For many individuals and families, owning a home in New Mexico is a lifelong dream. However, with rising real estate prices, some may find themselves seeking financing beyond the conforming loan limit. This is where jumbo loans come into play.

What is a jumbo loan?

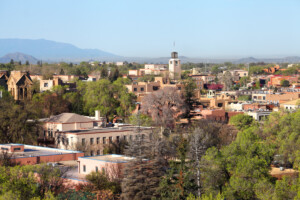

What exactly is a jumbo loan in New Mexico? A jumbo loan is a specialized type of mortgage that comes into play when you’re seeking financing for a home that surpasses the conforming loan limits (CLL) established by the Federal Housing Finance Agency (FHFA). Typically, this type of loan is necessary for upscale, luxurious properties or those situated in pricey housing markets like Santa Fe.

If the home you’re purchasing will require you to borrow more than the CLL, you’ll need to apply for a jumbo loan. Because of the larger loan amounts, jumbo loans typically carry stricter requirements and higher interest rates than conforming loans. Lenders may require a higher down payment, a lower debt-to-income ratio, and a stronger credit score to qualify for a jumbo loan in New Mexico.

Your future home is just a tap away

Explore homes with the Redfin app anytime, anywhere.

What is the jumbo loan limit in New Mexico?

Your future home is just a tap away

In New Mexico, the conforming loan limit is $766,550 across all counties. So, for example, if you’re buying a home in Santa Fe County, where the median sale price is $622,000, a loan limit exceeding $766,550 would be considered a jumbo loan.

As a reminder, the amount being borrowed is what determines whether or not you’ll need a jumbo loan, not the home price. So, if you were to put $50,000 down on a $750,000 home in Albuquerque, the mortgage would be $700,000, which is under the conforming loan limit for this area. In this case, your loan wouldn’t be considered a jumbo loan.

For more information on the conforming loan limit in your county, use the FHFA map.

What are the requirements for a jumbo loan in New Mexico?

Borrowers must meet stricter requirements to qualify for a jumbo loan than they would for a conforming loan. The specific requirements can vary from lender to lender, but below are the typical requirements for borrowers seeking a jumbo loan in New Mexico.

Higher credit score: In order to have your loan application approved for a jumbo loan, most lenders will require a credit score of 720 or higher. While some lenders may be more lenient and accept a score as low as 660, a score below this is generally not accepted. In contrast, a credit score as low as 620 could suffice for a conforming loan with some lenders.

Larger down payment: Obtaining a jumbo loan in New Mexico typically requires a larger down payment compared to a conventional loan. Lenders may require a down payment of 10% to 20% or more, depending on the specific loan program and the borrower’s financial situation. If you’re approved with a down payment less than 20%, keep in mind you’ll most likely be required to purchase private mortgage insurance (PMI).

More assets: During the asset review process, lenders typically request that jumbo loan borrowers provide evidence of sufficient liquid assets or savings to cover the equivalent of one year’s worth of loan payments.

Lower debt-to-income ratio (DTI): Lenders typically require a debt-to-income ratio (DTI) of under 43% for jumbo loan borrowers, although a DTI closer to 36% is preferred. This ratio is calculated by dividing the sum of all monthly debt payments by the borrower’s gross monthly income. A lower DTI indicates a stronger ability to repay the loan and can help borrowers secure more favorable terms and rates. It’s important for New Mexico borrowers seeking a jumbo mortgage to have a clear understanding of their DTI and take steps to improve it if necessary.

Additional home appraisals: When you buy a home in New Mexico, your lender will require a home appraisal to confirm that the property’s value is equal to or higher than the loan amount. In some cases, a lender may require an additional appraisal for a jumbo loan. In housing markets with very few comparable property sales, the cost of the appraisal may be higher than in cities with more frequent sales.

United States

United States Canada

Canada