Plus, nearly two-thirds of U.S. homeowners have spent money to protect their homes against climate risks, with over one-third investing $5,000 or more. Extreme temperatures and flooding are among the top concerns.

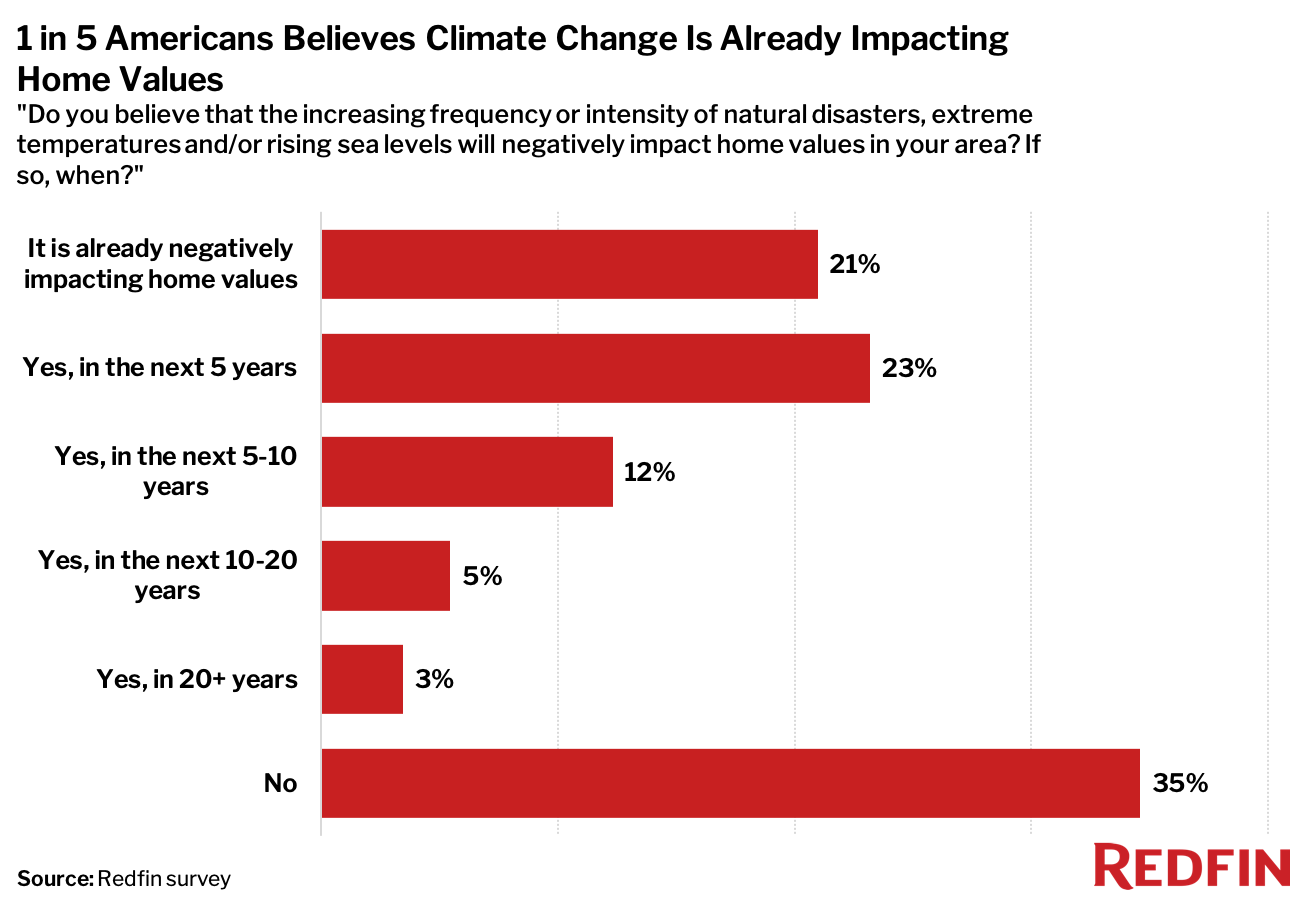

One in five Americans (21%) believes the increasing frequency or intensity of natural disasters, extreme temperatures and/or rising sea levels are hurting home values in their area, a new Redfin survey found. A comparable share—23%—expect one or more of these factors to hurt local housing values in the next five years, and 12% think values will be negatively impacted in the next five to 10 years. Just over a third (35%) of Americans believe these factors will never diminish home values where they live.

