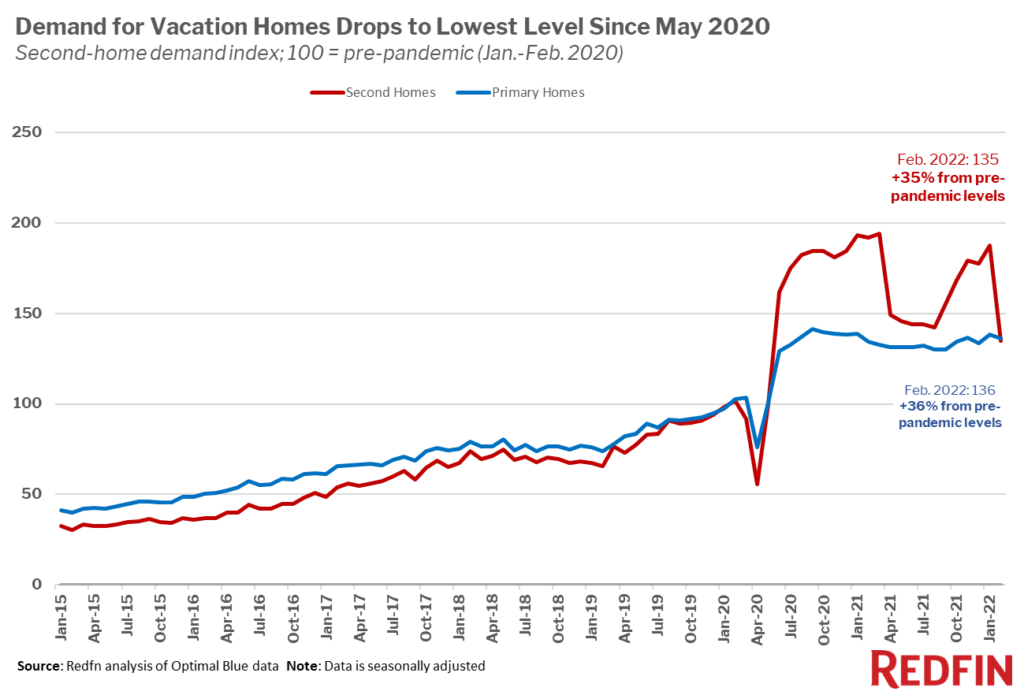

The vacation-home boom started fading in February, partly because of rising mortgage rates. Still, demand for second homes is 35% above pre-pandemic levels.

Demand for vacation homes dropped sharply in February, with mortgage-rate locks for second homes reaching their lowest level since May 2020. Demand was still up 35% from pre-pandemic levels, but that’s significantly lower than the 87% increase the month before.

February also marked the first month since the start of the pandemic that growth in demand for primary residences outpaced that of vacation homes, albeit only slightly, with mortgage-rate locks for primary homes up 36% from pre-pandemic levels.

Demand for second homes started soaring in mid-2020 as the pandemic took hold, reaching a peak in March 2021, with demand up 95% from pre-pandemic levels. The combination of remote work, record-low mortgage rates and a desire to get away from crowds motivated many affluent Americans to buy vacation homes. But last month demand fell sharply from the month before as mortgage rates rose.

“Rising mortgage rates, combined with rising home prices, are hitting the second-home market much harder than the primary-home market,” said Redfin Chief Economist Daryl Fairweather. “That’s largely because vacation homes are optional. People don’t need a second home, but they do need a place to live. Still, people are buying up vacation homes more than they were before the pandemic, as work remains more flexible than it used to be.”

The average 30-year mortgage rate reached a peak of 3.92% in mid-February, substantially higher than the 2.65% low reached in the beginning of 2021. The typical monthly mortgage payment is up hundreds of dollars from a year ago, partly as a result of that increase.

Demand for second homes may continue to decline in the coming months as loan fees for second homes go up. The Federal Housing Finance Agency announced fees for second-home loans will increase by about 1% to 4% starting in April. The change will add about $13,500 to the cost of purchasing a $400,000 home for the typical second-home buyer, which can either be paid upfront or rolled into a mortgage (about $60 per month).

Home prices up, supply down in seasonal towns

Although mortgage-rate locks for second homes were down in February, prices continue to grow in seasonal towns, where vacation homes are often located. Home prices in seasonal towns rose 20% year over year in February to a median of $513,000. February marks more than a year and a half of 10%-plus year-over-year growth for home prices in seasonal towns.

That’s due partly to a severe shortage of inventory, with the number of homes for sale in seasonal towns down a record 29% year over year in February. The fact that home prices are up and inventory is down even though second-home demand is declining suggests that some workers with permanently remote jobs may be relocating to vacation destinations rather than purchasing second homes, and that investors are interested in seasonal towns.

Meanwhile, home prices in non-seasonal towns were up 13% to $414,000, and supply was down 17%.

For this analysis, a seasonal town is defined as an area where more than 30% of housing is used for seasonal or recreational purposes.

Methodology

The data in the first section of this report is from a Redfin analysis of mortgage-rate lock data from real estate analytics firm Optimal Blue. Redfin created a seasonally adjusted index of Optimal Blue’s data to adjust for typical seasonal patterns and allow for simple comparisons of second-home demand during and before the pandemic. We define “pre-pandemic” as January and February 2020 and set the index for that period to 100. Any data point above 100 represents second-home demand that’s above pre-pandemic levels and any data point below 100 represents demand below pre-pandemic levels. This data is subject to revision.

A mortgage-rate lock is an agreement between a homebuyer and a lender that allows the homebuyer to lock in an interest rate on a mortgage for a certain period of time, offering protection against future interest-rate hikes. Homebuyers must specify whether they are applying to secure a mortgage rate for a primary home, a second home or an investment property. Roughly 80% of mortgage-rate locks result in actual home purchases.

United States

United States Canada

Canada