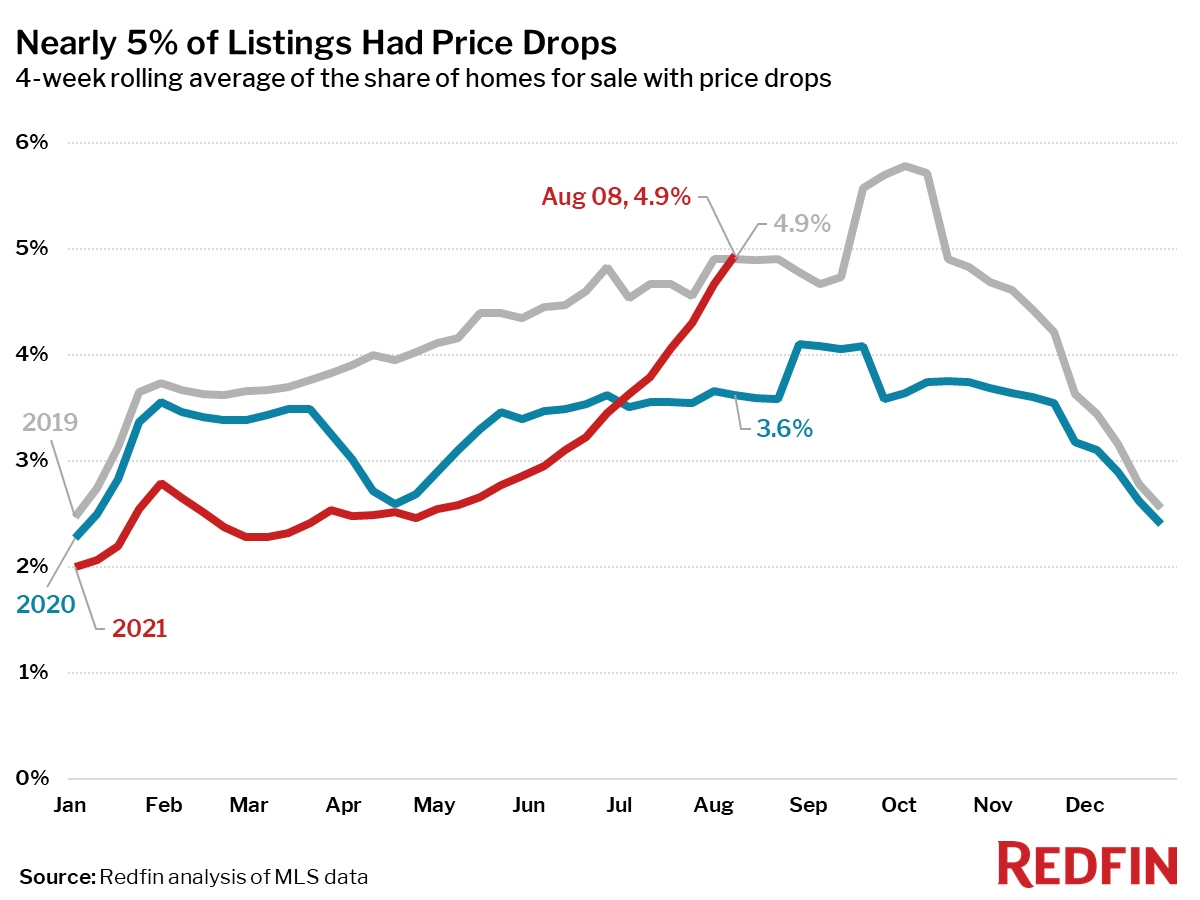

Nearly 5% of listings saw price drops, the highest level since 2019.

