The Hispanic-white homeownership gap is narrowing as the largest group of Hispanic Americans ages into prime homebuying years.

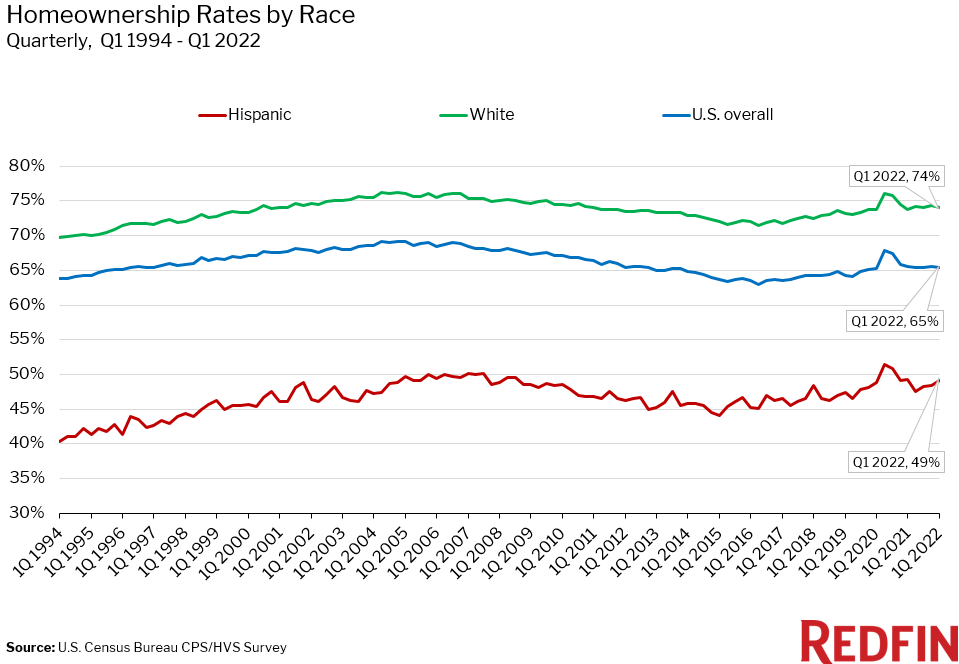

Nationwide, 49.1% of Hispanic families own their home. That’s essentially unchanged from 48.9% just before the pandemic began, but up from 46.3% a decade ago.

As the Hispanic homeownership rate increases, the Hispanic-white homeownership gap has narrowed slightly–but it’s still sizable. The gap is currently 24.9 percentage points, down from 27.2 points a decade ago. The white homeownership rate is essentially unchanged from just before the pandemic began and from a decade ago: 74.0% of white families own their home, up from 73.7% just before the pandemic began and 73.5% in the first quarter of 2012.

That’s according to U.S. Census data as of the first quarter. The words “family” and “household” are used interchangeably in this report to refer to people living in homes together. This report uses 2012 as a point of comparison because that’s when the U.S. housing market started to recover from the Great Recession.

The increase in Hispanic homeownership–and the narrowing racial gap–is largely because many Hispanic people have entered prime homebuying years over the last decade. Hispanic Americans are relatively young, with Gen Z and millennials making up the biggest share of Hispanic people in the U.S. Because homeownership rates steadily increase with age, the homeownership rate has risen as the many young Hispanic Americans grow older, and will likely continue to increase over the next few decades. Hispanic homeowners in the U.S. are more likely than people of other races or ethnicities to receive financial help making housing payments, which is another factor in the narrowing homeownership gap.

The Hispanic-white gap is likely to narrow further. White Americans are disproportionately old, with baby boomers representing the biggest age group. There’s less room for homeownership growth with an older population. Latinos are expected to account for about 53% of household formations through 2040, while the number of white households is expected to decline, according to the National Association of Hispanic Real Estate Professionals (NAHREP).

But even though the Hispanic homeownership rate is increasing, it’s still far lower than the white homeownership rate. In addition to systemic racism, the gap is largely due to exclusionary zoning, a lack of affordable homes for sale and lending practices that are overly reliant on credit scores and debt-to-income ratios, according to NAHREP.

The Hispanic homeownership rate has stayed essentially flat throughout the pandemic. That reflects soaring prices and a supply shortage, which created difficult homebuying conditions for many would-be buyers. The market was especially challenging for Hispanic buyers, partly because they’re twice as likely to use FHA loans, which can make it harder to win a home in a competitive situation.

“Continuing to grow the Hispanic homeownership rate is important for both Hispanic families and the country’s economy,” said Redfin Chief Economist Daryl Fairweather. “Owning a home is one of the best ways to build generational wealth in this country, pay for education and start businesses. Narrowing the racial homeownership gap is an important factor that could narrow the overall wealth gap–the existence of which is a major reason why Hispanic families have a disproportionately hard time buying a home. The good news is that many Hispanic homeowners are already benefiting from the boom in home values in the Sun Belt, where a lot of Hispanic Americans live.”

