Rental and home-sale prices increased more than 25% year over year in April in four of the five most popular second-home destinations: Phoenix, Cape Coral, FL, Naples, FL and Las Vegas.

Housing costs soared in second-home hotspots even more than the rest of the country after pandemic-fueled remote work prompted many Americans to pack up their laptops and relocate to the beach.

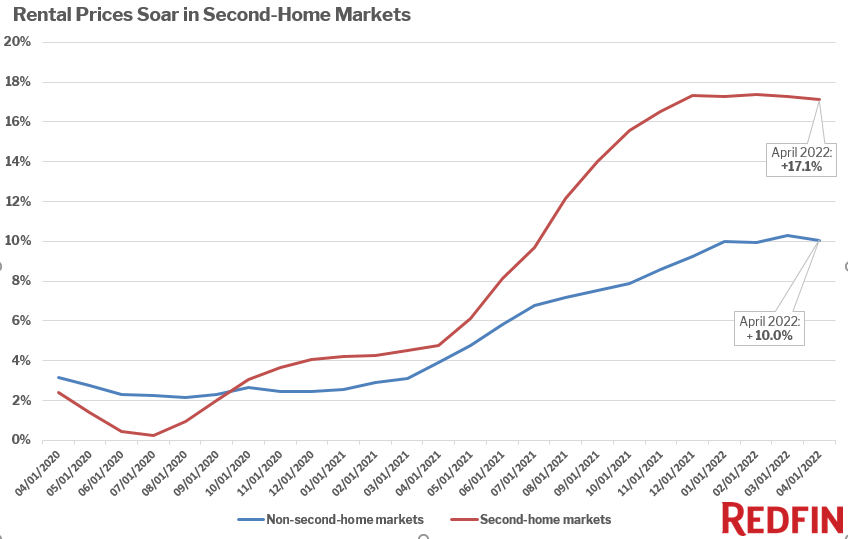

Average rental prices rose 17.1% year over year nationwide to $1,893 in popular second-home markets in April. That’s compared with a 10% increase to $1,484 in places that aren’t considered second-home destinations.

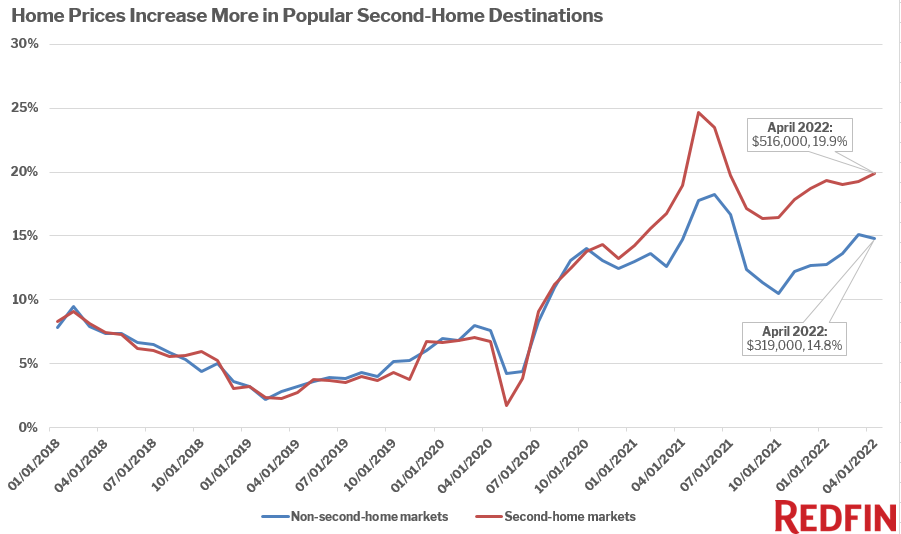

The story is similar in the for-sale market. The typical home in second-home markets sold for a record $516,423 in April, up 19.9% year over year. In non-second-home markets, prices increased 14.8% to a record $389,156. Although the housing market is now slowing down, prices have soared since the beginning of the pandemic.

Home and rental prices skyrocketed in Phoenix, Cape Coral, FL, Naples, FL, Myrtle Beach, SC and Las Vegas, the top five second-home markets in the nation. Rental prices have increased by 25% year over year or more in four of those five areas (Myrtle Beach is the exception), and sale prices have increased by at least 25% in all five.

