Home prices have been surging by double digits for three and a half months as the mismatch between supply and demand continues.

Key housing market takeaways for 400+ U.S. metro areas during the 4-week period ending November 1:

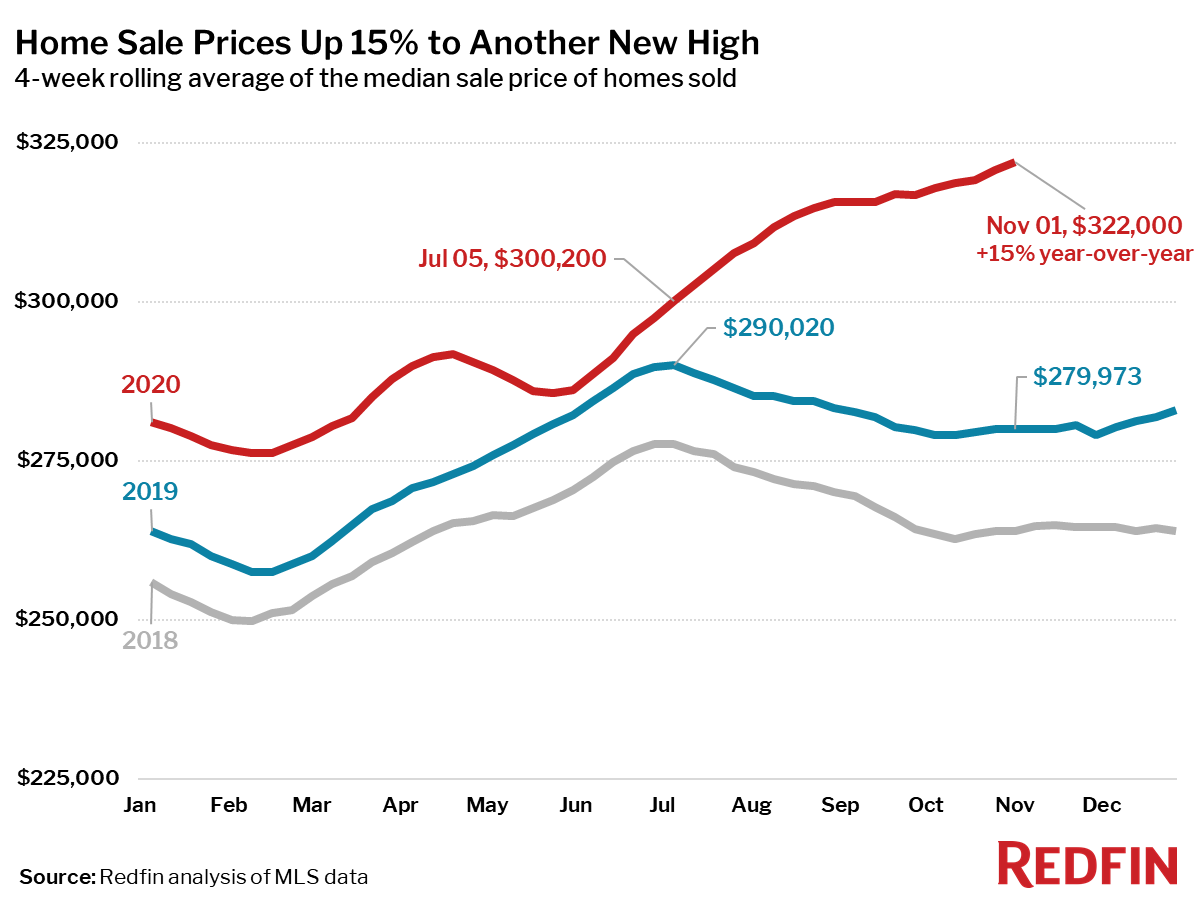

- The median home sale price increased 15% year over year to $322,000—the highest on record. In the week ending November 1, home prices were up 16% from the same week a year earlier. Home prices continue to buck their typical seasonal pattern. The national median home price typically peaks the first week of July and declines through the fall, but this year since the four-week period ending July 5, home prices have increased 7.3%. Over that same period in 2018 and 2019, prices declined 4.2%.

