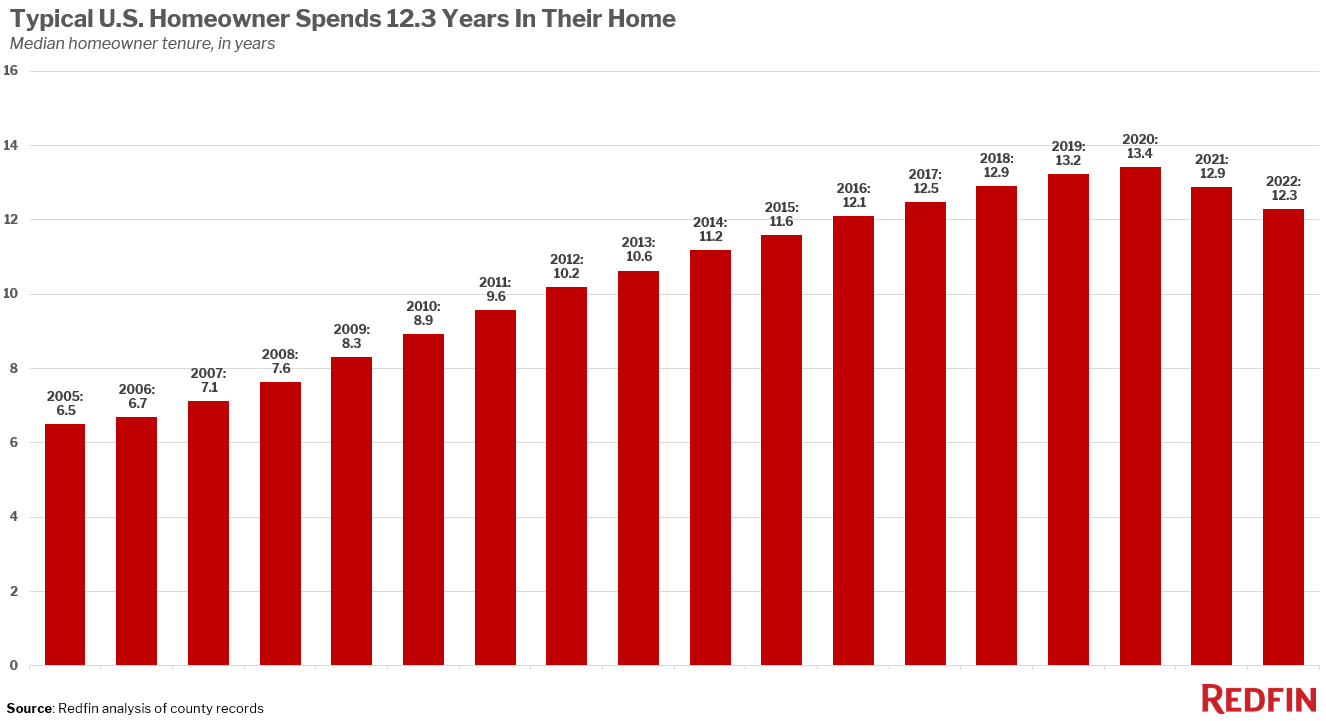

- Homeowner tenure is down slightly from the peak reached in 2020, but it has nearly doubled over the last couple decades, contributing to the lack of for-sale inventory.

- Baby boomers are driving the general trend of longer homeowner tenure; more than one-third of homeowners 65 and older have held onto their home for at least 33 years.

- The opposite trend holds true for millennial homeowners: Half have owned their home for 3 years or less.