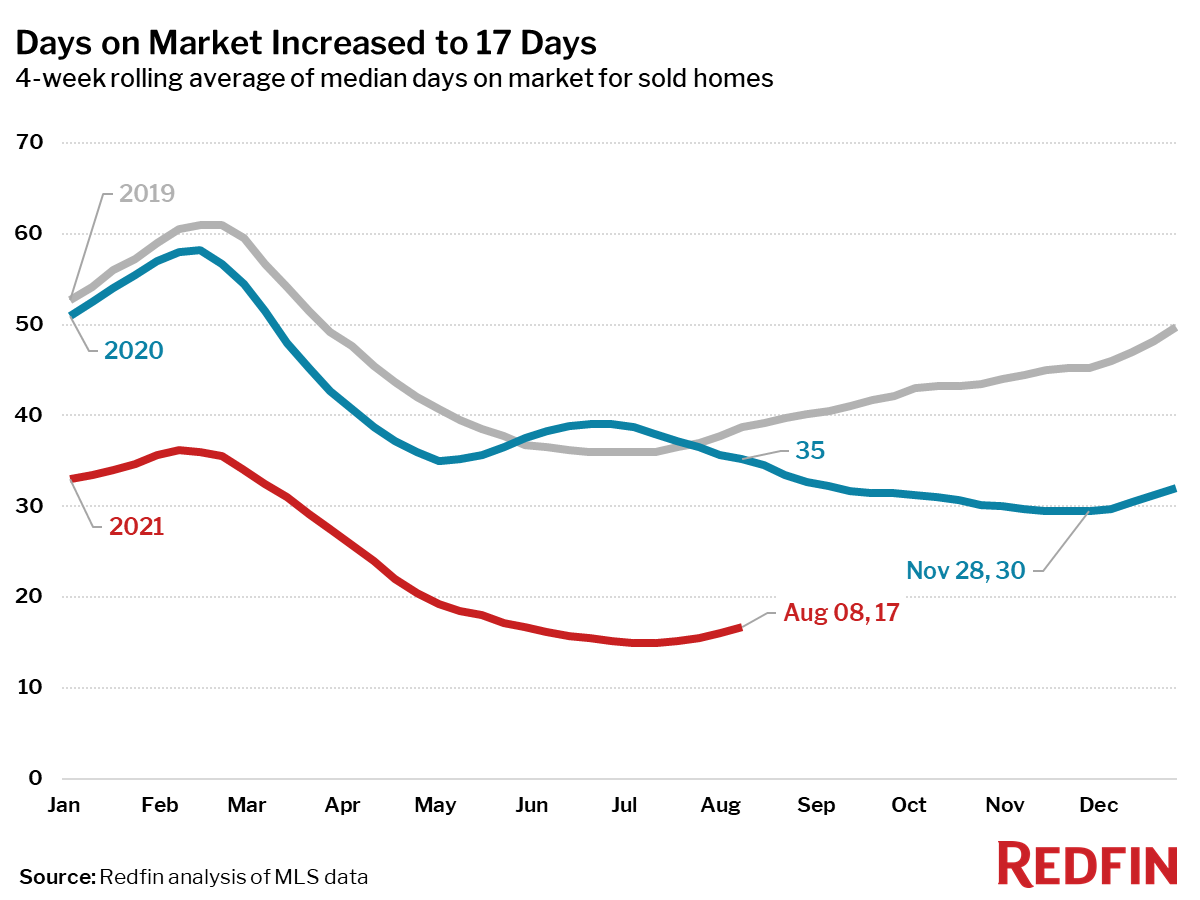

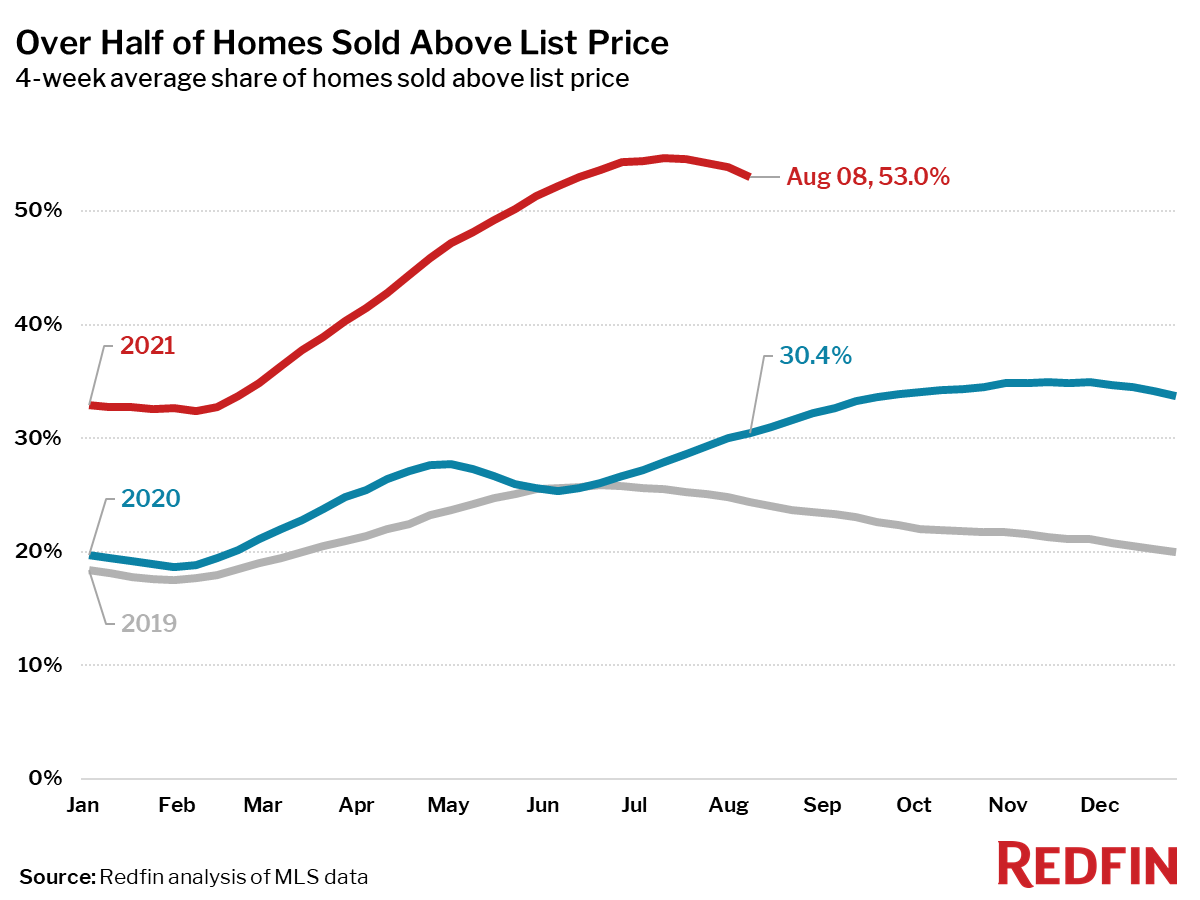

Home sellers are increasingly realizing that the housing market is no longer heating up. The share of homes for sale with a price drop rose for the fifteenth consecutive week to 4.9%, a level last seen in 2019. Buyers may also be starting to notice that homes are staying on the market a little longer—a median 17 days—as more homeowners are listing their homes and at more realistic prices. Asking prices have eased back to where they were in May, and while they are still being bid up half the time, homes are selling for less of a premium above list price than they were last month.

Overall, the market is becoming more balanced and following typical seasonal trends. The scales are still tipped in favor of sellers, but not as dramatically as they were in the spring.

“For the first time in over a year, homebuyers don’t need to feel rushed,” said Redfin Chief Economist Daryl Fairweather. “Although the market still feels tight and competitive, the number of homes for sale keeps creeping up as more homes are listed. Those home sellers are adjusting their price expectations or seeing their homes sit on the market. There could be even more listings coming on the market as mortgage forbearance ends and homeowners with missed payments decide to sell. And mortgage rates remain near all-time lows with no signs of an increase on the horizon.”

Key housing market takeaways for 400+ U.S. metro areas:

Unless otherwise noted, the data in this report covers the four-week period ending August 8. Redfin’s housing market data goes back through 2012.

Data based on homes listed and/or sold during the period:

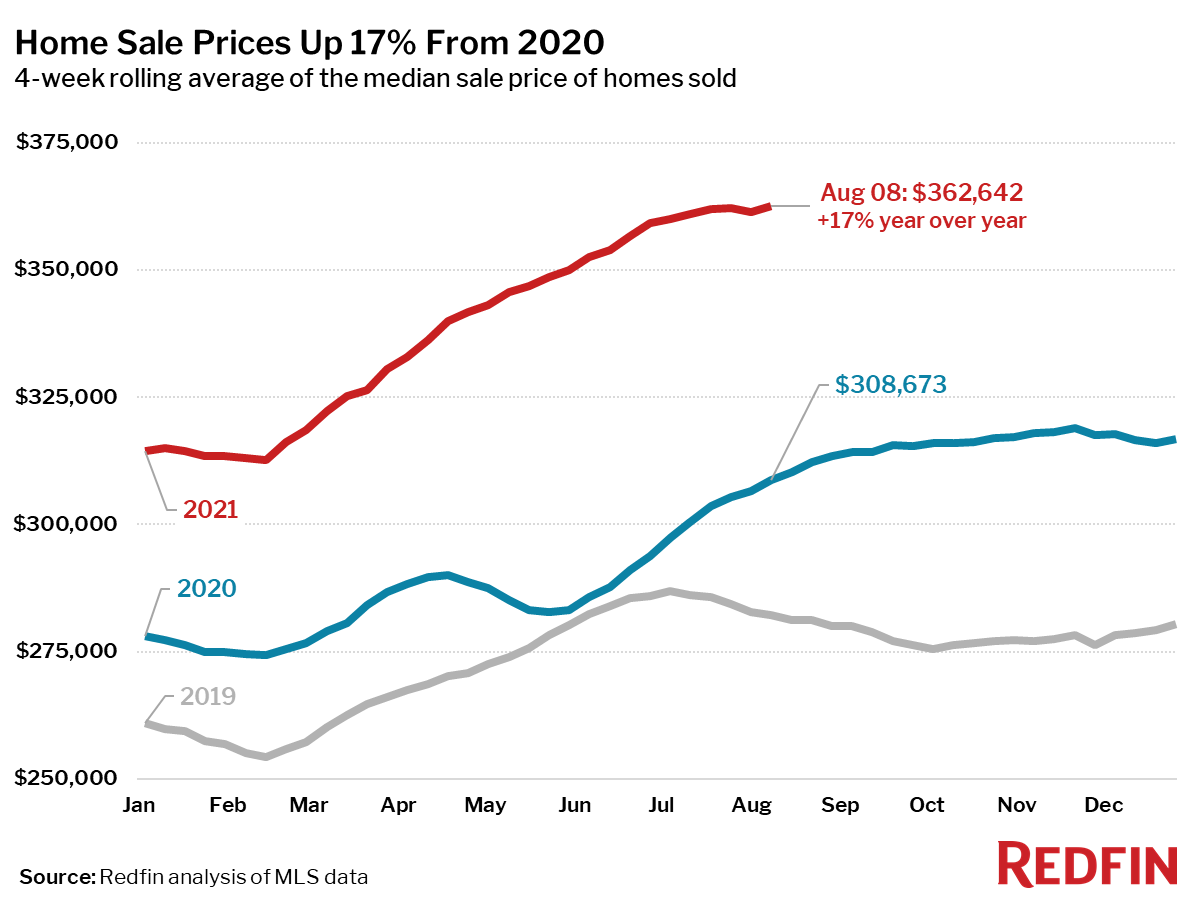

- The median home-sale price increased 17% year over year to $362,642, a record high.

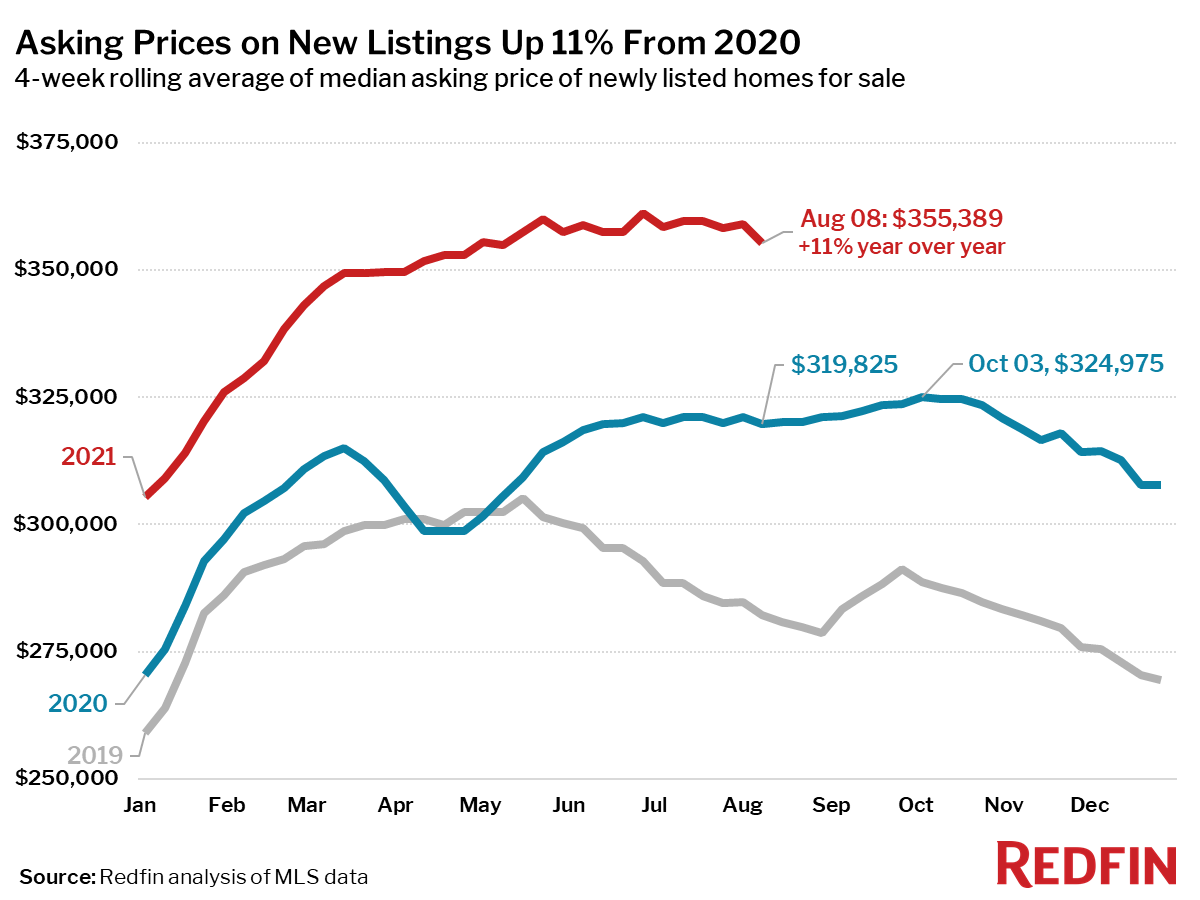

- Asking prices of newly listed homes were up 11% from the same time a year ago to a median of $355,389. This is down 1.6% from the all-time high set during the four-week period ending June 27, and the lowest since early May.