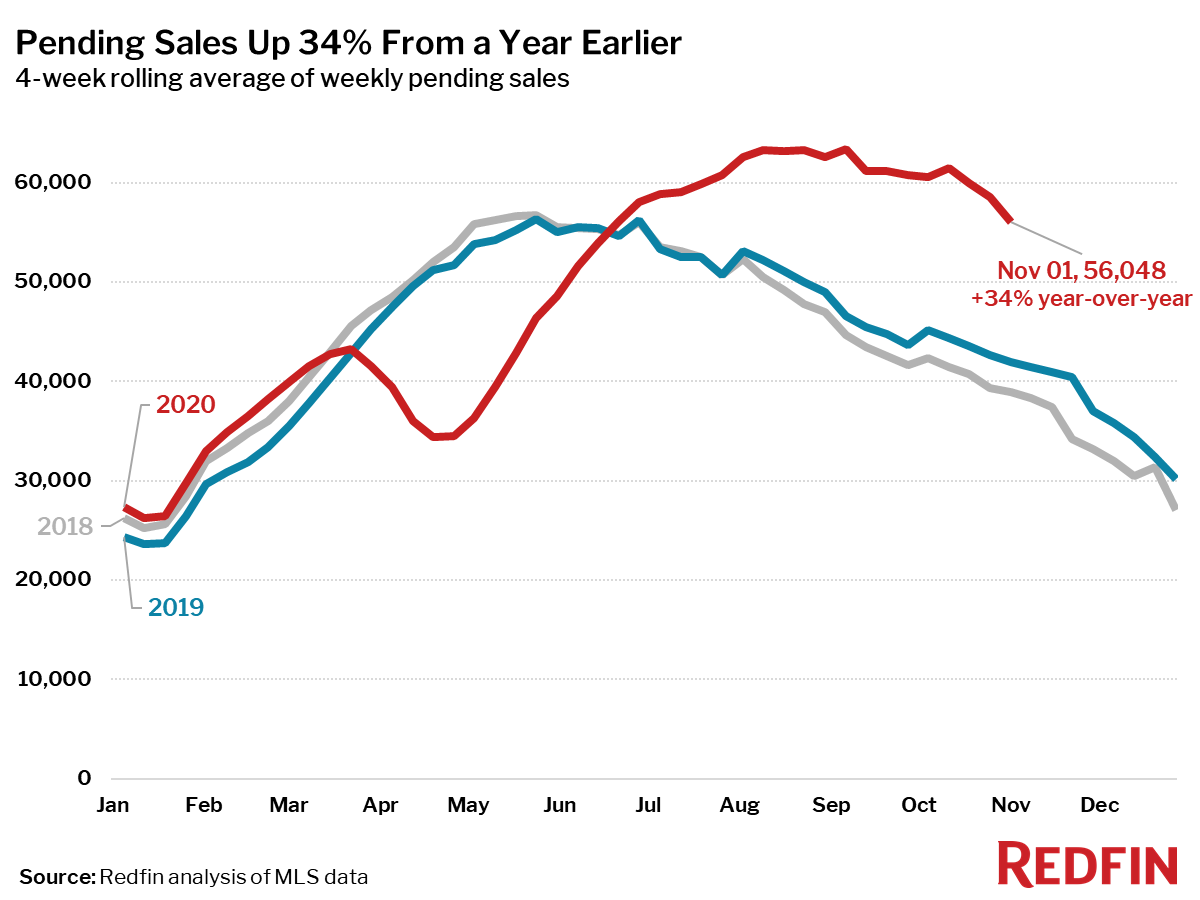

- Pending home sales climbed 34% year over year even as the number of pending sales continued a typical seasonal decline.