Prices began growing faster in second-home destinations at the end of 2020, soon after demand for second homes skyrocketed as affluent Americans took advantage of pandemic-fueled remote work to decamp to vacation destinations and escape crowded cities. Mortgage-rate locks for second homes spiked in June 2020 and remained elevated through the beginning of 2022, reaching a peak of 88% above pre-pandemic levels in March 2021.

“The popularity of vacation towns has sent housing costs through the roof, making it harder for many locals to afford living in their hometowns,” said Redfin Deputy Chief Economist Taylor Marr. “The second-home boom is ending as many vacation-home buyers are priced out of the market due to historically high prices and high mortgage rates–but those same factors have already pushed locals to the sidelines. Locals in popular beach towns and vacation spots have spent the last two years competing for a limited number of homes with wealthy second-home seekers–and often losing.”

“But many of the places where prices soared partly due to pandemic-driven second-home purchases and migration are likely to see price growth slow quicker than other parts of the country as the market cools down,” Marr continued. “The outsized price growth is unsustainable, especially as demand for second homes drops.”

One bright spot for locals who already own homes in vacation towns is that rising prices also means home equity has increased substantially.

And partly as a result of dropping demand, the supply of homes for sale in second-home markets is improving. Supply in second-home destinations was still down 13.3% year over year in April–but that’s the smallest decline since September 2020, and the number of homes for sale in second-home markets has been rising since the beginning of the year. Supply in non-second-home destinations was down 12.5%, marking the smallest gap in a year.

Home, rental prices have skyrocketed in popular vacation-home spots

Phoenix is an apt example of how the second-home boom has impacted the local housing market. In Phoenix, where there are more second homes than anywhere else in the nation, rental prices grew 32.8% year over year to $1,946 in April, and home prices rose 25.3% to $495,000.

“We had even more second-home buyers than usual last year from the West Coast, Midwest and Canada. It had a big impact on local buyers, many of whom don’t have the cash to compete with people coming in with a lot of cash from out of town,” said Phoenix Redfin agent Heather Mahmood-Corley. “A lot of out-of-towners were able to pay in all cash, make large down payments, waive the appraisal contingency, and/or bid up prices–something local buyers often don’t have the resources to do.”

“Earlier in the year, I had one buyer from Seattle who paid nearly $200,000 over asking price for a second home in Scottsdale. Another buyer from San Francisco paid $80,000 over list price and waived all contingencies to get a house against 50 other offers,” Mahmood-Corley continued. “But demand for second homes is slowing in some areas, giving buyers some relief from competition. I’ve had two out-of-town buyers get houses for under asking price in the last few months.”

Prices have also increased sharply in Cape Coral, FL and Naples, FL, the next-most prevalent second-home markets, where rental prices grew 41% and 37.7%, respectively, and sale prices rose 38.2% and 37.6%.

In Myrtle Beach, where home-sale prices rose 30.6% year over year to $307,000, many second-home buyers use them as short-term rentals. Myrtle Beach is an attractive area for people hoping to rent out their properties because home prices are affordable compared to other parts of the country, and it’s popular with vacationers.

Sun Belt metros like Phoenix and parts of Florida have long been popular with retirees moving in from other parts of the country, but they’ve increased in popularity with homebuyers–both those purchasing vacation homes and those relocating permanently–as the pandemic has normalized remote work.

Mortgage applications for second homes in Phoenix increased 23% from 2018-2019 to 2020-2021, and they increased even more in Florida: 59% in Cape Coral and 75% in Naples. Applications were up 38% in Myrtle Beach and 16% in Las Vegas.

Methodology

This is according to a Redfin analysis of second-home mortgage origination data from the Home Mortgage Disclosure Act (HMDA) from 2018 through 2021. We aggregated second-home purchases for more than 3,000 U.S. counties. A county is considered a “second-home market” if it is among the top 100 with the most second homes purchased during the 2020-2021 period. The housing market data for all counties comes from the MLS and the rental market data comes from RentPath.

Note that while this report uses the names of metro areas, the data is at the county level. For example, the data for Phoenix is for Maricopa County, and the data for Cape Coral is for Lee County. The metro-level analysis includes the top 100 counties with the most second homes in the U.S.

United States

United States Canada

Canada