Black real estate wealth hit a record high in 2021– here is why I am hopeful it will continue to rise during this decade

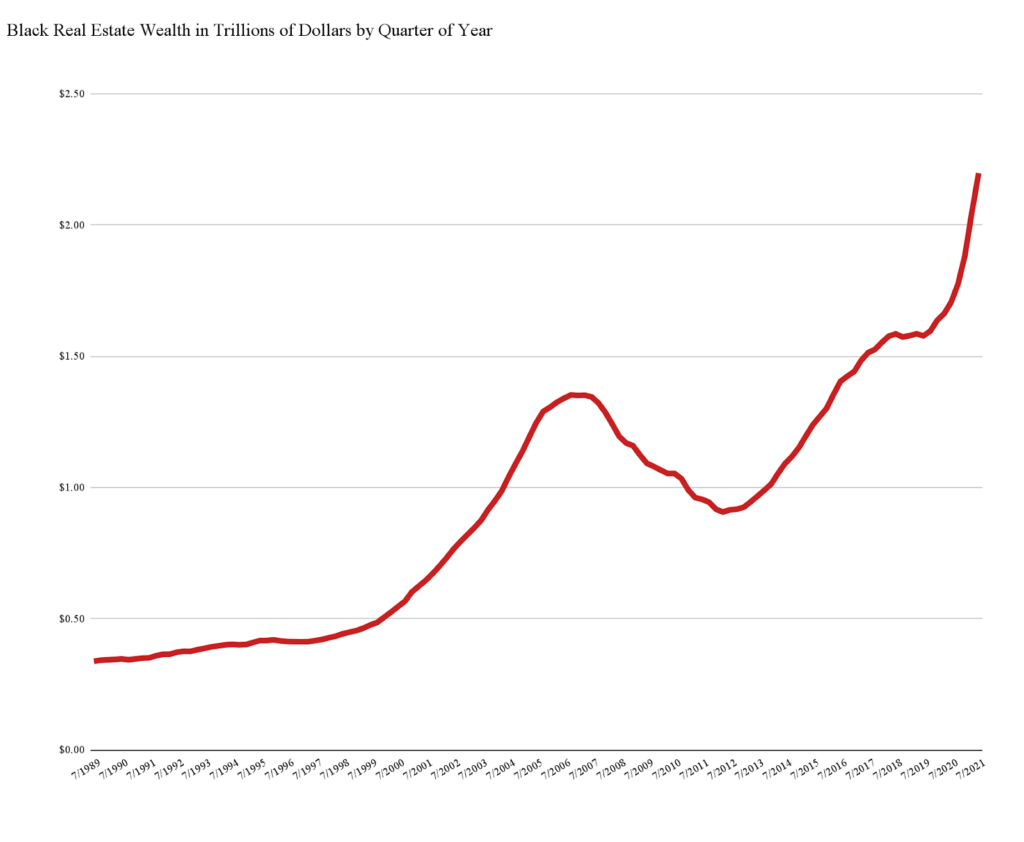

Black real estate wealth–the total value of homes owned by Black people in America–rose 28.9% year over year to a record high of $2.2 trillion in the third quarter of 2021, according to data from the Federal Reserve. Black real estate equity–real estate value minus mortgage debt–also set a record at $1.4 trillion, a 45% increase from the previous year. The share of real-estate wealth owned by Black Americans also hit a record, but remains disproportionately small at 6%, up from 5.3% the previous year. White (non-Hispanic) Americans currently own a disproportionately large share of real estate wealth at 75.7%, down from 77.1% the previous year. Black people represent 13.4% of the U.S. population, while non-Hispanic white people represent 60.1%.

These improvements in Black real estate wealth are worth celebrating, but there is still a long way to go to close the Black-white real estate wealth gap. Here are three reasons why I am optimistic that Black real estate wealth will continue to grow over the next decade.