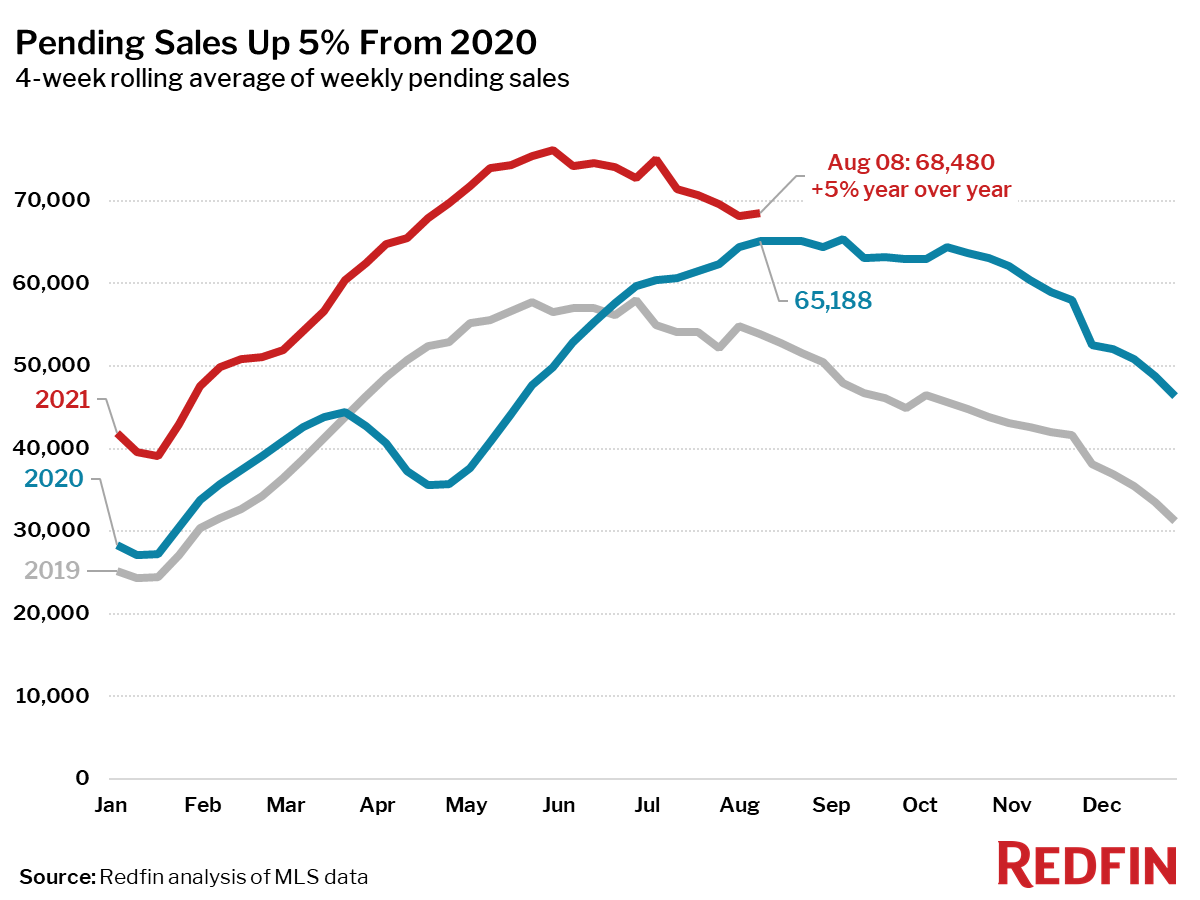

- Pending home sales were up 5% year over year, the smallest increase since the four-week period ending June 28, 2020. Pending sales were down 10% from their 2021 peak during the four-week period ending May 30, a faster fall than the 5% decrease over the same period in 2019.