This is according to a Redfin-commissioned survey of 2,000 members of the general U.S. population. The survey was fielded by research technology company Lucid from Feb. 25, 2021 to March 1, 2021.

“Climate change is posing an increasingly large risk to homeowners. As storms, wildfires and rising sea levels render more areas undesirable in the coming years, housing values in those areas will decline. This means a growing number of homeowners will see a major source of wealth—their home equity—wiped away,” said Redfin Chief Economist Daryl Fairweather. “We may also see folks in at-risk areas choose to rent instead of own to avoid getting stuck with devalued properties.”

The breakdowns in the next three sections of this report focus on the 419 respondents who indicated that they believe home values in their area are already being negatively impacted by the increasing frequency/intensity of natural disasters, extreme temperatures and/or rising sea levels.

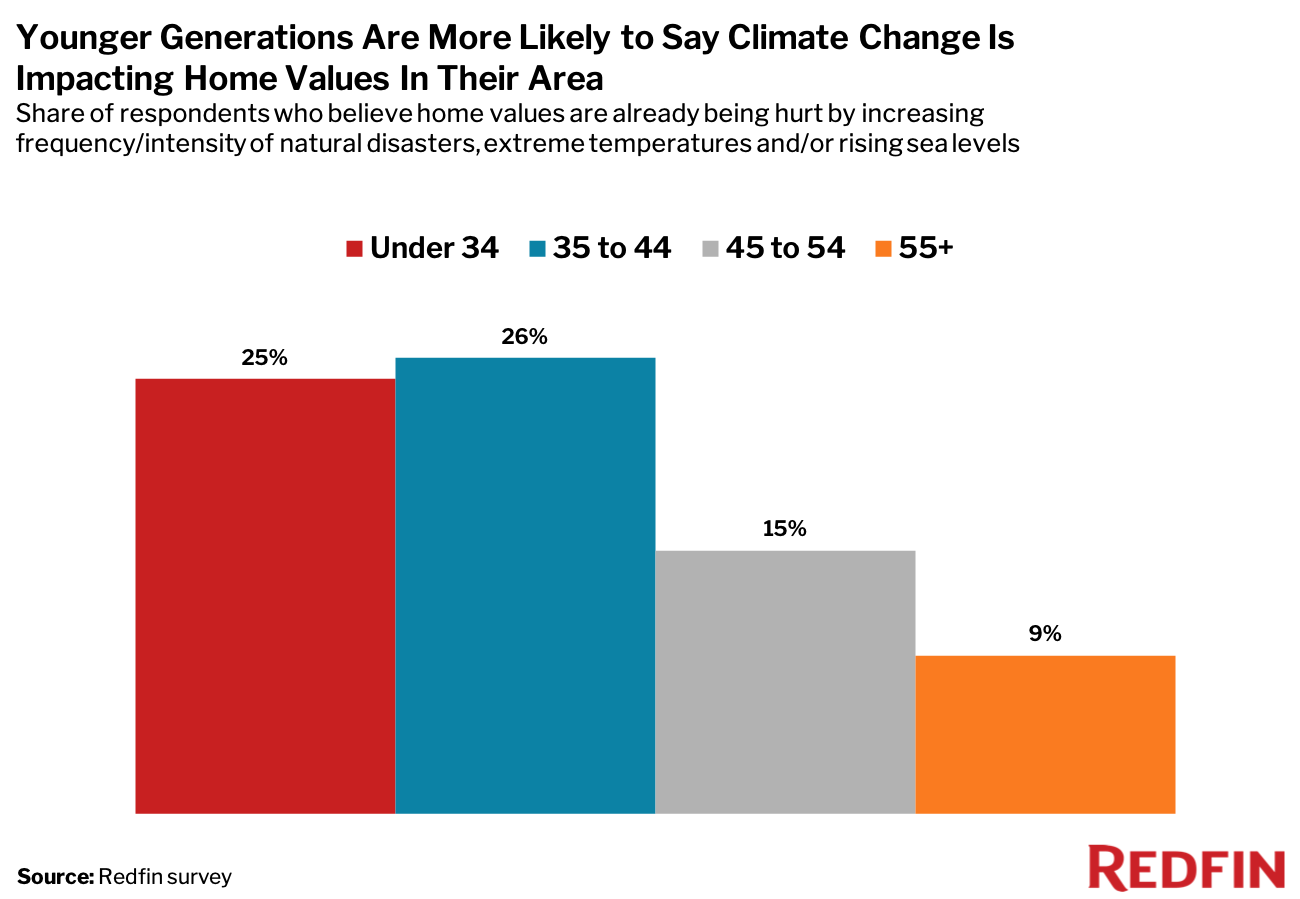

Younger Respondents Are More Likely to Say Climate Change Is Affecting Home Values

About a quarter of respondents aged 44 and younger believe home values in their area are already being negatively impacted by the increasing frequency/intensity of natural disasters, extreme temperatures and/or rising sea levels. That compares with 15% of participants aged 45 to 54 and 9% of participants aged 55 and older.

