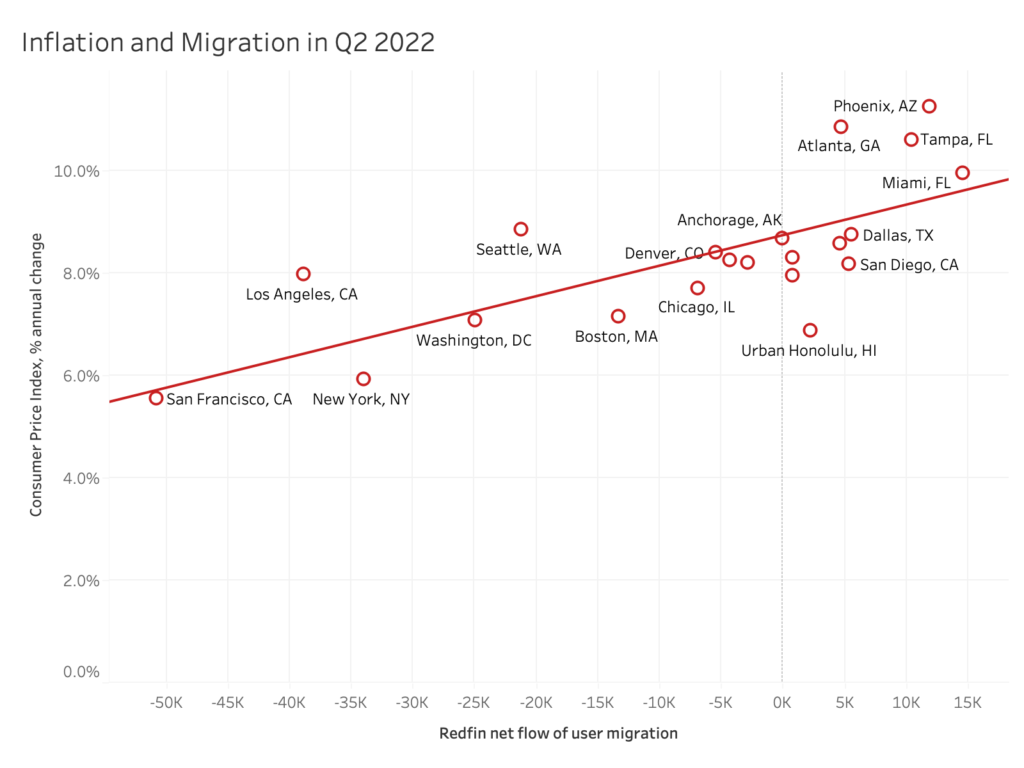

Phoenix, Atlanta, Tampa and Miami, all Sun Belt metros popular with relocating homebuyers, have the highest inflation rates in the country. Housing prices make up a big portion of the rising costs in those places.

The most popular destinations for relocating homebuyers have the highest inflation rates in the U.S., partly because they’re attracting so many new residents and experiencing sharp home-price increases. Inflation is persistent nationwide, with the prices of goods and services hitting a four-decade high in June, but specific rates vary depending partly on where you live.

Four U.S. metros experienced double-digit inflation in the second quarter–Phoenix, Atlanta, Tampa, FL and Miami–and all four were among the most popular migration destinations for Redfin.com users.

Phoenix saw prices of goods and services rise 11.3% year over year on average in the second quarter on average, the highest inflation rate of the metros in this analysis. Phoenix was also the third-most popular destination for Redfin.com users looking to move from one metro to another, according to Redfin’s migration data.

Atlanta, the 12th-most popular destination, had the second highest inflation rate at 10.9%, and Tampa (10.6%) clocked in at number three for inflation and number two for migration. Miami, the most popular destination, had the fourth-highest inflation rate (10%).

Prices of goods and services are rising much slower in the metros homebuyers are leaving

The places homebuyers are leaving tend to have lower inflation rates. In San Francisco, which tops the list of metros Redfin.com users looked to leave in the second quarter, prices rose 5.6%. That’s the lowest inflation rate of the metros in this analysis and half that of Phoenix.

New York had the second-lowest inflation rate (5.9%) and it’s number three on the list of places homebuyers are leaving. Los Angeles (8%), Washington, D.C. (7.1%) and Seattle (8.9%), which round out the top five metros homebuyers are leaving, all have inflation rates near the middle of the pack.

“A place’s popularity has a big impact on how much its local prices go up,” said Redfin Deputy Chief Economist Taylor Marr. “An influx of people moving into a place like Phoenix or Tampa pushes up demand for everything from housing to food to fuel, which pushes up prices in all those areas and ultimately contributes to overall inflation. That means it’s getting more difficult for locals to afford daily expenses, especially when you consider that wages aren’t rising as quickly. In Phoenix, for instance, wages are up about 6% from a year ago but inflation is up more than 11% and asking rents are up 24%. Homeowners are in a better position than renters because they benefit from rising home values.”

Housing costs are a bigger inflation driver in popular migration destinations

The increase in housing costs is a bigger contributor to inflation in migration hotspots than the places homebuyers are leaving.

In Phoenix, for instance, overall housing costs rose nearly 16% year over year in June, the second-biggest inflation driver behind transportation. And in Atlanta, housing costs rose 11%, also the second-biggest inflation driver after transportation. Transportation includes fuel, which is a particularly noticeable inflation driver in car-dependent places like Phoenix and Atlanta.

On the other end of the spectrum, housing costs increased 3.8% in San Francisco, a small inflation driver compared with food, medical care and other goods and services, in addition to transportation. The story is similar in New York, where housing costs rose 4.2%, also a smaller increase than most of the other categories.

The share of homebuyers relocating is at a record high, largely thanks to remote work making moving more feasible. Many homebuyers have moved from expensive coastal job centers to comparatively affordable Sun Belt metros, though their popularity has rendered several of those areas less affordable than before. Phoenix home prices have risen more than 60% throughout the pandemic, reaching $486,000 in May.

Because home prices and other costs are rising faster in popular migration destinations, the financial benefit of living in a place like Phoenix instead of coastal California may eventually diminish.

Methodology

This report is based on a Redfin analysis of the correlation between inflation (the rising prices of goods and services) and migration in metro areas where inflation data is available. Redfin migration data is aggregated to the combined statistical area (CSA). This analysis measures the popularity of migration destinations by net inflow, or how many more Redfin.com users are looking to move into a metro area than move out of it. Inflation rates are measured by the Bureau of Labor Statistics at the core-based statistical area (CBSA) by the Consumer Price Index, the average change over time in prices for goods and services such as fuel, energy and food.

United States

United States Canada

Canada