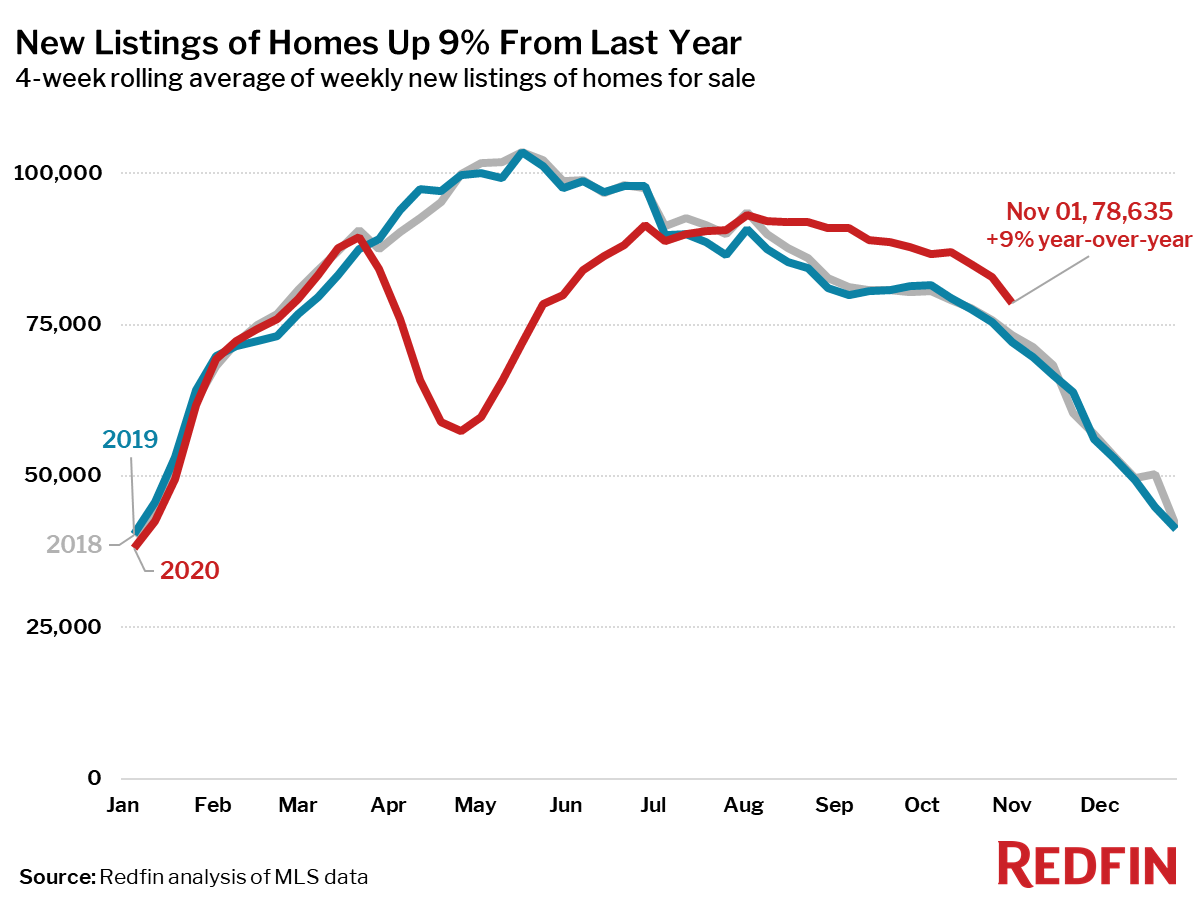

- New listings of homes for sale were up 9% from a year earlier.