Unlike baby boomers, millennials and Gen Zers—who are making up an increasingly large share of the homebuying market—grew up learning about climate change. Young climate activists like Greta Thunberg have captured the world’s attention and encouraged their peers to take action. A 2019 report by Yale University found that millennials are more likely than older generations to say global warming is personally important to them and express willingness to donate money to organizations focused on it.

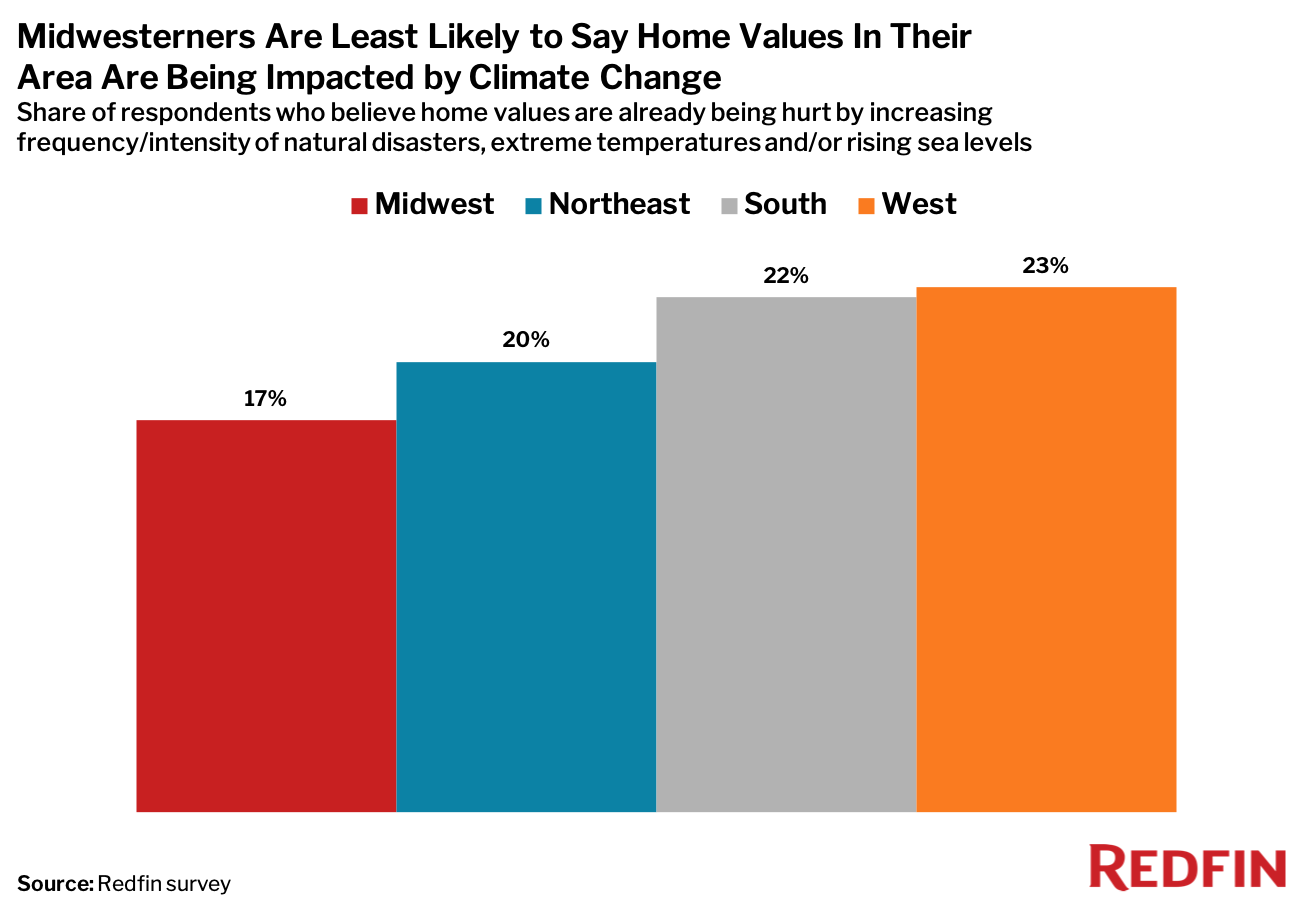

Midwesterners Are Least Likely to Say Climate Change Is Hurting Housing Values

Seventeen percent of respondents living in the Midwest think climate change is negatively affecting housing values in their area, compared with 20% of respondents in the Northeast, 22% in the South and 23% in the West.

While the Midwest is warming up and experiencing greater precipitation in some areas, it hasn’t seen the sudden uptick in devastating natural disasters that other parts of the U.S. have. The West Coast had its most active fire year on record in 2020, with more than five million acres burning across California, Oregon and Washington, and homes in many wildfire-prone zip codes selling for a discount. And in Texas, a massive winter storm in February 2021 left 111 people dead and millions without power.

“Homeowners are still getting their pipes repaired from the freeze. Some are still without water,” said Ashley Vasquez, a Redfin real estate agent in Houston, which is also prone to flooding. “I had one home that was supposed to close a month ago, but the process has been delayed because of the storm. We now have to get the home reinspected and reappraised to assess whether the freeze impacted the value.”

While buyers are concerned about flooding and storms in Texas, many are overlooking these risks because there are so few homes for sale, Vasquez added.

“A lot of people from the East Coast and the West Coast are moving to Texas, which is intensifying the huge lack of inventory here,” she said. “Many buyers are disregarding flaws in a home or neighborhood because competition is fierce and they’re just ready to be done with the process. If the inventory situation improves, I think homebuyers will start paying more attention to climate change.”

