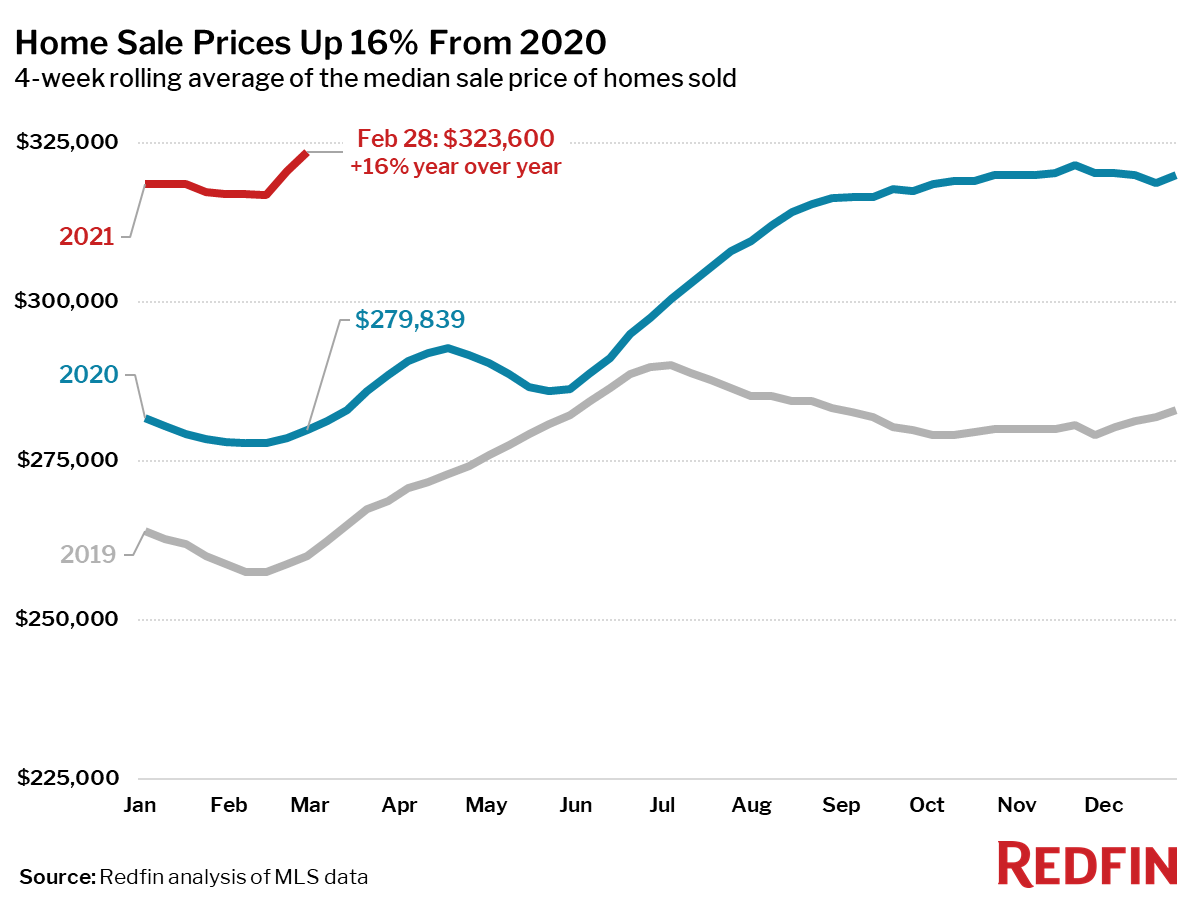

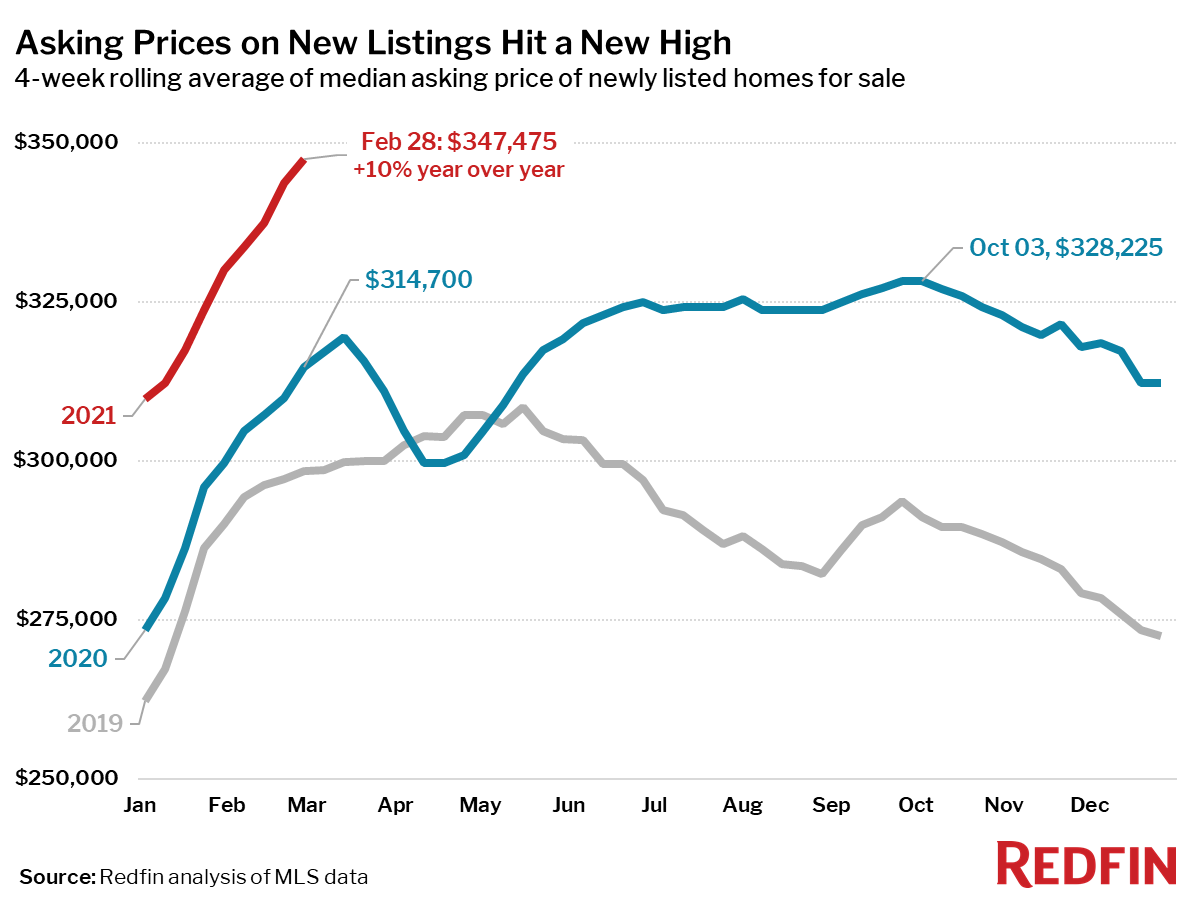

Median asking and selling prices both climbed by double digits to new all-time highs.

Key housing market takeaways for 400+ U.S. metro areas during the 4-week period ending February 28:

- The median home-sale price increased 16% year over year to $323,600, an all-time high. This is the largest increase on record in this data set, which goes back through 2016.

- Asking prices of newly listed homes hit a new all-time high of $347,475, up 10% from the same time a year ago.

