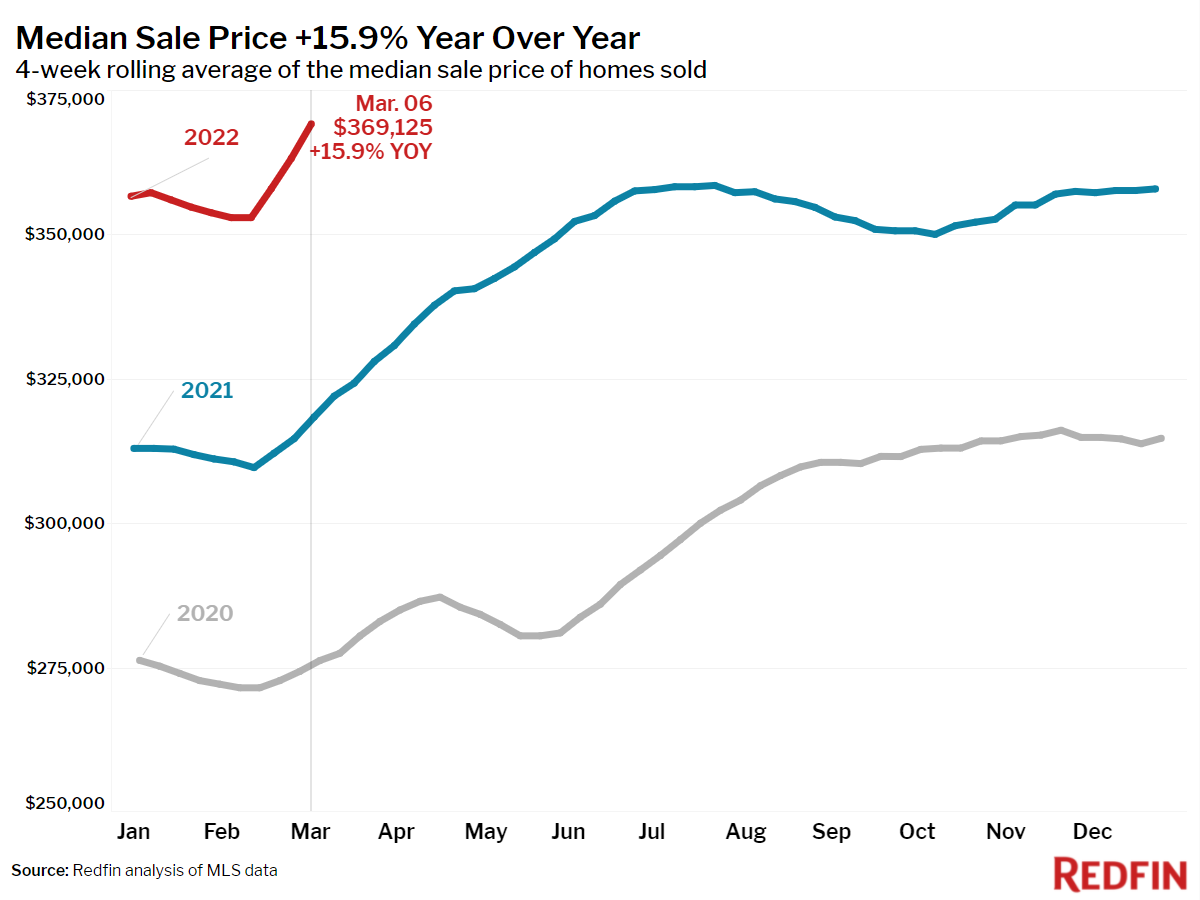

Three out of five homes that went under contract during the four week period ending March 6 found a buyer within two weeks, an all-time high, as supply shrank to a new low. Recent home sellers also enjoyed the biggest price premiums ever seen this time of year, with the typical home selling for 1.1% above list price. Last year at this time, the typical home sold for 0.3% below list price. The median home sale price shot up 16% year over year to a new high of $369,125.