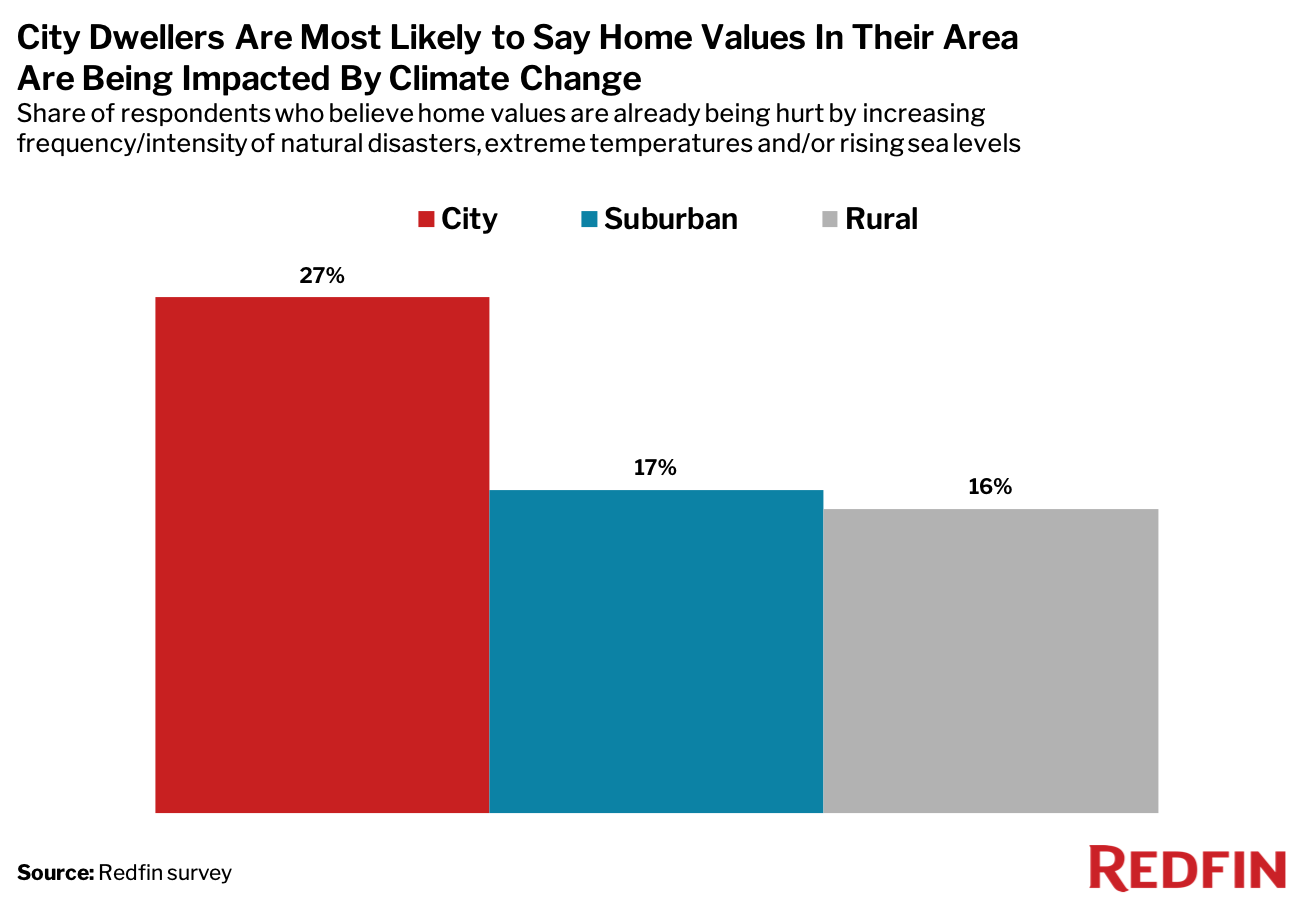

City Dwellers Are Most Likely to Say Climate Change Is Hurting Housing Values

More than a quarter (27%) of city dwellers think local home values are being negatively impacted by the increasing frequency/intensity of natural disasters, extreme temperatures and/or rising sea levels. That compares with 17% of respondents living in suburban areas and 16% living in rural areas.

“Cities tend to skew younger and more liberal, which is likely why they’re home to a larger share of people who are worried about the risks of climate change,” Fairweather said. “Many city leaders have committed to carbon-reduction plans that are much more ambitious than the proposals put forth by federal and state officials.”

While the United States has wavered on its commitment to the Kyoto Protocol and the Paris climate accord, for example, cities have stayed the course on their pledges to cut greenhouse-gas emissions. During President Trump’s term, 468 city mayors representing 74 million Americans committed to uphold the goals and commitments outlined in the Paris climate accord. That included mayors from cities as varied as New York City, Little Rock, AR, Honolulu and Salt Lake City.

Americans Are Spending Thousands of Dollars to Protect Their Homes Against Climate Change

The remainder of this report focuses on the roughly 1,200 respondents who indicated they own the property they currently live in.