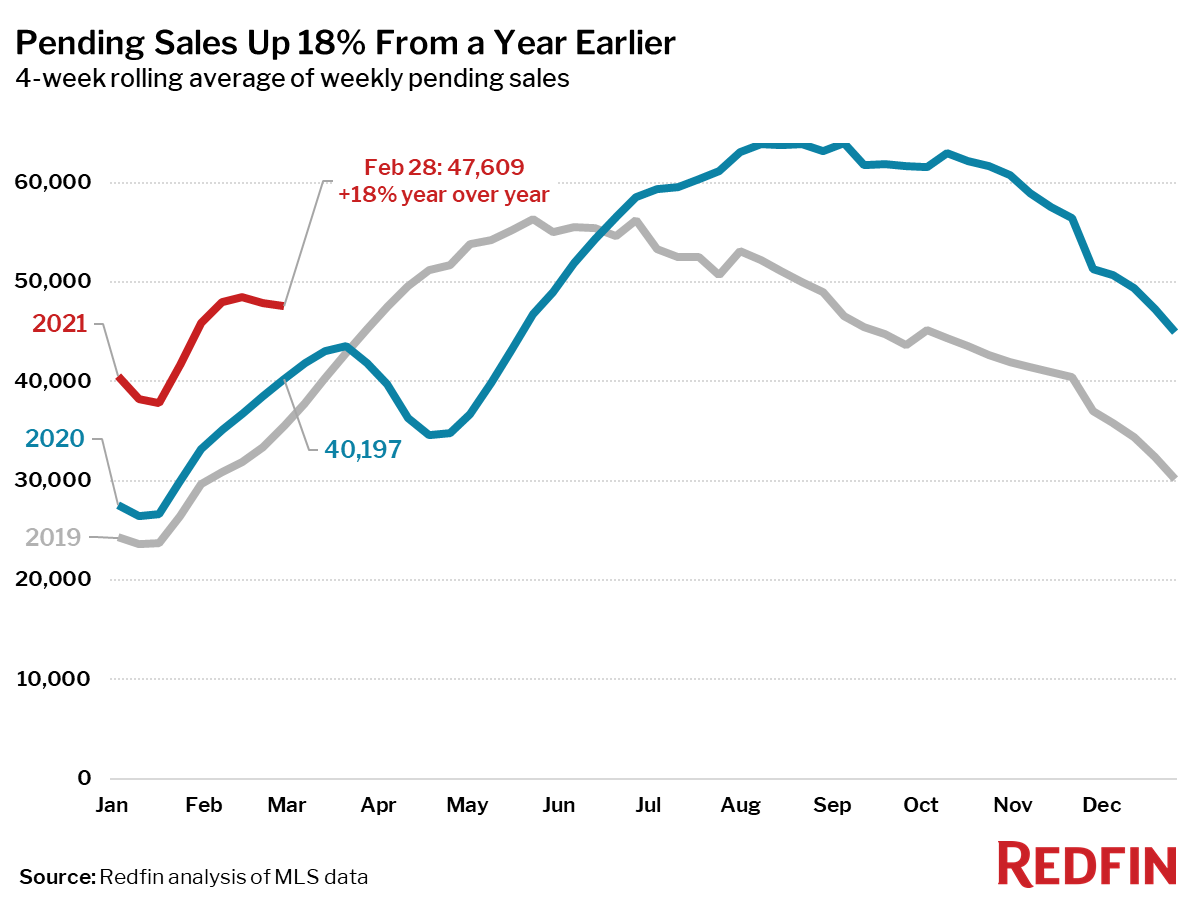

- Pending home sales were up 18% year over year.

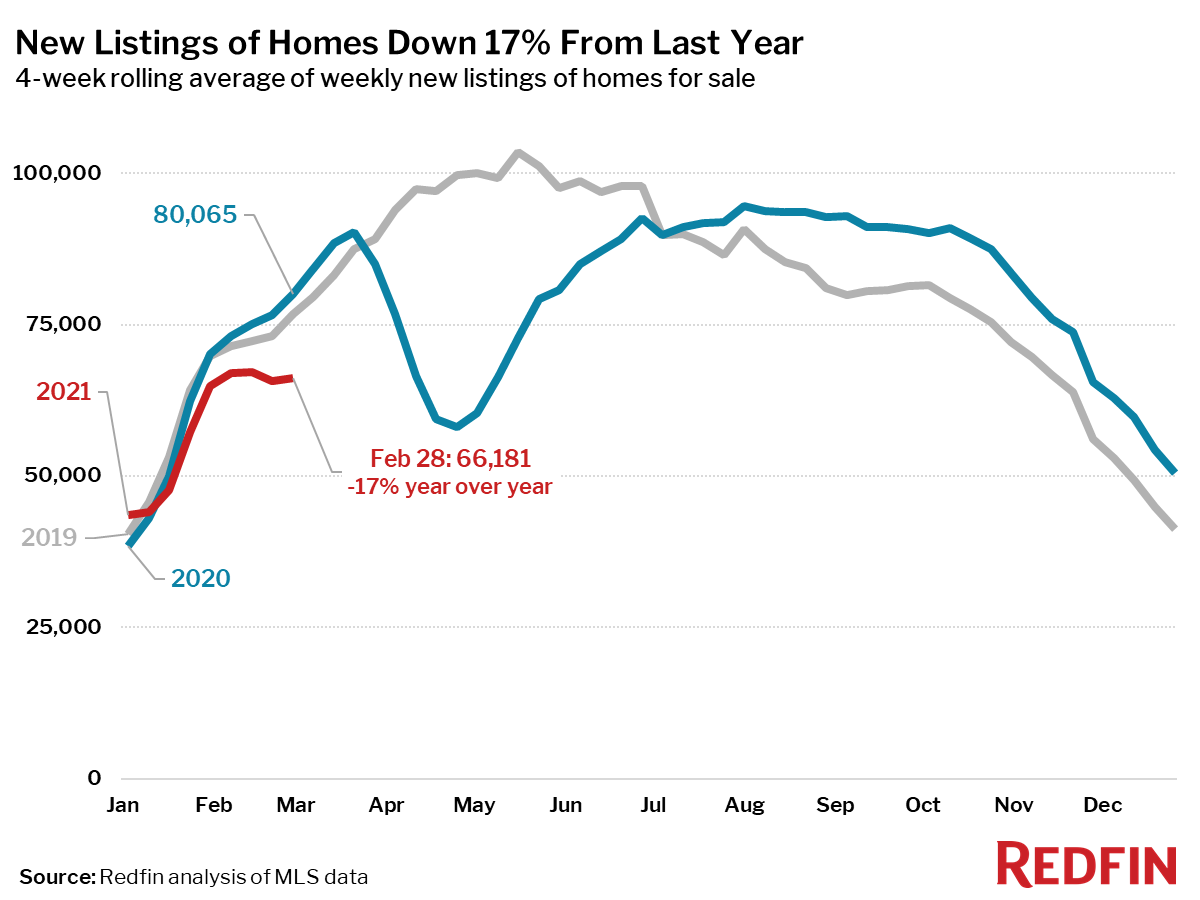

- New listings of homes for sale were down 17% from a year earlier.