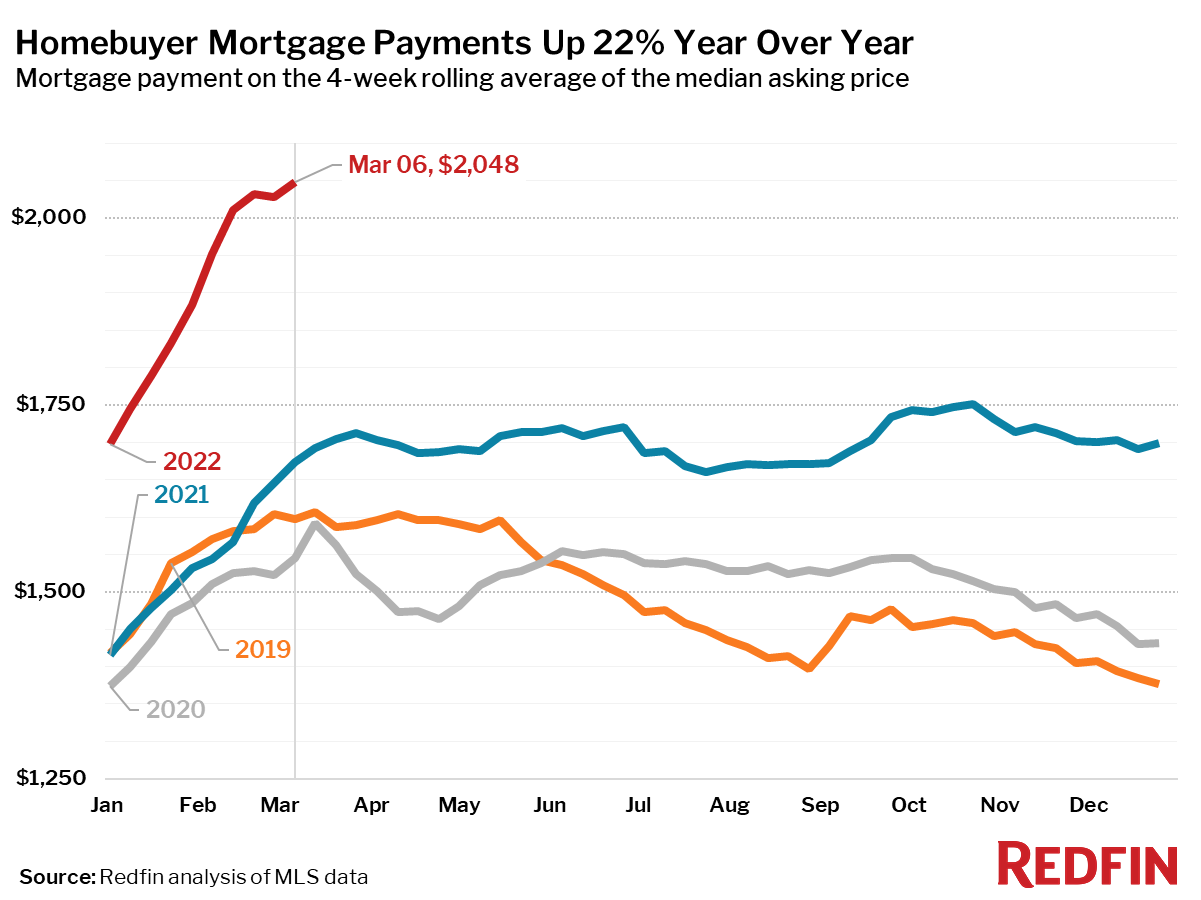

“Homebuyers are in a frenzy,” said Redfin Deputy Chief Economist Taylor Marr. “Buyers are reacting to changes in mortgage rates but are so far unfazed by the war in Ukraine, stock market volatility and rising oil prices. However, these risks are reaching levels that could be dangerous for the economy, and the Fed is on the cusp of raising rates further to cool inflation. The silver lining for housing is that the spike in mortgage rates has paused for now.”

Key housing market takeaways for 400+ U.S. metro areas:

Unless otherwise noted, the data in this report covers the four-week period ending March 6. Redfin’s housing market data goes back through 2012.

Data based on homes listed and/or sold during the period:

- The median home sale price was up 16% year over year to a record high of $369,125, and up 34% from the same time in 2020.

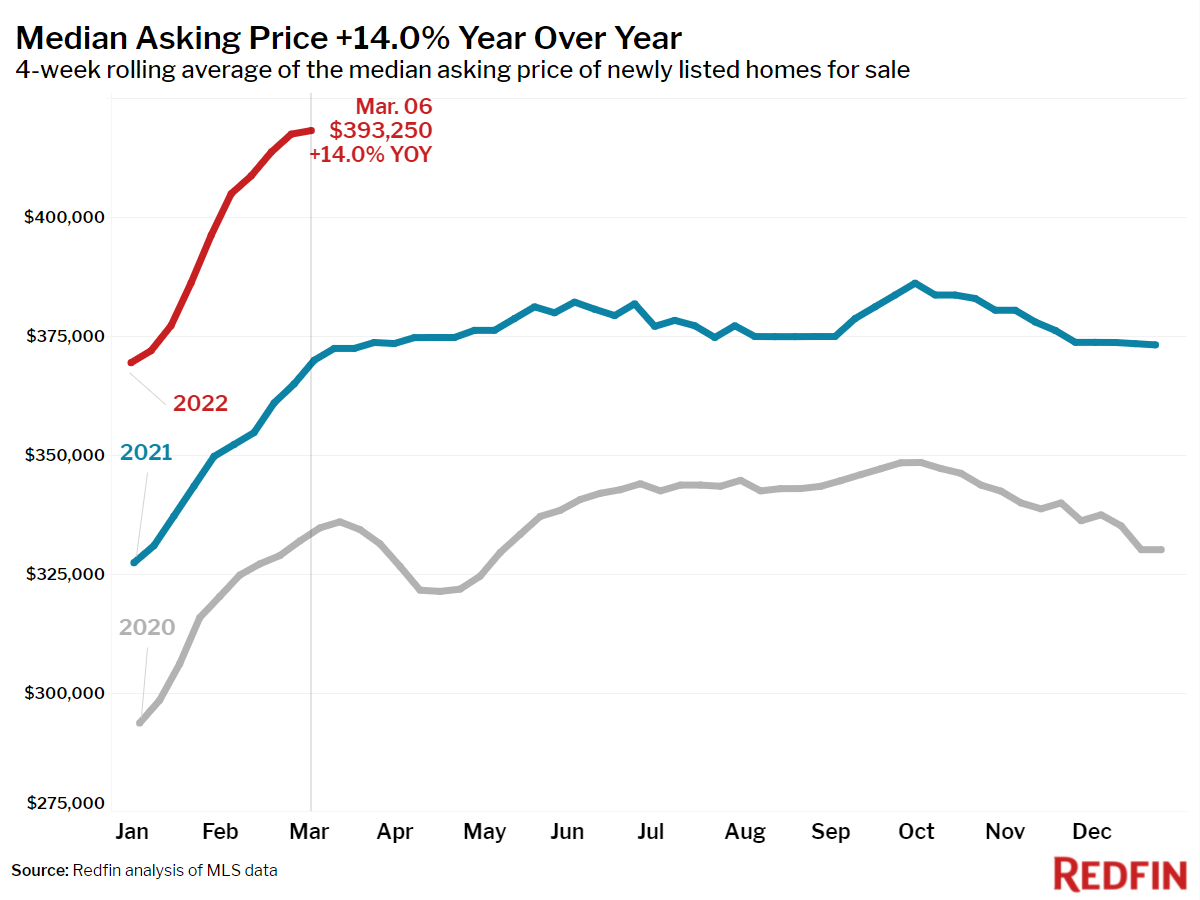

- The median asking price of newly listed homes increased 14% year over year to an all-time high of $393,250, and rose 27% from the same time in 2020.

- The monthly mortgage payment on the median asking price home rose slightly to a record high of $2,048 at the current 3.85% mortgage rate. This was up 22% from a year earlier, when mortgage rates were 3.05%, and up 33% from the same period in 2020, when rates were 3.36%.