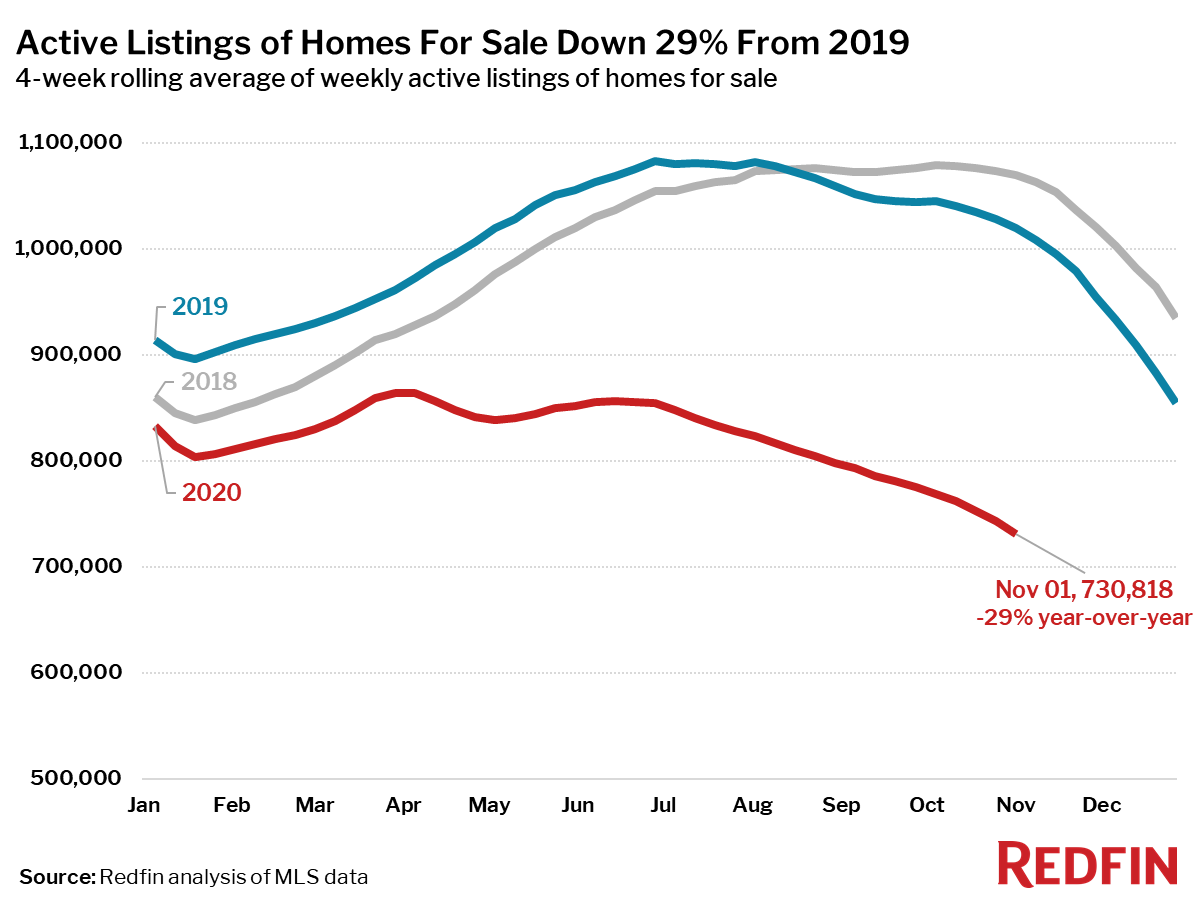

- Active listings (the number of homes listed for sale at any point during the period) fell 29% from 2019 to a new all-time low.