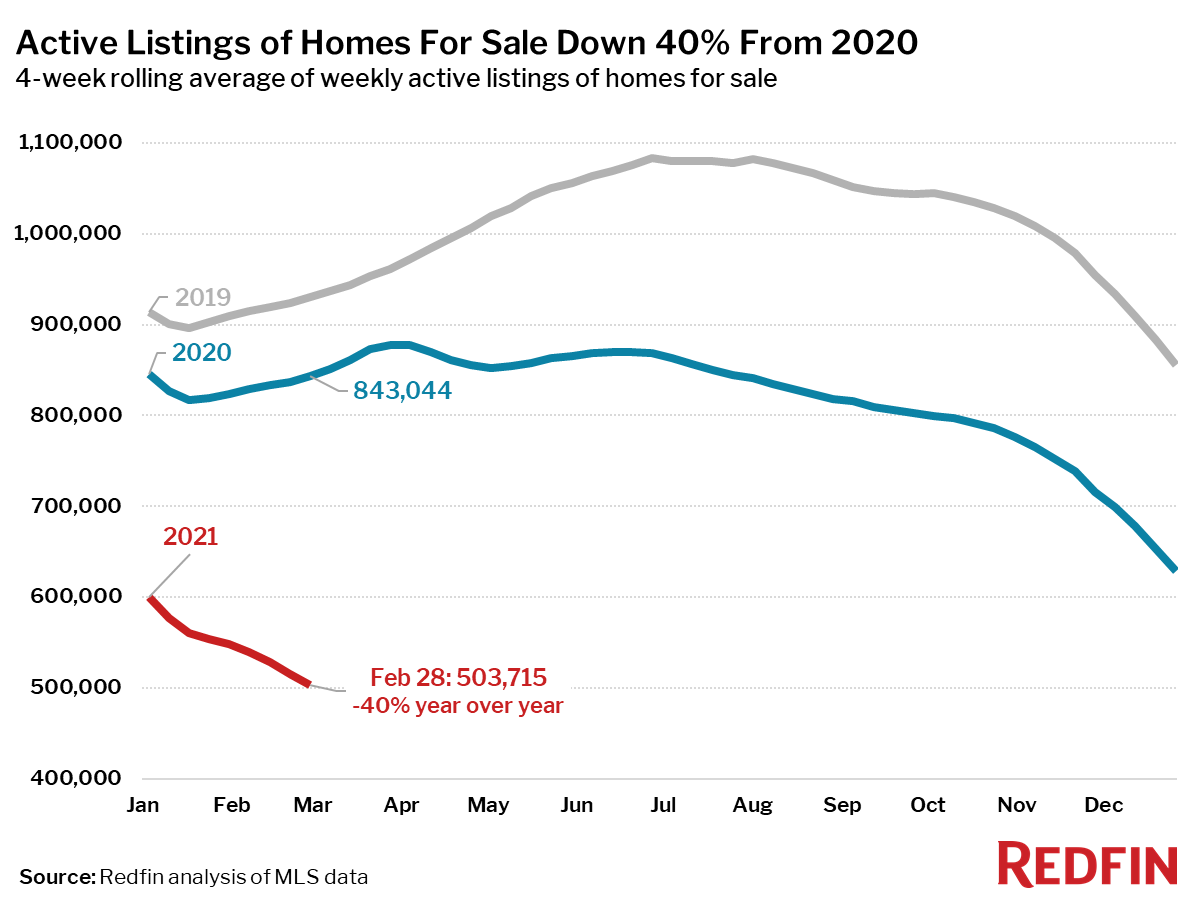

- Active listings (the number of homes listed for sale at any point during the period) fell 40% from 2020 to a new all-time low.

