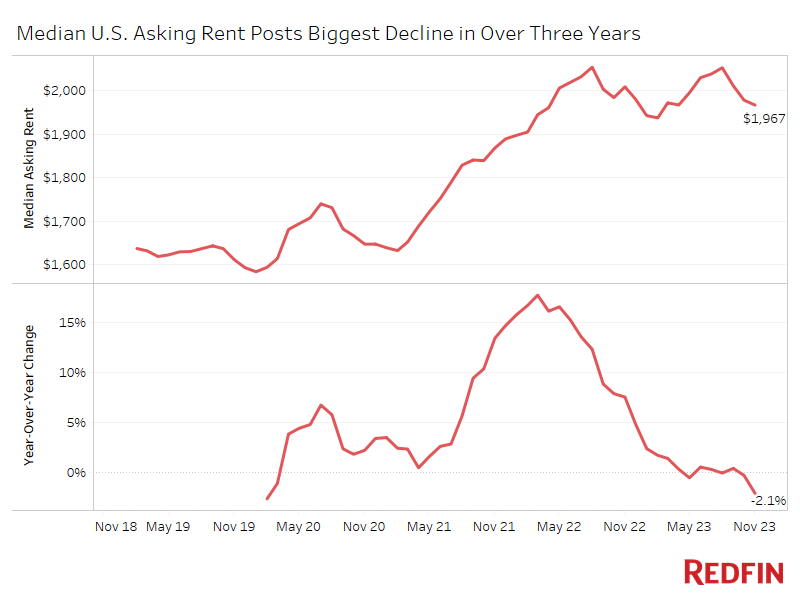

The median U.S. asking rent fell 2% year over year in November—the biggest decline since 2020—as landlords grappled with rising vacancies due to a building boom in recent years. But rents are still rising in the Midwest, partly because out-of-towners are moving in to get more bang for their buck.

The median U.S. asking rent declined 2.1% year over year in November to $1,967—the biggest annual drop since February 2020—and fell 0.6% from October.

The rental market has lost momentum over the last year and a half in large part because there are more apartments on the market—the result of a building boom in recent years. This jump in supply has left many landlords struggling to fill vacancies, motivating them to drop asking rents in some cases.

“Renters are finally catching a break. Better deals are easier to come by because landlords are doling out concessions and rents have started falling in a meaningful way. Rising supply also means renters have more good options to choose from,” said Redfin Chief Economist Daryl Fairweather. “With homeownership so expensive, renting has started to lose its stigma. Still, we may see more renters jump into the homebuying market next year as home-sale prices and mortgage rates tick down.”

Some landlords are offering one-time discounts like a free month’s rent or reduced parking costs to attract renters. This means the prices renters are paying in total are likely coming down faster than they appear to be in the data.

Rents have also cooled due to economic uncertainty and slowing household formation, along with intensifying affordability challenges driven by inflation and the pandemic surge in rents. Additionally, there are new signs that the economy is slowing; Americans are starting to tighten their belts, which could be contributing to the decline in rents, Fairweather said.

While rents are dropping, they’re still 22.1% higher than they were in November 2019 before the pandemic housing boom and are just 4.2% below the $2,054 record high hit in August 2022.