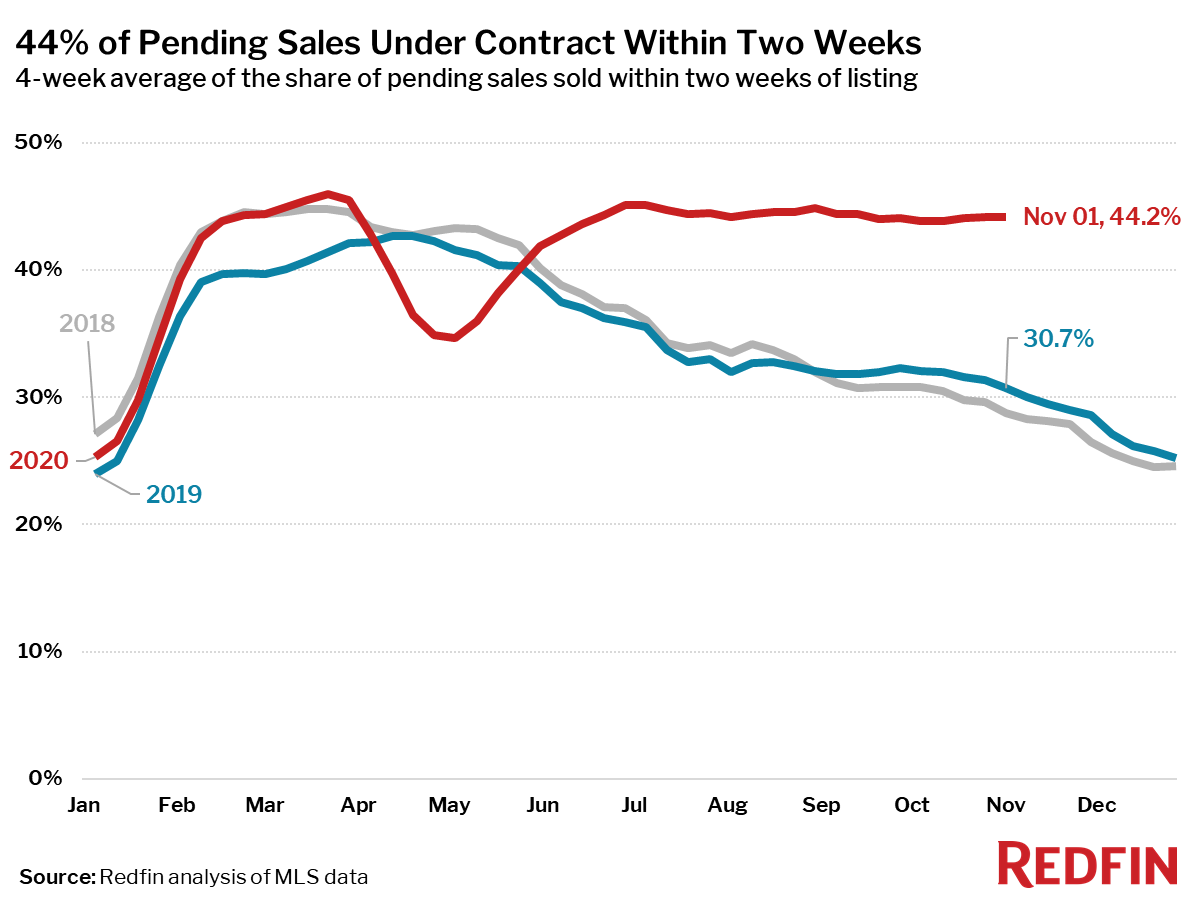

- 44% of homes that went under contract had an accepted offer within the first two weeks on the market. This measure typically peaks in April or May and declines through the end of the year, but this year it has held steady since late June and is currently 14 points higher than it was at this time a year ago.