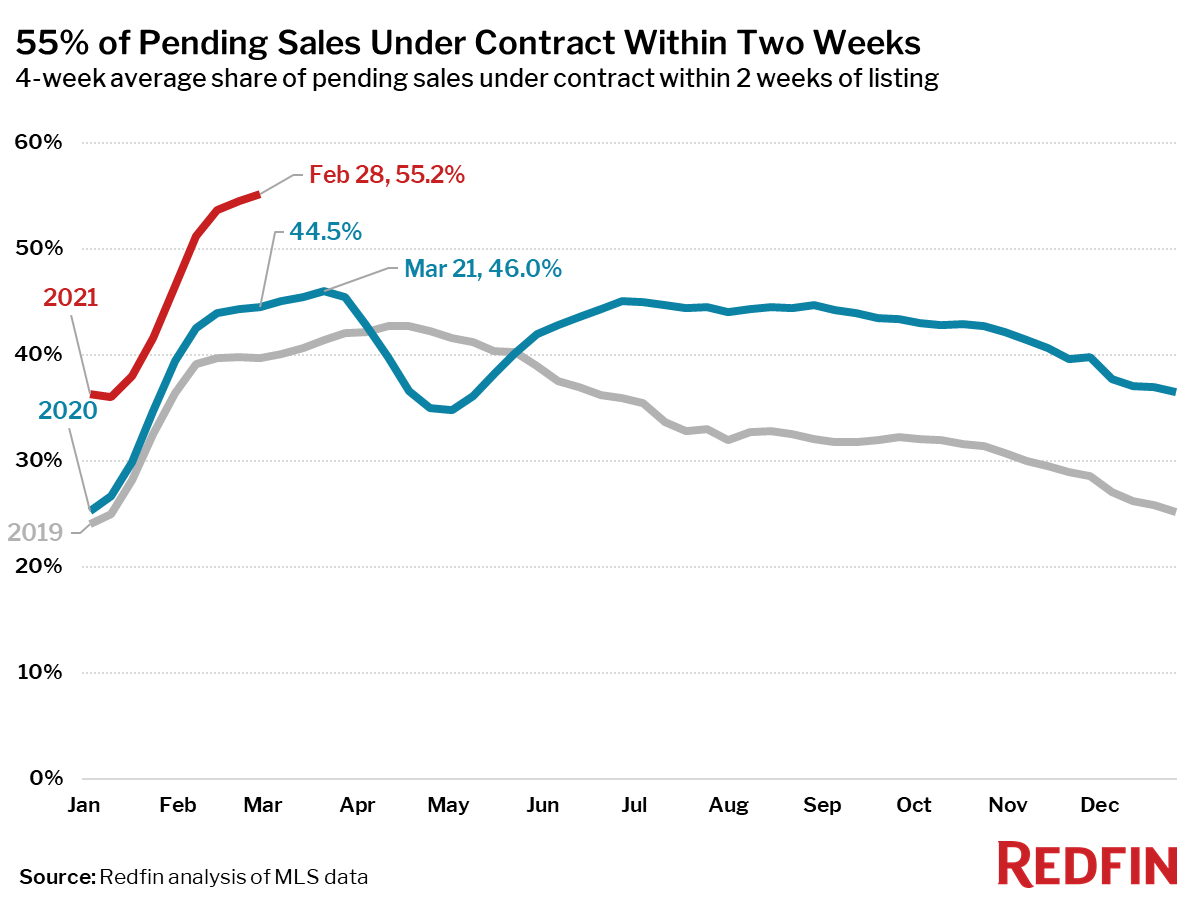

- 55% of homes that went under contract had an accepted offer within the first two weeks on the market, well above the 44% rate during the same period a year ago. This is another new all-time high for this measure since at least 2012 (as far back as Redfin’s data for this measure goes). During the week ending February 28, 57% of homes sold in two weeks or less.