“Hispanics are the largest minority group in the U.S., their buying power has doubled over the last 30 years and they will become an even more important driver of the U.S. economy in the future,” Fairweather continued. “It’s important for policymakers and real estate professionals to prioritize narrowing racial and ethnic homeownership gaps. The federal government’s new equitable homeownership plan, which includes consumer education initiatives for renters and homeowners and increasing access to mortgages, is a step in the right direction. But there’s still a lot of work to be done, and that work must include helping make housing more affordable to first-time homebuyers.”

Detroit, San Antonio, and Riverside, CA have the highest Hispanic homeownership rates; New York and Boston have the lowest

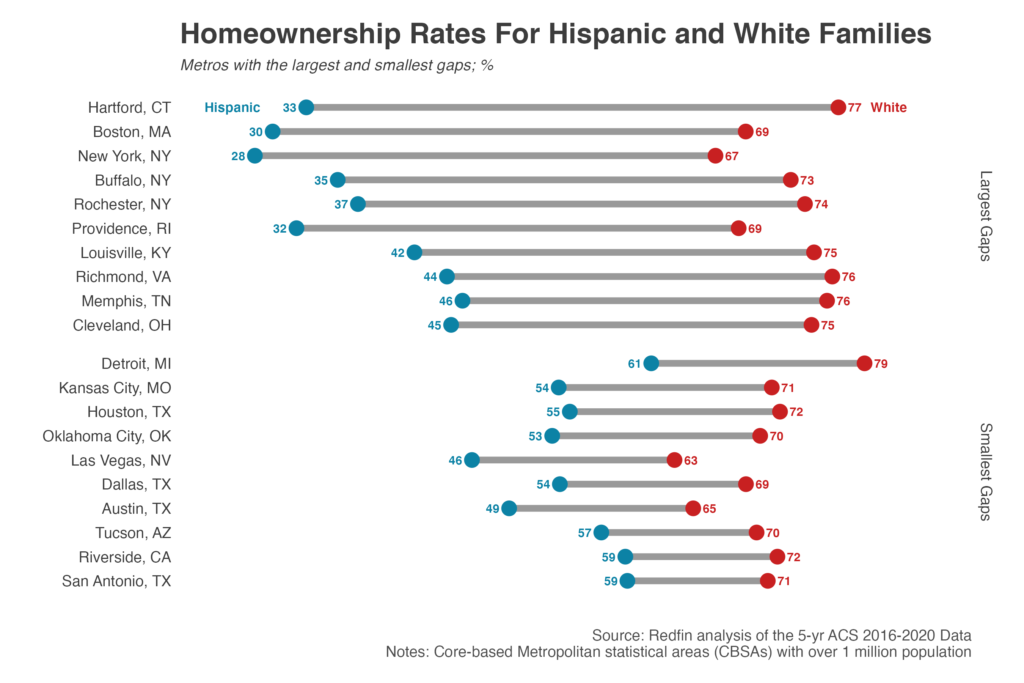

Sixty-one percent of Hispanic families in Detroit own the home they live in, the highest Hispanic homeownership rate in the U.S. of all metros with more than 1 million residents. It’s followed by San Antonio, TX (59%) and Riverside, CA (59%). St. Louis, Chicago and Houston come next, at 55% apiece. Detroit also has the highest homeownership rate for white families (79%), and St. Louis comes in at number four (77%).

The metro-level data in this report is from a Redfin analysis of the U.S. Census’ 2016-2020 5-year American Community Survey, released in March 2022–the most recent metro data available. Note that the national data above is more recent, from the first quarter of 2022.

San Antonio and Riverside are also the metros with the smallest Hispanic-white homeownership gaps, with 71% and 72% of white families in those metros owning their homes, respectively. Tucson, AZ, Austin and Dallas have the next-smallest gaps. Fifty-seven percent of Hispanic families in Tucson own their homes, versus 70% of white families. In Austin, it’s 49% versus 65%, and in Dallas, it’s 54% versus 69%.

On the other side of the spectrum are five East Coast metros. Just 28% of Hispanic families in the New York metro own their home, the lowest Hispanic homeownership rate in the U.S. It’s followed by Boston (30%), Providence, RI (32%), Hartford, CT (33%) and Buffalo, NY (35%).

Four of those five metros also have the largest Hispanic-white homeownership gaps. Hartford, where 77% of white families own their home, has the largest gap. It’s followed by Boston (69% white homeownership rate), New York (67% white homeownership rate), Buffalo (73% white homeownership rate) and Rochester, NY (37% Hispanic homeownership rate; 74% white homeownership rate).

In most metros, Hispanic families are more likely to own their home than they were a decade ago

The homeownership rate for Hispanic families in Birmingham, AL, was 57% in 2020, up from 38% in 2012, the biggest increase in the U.S.

“Alabama’s Hispanic population started growing significantly in the 1990s with a surge in job opportunities in the automobile, textile and agriculture industries, among others,” said Birmingham Redfin agent Liliana Perez. “The homeownership rate has risen in the last decade because a lot of the people who moved here 20 or 30 years ago have moved into higher-paying jobs and saved enough money to purchase their own homes–and people who were children when they came to Alabama are now entering prime homebuying years.”