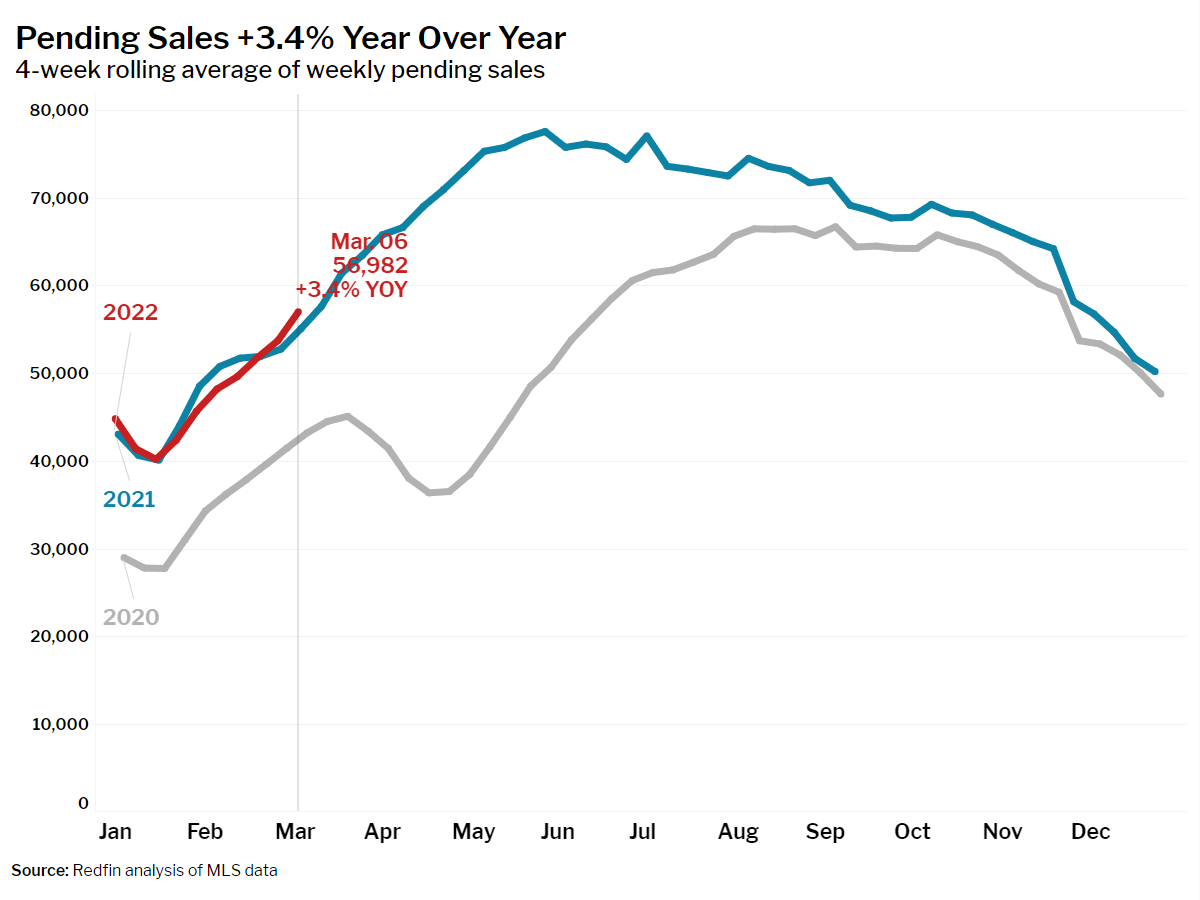

- Pending home sales were up 3.4% year over year and up 32% from the same period in 2020, just prior to the start of the pandemic.

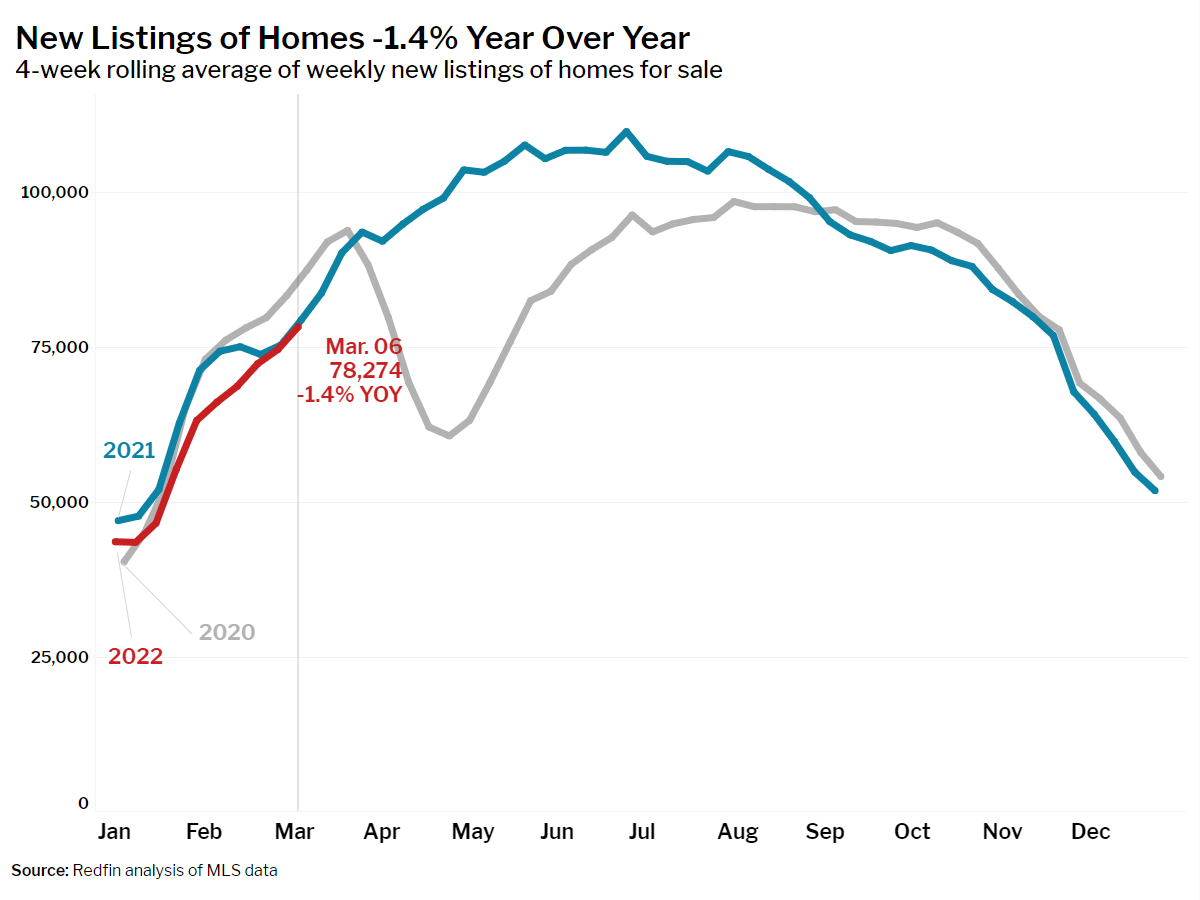

- New listings of homes for sale were down 1.4% from a year earlier. Compared to 2020, new listings were down 11%.

