- Rents hit a low point last February—one reason they’re now showing a sizable year-over-year uptick.

- Another factor driving rents up: the jump in mortgage rates last month, which buoyed rental demand.

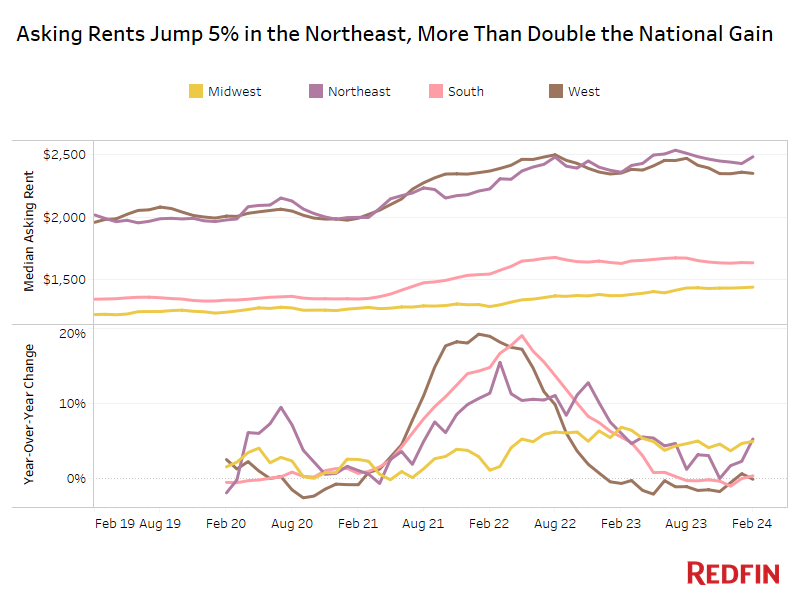

- The Northeast and Midwest were the biggest gainers, with asking rents rising roughly 5% from a year earlier. Rents in the West and South were roughly flat.

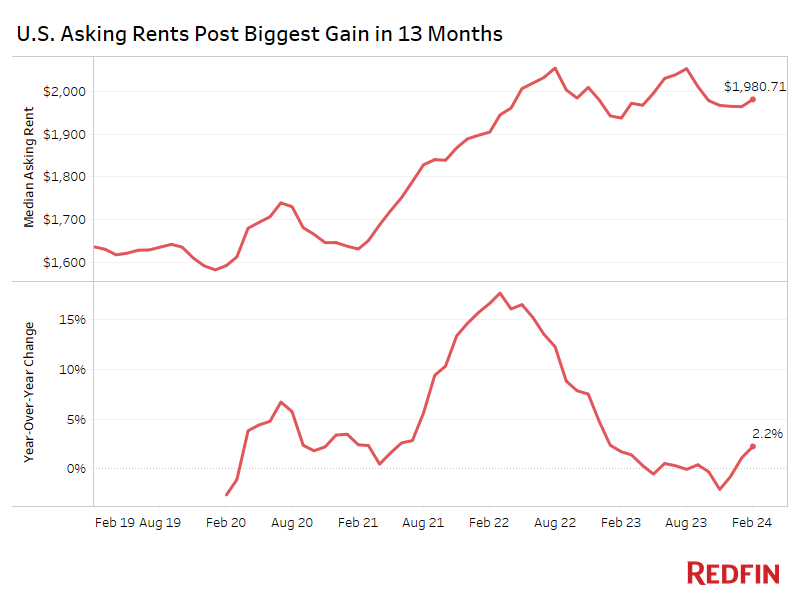

The median U.S. asking rent rose 2.2% year over year to $1,981 in February, the largest gain since January 2023, and increased 0.9% from a month earlier.

Asking rents hit a low point last February, which is one reason we saw a sizable year-over-year increase this February. Mortgage rates were also likely at play.

“Mortgage rates ticked back up in February—a disappointing development for prospective homebuyers, who just a few months ago got a glimmer of hope as rates finally started to fall,” said Redfin Chief Economist Daryl Fairweather. “With rates still elevated, many are opting to continue renting, which is buoying rental demand, and as a result, rent prices.”

It’s worth noting that the Federal Reserve is expected to lower interest rates before the end of the year, which could turn more renters into buyers and cause asking rents to dip again.

An increase in rents in the Northeast and Midwest also contributed to the jump in asking rents in February, which we will discuss further in the next section.

While rents jumped in February, they’re relatively stable compared to the past two years, when the pandemic sent the rental market on a rollercoaster ride. For the majority of 2022, growth in asking rents slowed rapidly following a surge during the pandemic, and in 2023, asking rents actually declined on a year-over-year basis.

The median asking rent in February was $73 below (-3.5%) the record high set in August 2022 (rents often peak in the summer and trough in the winter), but was still $387 higher (+24.3%) than it was in February 2020—the month before the coronavirus was declared a pandemic and a moving frenzy started driving up rents. That means affordability remains strained for many U.S. renters.

The Northeast and Midwest Lead the Nation in Rent Increases

The median asking rent in the Northeast jumped 5.2% year over year to $2,481 in February—the largest gain in nine months. Rents in the Midwest saw a similar increase, rising 4.9% to $1,441—the biggest increase in five months. Meanwhile, asking rents in the South and West were essentially flat, rising 0.3% to $1,635 and falling 0.1% to $2,349, respectively.

The Northeast and West have been nearly tied for the most expensive rental region for much of recent history, but switched spots over the last year; the West was the priciest region for much of the pandemic homebuying frenzy, but the Northeast reclaimed the top spot in November 2022 and has held it ever since.

Rents are likely holding up best in the Northeast and Midwest because those regions haven’t been building as much as the South and West, meaning landlords aren’t under as much pressure to fill vacancies.

Methodology

Asking price data includes single-family homes, multi-family units, condos/co-ops and townhouses from Rent.com and Redfin.com.

Redfin has removed metro-level data from monthly rental reports for the time being as it works to expand its rental analysis.

Prices reflect the current costs of new leases during each time period. In other words, the amount shown as the median rent is not the median of what all renters are paying, but the median asking price of apartments that were available for new renters during the report month.

United States

United States Canada

Canada