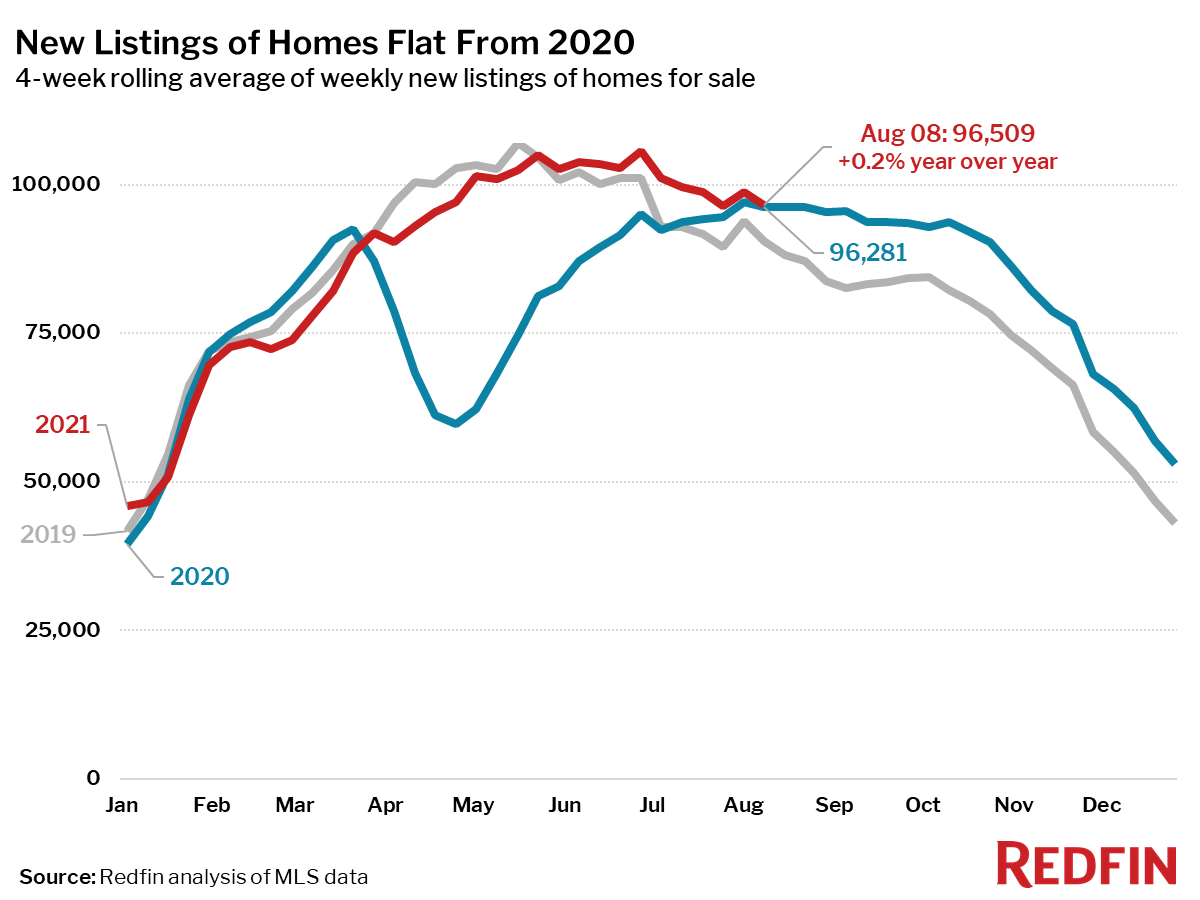

- New listings of homes for sale were up 0.2% from a year earlier. The number of homes being listed is in a typical seasonal decline, down 9% from the 2021 peak during the four-week period ending June 27, compared to a 10% decline over the same period in 2019.

- Active listings (the number of homes listed for sale at any point during the period) fell 25% from 2020—the smallest decline since the four-week period ending December 6, 2020—and have climbed 15% since their 2021 low during the four week period ending March 7.