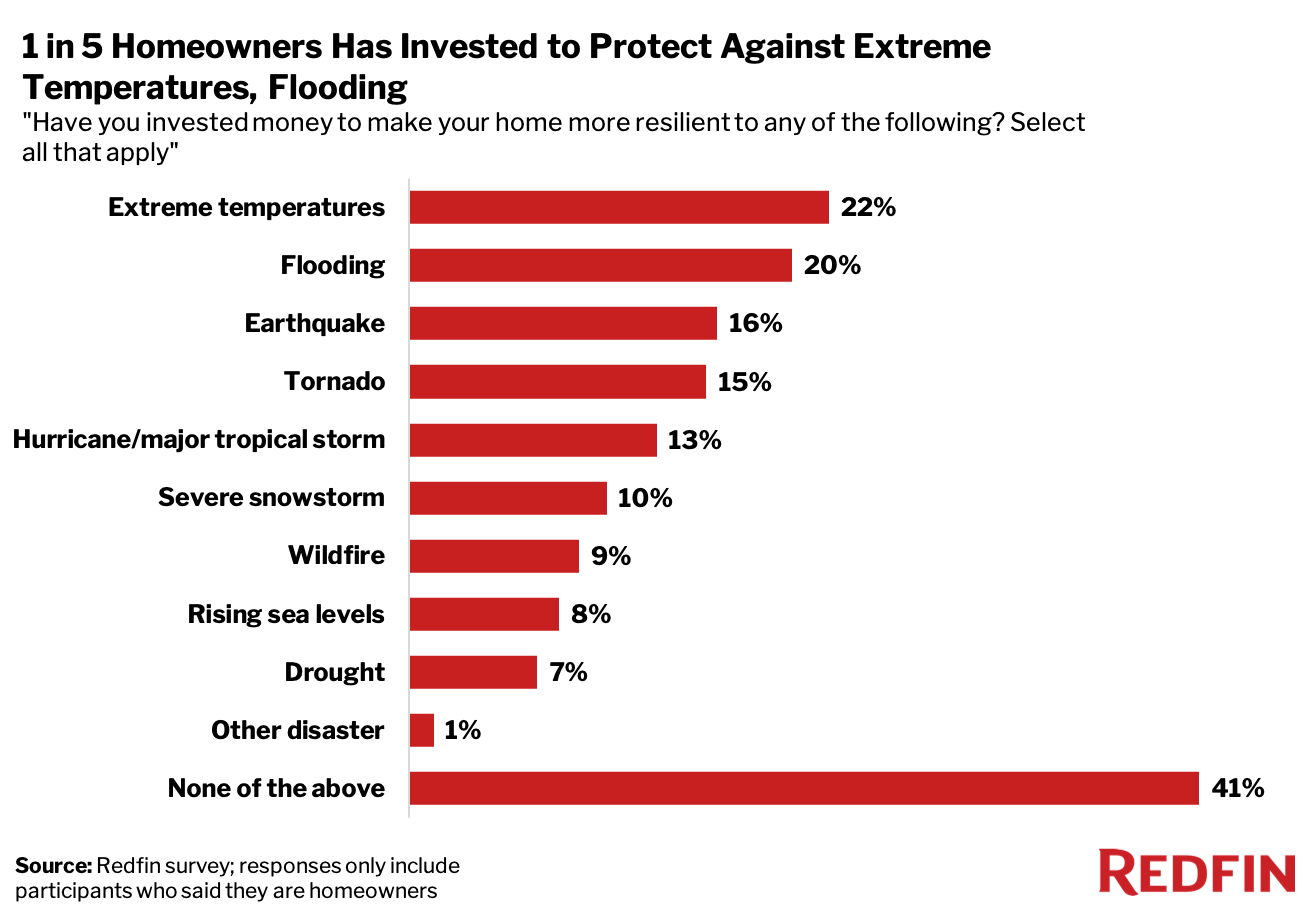

More than half (59%) of surveyed homeowners have invested in making their homes more resilient to at least one climate-related risk, with over a third (36%) spending $5,000 or more.

Extreme temperatures and flooding are the top climate threats the surveyed homeowners are bracing for, with roughly 20% of respondents indicating that they have fortified their properties against one of those risks and/or the other. Next come earthquakes (16%), tornadoes (15%), hurricanes or other major tropical storms (13%) and severe snowstorms (10%).

In Houston, some homebuyers seek out discounts when bidding on properties that lack storm-resistant features, according to Vasquez.

“Buyers want upgraded windows, hurricane roofs, new pipes, and good plumbing and electrical systems,” she said. “They will sometimes try to negotiate down the price if a home doesn’t have these features, though that has been happening less frequently lately because the market is red hot, meaning there’s not as much room for negotiation.”

Americans are fortifying their properties not only to keep themselves and their families safe from the dangers of climate change, but also to protect their home equity, according to Fairweather.

“Some homeowners are finding that in order to preserve the value of their properties, they need to invest in making their homes more resilient to climate change,” Fairweather said. “However, this can be costly and make owning a home even less affordable at a time when housing prices are already soaring.”