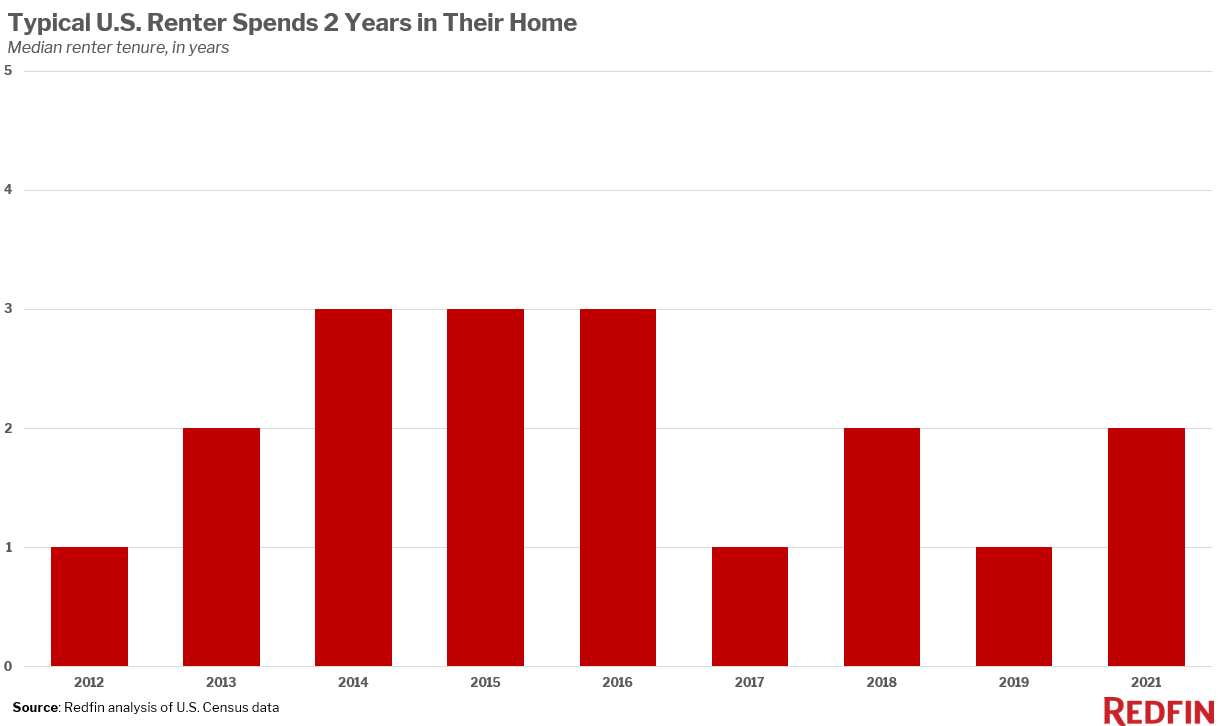

- Renters move much more frequently, with the typical renter moving every two years, contributing to the imbalance between the number of people moving and the number of homes up for sale.

- Californians hold onto their homes longest, largely because of property-tax laws.

The typical U.S. homeowner has spent 12.3 years in their home. That’s down from the peak of 13.4 years hit in 2020 and 12.9 years in 2021.

But the typical American is still living in their home much longer than before, with median homeowner tenure sitting at about 10 years in 2012 and 6.5 years in 2005.

This data is from a Redfin analysis of median homeowner tenure by year in the U.S. as of 2022, using historical county records. Home tenure for 2022 is defined as the number of years between the most recent sale date of a home and December 1, 2022. Data on homeowner and renter tenure by age is from a Redfin analysis of the U.S. Census Bureau’s 1-year American Community Survey in 2021, the most recent year for which the data is available.

Older people aging in place are driving the general trend toward longer homeowner tenure. Most Americans 65 and older have owned their home for at least 23 years, and most Americans aged 35 to 64 have owned theirs for at least eight years. Compare that with homeowners under 35: Nearly half (49%) have owned their home for three years or less, and another 37% have owned theirs for four to seven years.

| Homeowner Tenure By Age

Median U.S. homeowner tenure by age, as of 2021 |

|||

| Under 35 years old | 35 to 64 years old | 65 years and older | |

| 3 years or less | 49% | 15% | 7% |

| 4 to 7 years | 37% | 22% | 10% |

| 8 to 12 years | 10% | 17% | 9% |

| 13 to 22 years | 3% | 27% | 20% |

| 23 to 32 years | 1% | 14% | 19% |

| 33 years or more | 0% | 5% | 35% |

| Source: Redfin analysis of U.S. Census Bureau’s 1-year American Community Survey 2021 | |||

Overall homeowner tenure has ticked down from its peak largely because so many people moved from one home to another in 2021 and the first half of 2022. Record-low mortgage rates during that period motivated many Americans to buy homes, either becoming homeowners for the first time or selling their home to move to a better one. Pandemic-fueled remote work prompted many Americans to relocate to a different part of the country, too.