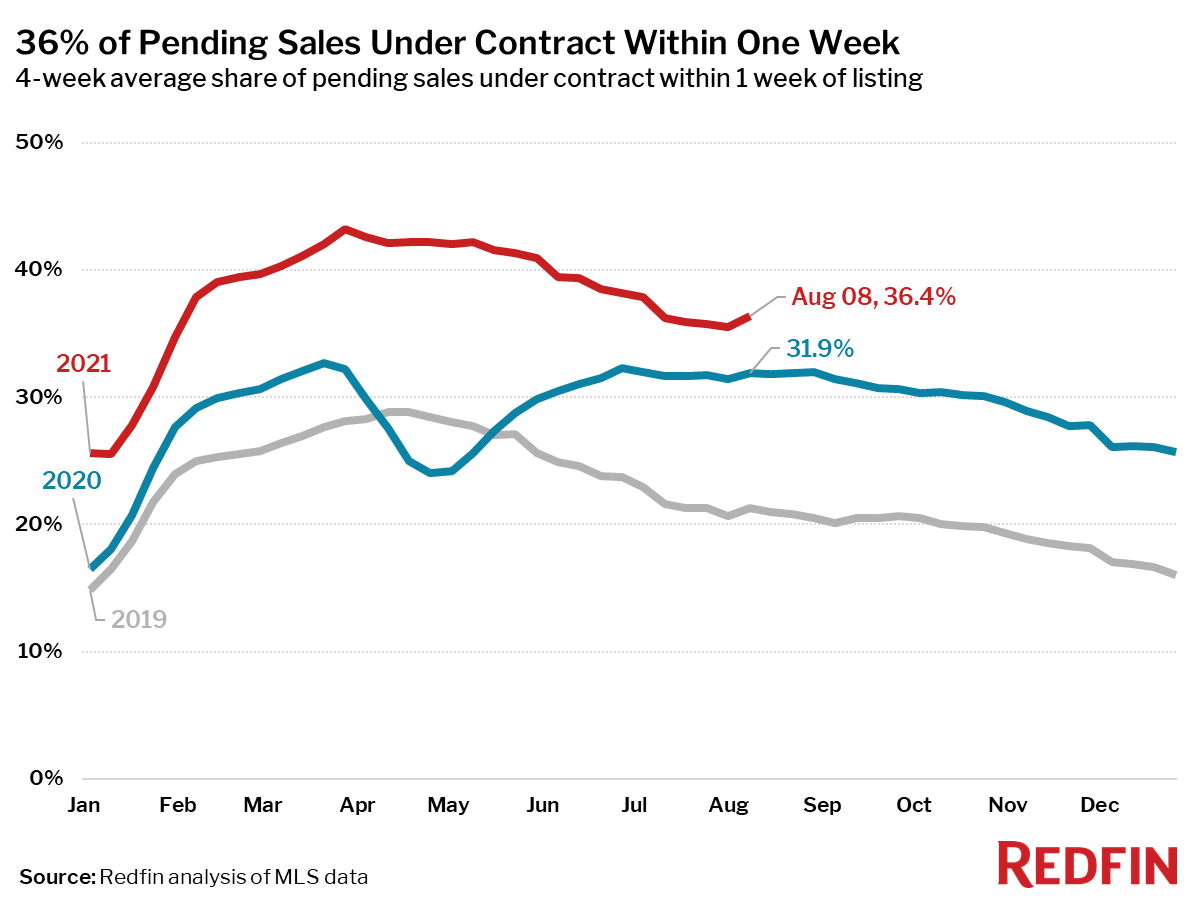

- 50% of homes that went under contract had an accepted offer within the first two weeks on the market, well above the 44% rate during the same period a year ago, but down 7 percentage points from the high point of the year, set during the four-week period ending March 28.

- 36% of homes that went under contract had an accepted offer within one week of hitting the market, up from 32% during the same period a year earlier, but down 7 percentage points from the high point of the year, set during the four-week period ending March 28.

- Homes that sold were on the market for a median of 17 days, up from the all-time low of 15 days that had held for four weeks in late June and July, and down from 35 days a year earlier.

- 53% of homes sold above list price, up from 30% a year earlier. This measure has been falling since the four-week period ending July 11 when it peaked at 55%.

- The share of homes for sale with price drops rose to 4.9%, on par with 2019 levels and 1.3 percentage points higher than this time last year.

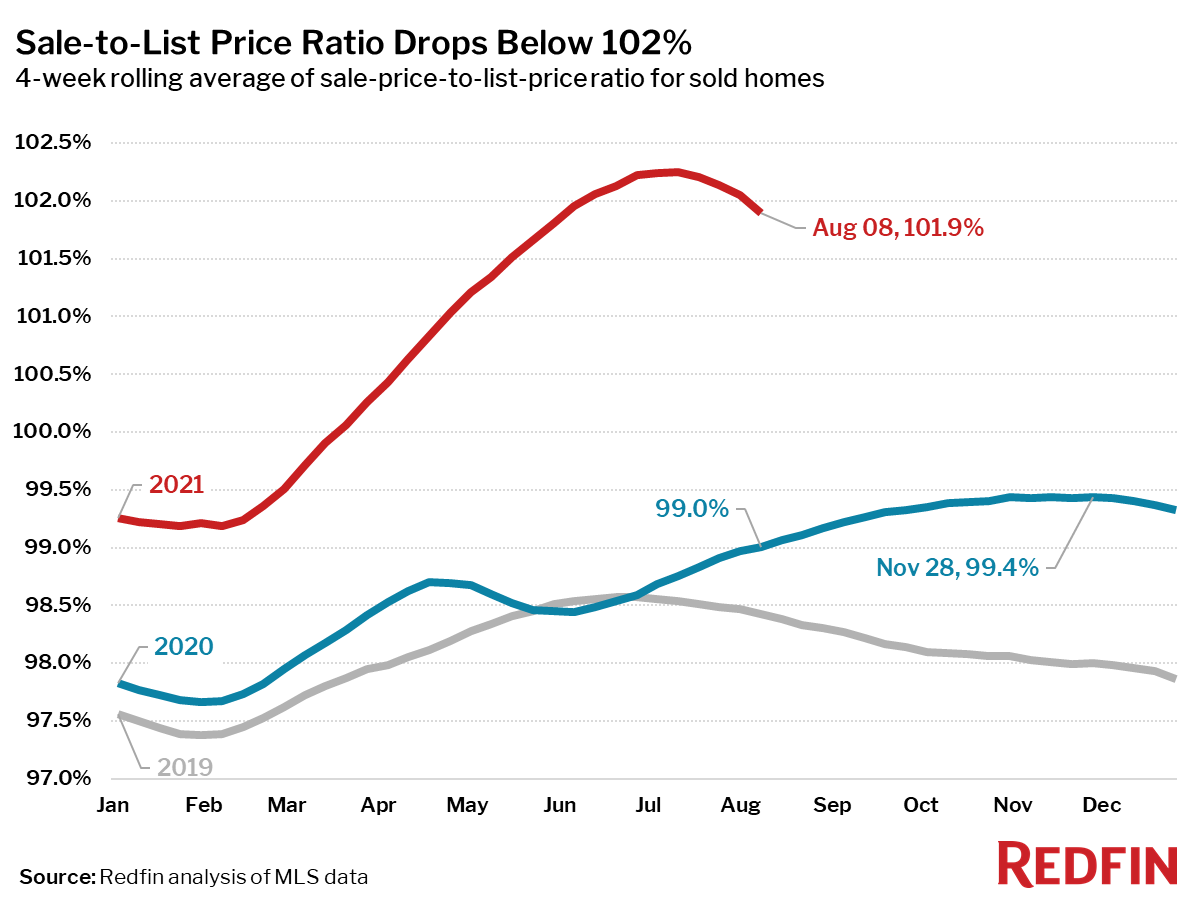

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, decreased to 101.9%. In other words, the average home sold for 1.9% above its asking price. This measure is down 0.4 percentage points from its peak during the four-week period ending July 11, and up 2.9 percentage points from a year earlier.