President Joe Biden proposed a massive infrastructure bill in March that calls for spending $213 billion on building, preserving and retrofitting over two million “affordable and sustainable” places to live. His plan specifically targets disadvantaged communities, which often bear the brunt of climate change. Hopefully, this will help reduce the cost of owning and maintaining a home for many Americans, Fairweather said.

Roughly 1 in 3 Homeowners Has Spent at Least $5,000 Fortifying Their Homes Against Climate Threats

More than a third (35%) of surveyed homeowners have invested $5,000 or more to make their properties more resilient to climate risk, while 20% have spent up to $5,000. Of the respondents who have invested in fortifying their homes, the most common amount spent was $5,000 to $9,999.

Ever since the destructive 2017 Tubbs Fire hit northern California, people who stayed in the area have been hard at work strengthening their homes, according to Napa, CA Redfin real estate Christopher Anderson.

“Homeowners are fireproofing their houses and empty lots and removing dead trees and bushes. If they have wood-shake roofs, they’re changing them out for roofs made of concrete or some other material that doesn’t burn. They’re replacing wooden fencing with steel fencing, and wooden decks with stone patios,” Anderson said. “Buyers are also paying more attention than they used to. They’re looking at every property a bit more closely. How close did the fire get? What steps has the seller taken to mitigate fire risk?”

