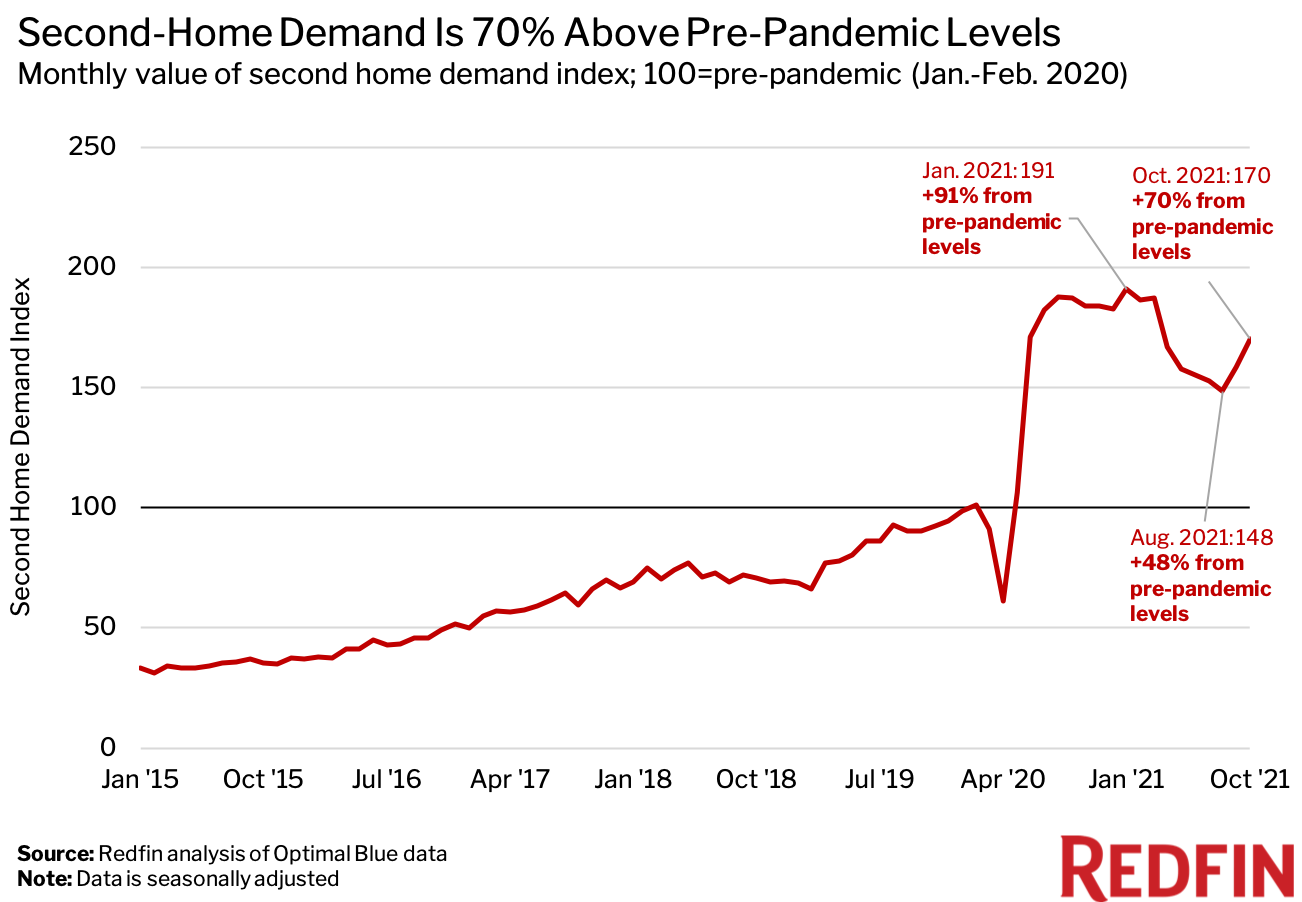

While demand for vacation homes has cooled slightly since the start of the year, it’s expected to remain above pre-pandemic levels as Americans take advantage of more permanent remote-work policies.

Demand for second homes was up 70% from pre-pandemic levels in October, outpacing August’s 48% gain but below January’s record 91% growth.

That’s according to a Redfin analysis of mortgage-rate lock data from real estate analytics firm Optimal Blue. Redfin created a seasonally-adjusted index of Optimal Blue’s data in order to adjust for typical seasonal patterns and allow for simple comparisons of second-home demand during and before the pandemic. We define “pre-pandemic” as January and February 2020 and set the index for that period to 100. Any data point above 100 represents second-home demand that’s above pre-pandemic levels and any data point below 100 represents demand below pre-pandemic levels. This data is subject to revision.

A mortgage-rate lock is an agreement between a homebuyer and a lender that allows the homebuyer to lock in an interest rate on a mortgage for a certain period of time, offering protection against future interest-rate hikes. Homebuyers must specify whether they are applying to secure a mortgage rate for a primary home, a second home or an investment property. Roughly 80% of mortgage-rate locks result in actual home purchases.

Home sales are on the rise during a time of year when the housing market typically slows down, with many buyers eager to lock in low mortgage rates on second homes before rates increase further.

“Many companies have solidified their remote-work policies, which is fueling continued demand for vacation homes,” said Redfin Chief Economist Daryl Fairweather. “We expect this demand to stay strong as more employers establish permanent guidelines giving workers flexibility to live and work wherever they’d like.”

In March, a restriction enacted by the Treasury Department and Federal Housing Finance Agency limited the number of second-home and investment property loans Fannie Mae could purchase. That restriction was removed in September, making it easier for second-home purchasers to get a low mortgage rate, which is likely also fueling demand for second homes, Fairweather added.

United States

United States Canada

Canada