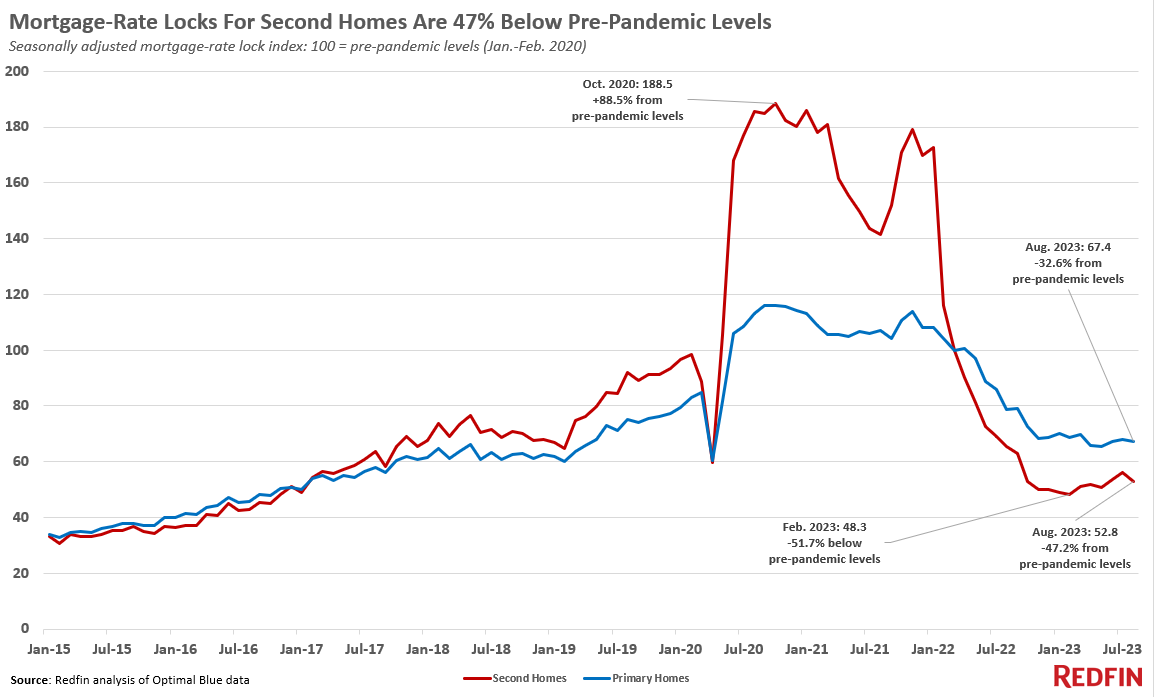

Mortgage rate locks for second homes are down nearly 50% from pre-pandemic levels, compared to a 33% drop for primary homes.

Mortgage-rate locks for second homes were down 47% from pre-pandemic levels on a seasonally adjusted basis in August, compared to a 33% decline for primary homes. August marks the 14th-straight month that second-home demand has hovered at least 30% below pre-pandemic levels, as high housing costs and limited inventory deter would-be buyers. Rate locks for second homes hit a seven-year low in February, dropping to 52% below pre-pandemic levels.

That’s according to a Redfin analysis of Optimal Blue data. A mortgage-rate lock is an agreement between a homebuyer and a lender that allows the homebuyer to lock in an interest rate on a mortgage for a certain period of time; roughly 80% of rate locks result in purchases. See the end of this report for more details on methodology.

Demand for second homes is also down from a year ago. Mortgage-rate locks for second homes is down 19% year over year, bigger than the 14% decline for primary homes.

The plunge in mortgage locks for vacation homes comes after they skyrocketed during the pandemic, hitting a peak of 88.5% above pre-pandemic levels in October 2020. Affluent Americans jumped at the chance to snap up second homes with record-low mortgage rates during a time when many of them could work remotely from vacation towns. Demand for primary homes jumped during that time, too, but the increase was much more modest, reaching a peak of 16% above pre-pandemic levels in late 2020.

High prices and loan fees, plus diminishing appeal of rental properties, deter second-home buyers

Mortgage rates rose to a two-decade high in August, keeping demand low for both primary homes and second homes. Still-high home prices, the elevated cost of other goods and services, the uncertain economy, and a lack of new listings are also holding back buyers of both home types.

But the drop in demand for vacation homes is bigger, due to a variety of factors:

-

- It’s more expensive to buy a second home. The typical home in a seasonal town–where many second homes are located–sells for $564,000, up 5% from a year earlier. That’s compared with $421,000 for homes in non-seasonal towns, also up 5%. Mortgage rates for second homes are also typically higher. Finally, the federal government increased loan fees for second homes in 2022, often adding tens of thousands of dollars to the cost of purchasing a home.

- Many workers are returning to the office. The allure of second homes has diminished as many companies–including big ones like Amazon, Apple, Disney and JPMorgan– call workers back to the office, at least part of the time.

- Short-term rentals are less attractive. Buying a vacation home to rent it out on a short-term rental site like Airbnb may be less attractive than it once was. Local governments including New York City are instituting new short-term rental regulations, like new taxes and strict permitting, that cut into profits and make the business more difficult.

- The long-term rental market is cooling. Buying a vacation home to rent it out long term is less attractive, too. The rental market has cooled from its pandemic peak; although asking rents are still high, many landlords are being forced to offer concessions to attract renters. Plus, there’s a rising number of vacancies for landlords to fill, with many new units set to hit the market soon.

Demand for second homes is up slightly from the bottom it hit in the beginning of the year. That’s likely because home prices have come down in some second-home hotspots, including Austin, TX and Phoenix, and some affluent Americans are investing in vacation homes before prices rise.

Interest in second homes first fell below pre-pandemic levels in April 2022, the month the loan-fee increase took effect and several months after mortgage rates started jumping.

Methodology

The data in this report is from a Redfin analysis of mortgage-rate lock data from real estate analytics firm Optimal Blue. It does not include cash purchases. Redfin created a seasonally adjusted index of Optimal Blue’s data to adjust for typical seasonal patterns and allow for simple comparisons of second-home demand before, during and after the pandemic. We define “pre-pandemic” as January and February 2020 and set the index for that period to 100. We used early 2020 as a comparison point because it provides a baseline for mortgage demand before homebuyer activity fluctuated wildly during the pandemic. Any data point above 100 represents second-home demand that’s above pre-pandemic levels and any data point below 100 represents demand below pre-pandemic levels. This data is subject to revision.

A mortgage-rate lock is an agreement between a homebuyer and a lender that allows the homebuyer to lock in an interest rate on a mortgage for a certain period of time, offering protection against future interest-rate hikes. Homebuyers must specify whether they are applying to secure a mortgage rate for a primary home, a second home or an investment property. Roughly 80% of mortgage-rate locks result in actual home purchases.

United States

United States Canada

Canada