Natural Disaster Insurance Premiums Are on the Rise

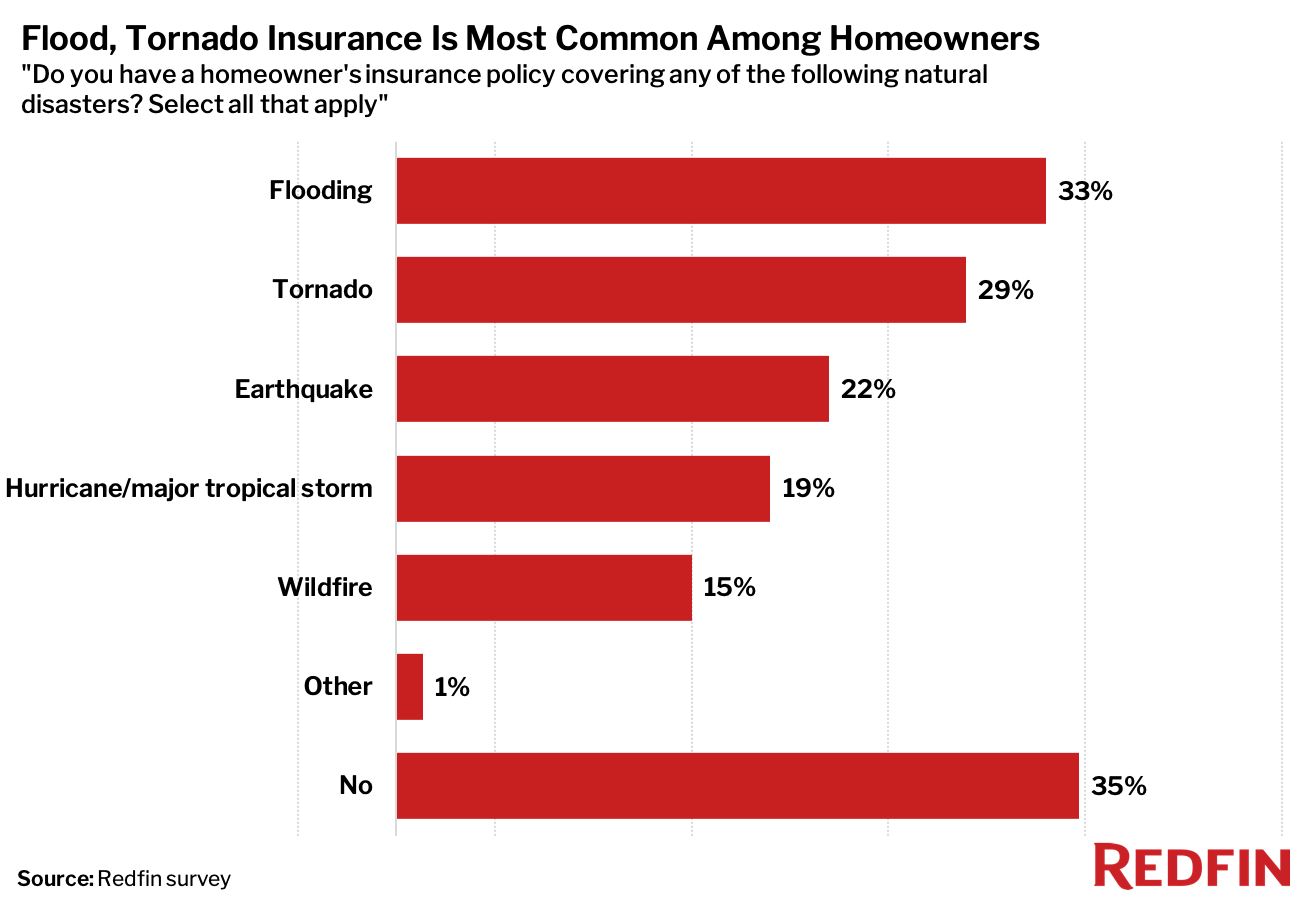

About two-thirds (65%) of surveyed homeowners have a home insurance policy covering some type of natural disaster. Flooding is the most common threat for which homeowners possess insurance, with a third (33%) of respondents indicating they have policies to protect against this risk. Next come tornadoes (29%), earthquakes (22%), hurricanes or other major tropical storms (19%) and wildfires (15%).