Credit-score reform

One of the things holding back Black Americans from accumulating real estate wealth is access to financing. Black homeownership reached a peak of 49.1% in 2004, but after the housing bubble burst, many Black homeowners were unable to make mortgage payments and were forced to sell or enter foreclosure.The Black homeownership rate fell to a low of 41.6% in 2016 and still hasn’t fully recovered– the Black homeownership rate was 44.2% in 2021.

Since the foreclosure crisis, lending standards have become much stricter, making it difficult for Black potential homebuyers to secure a mortgage. For example, the majority of borrowers–those to whom a bank agrees to loan money to buy a home–have a credit score above 760. Before the Great Recession, the majority of mortgage borrowers had a credit score below 760. But most–54%–Black Americans have a credit score below 640 or no credit score at all, compared to 37% of white Americans. To put that into context, qualifying for a mortgage with a credit score below 640 is highly uncommon now that subprime lending has virtually gone extinct. Credit scores do not directly consider race, but 30% of Black Americans feel they were misinformed or tricked during their first experiences with credit compared to only 18% of White Americans, and flawed data can exacerbate racial bias in credit scores.

But there is currently a movement to overhaul the credit system. The Financial Services Committee has proposed legislation that could narrow the Black-white credit gap. The proposed legislation would protect the credit standing of victims of predatory lending and create federal oversight into credit scoring models. Additionally, credit scoring companies like Experian have been experimenting with changes to their formulas that would factor in rent payments, utility bills and streaming services, which could help people with no credit or poor credit achieve a better credit score.

The YIMBY movement

In order to narrow the Black-white real estate wealth gap, we need to increase the supply of homes for sale in the places where Black people live. Unfortunately, Black homebuyers have faced sharper declines in homes for sale than white homebuyers. But this trend could reverse thanks to the YIMBY (yes in my back yard) movement that aims to do away with exclusionary zoning that prohibits multifamily housing and contributes to rising home prices and racial segregation. There have been several major wins for the YIMBY movement in recent years. California, Oregon and Minneapolis have all eliminated single family zoning. These zoning reforms are facing pushback from current homeowners who don’t want multifamily housing (or the kinds of people who live in multifamily housing) in their neighborhoods. While it’s largely too soon to measure the success of these reforms, I believe the YIMBY movement will gain more momentum and we will see more development of homes that Black people have a chance at affording. That’s because the YIMBY movement is non-partisan– leaders on the left and right, from Congresswoman Alexandria Ocasio Cortes (D) to Senator Todd Young (R) are embracing the YIMBY movement.

Equitable economic growth

Black wages, adjusted for inflation, have only grown a paltry 1.4% since the start of 2002; meanwhile white wages are up 6.6%. But there are signs Black wage growth will start to catch up to white wage growth, which would allow more Black people to afford to buy homes.

I am hopeful that the current labor shortage, along with the normalization of remote work, will lead to better employment opportunities for Black Americans. A tight labor market will benefit Black workers, who have historically suffered the most from weak labor markets. The normalization of remote work will allow companies headquartered in places with low Black populations such as Silicon Valley and Seattle to hire Black workers in places where they are more likely to live, like Atlanta and Houston.

I am also optimistic about the future of HBCUs (historically Black colleges and universities). HBCUs historically have had a better track record of increasing economic mobility for their graduates than other U.S. colleges and universities. There have been many recent large donations to HBCUs, which should give these institutions even more resources to educate and serve their students. My own family’s story of economic mobility started with my great-grandfather, Walter Merrick, immigrating from Trinidad to attend Howard University’s medical school in 1915. He became a physician in Harlem and used his earnings to buy a brownstone townhome in the formerly red-lined Brooklyn neighborhood of Bed-Stuy in 1931. My aunt still owns the home, and I lived there rent-free while I interned in Manhattan in 2008, so I know first-hand the way that HBCUs foster the creation of Black intergenerational wealth and economic opportunity.

United States

United States Canada

Canada