Other leading indicators of homebuying activity:

- Mortgage purchase applications increased 2% week over week (seasonally adjusted) during the week ending August 6. For the week ending August 12, 30-year mortgage rates rose to 2.87%, the highest level in four weeks.

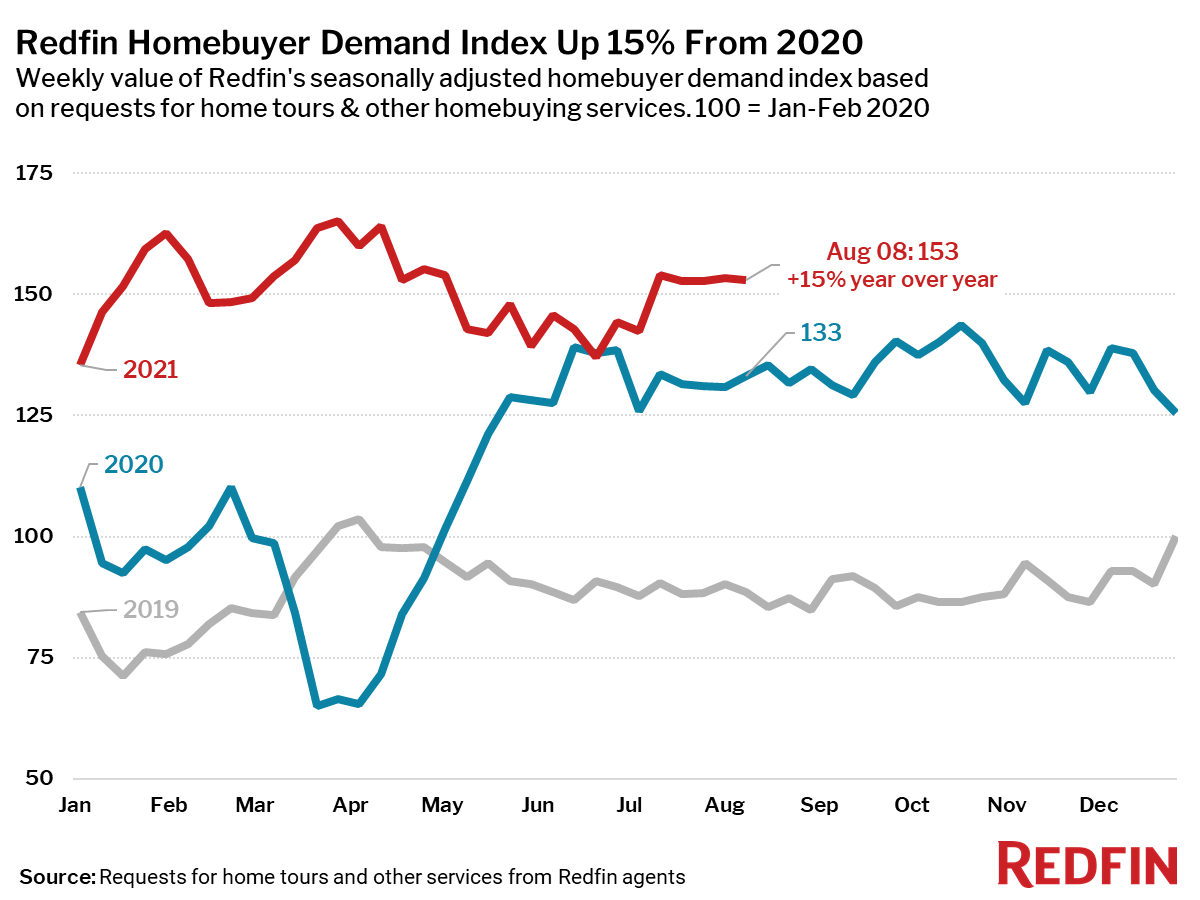

- From January 1 to August 8, home tours went up 15%, compared to a 42% increase over the same period last year according to home tour technology company ShowingTime.

- The seasonally adjusted Redfin Homebuyer Demand Index—a measure of requests for home tours and other services from Redfin agents—has been roughly flat since the four-week period ending July 11, and was up 15% from a year earlier.

Refer to our metrics definition page for explanations of all the metrics used in this report.

United States

United States Canada

Canada