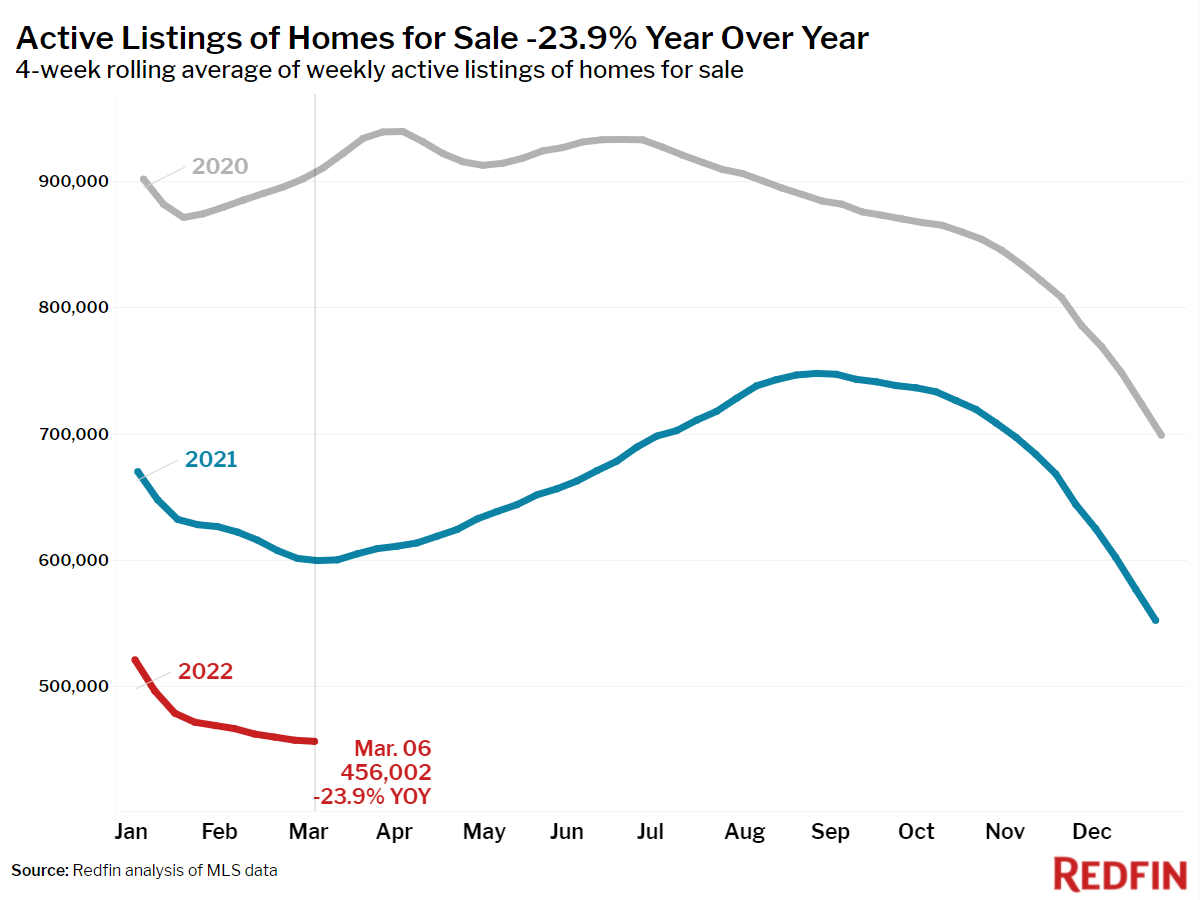

- Active listings (the number of homes listed for sale at any point during the period) fell 24% year over year, dropping to an all-time low of 456,000. Listings were down 50% from the same period in 2020.