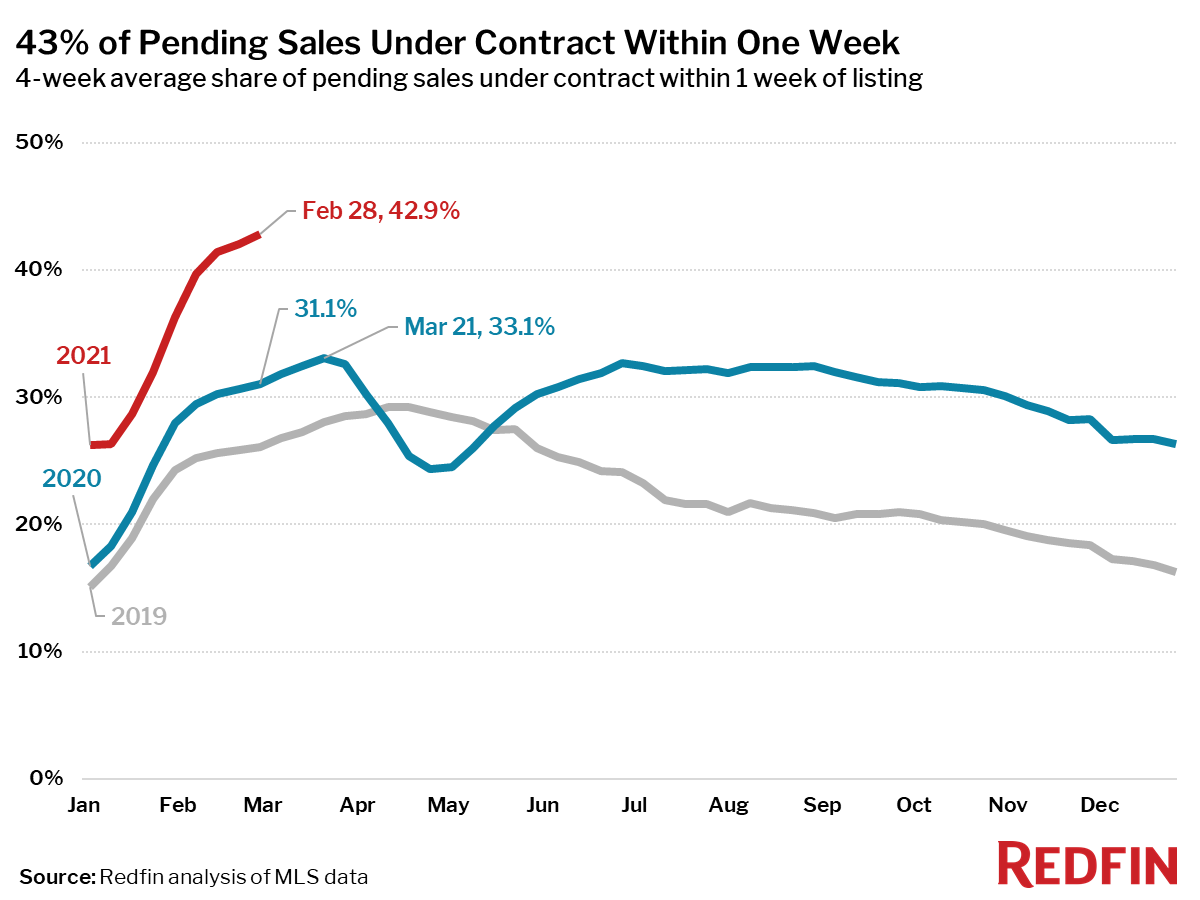

- 43% of homes that went under contract had an accepted offer within one week of hitting the market, up from 30% during the same period a year earlier. This is also an all-time high for this measure. During the week ending February 28, 44% sold in one week or less.

