The West is the only region seeing a drop in asking rents, which are coming back down to earth after surging a record 19% last year.

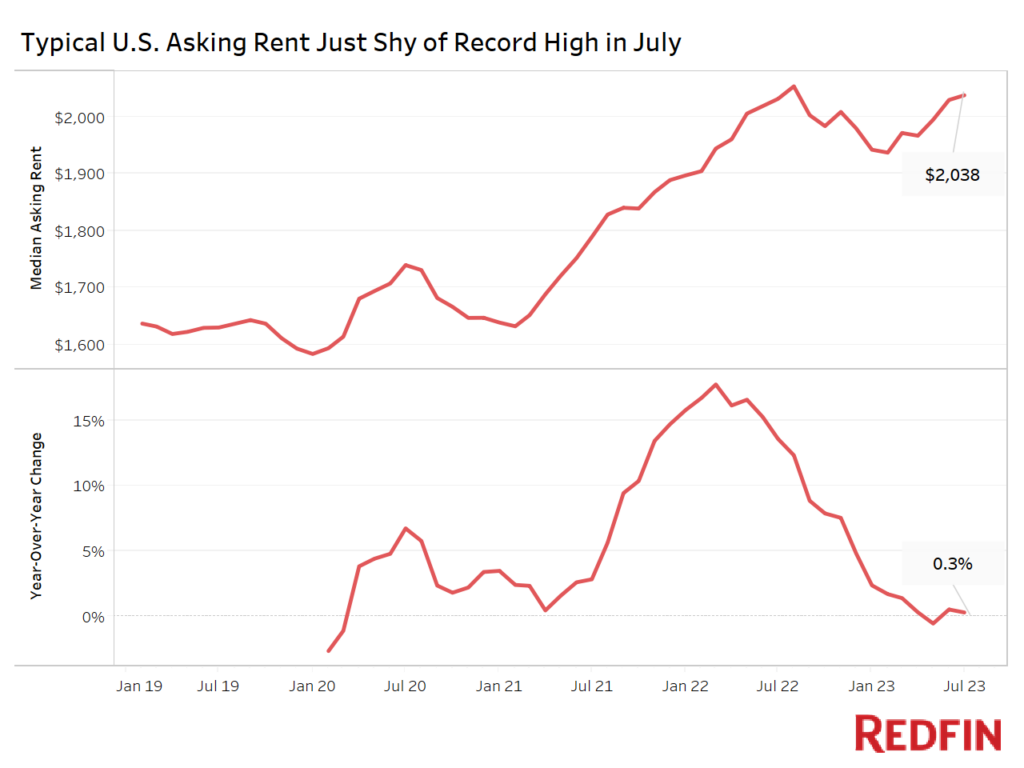

The median U.S. asking rent in July was $2,038, just $16 below the record high set in August 2022. While rents are just shy of their all-time high, rent growth remains sluggish. The median asking rent was up just 0.3% from a year earlier in July, compared with a 13.6% annual gain in July 2022.

Rent gains cooled over the past year due to an increase in supply, economic uncertainty and slowing household formation, but big bargains are still often hard to come by given rents are near record highs.

“While rents are flattening out, it’s too early to say whether rent growth has bottomed,” said Redfin Deputy Chief Economist Taylor Marr. “A strong job market, cooling inflation and increasing consumer spending—which have decreased the likelihood of a recession—point to resilient renter demand. But there are still a lot of newly built apartments that have yet to hit the market, meaning rents may still have room to fall as landlords grapple with rising vacancies.”

The median asking rent is near its record high because the housing market tends to be “downside sticky,” meaning prices don’t typically fall substantially even when business is slow, Marr added. Instead of lowering rents, many landlords offer perks like a free month’s rent or discounted parking, which tend to be less detrimental to profits.

The number of options renters have to choose from has steadily climbed over the past decade. Completed residential projects in buildings with five or more units rose 26.3% year over year to 476,000 on a seasonally adjusted basis in June—the most recent month for which data is available—meaning landlords have more vacancies to fill and less leeway to raise prices.

