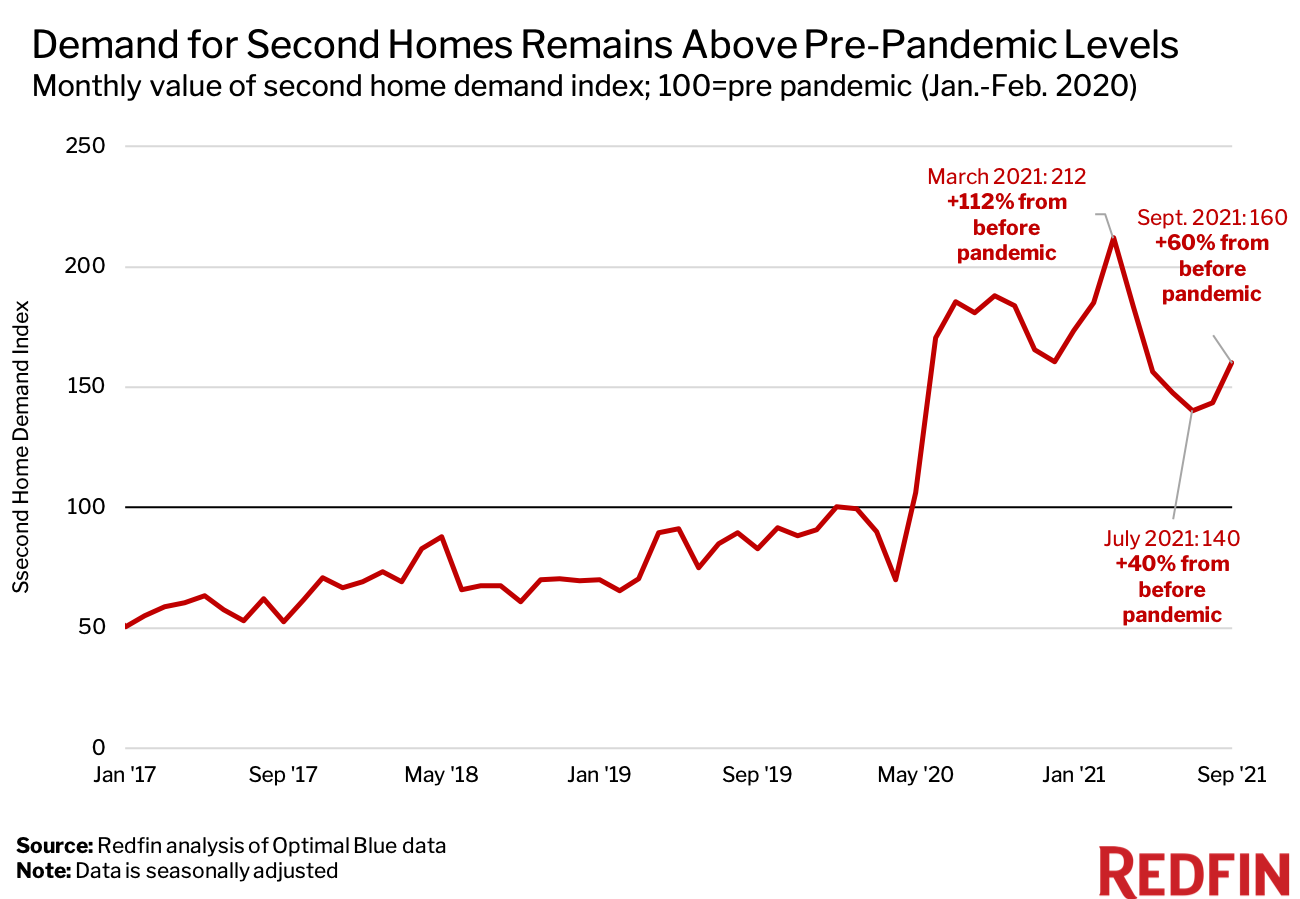

Demand for second homes was up 60% from pre-pandemic levels in September, an uptick from July’s 40% increase but still below March’s record growth.

In September, demand for second homes was 60% higher than it was before the coronavirus pandemic hit. While that’s a slowdown from the record 112% surge we saw in March, it’s an acceleration from July’s 40% gain.

That’s according to a Redfin analysis of mortgage-rate lock data from real estate analytics firm Optimal Blue. Redfin created a seasonally-adjusted index of Optimal Blue’s data in order to adjust for typical seasonal patterns and allow for simple comparisons of second-home demand during and before the pandemic. We define “pre-pandemic” as January and February 2020 and set the index for that period to 100. Any data point above 100 represents second-home demand that’s above pre-pandemic levels and any data point below 100 represents demand below pre-pandemic levels. This data is subject to revision.

A mortgage-rate lock is an agreement between a homebuyer and a lender that allows the homebuyer to lock in an interest rate on a mortgage for a certain period of time, offering protection against future interest-rate hikes. Homebuyers must specify whether they are applying to secure a mortgage rate for a primary home, a second home or an investment property. Roughly 80% of mortgage-rate locks result in actual home purchases.

The popularity of vacation homes skyrocketed at the onset of the coronavirus pandemic, with many well-off Americans opting to leave city-life behind and work remotely. But the surge in demand for second homes started to slow as cities lifted stay-at-home restrictions, the initial shock of the pandemic faded, spring homebuying season ended and the overall housing market began to cool.

A new rule from Fannie Mae probably also contributed to the slowdown in vacation-home demand, according to Redfin Deputy Chief Economist Taylor Marr. The government sponsored mortgage enterprise announced plans in March to limit the number of second-home and investment-property loans it would buy, effectively making it more challenging and expensive for some buyers to take out mortgages on vacation homes.

“The market may have overreacted to the Fannie Mae rule a bit, which would explain why we’ve been seeing demand for second homes bounce back,” Marr said. “Mortgage rates are on the rise as well, which is likely creating a renewed sense of urgency for vacation-home buyers who want to purchase properties before rates climb even further.”

In the middle of last month, the Treasury Department and Federal Housing Finance Agency announced that they would remove the aforementioned restrictions on Fannie Mae in an effort to boost housing supply. This will likely help keep demand for second homes above pre-pandemic levels for the foreseeable future, Marr said. Permanent remote work policies may also fuel sustained interest in second homes. Amazon.com Inc. earlier this month said it will allow many employees to work from home indefinitely, following in the footsteps of other major corporations that have recently made similar announcements.

United States

United States Canada

Canada