But Americans are staying put much longer now than in the past couple decades. There are several reasons why that’s true, and why homeowner tenure is likely to stay elevated in the coming decade:

-

- Older Americans are aging in place. Long homeowner tenure is driven by older generations, as noted in the table above. Plus, older Americans report a desire to stay put, suggesting the aging in place trend will continue. Nearly 9 in 10 Americans between 50 and 80 years old say it’s important to stay in their homes as they get older.

- The population is aging. Roughly 17% of people in the U.S. are 65 or older, up from about 13% in 2010, and the share is expected to continue increasing. Combine that with older Americans staying in their homes longer.

- Lack of affordability. Home prices are still much higher than they were before the pandemic. Combine that with elevated mortgage rates, and typical monthly mortgage payments are near their record high, discouraging many people from moving.

- Lack of move-up buyers. Today’s homeowners are discouraged from selling their home and buying another because so many Americans either bought when mortgage rates were at their record low or refinanced during that time. Roughly 85% of mortgage holders have an interest rate far below 6%, disincentivizing them from giving up their comparatively low rate.

- Historically high rental prices. Although rental-price growth is slowing, asking rents are still higher than they were before the pandemic. That’s motivating some homeowners to become landlords rather than sell.

- Shortage of homes for sale. The supply of homes for sale is near historic lows and very few new listings are coming on the market. Even if a homeowner were considering a move, there’s not much out there to choose from.

“Even though the length of time Americans are staying in their homes has ticked down from the peak it reached in 2020, it’s likely to head back up again in the next few years,” said Redfin Senior Economist Sheharyar Bokhari. “Today’s mortgage rates are more than double the lows reached during the pandemic homebuying frenzy, which means people have extra incentive to hang onto their homes. Even if rates dip down to 4% or 5%, that’s still significantly higher than the sub-3% rates many homeowners have now. That lock-in effect, combined with older Americans’ desire to stay put in their homes, points to lengthening tenure in the future.”

“But although that limits the number of homes hitting the market, competing forces could help the supply shortage,” Bokhari continued. “Remote work is still much more popular than before the pandemic, so more people have the freedom to relocate or move further away from city centers. Plus, millennials–the largest generation in the U.S.–are in prime moving years, pushed to sell their homes by things like growing families and new jobs.”

Renters move much more often than homeowners, which creates a mismatch between the number of homes for sale and the people who want to buy one

The scarcity of homes for sale is contributing to double-digit homeowner tenure, and the reverse is also true: Long tenure is holding back supply.

That’s problematic for people who want to buy a home but are unable to find one they can afford. The fact that renters move much more often illustrates the issue. The typical renter stayed in their home for two years in 2021, versus 13 years for homeowners. Most renters have to move to another rental rather than buy a home because of the mismatch between the number of people moving and the number of homeowners listing their home during any given year.

That’s especially true for younger Americans because they move more often. Nearly three-quarters (72%) of renters under 35 years old spend three years or less in a rental property, compared with 39% of 35-64 year olds and 27% of people aged 65 and older.

| Renter Tenure By Age

Median U.S. renter tenure by age, as of 2021 |

|||

| Under 35 years old | 35 to 64 years old | 65 years and older | |

| 3 years or less | 72% | 39% | 27% |

| 4 to 7 years | 22% | 31% | 26% |

| 8 to 12 years | 4% | 16% | 17% |

| 13 to 22 years | 1% | 10% | 16% |

| 23 to 32 years | 0% | 3% | 7% |

| 33 years or more | 0% | 1% | 8% |

| Source: Redfin analysis of U.S. Census Bureau’s 1-year American Community Survey 2021 | |||

Overall, the typical length of time renters stay in any one rental home hasn’t fluctuated much over the last decade. The median has bounced between one, two and three years for the last decade. The length of time renters stay in one place is unlikely to increase anytime soon. Fewer tenants are renewing their leases, likely because rental prices are declining and they may find a better deal by moving.