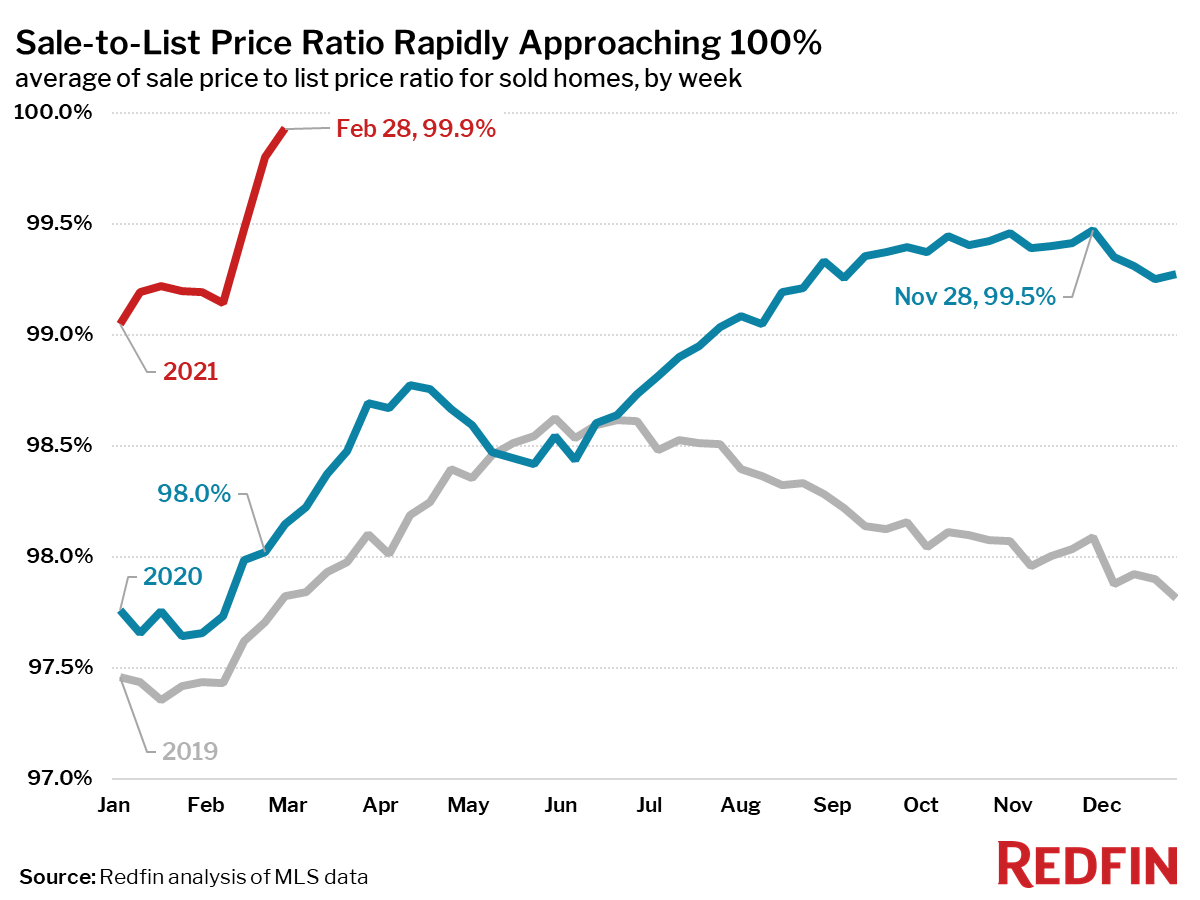

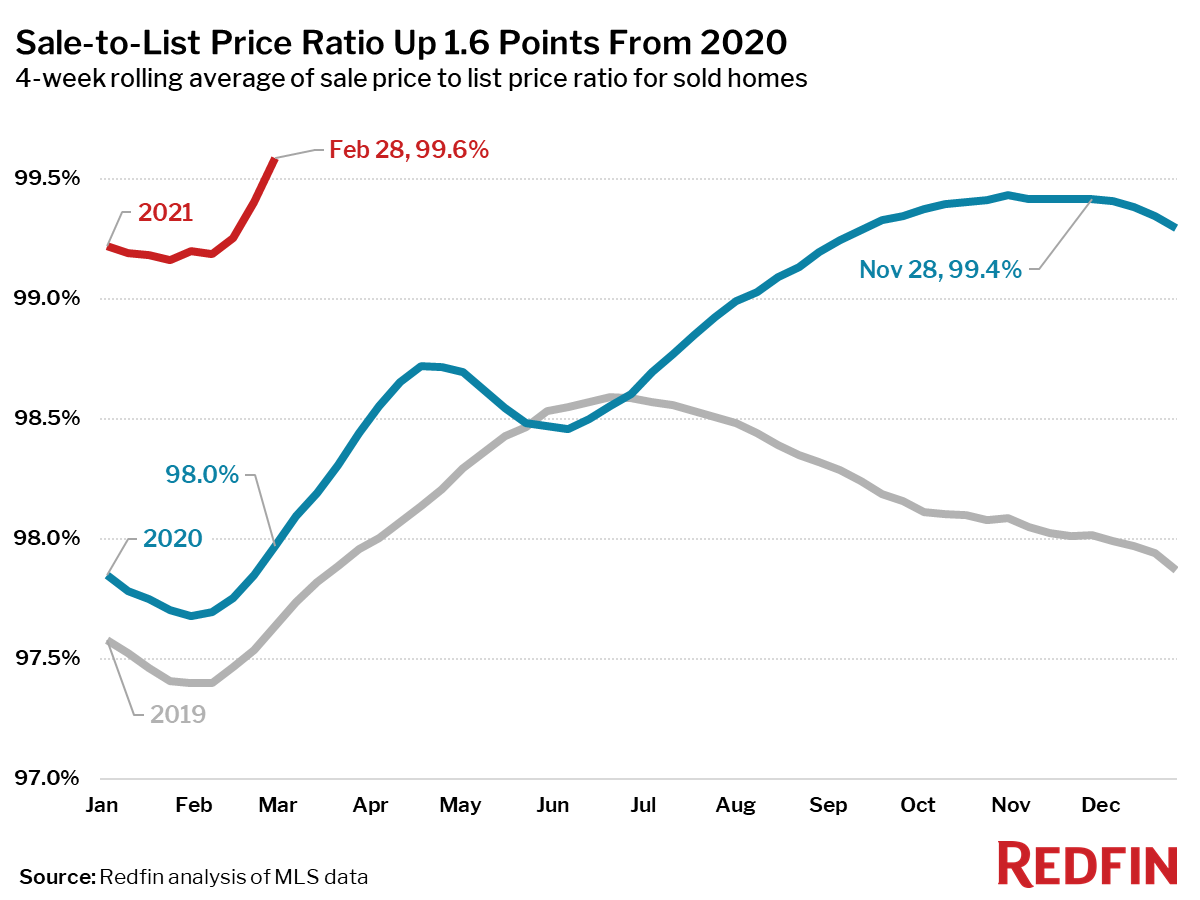

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, increased to 99.6%—1.6 percentage points higher than a year earlier and an all-time high. During the 7-day period ending February 28, the ratio shot up to 99.9%, also an all-time high.

