Housing Equality & Policy

70% of Florida Homeowners Have Seen Rise in Insurance Costs or Changes in Coverage: Survey

12% of Florida respondents who have faced insurance changes have been dropped by their insurance company—an increasingly common trend as insurers back out of flood-prone areas. The share is almost as high in fire-prone California. Nationwide, one-third of homeowners who lost insurance have moved or plan to move, but nearly the same share are staying

Climate Change Pushes Up Home Insurance Premiums

Originally published to Forbes on September 18, 2023. A recent study from PolicyGenius found that quoted homeowner’s insurance premiums increased by 21% nationally from May 2022 to May 2023. Florida experienced the largest jump with premiums increasing by 35%. The steep increases in homeowner’s insurance costs contribute to the already intractable housing affordability crisis, as homeowners

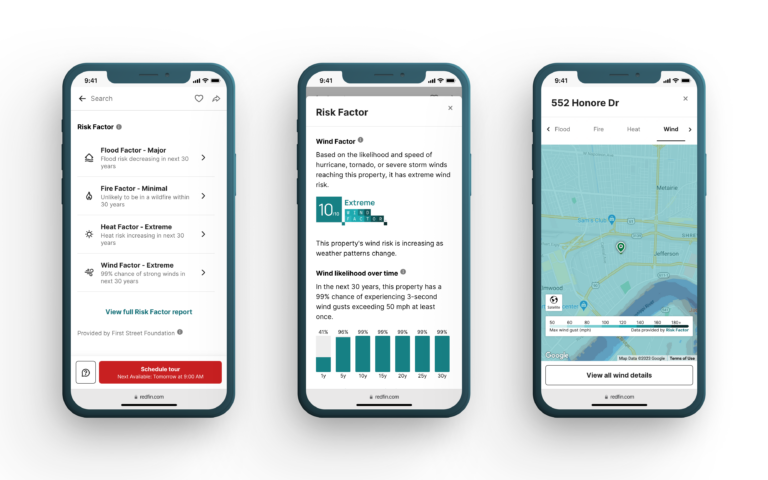

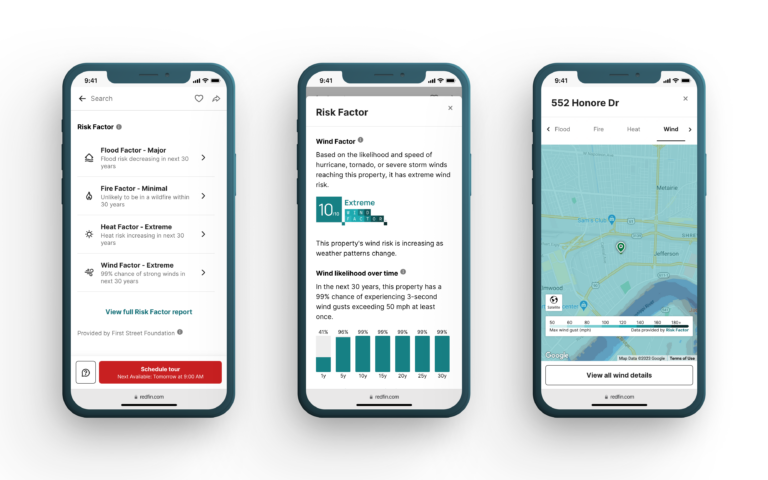

Redfin Adds Wind Risk Data for U.S. Homes

This week, Redfin became the first brokerage to publish wind risk data for nearly every U.S. home for sale on Redfin.com. That means you can now use Redfin to find important information about a home’s wildfire, flood, extreme heat and wind risk, provided by our partners at First Street Foundation. Why We Did It

Migration Into America’s Most Flood-Prone Areas Has More Than Doubled Since the Start of the Pandemic

Nearly 400,000 more people moved into than out of the most flood-prone counties in 2021 and 2022—a 103% increase from the prior two years. The counties most vulnerable to wildfires and heat have also seen more people move in than out as the housing affordability crisis pushes Americans into disaster-prone areas. New Orleans and Paradise,

Home Listings, Sales Bounce Back in Florida Towns Hit by Hurricane Ian Despite Increasing Climate Risk

The Cape Coral metro area has more than made up for the plunge in new listings caused by the storm. Home sales have also started to rebound. Listings of homes for sale in the Cape Coral-Fort Myers, FL metropolitan area have recovered after plunging in the wake of Hurricane Ian last fall, and sales have

58% of Homeowners Have Spent Money to Protect Their Homes From Climate Threats: Survey

One-third of homeowners have spent $5,000 or more to make their homes more resilient to climate risk. Overall, extreme temperatures are the most common climate risk homeowners invest to protect against, followed by flooding and hurricanes/other major tropical storms. 36% of homeowners say they have an insurance policy covering flooding—a higher share than other climate

70% of Florida Homeowners Have Seen Rise in Insurance Costs or Changes in Coverage: Survey

12% of Florida respondents who have faced insurance changes have been dropped by their insurance company—an increasingly common trend as insurers back out of flood-prone areas. The share is almost as high in fire-prone California. Nationwide, one-third of homeowners who lost insurance have moved or plan to move, but nearly the same share are staying

Climate Change Pushes Up Home Insurance Premiums

Originally published to Forbes on September 18, 2023. A recent study from PolicyGenius found that quoted homeowner’s insurance premiums increased by 21% nationally from May 2022 to May 2023. Florida experienced the largest jump with premiums increasing by 35%. The steep increases in homeowner’s insurance costs contribute to the already intractable housing affordability crisis, as homeowners

Redfin Adds Wind Risk Data for U.S. Homes

This week, Redfin became the first brokerage to publish wind risk data for nearly every U.S. home for sale on Redfin.com. That means you can now use Redfin to find important information about a home’s wildfire, flood, extreme heat and wind risk, provided by our partners at First Street Foundation. Why We Did It

Migration Into America’s Most Flood-Prone Areas Has More Than Doubled Since the Start of the Pandemic

Nearly 400,000 more people moved into than out of the most flood-prone counties in 2021 and 2022—a 103% increase from the prior two years. The counties most vulnerable to wildfires and heat have also seen more people move in than out as the housing affordability crisis pushes Americans into disaster-prone areas. New Orleans and Paradise,

Home Listings, Sales Bounce Back in Florida Towns Hit by Hurricane Ian Despite Increasing Climate Risk

The Cape Coral metro area has more than made up for the plunge in new listings caused by the storm. Home sales have also started to rebound. Listings of homes for sale in the Cape Coral-Fort Myers, FL metropolitan area have recovered after plunging in the wake of Hurricane Ian last fall, and sales have

58% of Homeowners Have Spent Money to Protect Their Homes From Climate Threats: Survey

One-third of homeowners have spent $5,000 or more to make their homes more resilient to climate risk. Overall, extreme temperatures are the most common climate risk homeowners invest to protect against, followed by flooding and hurricanes/other major tropical storms. 36% of homeowners say they have an insurance policy covering flooding—a higher share than other climate

United States

United States Canada

Canada