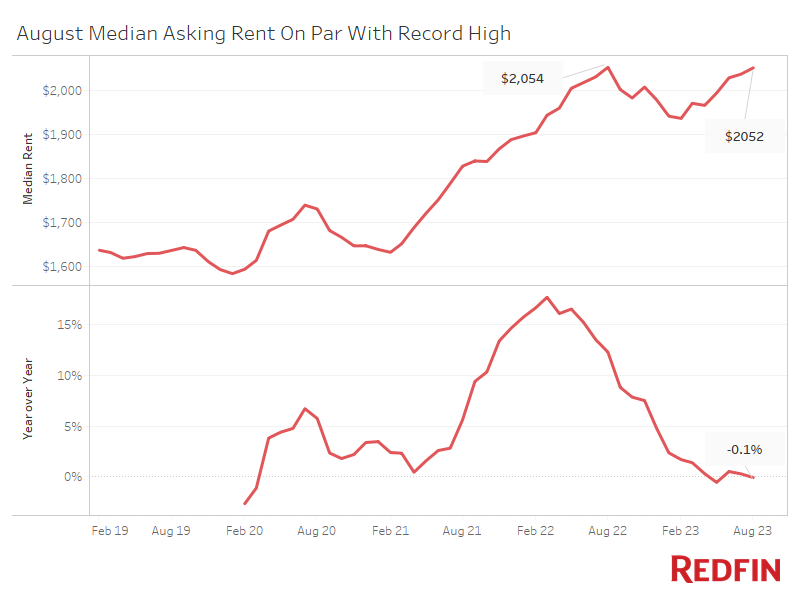

The median asking rent in August was $2,052, just $2 below the record high set a year earlier. Instead of taking a haircut on rents, some landlords are throwing in one-time concessions to attract renters as vacancies rise.

The median U.S. asking rent in August was $2,052, just $2 below (-0.1%) the record high set a year earlier. That’s up just slightly (0.7%) from a month earlier, when the typical asking rent was $2,038.

While asking rents are near their all-time high, tenants in some parts of the country are finding deals. With vacancies on the rise, some landlords are doling out one-time discounts to attract renters while maintaining high asking rents on paper. This means rents are effectively coming down in some areas even though the declines don’t show up in asking-rent data.

“A year ago, you really didn’t see concessions in the market. Fast forward to today, and they are far more common, with landlords offering from one to three months free in an effort to attract new tenants without lowering their asking rents,” said Jon Ziglar, Chief Executive Officer Rent., a Redfin company. “Higher-end properties are beginning to see pressure in certain markets as a significant portion of new units coming online are in the higher end and luxury segment. We are still seeing a lot of competition for more affordable units due to less new supply, as well as increased pressure on consumer wallets limiting the ability to stretch for that higher level experience.”

Some building owners are raising rents for existing tenants but not new tenants to bolster returns without scaring off prospective renters.

Even though rents are hovering near their all-time high, they’re no longer posting large year-over-year jumps like they were in the past two years, when rental demand was surging. In August 2022, for instance, the median asking rent was up 12.3% year over year. Rent growth has cooled over the past year due to slowing household formation, economic uncertainty, affordability challenges and an increase in rental supply.

Completed residential projects in buildings with five or more units rose 28.9% year over year in the second quarter—the most recent quarter for which data is available. That means landlords have more vacancies to fill and less leeway to raise prices. The national rental vacancy rate was 6.3% in the second quarter, up from 5.6% a year earlier. That’s just shy of the first quarter’s 6.4% rate, which was the highest in two years.

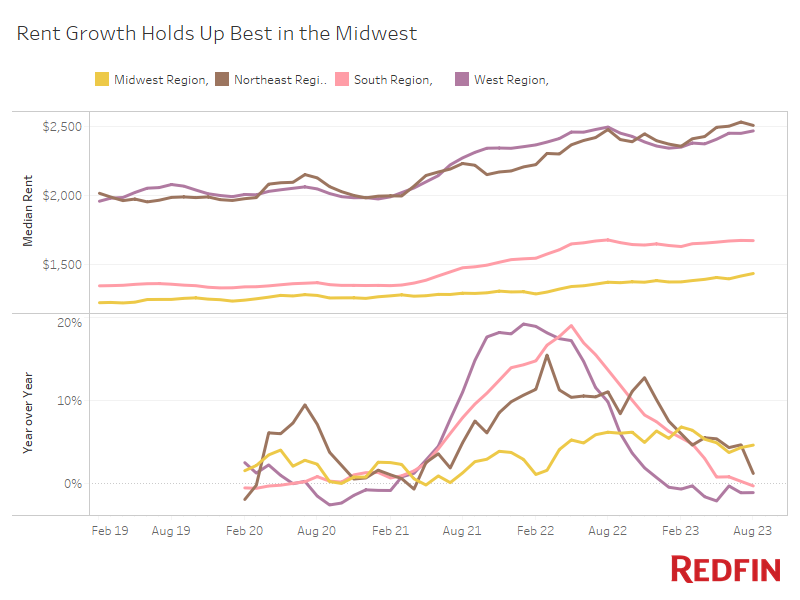

Rents Fall in the West, Rise in the Midwest and Northeast

In the West, the median asking rent fell 1.1% year over year to $2,469 in August. And in the South, it fell 0.3% to $1,673—the first (albeit small) decline since 2020. By comparison, asking rents climbed 4.6% year over year to a record $1,434 in the Midwest and rose 1.2% to $2,509 in the Northeast.

The rental market has cooled quickly in the West and South in part because those markets saw outsized rent increases during the pandemic. Rents skyrocketed as people flooded into Sun Belt cities including Phoenix, Miami and Dallas. But once the rental frenzy cooled, rents in those regions had more room to fall. The West has also been disproportionately impacted by layoffs in the tech sector, which may be contributing to its soft rental market.

While rents in the West and South have been relatively sluggish, these regions’ rental markets have started to stabilize in recent months as the impact of the pandemic price boom moves further into the rearview mirror and layoffs ease.

Methodology

Asking price data includes single-family homes, multi-family units, condos/co-ops and townhouses from Rent.com and Redfin.com.

Redfin has removed metro-level data from monthly rental reports for the time being as it works to expand its rental analysis.

Prices reflect the current costs of new leases during each time period. In other words, the amount shown as the median rent is not the median of what all renters are paying, but the median asking price of apartments that were available for new renters during the report month.

United States

United States Canada

Canada