“Plus, the typical home in Birmingham still sells for under $300,000, making it affordable compared to other states with big Hispanic populations like California and Florida,” Perez continued. “Relatively affordable housing means it’s easier for families to afford homes, though many Hispanic people in the area do face financing obstacles, such as a language barrier or difficulty obtaining loans without a social security number.”

Birmingham is followed by Memphis, TN, where the rate went from 38% to 46%, and Minneapolis, where it went from 42% to 50%. Nashville (38% to 45%), Columbus, OH (35% to 42%) and Raleigh, NC (42% to 49%), come next.

The rate stayed roughly the same in Rochester, Cincinnati, OH, San Diego, Tampa, FL, San Francisco and Los Angeles.

Two Florida metros top the list of places where the Hispanic homeownership rate has declined most. In Jacksonville, 50% of Hispanic families owned their home in 2020, down from 55% in 2012, and 52% of Hispanic Miami families owned their home in 2020, down from 57% in 2012. They’re followed by Pittsburgh, where the rate dropped from 49% to 45%, Orlando (52% to 50%) and San Jose, CA (42% to 40%).

All in all, the Hispanic homeownership rate rose in 35 metros, stayed about the same in six metros and declined in nine metros.

Homeownership Rates for Hispanic Families, By Metro Area

U.S. metro areas with population of more than 1 million.

Share of households that own the home they live in

| U.S. metro area | Homeownership rate: Hispanic households (2020) | Homeownership rate: Hispanic households (2012) | Homeownership rate: White households (2020) | Homeownership rate: White households (2012) |

|---|---|---|---|---|

| Atlanta, GA | 49% | 44% | 76% | 78% |

| Austin, TX | 49% | 47% | 65% | 65% |

| Baltimore, MD | 54% | 47% | 77% | 77% |

| Birmingham, AL | 57% | 38% | 79% | 80% |

| Boston, MA | 30% | 26% | 69% | 69% |

| Buffalo, NY | 35% | 33% | 73% | 73% |

| Charlotte, NC | 47% | 43% | 75% | 76% |

| Chicago, IL | 55% | 54% | 75% | 77% |

| Cincinnati, OH | 45% | 45% | 74% | 74% |

| Cleveland, OH | 45% | 45% | 75% | 76% |

| Columbus, OH | 42% | 35% | 69% | 69% |

| Dallas-Fort Worth, TX | 54% | 52% | 69% | 71% |

| Denver, CO | 50% | 46% | 71% | 71% |

| Detroit, MI | 61% | 59% | 79% | 80% |

| Grand Rapids, MI | 54% | 46% | 78% | 78% |

| Hartford, CT | 33% | 30% | 77% | 77% |

| Houston, TX | 55% | 54% | 72% | 73% |

| Indianapolis, IN | 46% | 41% | 73% | 74% |

| Jacksonville, FL | 50% | 55% | 74% | 74% |

| Kansas City, MO | 54% | 50% | 71% | 73% |

| Las Vegas, NV | 46% | 44% | 63% | 63% |

| Los Angeles, CA | 39% | 40% | 57% | 60% |

| Louisville, KY | 42% | 38% | 75% | 75% |

| Memphis, TN | 46% | 38% | 76% | 77% |

| Miami, FL | 52% | 57% | 74% | 76% |

| Milwaukee, WI | 41% | 42% | 70% | 70% |

| Minneapolis, MN | 50% | 42% | 77% | 77% |

| Nashville, TN | 45% | 38% | 73% | 73% |

| New Orleans, LA | 45% | 46% | 75% | 73% |

| New York, NY | 28% | 26% | 67% | 67% |

| Oklahoma City, OK | 53% | 50% | 70% | 72% |

| Orlando, FL | 50% | 52% | 72% | 72% |

| Philadelphia, PA | 48% | 47% | 76% | 77% |

| Phoenix, AZ | 53% | 52% | 72% | 72% |

| Pittsburgh, PA | 45% | 49% | 74% | 74% |

| Portland, OR | 40% | 37% | 66% | 65% |

| Providence, RI | 32% | 27% | 69% | 67% |

| Raleigh, NC | 49% | 42% | 74% | 76% |

| Richmond, VA | 44% | 42% | 76% | 78% |

| Riverside, CA | 59% | 58% | 72% | 73% |

| Rochester, NY | 37% | 36% | 74% | 75% |

| Sacramento, CA | 48% | 46% | 68% | 68% |

| Salt Lake City, UT | 54% | 50% | 73% | 73% |

| San Antonio, TX | 59% | 60% | 71% | 73% |

| San Diego, CA | 41% | 41% | 61% | 62% |

| San Francisco, CA | 41% | 42% | 61% | 61% |

| San Jose, CA | 40% | 42% | 64% | 67% |

| Seattle, WA | 40% | 39% | 66% | 66% |

| St. Louis, MO | 55% | 53% | 77% | 78% |

| Tampa, FL | 53% | 53% | 73% | 74% |

| Tucson, AZ | 57% | 56% | 70% | 69% |

| Virginia Beach, VA | 48% | 45% | 73% | 73% |

| Washington, D.C. | 51% | 50% | 72% | 73% |

United States

United States Canada

Canada