But there are signs that the homebuilding boom is easing. The number of permitted residential projects in buildings with five or more units fell 33.4% year over year to 465,000 on a seasonally-adjusted basis in June, the biggest drop since 2016. Permits, or approvals given by local jurisdictions to start construction projects, are a leading indicator of what’s happening in the housing market. Completions are a lagging indicator.

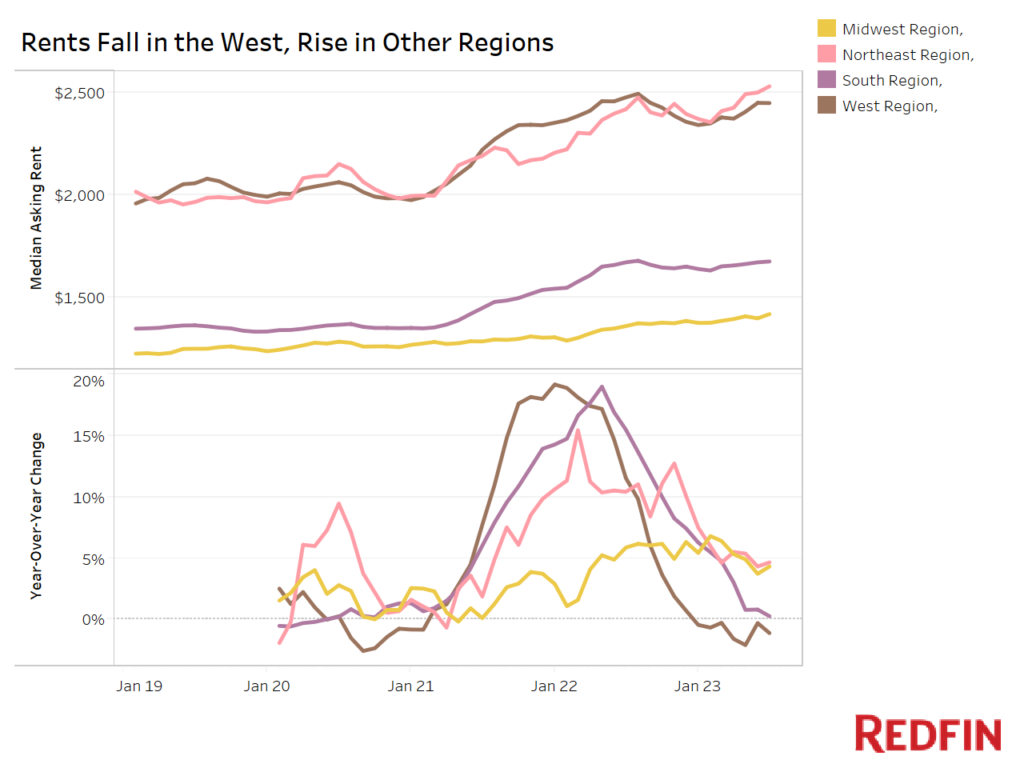

Rents Fall in the West, Rise in the Midwest and Northeast

In the West, the median asking rent fell 1.1% year over year to $2,451 in July. And in the South, it rose 0.3% to $1,674—the smallest increase since 2020. By comparison, asking rents rose 4.6% to a record $2,533 in the Northeast and climbed 4.3% to a record $1,416 in the Midwest.

The rental market has cooled quickly in the West and South in part because those markets saw outsized rent increases during the pandemic. Rents skyrocketed as people flooded into Sun Belt cities including Phoenix, Miami and Dallas. Now, rents in those regions have relatively more room to fall—especially as renters increasingly find themselves priced out of certain cities. The West has also been disproportionately impacted by layoffs in the tech sector, which may be contributing to its soft rental market.

While rents in the West and South have been relatively sluggish, it’s worth noting that these regions’ rental markets have started to stabilize in recent months as the impact of the pandemic price boom moves further into the rearview mirror and layoffs ease.

Methodology

Asking price data includes single-family homes, multi-family units, condos/co-ops and townhouses from Rent.com and Redfin.com.

Redfin has removed metro-level data from monthly rental reports for the time being as it works to expand its rental analysis.

Prices reflect the current costs of new leases during each time period. In other words, the amount shown as the median rent is not the median of what all renters are paying, but the median asking price of apartments that were available for new renters during the report month.

United States

United States Canada

Canada