-

Return-to-office mandates are forcing some people to choose between selling their home at a loss or losing their job.

-

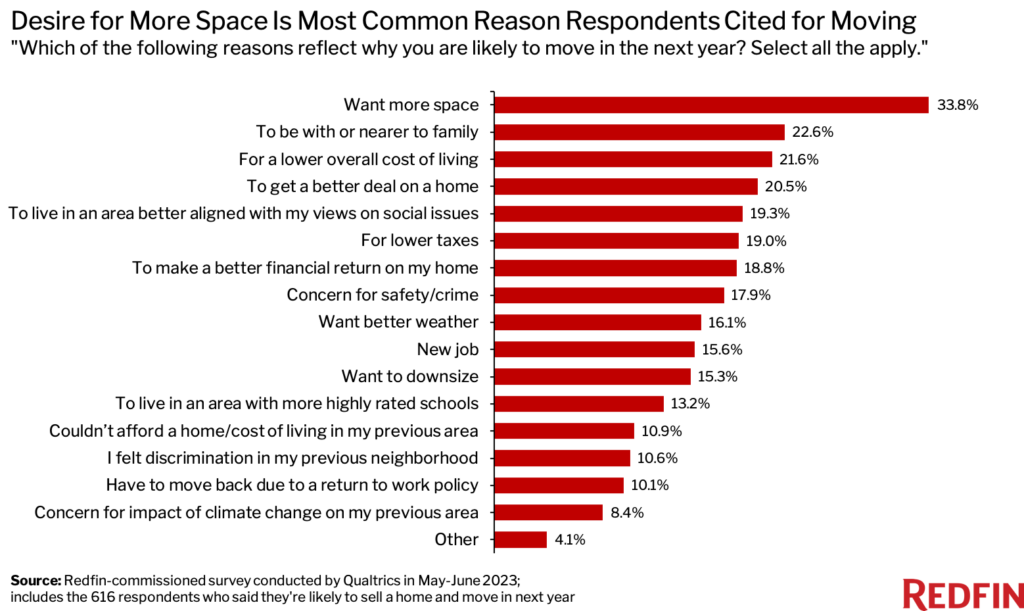

Roughly 20% of surveyed sellers say they’re moving due to safety/crime concerns, a desire to live somewhere more aligned with their social views and/or lower taxes.

-

About 10% of respondents cite discrimination in their neighborhood and/or worries about climate change as reasons for their move.

-

The most common reasons respondents give for relocating are the desire for more space, proximity to family and a lower cost of living.

Return-to-work policies are motivating one of every 10 (10.1%) U.S. home sellers to relocate.

That’s according to a Redfin-commissioned survey conducted by Qualtrics in May and June 2023. The survey was fielded to 5,079 U.S. residents. This report focuses on the 616 respondents who indicated that they’re likely to sell a home and move in the next year.

While returning to the office wasn’t the most common reason respondents listed for moving, the response rate is notable because back-to-office mandates are an emerging cause of relocation.

In Boise, ID, Redfin Premier real estate agent Shauna Pendleton has a pair of clients who are selling their home after only about a year because their Seattle-based employer is requiring them to return to the office. They will likely have to sell at a loss since they bought when home prices were near their peak.

“My sellers both work at the same company, which told them they have to be in the office three days a week or they’ll lose their jobs. They have six months to make the move,” Pendleton said. “They’ll probably have to take a $100,000 loss on their home. Their new house in Seattle won’t be anything close to the size of their property in Boise, and their mortgage rate will be much higher.”

Amazon, Apple, Goldman Sachs, Google, JPMorgan Chase and Meta are among the major corporations that have asked their employees to come back to the office at least part time.

Redfin asked employees living within a 20 mile radius of its Seattle, San Francisco and Frisco offices to return to the office two days a week, but did not ask employees to relocate.

Roughly 1 in 5 Respondents Cited Social Views, Taxes, Crime as Reasons for Move

With mortgage rates near the highest level in over two decades, there aren’t a ton of people selling their homes, meaning many of those who are selling are doing so because they don’t have the luxury to wait. But the results of Redfin’s survey show that movers today are still considering factors including climate change and social issues when deciding where to live.

Nearly one in five (19.3%) respondents with plans to sell their home in the next year said they want to relocate to live in a place better aligned with their views on social issues. A similar share cited lower taxes (19%) and concerns about safety/crime (17.9%).

Also notable: one in 10 (10.6%) respondents said they’re planning to move because they’ve dealt with discrimination in their neighborhood. A similar share (8.4%) listed concerns about the impact of climate change on their neighborhood as a reason for relocation.

“Real estate is all about priorities and compromise,” said Redfin Chief Economist Daryl Fairweather. “While a lot of homeowners are staying put, refusing to give up their rock-bottom mortgage rates, some are opting to trade their low rate for a safer neighborhood, lower taxes and/or neighbors with the same political views.”

The desire for more space is the most common factor driving people to relocate, with one-third (33.8%) of respondents citing it as a reason for their move. Next came the desire to be closer to family (22.6%), followed by the desire for a lower cost of living (21.6%).

Many of the people who are moving today want homes that are bigger and less expensive. While those two pursuits may seem contradictory, some house hunters are achieving both by moving somewhere that’s more affordable. Of course, high mortgage rates are eating away some of the benefit of relocating to a less expensive place, with the average 30-year-fixed mortgage rate now at 7.12%.

United States

United States Canada

Canada