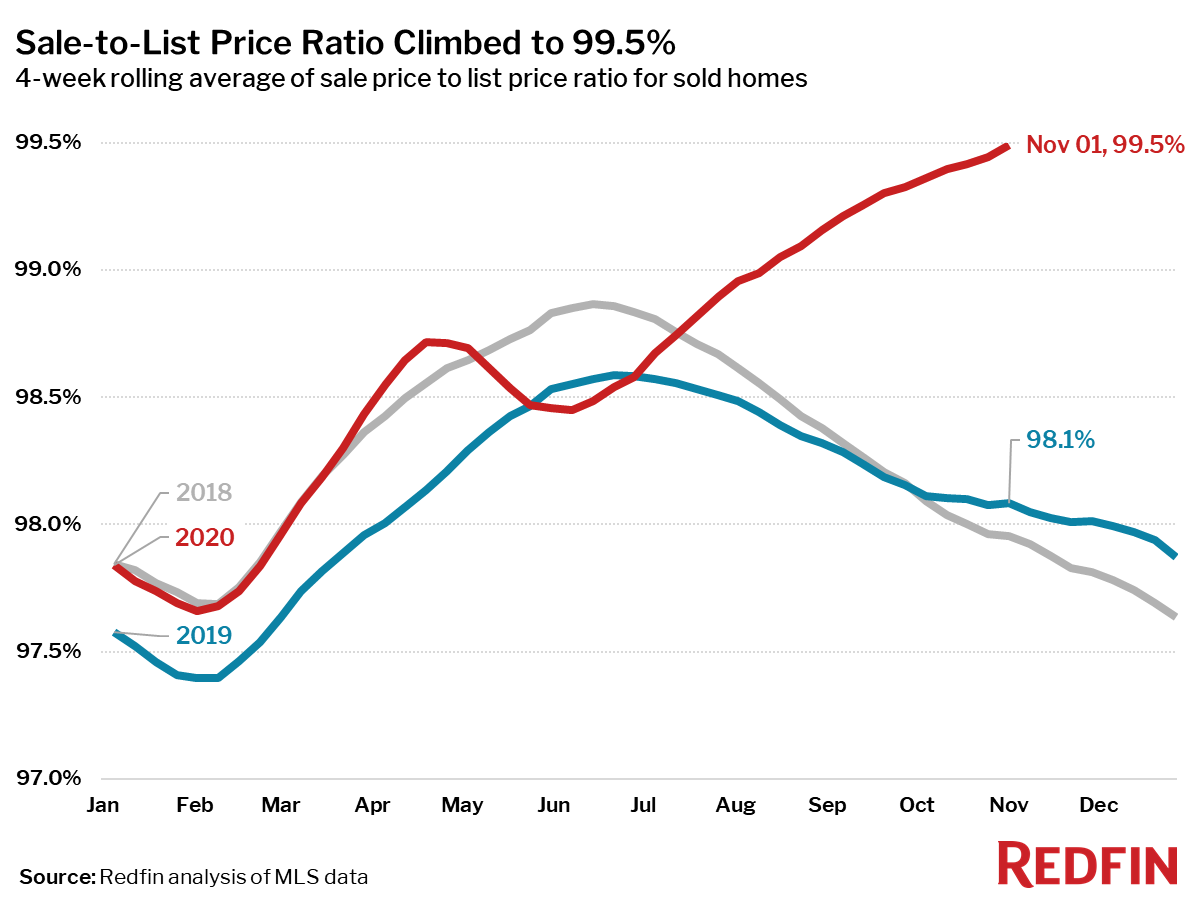

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, rose to 99.5%—an all-time high and 1.4 percentage points higher than a year earlier.

- For the week ending November 1, the seasonally adjusted Redfin Homebuyer Demand Index was up 31% from pre-pandemic levels in January and February.

- Mortgage applications decreased 1% week over week (seasonally-adjusted) and were up 25% from a year earlier (unadjusted) during the week ending October 30. For the week ending November 5, 30-year mortgage rates declined to 2.78%. Rates have been below 3% since late July.

“Some sellers may be waiting until after the election results are certain before they list their homes,” said Redfin chief economist Daryl Fairweather. “But homebuyers are still rushing into the market to take advantage of record-low mortgage rates. Mortgage rates could fall even further this month if the election outcome remains uncertain. Lower mortgage rates could push even more buyers to purchase a home in the remaining months of 2020.”

United States

United States Canada

Canada