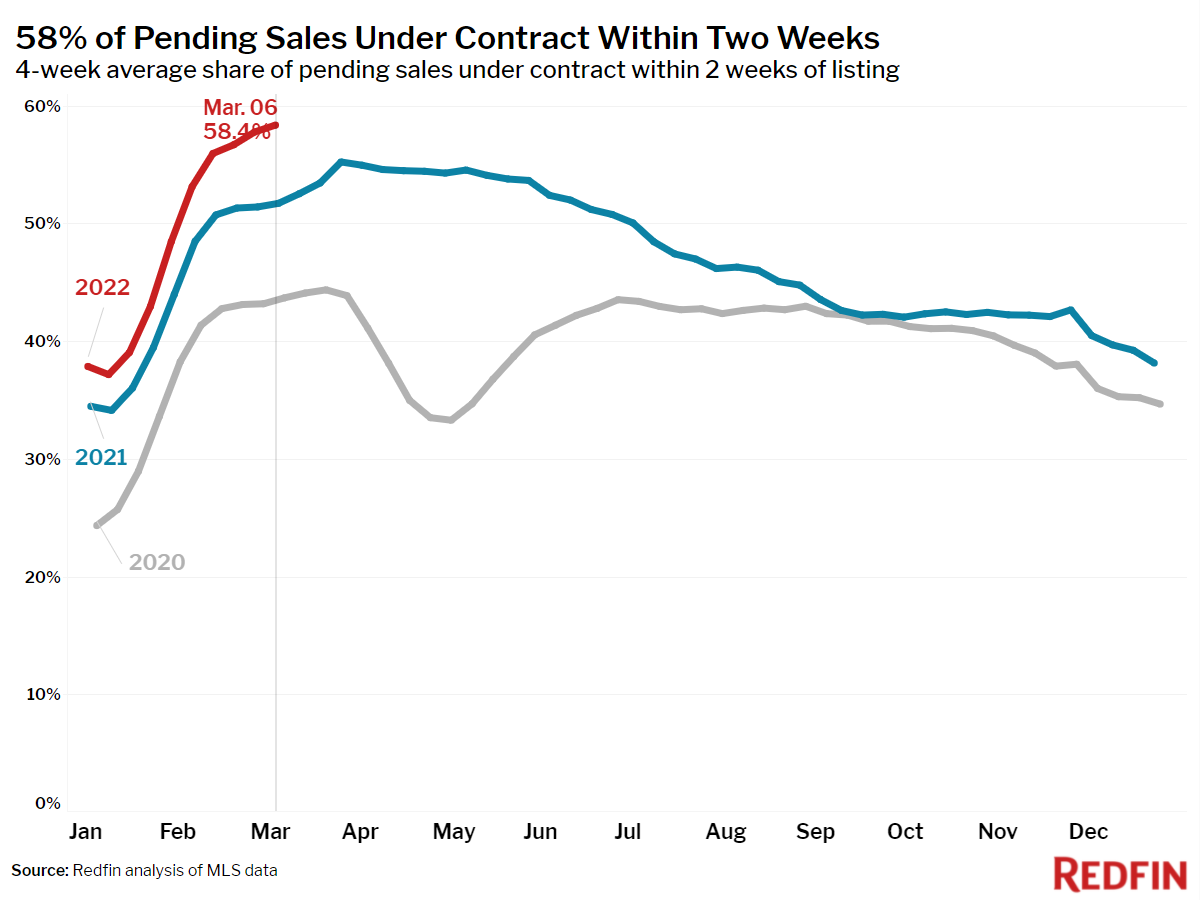

- 58% of homes that went under contract had an accepted offer within the first two weeks on the market, an all-time high. This was up from the 52% rate of a year earlier and 44% in 2020.

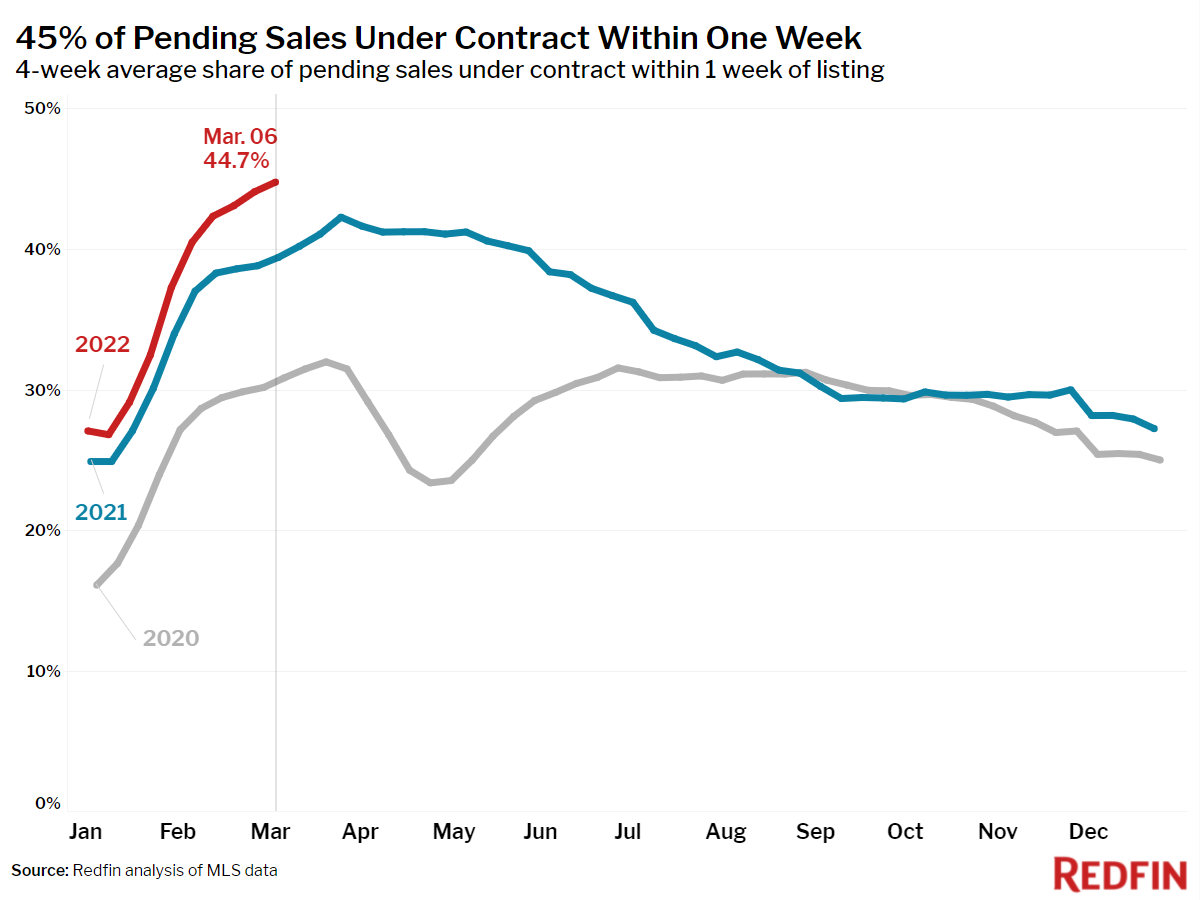

- 45% of homes that went under contract had an accepted offer within one week of hitting the market, an all-time high. This was up from 39% during the same period a year earlier and 31% in 2020.