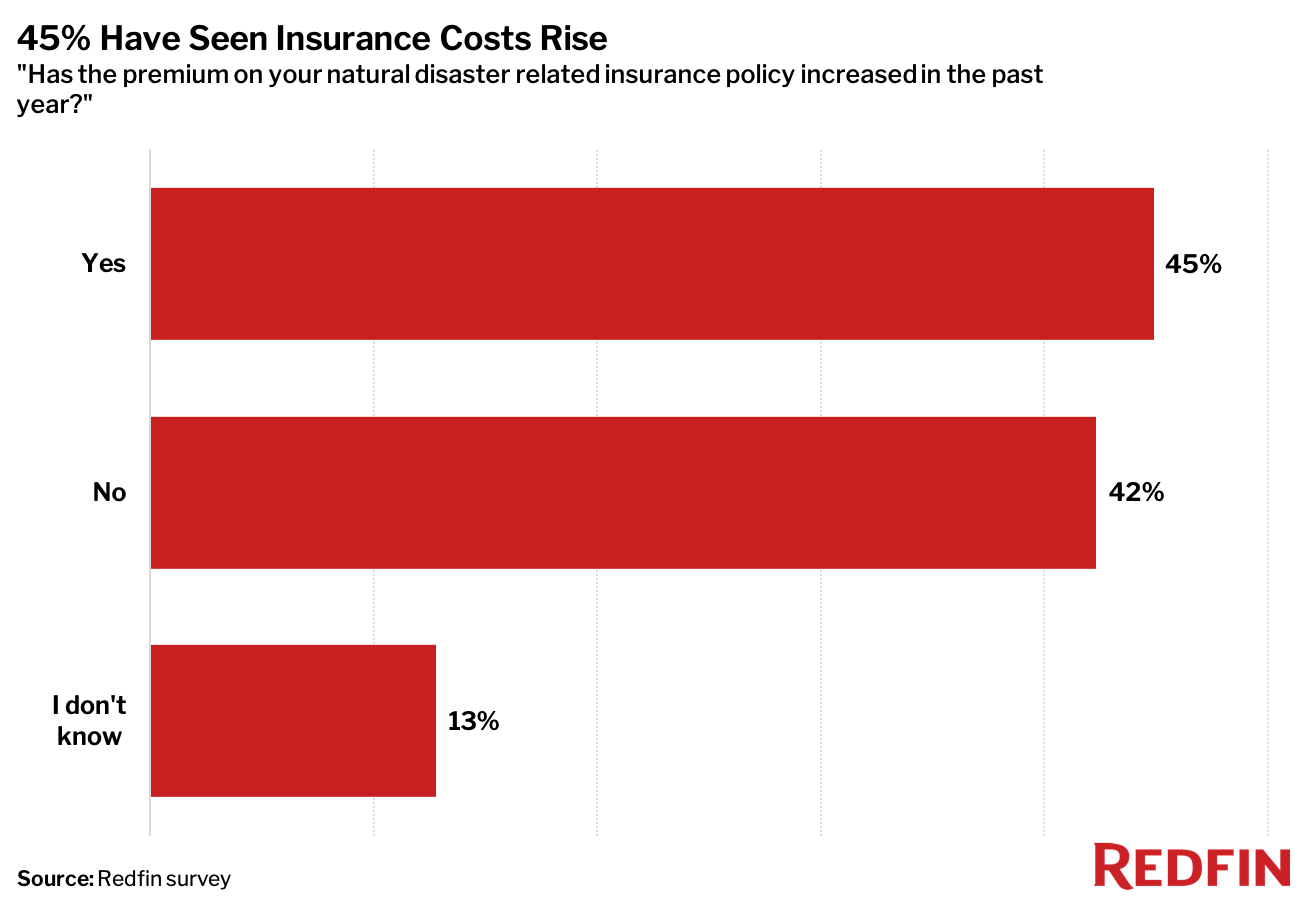

As weather catastrophes become more frequent, insurance costs have jumped. Almost half (45%) of surveyed homeowners with natural disaster related insurance policies have seen their premiums increase in the last year.

“Some homebuyers are jumping through extra hoops to get insured in California due to new rules established in the wake of the wildfires,” Anderson said. “I had one buyer who had just closed escrow when he found out his normal insurance carrier wouldn’t cover him because of all of the vegetation around the property. He had to hire an insurance broker to find another company that would take him on, and the other company charged a higher rate.”

Anderson continued: “Every time there’s a fire, there’s a moratorium on new insurance policies, so many homeowners have to seek out insurance from the state. The problem is that state insurance costs significantly more than private insurance and doesn’t provide the same level of protection.”

United States

United States Canada

Canada