Californians keep their homes longest; homeowners in Louisville and Las Vegas hold on less than half as long before moving

Homeowners stay put longest in expensive parts of California. The typical Los Angeles homeowner has owned their home for 18.2 years, followed by 17.3 years in San Jose. Cleveland (17.1 years), San Francisco (16.3 years) and Memphis (16.2 years) round out the top five. The typical homeowner tenure in each of those metros increased by roughly four years over the last decade.

People hold onto their homes for a particularly long time in California–the median tenure in San Diego and Riverside is also longer than the national average–largely because the state’s tax laws incentivize homeowners to stay put. California’s Proposition 13 limits property-tax increases.

Tenure is shortest in relatively affordable migration destinations in the southern half of the country. It’s shortest in Louisville, KY (6.9 years), followed by Las Vegas (7.6 years), Nashville (8.2 years), Raleigh (8.3 years) and Charlotte (8.3 years).

| Metro-Level Summary, Homeowner Tenure

Median homeowner tenure, in years |

|||

| U.S. metro area | 2022 | 2021 | 2012 |

| Atlanta, GA | 8.7 | 9.5 | 10.3 |

| Baltimore, MD | 15.5 | 15.3 | 11.4 |

| Birmingham, AL | 9.8 | 11.4 | 9.6 |

| Buffalo, NY | 11.5 | 11.4 | 8.4 |

| Charlotte, NC | 8.3 | 8.6 | 9.7 |

| Chicago, IL | 15.3 | 15.2 | 10.5 |

| Cincinnati, OH | 13.4 | 14.0 | 10.9 |

| Cleveland, OH | 17.1 | 16.7 | 13.4 |

| Columbus, OH | 12.0 | 12.9 | 11.1 |

| Denver, CO | 8.8 | 8.5 | 10.1 |

| Detroit, MI | 14.2 | 14.7 | 11.2 |

| Hartford, CT | 13.2 | 13.4 | 9.3 |

| Jacksonville, FL | 10.3 | 12.6 | 10.9 |

| Las Vegas, NV | 7.6 | 7.6 | 8.9 |

| Los Angeles, CA | 18.2 | 17.7 | 13.5 |

| Louisville, KY | 6.9 | 6.6 | 5.2 |

| Memphis, TN | 16.2 | 15.9 | 12.6 |

| Miami, FL | 12.5 | 14.3 | 10.9 |

| Milwaukee, WI | 11.0 | 11.6 | 9.3 |

| Minneapolis, MN | 10.2 | 11.0 | 10.1 |

| Nashville, TN | 8.2 | 8.2 | 8.6 |

| New Orleans, LA | 15.2 | 14.7 | 10.6 |

| New York, NY | 15.4 | 15.3 | 11.7 |

| Oklahoma City, OK | 11.4 | 11.8 | 9.3 |

| Orlando, FL | 8.6 | 9.2 | 9.6 |

| Philadelphia, PA | 15.7 | 15.5 | 12.0 |

| Phoenix, AZ | 8.3 | 8.3 | 9.1 |

| Pittsburgh, PA | 15.3 | 15.2 | 12.5 |

| Portland, OR | 11.3 | 11.6 | 9.8 |

| Providence, RI | 15.6 | 15.1 | 9.4 |

| Raleigh, NC | 8.3 | 8.3 | 9.1 |

| Richmond, VA | 15.2 | 14.9 | 11.6 |

| Riverside, CA | 12.4 | 13.8 | 10.4 |

| Sacramento, CA | 11.9 | 12.9 | 10.9 |

| San Diego, CA | 15.4 | 15.3 | 12.1 |

| San Francisco, CA | 16.3 | 16.0 | 12.0 |

| San Jose, CA | 17.3 | 16.7 | 13.0 |

| Seattle, WA | 12.7 | 12.6 | 9.9 |

| Tampa, FL | 9.0 | 9.5 | 10.2 |

| Virginia Beach, VA | 12.7 | 13.6 | 10.5 |

| Washington, DC | 14.1 | 14.5 | 10.7 |

United States

United States Canada

Canada