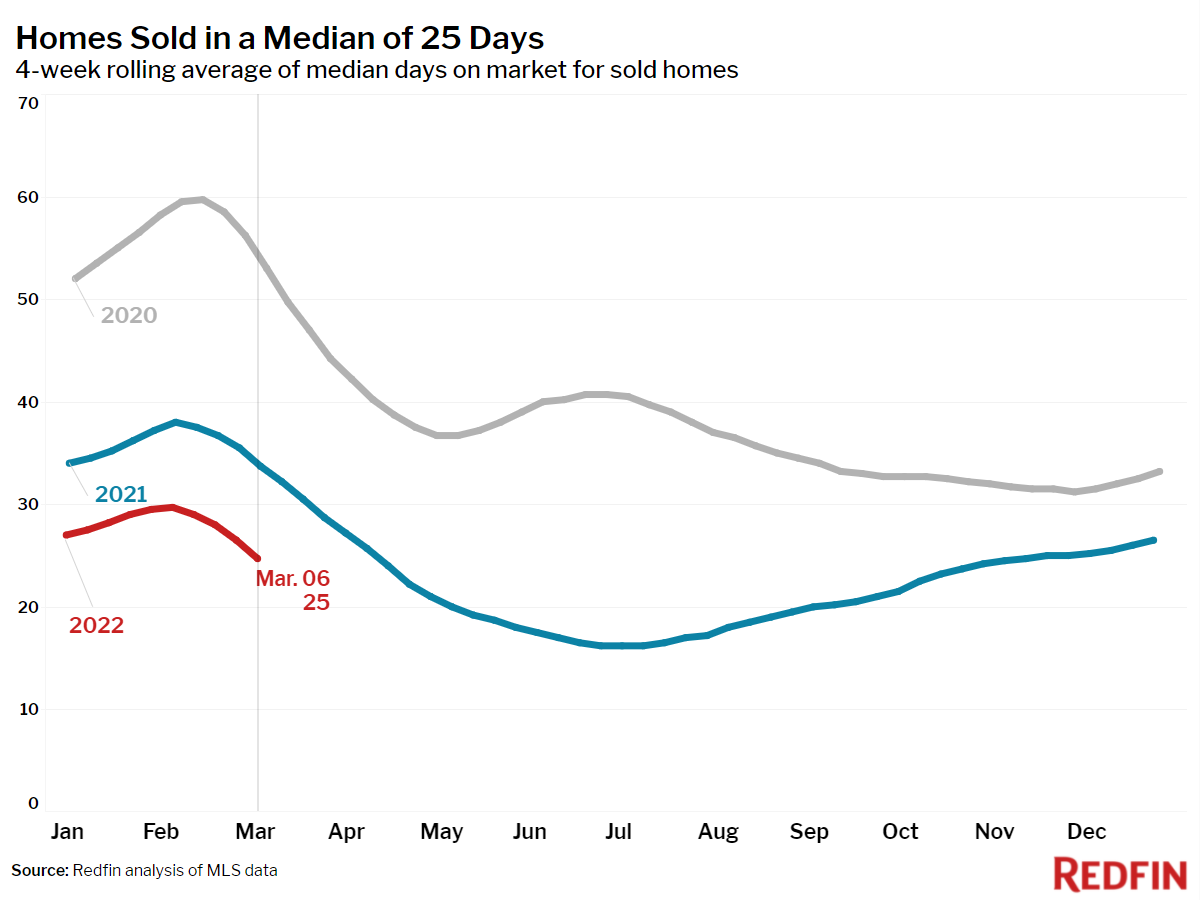

- Homes that sold were on the market for a median of 25 days, down from 34 days a year earlier and 53 days in 2020.

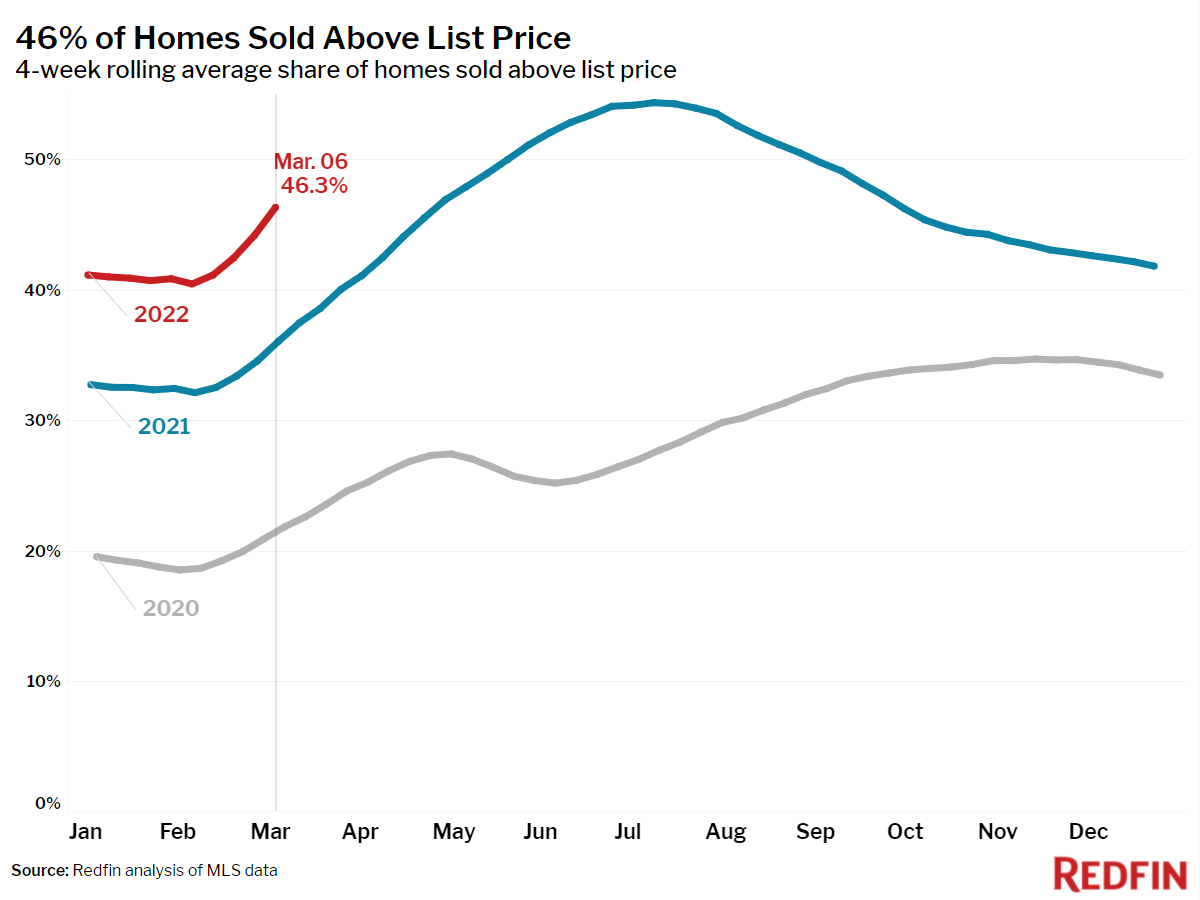

- 46% of homes sold above list price, up from 36% a year earlier and 22% in 2020.

