High home prices and mortgage rates, along with economic uncertainty and an increase in second-home loan fees, have put an end to the pandemic-driven vacation-home boom.

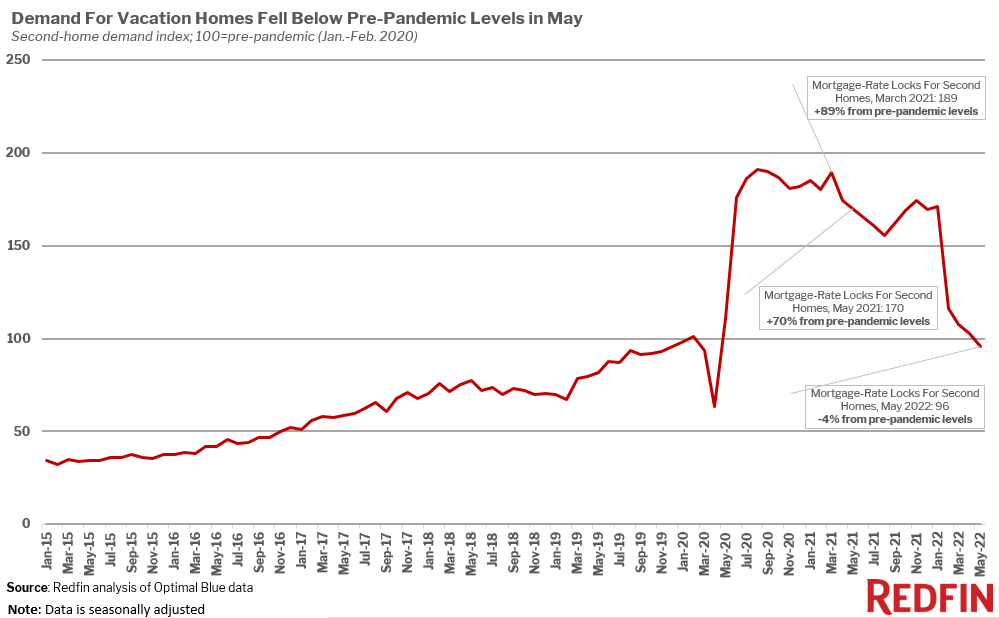

Demand for vacation homes has fallen below the pre-pandemic baseline for the first time in two years, with mortgage-rate locks for second homes down 4% from before the pandemic in May. That’s down from a revised rate of 3% above pre-pandemic levels a month earlier, and 70% above pre-pandemic levels a year earlier.

That’s according to a Redfin analysis of Optimal Blue data. A mortgage-rate lock is an agreement between a homebuyer and a lender that allows the homebuyer to lock in an interest rate on a mortgage for a certain period of time, offering protection against future interest-rate hikes. Homebuyers must specify whether they are applying to secure a mortgage rate for a primary home, a second home or an investment property. We define “pre-pandemic levels” as January and February of 2020.

Demand for second homes is declining due to high home prices, mortgage rates that have rapidly risen to nearly 6% and a slumping stock market–factors that are also cooling the rest of the housing market. Another deterrent to second-home buyers is the fact that the federal government increased loan fees for second homes in April, adding roughly $13,500 to the cost of purchasing a $400,000 home.

“Skyrocketing monthly payments, along with higher loan fees, have priced many second-home buyers out of the market,” said Redfin Deputy Chief Economist Taylor Marr. “Many would-be second-home buyers are also deterred by turmoil in the stock markets, high inflation and recession fears, and they can be quicker to pull back from the market because vacation homes aren’t a necessity the way primary homes are. The cooldown in the second-home market is likely to continue as long as mortgage rates are elevated and the stock market is slumping.”

The drop in vacation-home demand marks a drastic change from the second half of 2020 and 2021, when mortgage-rate locks for second homes skyrocketed due to record-low mortgage rates and the flexibility to work from anywhere thanks to remote work. Demand peaked in March 2021, when it was about 90% above pre-pandemic levels.

Interest in vacation homes started declining sharply in February as mortgage rates began their ascent. The average 30-year fixed mortgage rate reached 5.78% in the week ending June 16.

Methodology

The data in this report is from a Redfin analysis of mortgage-rate lock data from real estate analytics firm Optimal Blue. Redfin created a seasonally adjusted index of Optimal Blue’s data to adjust for typical seasonal patterns and allow for simple comparisons of second-home demand during and before the pandemic. We define “pre-pandemic” as January and February 2020 and set the index for that period to 100. Any data point above 100 represents second-home demand that’s above pre-pandemic levels and any data point below 100 represents demand below pre-pandemic levels. This data is subject to revision.

A mortgage-rate lock is an agreement between a homebuyer and a lender that allows the homebuyer to lock in an interest rate on a mortgage for a certain period of time, offering protection against future interest-rate hikes. Homebuyers must specify whether they are applying to secure a mortgage rate for a primary home, a second home or an investment property. Roughly 80% of mortgage-rate locks result in actual home purchases.

United States

United States Canada

Canada