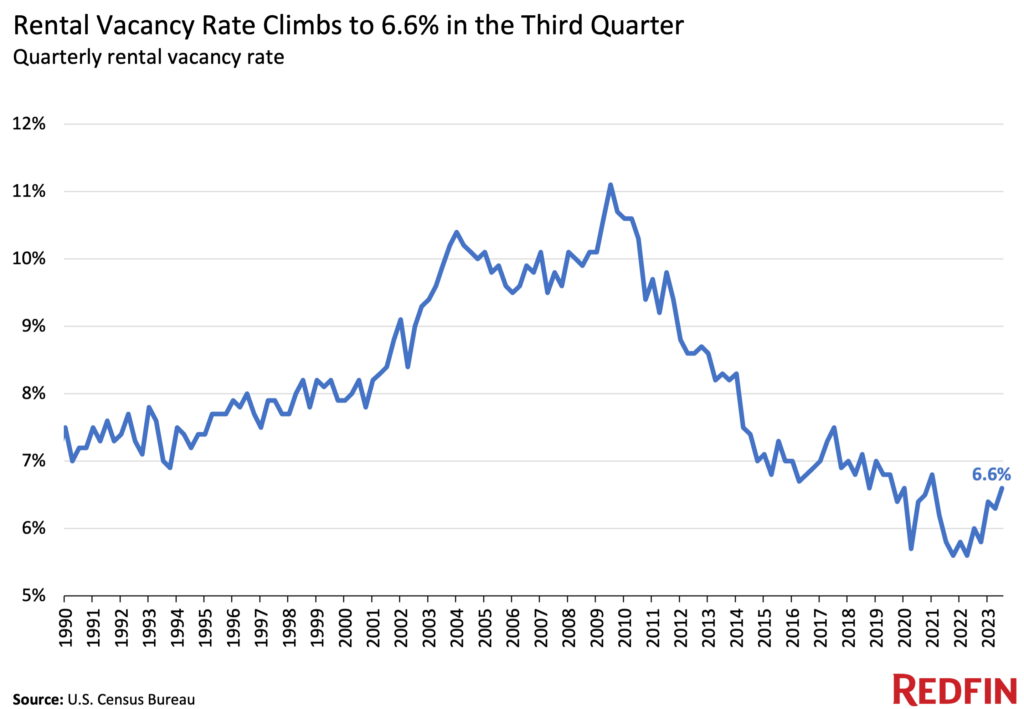

Apartment Construction Is Still Going Strong, Leading to Rise in Vacancies

The number of completed apartments in the U.S. rose 7% year over year in the third quarter to a seasonally adjusted annual rate of 1.2 million, one of the highest levels of the last three decades. The third quarter is the most recent period for which data is available.

The number of apartment buildings on which construction has started also stands at one of the highest levels of the past three decades, but has begun to decline. It fell 26.2% year over year in the third quarter to a seasonally adjusted annual rate of 1.2 million.

Because renters have an increasing number of buildings to choose from, vacancies are climbing. The rental vacancy rate rose to 6.6% in the third quarter, the highest level since the first quarter of 2021.

While there are a lot of apartments hitting the market, there aren’t as many single-family homes for rent. Redfin predicts prices of large rentals will rise in 2024 because they’re particularly attractive to millennials, many of whom desire homes large enough for their growing families. Remote work has also boosted the appeal of large rentals, which offer more space for home offices. Even though homebuying affordability is expected to improve slightly next year, many Americans will remain priced out of homeownership and have no choice but to continue renting.

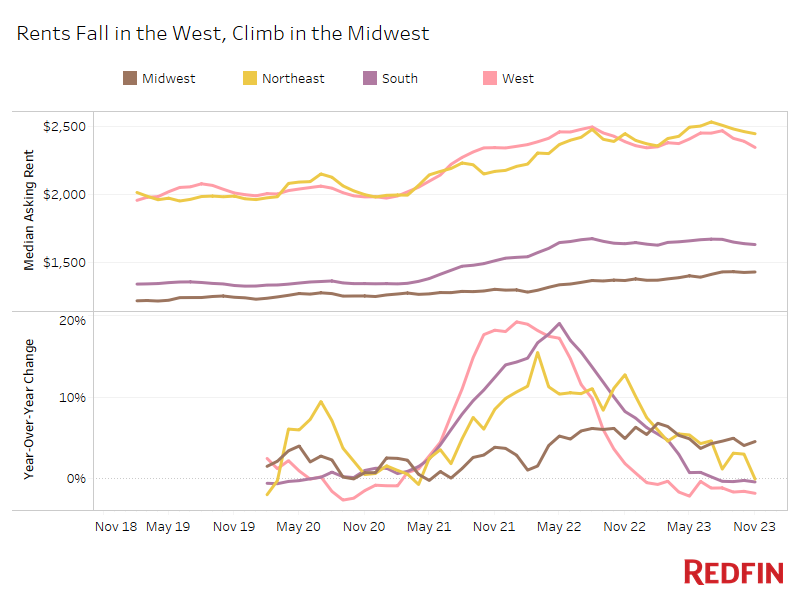

Rents Jump in the Midwest, Fall in the West

The median asking rent in the Midwest rose 4.6% year over year to $1,434—the only increase among the four major U.S. regions. Asking rents fell 1.8% year over year to $2,347 in the West, were little changed in the South (-0.4% to $1,635) and were unchanged in the Northeast (0% to $2,447).

Rents are climbing in the most affordable region and falling fastest in one of the least affordable, which makes sense at a time when housing affordability is so strained. Research shows that a near-record share of house hunters are leaving their metro when they move, many in search of a more affordable place to live.

“The rental market in Milwaukee is really strong,” said local Redfin Premier real estate agent Keshia Tally, who is a landlord herself. “Every time one of my own units goes vacant, I get a ton of applicants. Surging housing costs have pushed homeownership out of reach for a lot of Milwaukeeans, so many are continuing to rent.”

Methodology

Asking price data includes single-family homes, multi-family units, condos/co-ops and townhouses from Rent.com and Redfin.com.

Redfin has removed metro-level data from monthly rental reports for the time being as it works to expand its rental analysis.

Prices reflect the current costs of new leases during each time period. In other words, the amount shown as the median rent is not the median of what all renters are paying, but the median asking price of apartments that were available for new renters during the report month.

United States

United States Canada

Canada