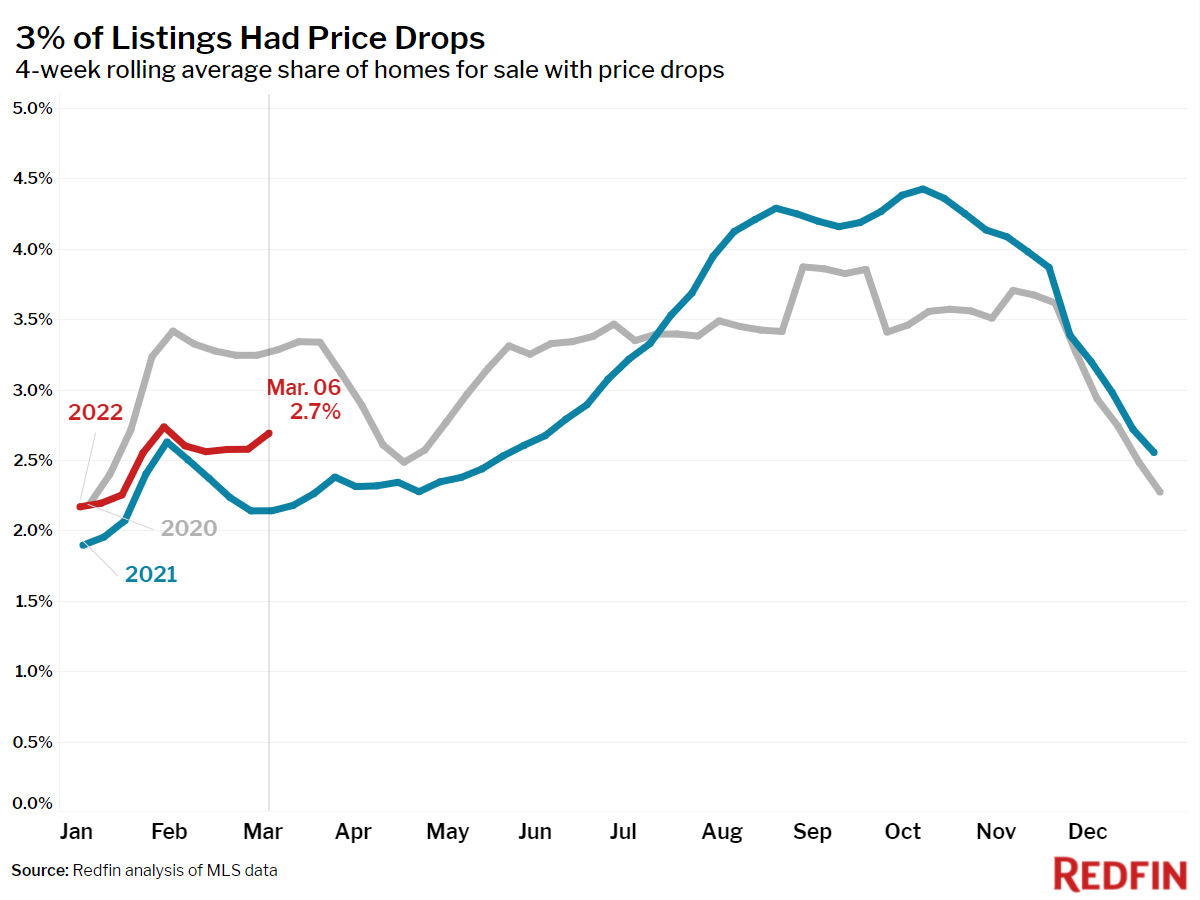

- On average, 2.7% of homes for sale each week had a price drop, up 0.6 percentage points from the same time in 2021, but down 0.6 percentage points from 2020.