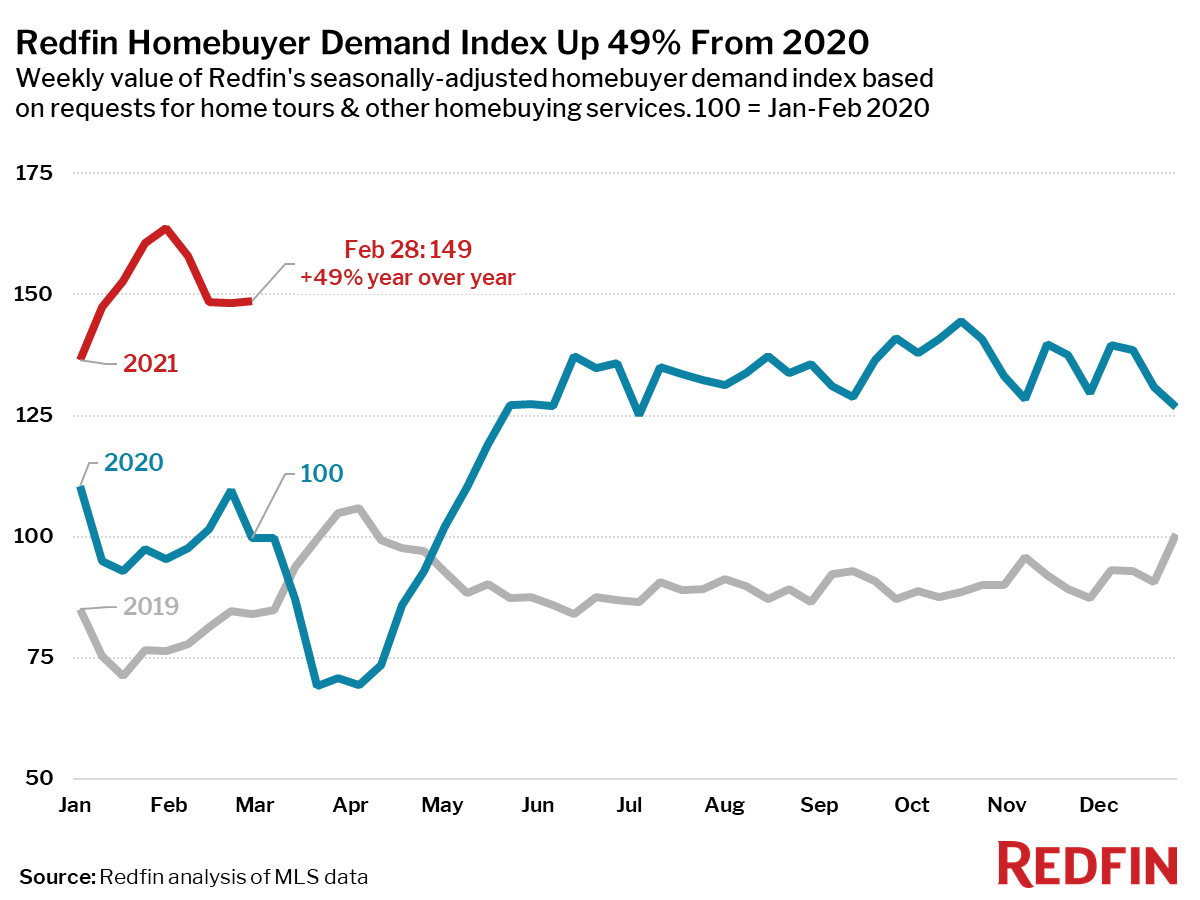

- For the 7-day period ending February 28, the seasonally adjusted Redfin Homebuyer Demand Index—a measure of requests for home tours and other services from Redfin agents—was up 49% from the same period a year ago.

- Mortgage purchase applications increased 2% week over week (seasonally adjusted) and were up 1% from a year earlier (unadjusted) during the week ending February 26. For the week ending March 4, 30-year mortgage rates increased to 3.02%, the highest level since July.

“Over the last few weeks winter storms have disrupted the housing market, and mortgage rates have risen sharply,” said Redfin Chief Economist Daryl Fairweather. “Although pending sales and new listings have taken a small hit in the last couple of weeks, home price gains are showing no signs of slowing down. However, It’s too early to tell what the impact of these changes will be to the spring housing market. The effects of the storms should be temporary, but higher mortgage rates could make some buyers less willing to bid up home prices.”

United States

United States Canada

Canada