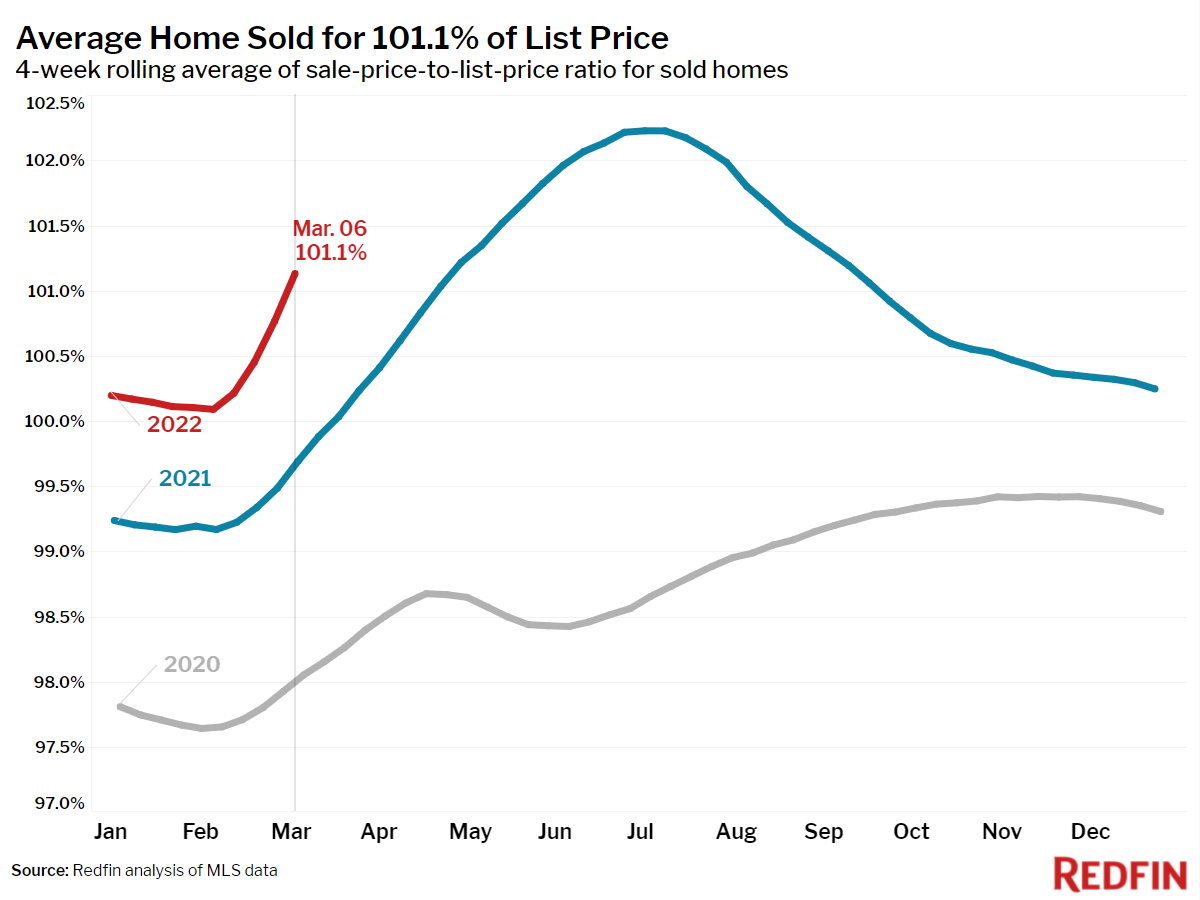

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, rose to 101.1%. In other words, the average home sold for 1.1% above its asking price. This was up from 99.7% in 2021 and 98.1% in 2020.

Other leading indicators of homebuying activity:

- Mortgage purchase applications increased 9% week over week (seasonally adjusted) during the week ending March 4.

- For the week ending March 10, 30-year mortgage rates rose to 3.85% from 3.76% the prior week.

- Touring activity from the first week of January through March 6 was 10 percentage points behind the same period in 2021 and 4 points behind the same period in 2020, according to home tour technology company ShowingTime.

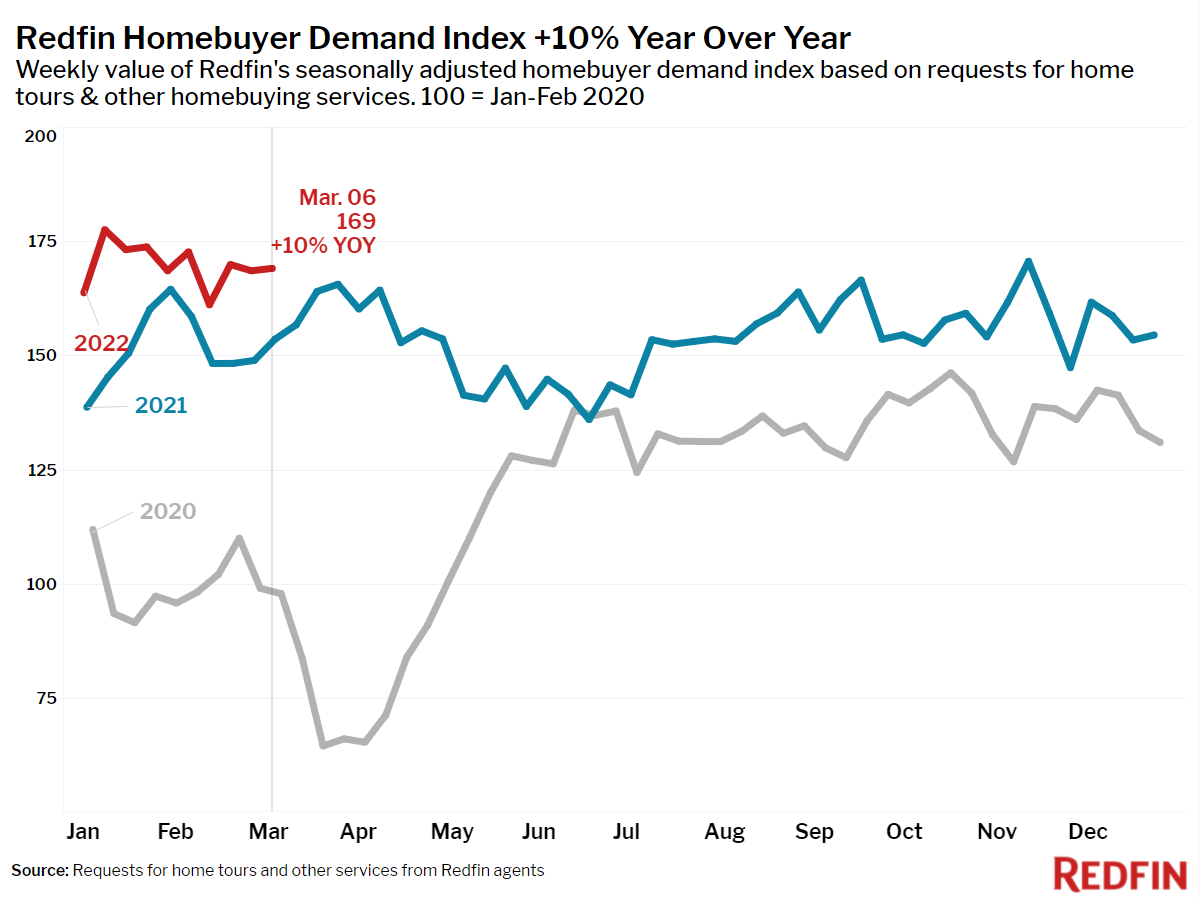

- The Redfin Homebuyer Demand Index rose less than 0.1% from the previous week during the seven-day period ending March 6 and was up 10% from a year earlier. The seasonally adjusted Redfin Homebuyer Demand Index is a measure of requests for home tours and other home-buying services from Redfin agents.

Refer to our metrics definition page for explanations of all the metrics used in this report.

United States

United States Canada

Canada